Market Overview

The Singapore Aircraft Seat Actuation Systems market is influenced by a rising demand for comfort and advanced seating technologies within the aviation industry. As of 2025, the market is valued at USD ~million, driven by ongoing advancements in actuation systems that enhance passenger comfort and improve the overall flight experience. The demand is propelled by increasing commercial aircraft deliveries and a growing focus on the upgrading of premium seating in both commercial and business aircraft. Additionally, technological innovations in electric and hybrid-electric actuation systems are shaping the market’s expansion.

The dominant markets in the Singapore Aircraft Seat Actuation Systems market are primarily driven by the region’s position as a global aviation hub. Singapore, with its strategic location and significant role in global aviation operations, has established itself as a leader. The country benefits from substantial investments in aircraft manufacturing, repair, and maintenance, as well as a rapidly expanding air travel sector. Moreover, Singapore’s advanced infrastructure, strong regulatory framework, and close ties with key players in the aviation and aerospace sectors position it as a key driver of the market in the Asia-Pacific region.

Market Segmentation

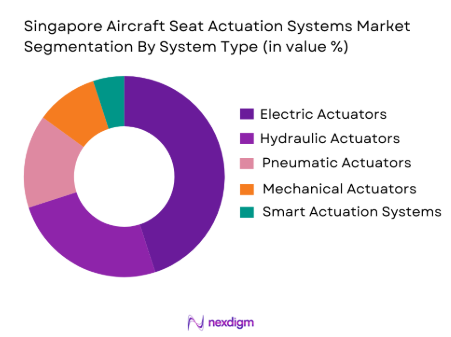

By System Type

The Singapore Aircraft Seat Actuation Systems market is segmented by system type, including electric actuators, hydraulic actuators, pneumatic actuators, mechanical actuators, and smart actuation systems. In recent years, electric actuators have gained a dominant market share. This is primarily due to the increasing demand for energy-efficient solutions and the focus on reducing the overall weight of aircraft. Electric actuators are seen as the future of aircraft seating, offering better performance, enhanced reliability, and lower maintenance costs compared to traditional hydraulic or pneumatic systems. As airlines focus on reducing operational costs and improving fuel efficiency, the adoption of electric actuators is expected to continue growing rapidly.

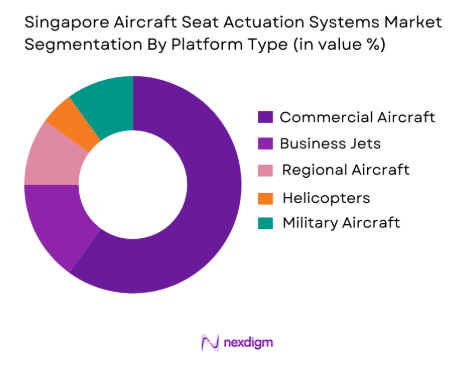

By Platform Type

The Singapore Aircraft Seat Actuation Systems market is also segmented by platform type into commercial aircraft, business jets, regional aircraft, helicopters, and military aircraft. Commercial aircraft dominate this segment, driven by the increasing demand for advanced seating technologies on long-haul flights. Airlines continue to invest in enhancing passenger comfort, especially in business and first-class cabins, where seat actuation systems are critical. Moreover, the expanding fleet of wide-body aircraft, which are more likely to incorporate advanced seating systems, is further supporting the growth of the commercial aircraft platform in the market.

