Market Overview

The Singapore aircraft seating market is valued at approximately USD ~billion in 2025, driven by the rapidly increasing air travel demand in the Asia-Pacific region, which is one of the largest and fastest-growing global aviation hubs. The demand for premium seating solutions is also on the rise as airlines look to enhance customer experience and maximize revenue per passenger. Factors such as increasing disposable income, the introduction of new aircraft models, and the growing trend of luxury air travel are significant contributors to the market’s size. The market is additionally bolstered by innovation in seat design, including the integration of advanced materials and technologies aimed at improving passenger comfort and airline operational efficiency.

Singapore remains one of the dominant markets in the aircraft seating sector due to its strategic position as a key aviation hub in Southeast Asia. The country is home to Changi Airport, one of the busiest and most advanced airports in the world, facilitating significant air travel traffic. Its proximity to emerging markets in Asia, alongside high passenger demand for both economy and premium seats, plays a pivotal role in driving the market’s growth. Furthermore, Singapore’s strong regulatory environment and support for aerospace innovation contribute to its dominance in the region.

Market Segmentation

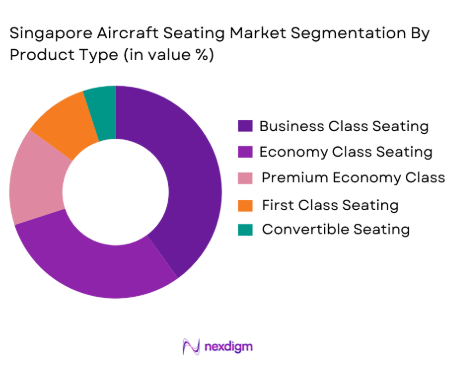

By Product Type

The Singapore aircraft seating market is segmented by product type into business class seating, economy class seating, premium economy class seating, first class seating, and convertible seating. In the product type segment, business class seating is the dominant subsegment. This is largely driven by increasing passenger demand for premium experiences, particularly on long-haul flights. Airlines are investing in business class products to cater to the growing affluent traveler segment, with features such as lie-flat seats, privacy dividers, and enhanced in-flight entertainment systems. The demand for these premium seats is also supported by airlines’ strategies to increase revenue per passenger and differentiate themselves in the competitive aviation market.

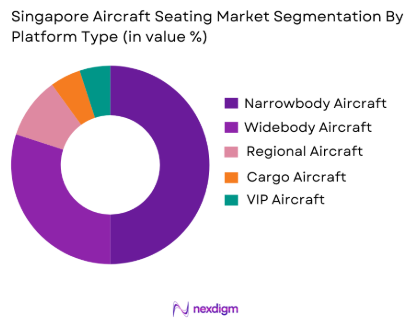

By Platform Type

The aircraft seating market is further segmented by platform type into narrowbody aircraft, widebody aircraft, regional aircraft, cargo aircraft, and VIP aircraft. Narrowbody aircraft seats have the largest share in the platform type segment. This dominance can be attributed to the extensive use of narrowbody aircraft for short-haul and medium-haul flights, which form a significant portion of air travel in the Asia-Pacific region. These aircraft are more cost-effective for airlines, leading to high volumes of seating demand for economy class, which constitutes the majority of seating in narrowbody aircraft. The consistent growth in budget carriers and the rise in regional tourism further support the demand for narrowbody aircraft seats.

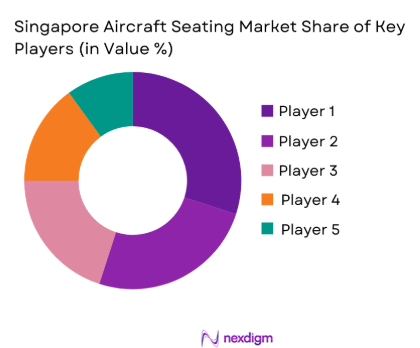

Competitive Landscape

The Singapore aircraft seating market is dominated by several major players, both local and international, including Recaro Aircraft Seating, Zodiac Aerospace, B/E Aerospace, Geven, and Acro Aircraft Seating. These companies have established a strong foothold in the market through innovative product offerings, global distribution networks, and a commitment to sustainability. International brands have a significant presence in the market due to the high demand for premium and innovative seating solutions from airlines operating in Singapore and the wider Asia-Pacific region.

| Company | Establishment Year | Headquarters | Revenue (USD Billion) | Product Innovations | Market Focus | Technology Integration |

| Recaro Aircraft Seating | 1906 | Germany | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 1896 | France | ~ | ~ | ~ | ~ |

| B/E Aerospace (Collins Aerospace) | 1968 | USA | ~ | ~ | ~ | ~ |

| Geven | 1987 | Italy | ~ | ~ | ~ | ~ |

| Acro Aircraft Seating | 2002 | UK | ~ | ~ | ~ | ~ |

Singapore aircraft seating market Analysis

Growth Drivers

Rising Demand for Air Travel in the Asia-Pacific Region

The increasing number of air passengers in Asia-Pacific, particularly in Singapore, is a major growth driver for the aircraft seating market. The rise in disposable income, along with the expanding middle class, has led to higher demand for both economy and premium seating. Airlines are responding by modernizing their fleets, leading to a higher requirement for advanced aircraft seating solutions.

Technological Advancements in Seating Solutions

Innovations in aircraft seating technologies, such as the integration of lightweight materials, smart seating, and more ergonomic designs, are driving the growth of the market. Airlines are investing in seating upgrades to enhance passenger comfort and improve operational efficiency, which directly boosts demand for advanced seating systems.

