Market Overview

The Singapore Aircraft Refurbishing Market has grown significantly due to the rising demand for aircraft cabin upgrades, retrofitting, and maintenance services in Asia-Pacific. With a market size of USD ~ billion in 2025, the market’s growth is driven by Singapore’s strategic position as a global aerospace hub, extensive air travel, and the growing fleet of commercial and private aircraft. The increasing focus on enhancing passenger experience, upgrading avionics, and extending the lifespan of aging aircraft further propels the demand for refurbishing services. Furthermore, airline operators and leasing companies are increasingly seeking cost-effective solutions for upgrading their fleets rather than investing in new aircraft.

Singapore remains the dominant player in the aircraft refurbishing market, primarily due to its well-established aviation infrastructure, world-class facilities at Seletar Aerospace Park, and being home to major MRO players. The city-state is strategically positioned with strong support from local authorities and government incentives. Additionally, countries like China, Japan, and South Korea significantly influence the APAC market, with their rapidly expanding airline fleets and high demand for refurbishment services to comply with safety standards and passenger comfort expectations. Singapore’s proximity to these key markets strengthens its role as a regional leader.

Market Segmentation

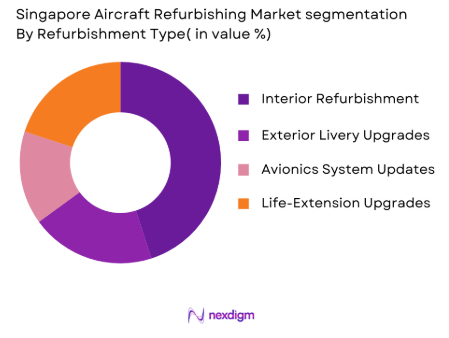

By Refurbishment Type

The aircraft refurbishing market is primarily segmented by the type of services offered. This includes interior refurbishment, exterior livery upgrades, avionics system updates, and life-extension upgrades. Among these, interior refurbishment has the dominant market share, driven by the constant demand for improving passenger comfort and experience. Airlines and leasing companies continue to invest in modernizing cabin interiors to attract passengers seeking luxury and comfort. Premium seating, inflight entertainment (IFE) systems, and Wi-Fi connectivity have become significant selling points for airlines. These factors, combined with regulatory demands for updated seating and safety compliance, keep interior refurbishment at the forefront of the market.

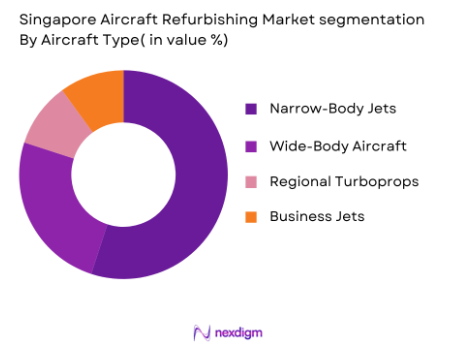

By Aircraft Type

The aircraft refurbishing market is also segmented by aircraft type, including narrow-body jets, wide-body aircraft, regional turboprops, and business jets. The narrow-body jets segment dominates due to their high presence in commercial fleets worldwide. Aircraft such as the Airbus A320 and Boeing~ require frequent refurbishing due to their widespread use by airlines for short to medium-haul flights. These aircraft are typically refurbished to enhance cabin interiors, reduce operational costs, and comply with evolving safety standards. With the growing trend of regional travel in the Asia-Pacific region, narrow-body jets remain the most prevalent type of aircraft for refurbishment.

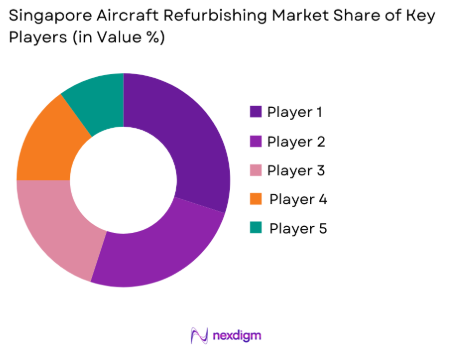

Competitive Landscape

The Singapore Aircraft Refurbishing Market is characterized by intense competition, with both regional and global players vying for dominance. Major players in the market include Singapore-based entities like SIA Engineering Company and ST Engineering Aerospace, which leverage their advanced facilities and strong relationships with local airlines. International players such as Lufthansa Technik, Collins Aerospace, and Jet Aviation also have a strong presence in the region, catering to both commercial and private aircraft segments. This consolidation highlights the importance of established capabilities, technology partnerships, and capacity in a competitive market.