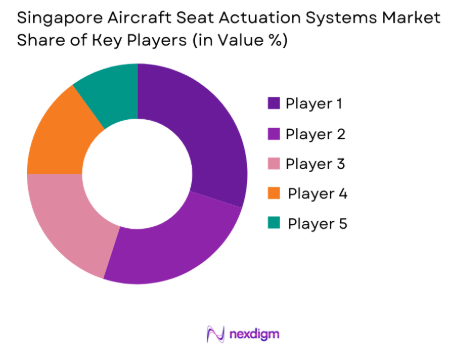

Competitive Landscape

The Singapore Aircraft Seat Actuation Systems market is consolidated, with a few major players leading the industry. The key companies include global giants such as Rolls-Royce, Safran, Moog, and Honeywell. These companies dominate due to their extensive product portfolios, global reach, and strong relationships with aircraft manufacturers. Their technological innovations, such as the development of electric actuation systems, are positioning them as leaders in the market. The competition in this sector is driven by the increasing demand for energy-efficient, lightweight, and reliable seating systems, which are critical for enhancing passenger comfort and reducing operational costs for airlines.

| Company | Establishment Year | Headquarters | Key Parameter 1 | Key Parameter 2 | Key Parameter 3 | Key Parameter 4 | Key Parameter 5 | Key Parameter 6 |

| Rolls-Royce | 1904 | UK | Product Portfolio | Global Presence | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | Market Share Leader | Strong R&D Capabilities | ~ | ~ | ~ | ~ |

| Moog | 1951 | USA | Customization Capabilities | Global Supplier Network | ~ | ~ | ~ | ~ |

| Honeywell | 1906 | USA | Integrated Solutions | Advanced Manufacturing Facilities | ~ | ~ | ~ | ~ |

| Liebherr Aerospace | 1949 | Germany | Actuation System Expertise | Focus on Aerospace | ~ | ~ | ~ | ~ |

Singapore Aircraft Seat Actuation Systems market Analysis

Growth Drivers

Increasing Demand for Premium Seating

As airlines focus on improving passenger comfort, particularly in business and first-class cabins, the demand for advanced seat actuation systems is rising. The growing preference for personalized seating configurations and recline functionalities in premium cabins is driving the adoption of sophisticated actuation systems. Airlines are investing in these systems to enhance customer satisfaction, which ultimately leads to higher revenues and brand loyalty, thus boosting the market for aircraft seat actuators in the region.

Growing Aircraft Fleet in Asia-Pacific

The Asia-Pacific region, particularly Singapore, is seeing a steady increase in aircraft deliveries and fleet expansions. This expansion is driven by rising air traffic and growing demand for international and regional travel. With the aviation hub status of Singapore, many global airlines and aircraft operators are upgrading their fleets and retrofitting older models, creating a significant demand for advanced seat actuation systems that improve both comfort and efficiency in newer aircraft designs.

Market Challenges

High Development and Certification Costs

Aircraft seat actuation systems involve significant research, development, and certification costs due to the strict safety and regulatory requirements imposed by aviation authorities. These high costs can be a barrier to entry for new players and also put pressure on established companies to maintain competitive pricing while adhering to the rigorous standards required for approval. The prolonged time for regulatory clearance also delays market entry, limiting the pace of technological innovation.

Supply Chain and Component Sourcing Issues

The global aerospace supply chain is highly complex and susceptible to disruptions. With the growing demand for seat actuation systems, manufacturers face challenges in sourcing high-quality materials and components, especially in the context of supply chain uncertainties and geopolitical tensions. These disruptions can cause delays in production and delivery, ultimately affecting the market growth and increasing operational costs for manufacturers and suppliers.

Opportunities

Retrofit and Aftermarket Growth

As more airlines seek to modernize their fleets, there is a substantial opportunity for the retrofit and aftermarket segments of the market. Airlines and aircraft operators are increasingly investing in upgrading existing aircraft with advanced seating solutions to meet passenger demands for comfort. This trend presents a lucrative opportunity for suppliers of seat actuation systems, particularly for MRO providers who can offer these services at a lower cost compared to new aircraft installations.

Shift Toward Electric and Energy-Efficient Actuators

The aviation industry’s growing focus on sustainability and energy efficiency presents a major opportunity for the development of electric and hybrid-electric actuation systems. These systems are lighter, more energy-efficient, and require less maintenance than traditional hydraulic or pneumatic systems, making them attractive to airlines looking to reduce operational costs and carbon emissions. As technology advances and regulations become more stringent, the demand for such systems is expected to rise, presenting opportunities for suppliers to innovate and lead in this emerging segment.