Market Challenges

High Cost of Advanced Seating Systems

One of the key challenges facing the Singapore aircraft seating market is the high cost associated with advanced seating technologies, especially in premium class cabins. Airlines must balance the investment in innovative, luxury seating with the operational cost implications, which can constrain their ability to upgrade seating across their fleets.

Regulatory and Certification Complexities

Aircraft seating manufacturers must comply with stringent aviation regulations and safety standards set by authorities such as the Civil Aviation Authority of Singapore. The certification process for new seating designs can be time-consuming and costly, delaying the introduction of innovative seating solutions into the market.

Opportunities

Growing Focus on Sustainable and Eco-Friendly Solutions

The increasing emphasis on sustainability presents significant opportunities for the aircraft seating market. Manufacturers can capitalize on the demand for eco-friendly materials and energy-efficient designs. Airlines are also under pressure to reduce their carbon footprint, and sustainable seating options could help them achieve these goals, while also appealing to environmentally conscious consumers.

Rise in Premium and Luxury Travel

The growing trend of luxury and premium travel, especially in Asia-Pacific, presents a significant opportunity for airlines to offer differentiated seating options. As affluent passengers seek more comfort and privacy, airlines are likely to invest in high-end business and first-class seating, driving demand for high-quality and customizable seating solutions.

Future Outlook

Over the next decade, the Singapore aircraft seating market is expected to show significant growth. This is primarily driven by a robust recovery in air travel demand following the pandemic, ongoing advancements in seating technology, and a rising trend of luxury and personalized seating solutions. Airlines are increasingly focusing on enhancing customer experience to differentiate themselves in the competitive aviation sector. In addition, innovations such as the use of eco-friendly materials and modular seating systems are expected to gain prominence, fuelling further market growth.

Major Players

- Recaro Aircraft Seating

- Zodiac Aerospace

- B/E Aerospace

- Geven

- Acro Aircraft Seating

- Aviointeriors

- STELIA Aerospace

- Rockwell Collins

- Thales Group

- Magellan Aerospace

- Safran Seats

- JAMCO Corporation

- Mirus Aircraft Seating

- Airtex Aircraft Seating

- Thompson Aero Seating

Key Target Audience

- Airlines

- Aircraft manufacturers

- Airline service providers

- Aviation industry regulators

- Airlines’ procurement teams

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aviation infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing an ecosystem map to encompass all stakeholders within the Singapore aircraft seating market. Secondary research through proprietary databases and reports will help define the key drivers of market growth, including technological advancements, economic conditions, and consumer preferences.

Step 2: Market Analysis and Construction

The next phase includes analysing historical market data, focusing on seating trends, platform preferences, and regional demand shifts. Data from industry reports, financial filings, and market surveys will be used to forecast future trends and identify potential growth sectors.

Step 3: Hypothesis Validation and Expert Consultation

During this phase, we validate the hypotheses developed using insights gathered from industry experts. Telephone and video interviews will be conducted with stakeholders from major airlines, aircraft manufacturers, and technology providers to ensure the accuracy of the market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all data collected, cross-referencing it with primary research findings, and creating a comprehensive market report. We will engage with seating manufacturers, airline operators, and regulatory bodies to verify market projections and trends, ensuring high accuracy and reliability.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Gro

- Growth Drivers

Rising demand for air travel in Asia-Pacific

Increasing investment in aircraft fleet modernization

Growing demand for premium and luxury travel options - Market Challenges

High initial cost of advanced seating systems

Regulatory compliance and certification complexities

Technological and supply chain constraints - Market Opportunities

Growing trend of airline partnerships for joint procurement

Advancements in lightweight seating materials

Expanding demand for eco-friendly and sustainable seating options - Trends

Integration of smart technology in aircraft seating

Shift towards more flexible, modular seating solutions

Increasing focus on enhancing passenger comfort and safety

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Business Class Seating

Economy Class Seating

Premium Economy Class Seating

First Class Seating

Convertible Seating - By Platform Type (In Value%)

Narrowbody Aircraft

Widebody Aircraft

Regional Aircraft

Cargo Aircraft

VIP Aircraft - By Fitment Type (In Value%)

OEM Fitments

Retrofit Fitments

Modification Fitments

Passenger-to-Cargo Conversions

Aftermarket Components - By End User Segment (In Value%)

Commercial Airlines

Private Jet Operators

Cargo and Freight Operators

VIP and Luxury Aircraft

Military & Government Aircraft - By Procurement Channel (In Value%)

Direct Procurement from OEMs

Third-party Distributors

Online Procurement

Government and Military Contracts

Aftermarket and Retrofit Sales

- Market Share Analysis

- Cross Comparison Parameters (Market Share by Region, Product Pricing Trends, Technology Adoption Rates, Customer Satisfaction Ratings, R&D Investment Levels)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Recaro Aircraft Seating

Zodiac Aerospace

Sichuan Haite High-Tech

B/E Aerospace

Geven S.p.A.

Acro Aircraft Seating

Adient Aerospace

Rockwell Collins

AVIC Aircraft Co.

Thales Group

Tamarack Aerospace Group

KSSU

H+S Aviation

Sogevac

Magnetic MRO

- Commercial airlines focusing on enhancing passenger comfort and reducing operational costs

- Private jet operators prioritizing customization and luxury seating features

- Cargo operators demanding more functional and flexible seating options

- Military and government aircraft opting for high durability and lightweight designs

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035