| Company Name | Establishment Year | Headquarters | Major Market Focus | Certifications | Service Portfolio | Key Aircraft Types | Strategic Alliances |

| SIA Engineering Company | 1982 | Singapore | Commercial Airlines, Leasing | ~ | ~ | ~ | ~ |

| ST Engineering Aerospace | 2000 | Singapore | Commercial, VIP Jets | ~ | ~ | ~ | ~ |

| Lufthansa Technik | 1951 | Germany | Commercial Airlines | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | Avionics, Interiors | ~ | ~ | ~ | ~ |

| Jet Aviation | 1967 | Switzerland | VIP Jets, Business Aviation | ~ | ~ | ~ | ~ |

Singapore Aircraft Refurbishing Market Dynamics

Growth Drivers

Fleet Ageing

The fleet ageing issue remains a key driver for the Singapore Aircraft Refurbishing Market. The average age of commercial aircraft globally was reported at 12 years in 2025, with airlines opting for refurbishing to extend the lifespan of their existing fleets rather than buying new ones. In the Asia-Pacific region, fleet size expansion coupled with increased aircraft utilization has accelerated refurbishment demand. According to the International Air Transport Association (IATA), Asia-Pacific airlines are projected to grow their fleet by over 5% annually through 2026, intensifying the need for more maintenance and refurbishment services.

Premium Passenger Experience Demand

The demand for premium passenger experiences has become a critical driver for refurbishing market growth, particularly in the Asia-Pacific region, where luxury travel is on the rise. In 2025, 15% of global air traffic revenue was from premium cabins, with airlines prioritizing investments in comfortable, luxurious cabin interiors. The demand for high-quality seating, advanced in-flight entertainment (IFE), and personalized service areas has resulted in a continuous need for upgrades and refurbishments. Governments across Asia, including Singapore, have allocated substantial investments into airport infrastructure, ensuring high-quality services and boosting premium passenger travel.

Market Challenges

Supply Chain Volatility

The aircraft refurbishing market in Singapore faces significant challenges due to supply chain disruptions, particularly regarding avionics, seats, and essential components. Global supply chains, still recovering from the COVID-19 pandemic, continue to experience volatility. In 2025, disruptions in the supply of seats and parts, such as engine components and cabin systems, increased refurbishment delays for airlines. This volatility is exacerbated by rising global demand for air travel, which places further pressure on suppliers. Shortages of critical components have led to extended waiting times for parts, hindering the timely completion of refurbishment projects.

Turnaround Time Pressures & AOG Costs

Aircraft-on-Ground (AOG) costs and turnaround time pressures present a significant challenge in the aircraft refurbishing market. Airlines incur substantial costs for each day an aircraft is grounded for maintenance or refurbishment. In 2025, global AOG costs were estimated to exceed USD ~billion, with Asia-Pacific airlines experiencing increased operational pressure to maintain fleet availability. The need for quick turnaround times in refurbishment projects is crucial to avoid such high costs. Aircraft with long turnaround times for refurbishing face operational inefficiencies, leading airlines to seek faster solutions, further complicating the challenge for service providers.

Opportunities

Eco‑Friendly Materials & Low‑Weight Interiors

The shift towards eco-friendly materials and low-weight interiors in aircraft refurbishing presents a major opportunity for growth. Airlines are under increasing pressure to meet sustainability goals and reduce their carbon footprint. In 2025, over 60% of airlines reported prioritizing eco-friendly materials in their refurbishment programs, including sustainable fabrics and lightweight seats. This trend is expected to grow as regulatory pressures increase, with Singapore Airlines, for example, already implementing sustainability-focused refurbishments. The market is ripe for innovation in sustainable and cost-effective materials that contribute to reducing operational costs while meeting environmental standards.

Digital Twin & Predictive Refurbishment Analytics

Digital twin technology and predictive refurbishment analytics are expected to be game-changers in the aircraft refurbishing market. As of 2025, several airlines in Asia have begun adopting digital twin technology to create virtual models of aircraft and simulate their performance during refurbishment. This approach enables predictive maintenance, reducing downtime and optimizing the refurbishment process. The predictive analytics market for aviation is growing rapidly, with several companies investing in data-driven technologies to anticipate component failures and reduce costs. This opportunity allows refurbishing service providers to offer more efficient, precise, and cost-effective solutions to airlines and leasing companies.

Future Outlook

Over the next decade, the Singapore Aircraft Refurbishing Market is poised to exhibit strong growth driven by increasing demand for aircraft upgrades, longer service life, and evolving consumer preferences for enhanced in-flight experiences. Advancements in technology such as virtual cabin design, eco-friendly materials, and fully integrated avionics systems will further drive the sector’s growth. Leasing companies will continue to fuel the demand for cost-effective refurbishing services as they seek to maintain the value of their portfolios. Additionally, regulatory pressures for passenger safety and environmental sustainability will encourage airlines to modernize their fleets, thereby providing substantial opportunities for refurbishing service providers.