Future Outlook

Over the next decade, the Singapore Aircraft Seat Actuation Systems market is poised for significant growth, driven by ongoing advancements in seating technologies, growing air travel demand, and an increased focus on passenger comfort and energy efficiency. The trend towards lightweight, electric, and hybrid-electric actuation systems will continue to dominate the market, supported by the shift towards sustainable aviation. The demand for seat actuators will rise as airlines invest in new aircraft deliveries and retrofitting existing fleets with advanced seating systems to enhance passenger experience, particularly in premium cabins.

Major Players

- Rolls-Royce

- Safran

- Moog

- Honeywell

- Liebherr Aerospace

- Parker Hannifin

- Boeing

- Triumph Group

- Collins Aerospace

- Thales Group

- Geaviation

- Woodward Inc.

- Schaeffler Group

- Rockwell Collins

- Airbus

Key Target Audience

- Airlines and aircraft operators

- Aircraft seat manufacturers

- Aircraft OEMs

- Aerospace technology developers

- Aircraft maintenance, repair, and overhaul companies

- Aircraft fleet leasing companies

- Government and regulatory bodies

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

This phase involves a comprehensive mapping of all critical stakeholders in the Singapore Aircraft Seat Actuation Systems market. We will gather both secondary and primary data to identify and define the key variables that impact market dynamics, such as technology trends, customer preferences, and regulatory factors.

Step 2: Market Analysis and Construction

In this phase, historical data is gathered and analysed to assess market trends, including market penetration, the ratio of actuation systems per aircraft, and associated revenues. We will also review service quality statistics to ensure the robustness and accuracy of market projections.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses derived from market analysis will be validated through interviews with industry experts. These consultations will provide additional insight into operational challenges, technological innovations, and financial factors that influence market trends.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with key manufacturers and stakeholders to verify the findings of the bottom-up approach. Insights gathered will allow for a comprehensive, accurate, and validated market report on the Singapore Aircraft Seat Actuation Systems market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for passenger comfort and aircraft interior innovation

Increasing aircraft deliveries and fleet expansions

Technological advancements in actuation systems for enhanced efficiency - Market Challenges

High cost of advanced actuation systems

Regulatory challenges and certification processes

Supply chain disruptions and component sourcing issues - Market Opportunities

Expansion of aircraft fleet in emerging markets

Development of next-gen lightweight actuation systems

Integration of sustainable materials and technologies in actuation systems - Trends

Shift towards electric and hybrid-electric aircraft

Increase in customization of seat configurations for premium cabins

Use of AI and automation for predictive maintenance in actuation systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Electric Actuators

Hydraulic Actuators

Pneumatic Actuators

Mechanical Actuators

Smart Actuation Systems - By Platform Type (In Value%)

Commercial Aircraft

Business Jets

Regional Aircraft

Helicopters

Military Aircraft - By Fitment Type (In Value%)

Linefit

Retrofit

OEM

Aftermarket

MRO (Maintenance, Repair, and Overhaul) - By End User Segment (In Value%)

OEM Manufacturers

Aircraft Operators

MRO Providers

Seat Manufacturers

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct Procurement

Distributor Procurement

Online Procurement

Bidding Procurement

Long-term Contracts

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Revenue Growth, Technological Advancements, Product Diversification, Regional Presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Detailed Profiles

Rolls-Royce

Safran

Honeywell International

Collins Aerospace

Moog Inc.

Liebherr Aerospace

Boeing

Airbus

Thales Group

Triumph Group

Sundstrand Corporation

Parker Hannifin

Daimler AG

Geaviation

Woodward Inc.

- Growth of the regional aviation market driving demand for seat actuation systems

- Increased focus on premium cabin designs to improve passenger experience

- Rising demand for retrofit systems for older aircraft

- Collaborations between OEMs and seat manufacturers for innovative seat solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- uture Demand by Platform 2026-2035