Major Players

- SIA Engineering Company

- ST Engineering Aerospace

- Lufthansa Technik

- Collins Aerospace

- Jet Aviation

- HAECO

- AAR Corp

- InTech Aerospace

- Diehl Aviation

- Gulfstream Aerospace

- ExecuJet Aviation Group

- Turbine Services & Solutions

- Air France Industries KLM E&M

- Honeywell Aerospace

- AerSale

Key Target Audience

- Aircraft Leasing Companies

- Airlines

- Aircraft Operators

- Aviation OEMs

- Aircraft Maintenance, Repair, and Overhaul (MRO) Service Providers

- Government and Regulatory Bodies

- Investors and Venture Capitalist Firms

- Airport Infrastructure Development Agencies

Research Methodology

Step 1: Identification of Key Variables

The first step is to map out the key stakeholders involved in the aircraft refurbishing value chain. This involves comprehensive desk research, utilizing secondary databases to understand market size, segment growth, and technological trends shaping the industry.

Step 2: Market Analysis and Construction

Historical market data is analyzed to derive insights into the demand for different aircraft refurbishing services. This includes evaluating service quality, customer preferences, and emerging trends within the market, such as eco-friendly refurbishing materials and advanced avionics systems.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry professionals, including airline executives, MRO operators, and refurbishment specialists, will help validate the market’s underlying trends. These expert consultations will offer a deeper understanding of the factors driving the demand for specific refurbishing services.

Step 4: Research Synthesis and Final Output

The final phase involves consolidating insights gathered through interviews and secondary data analysis. A comprehensive market forecast, along with key recommendations for stakeholders, will be formulated to ensure that the final output accurately reflects the current and future state of the aircraft refurbishing market in Singapore.

- Executive Summary

- Research Methodology (Definitions, Scope & Refurbishing Service Taxonomy, Market Sizing & Forecasting Model, Primary vs Secondary Data Triangulation, Singapore Airport & Aerospace Hub Data Sources, Value Chain Mapping)

- Market Genesis & Singapore Positioning

- Singapore Aircraft Refurbishing Ecosystem

- Industry Trends

- Value Chain & Service Delivery Models

- Growth Drivers

Fleet Ageing

Premium Passenger Experience Demand

Rapid APAC Aviation Growth

Regulatory & Safety Lifecycle Mandates - Market Challenges

Skilled Labor & Engineering Capacity Constraints

Supply Chain Volatility

Turnaround Time Pressures & AOG Costs

- Opportunities

VIP & Business Jet Customization

Eco‑Friendly Materials & Low‑Weight Interiors

Digital Twin & Predictive Refurbishment Analytics

- Industry Trends

Interior Personalization & Premium Seating Premiumisation

Add‑On Connectivity & IFEC Retrofit Demand

Rapid Tech Turnaround Strategies

- By Revenue, 2020-2025

- By Aircraft Units Served, 2020-2025

- By Average Service Ticket, 2020-2025

- By Refurbishment Effort, 2020-2025

- By Refurbishment Type (In Value%)

Interior Cabins

Exterior & Livery Renewals

Avionics & Connectivity Upgrades

Life‑Extension Structural Refurbishment - By Aircraft Type (In Value%)

Narrow‑Body Jets

Wide‑Body Aircraft

Business & VIP Jets

Regional Turboprops

- By End User Category (In Value%)

Commercial Airlines

Leasing Companies

Business Aviation Owners

Government / Military Programs - By Service Mode (In Value%)

Turnkey

Modular Refurbishment

On‑Site Line Services

- Market Share & Competitive Positioning

- Cross‑Comparison Parameters (Geographic Footprint, Certifications & Compliance Credentials, Turnaround Time Efficiency, Service Portfolio Breadth, OEM Partnerships, Specialized Interior Capabilities, VIP/Executive Refurb Expertise, Pricing Index vs Service Tier)

- SWOT Analysis of Key Players

- Pricing Analysis

- Porter’s Five Forces

- Detailed Company Profiles

SIA Engineering Company Ltd

ST Engineering Aerospace

Jet Aviation Singapore

Lufthansa Technik AG

Collins Aerospace

Jamco Corporation

Hong Kong Aircraft Engineering Co.

AAR Corp

InTech Aerospace

Diehl Aviation

Gulfstream Aerospace

Air France Industries KLM E&M

Turkish Technic

Asia Digital Engineering

ExecuJet Aviation Group

- Singapore & APAC Carrier Refurbishment Requirements

- Airlines vs Lessors Refurb Strategy Drivers

- Budget Allocation & Decision Models

- Customer Pain Points & Satisfaction Metrics

- Procurement Protocols

- Market Value, 2026-2035

- Number of Refurbishment Contracts, 2026-2035

- Fleet Impact, 2026-2035

- Service Demand Evolution, 2026-2035