Market Overview

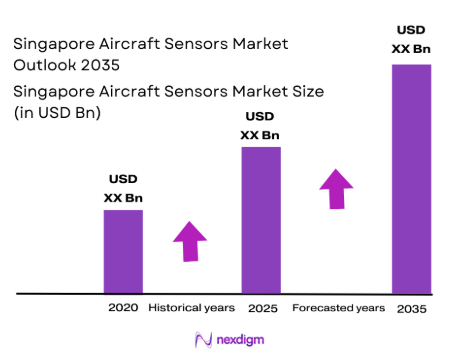

The Singapore aircraft sensors market is valued at USD~ million in 2025, primarily driven by increasing demand for advanced avionics in both commercial and military aircraft. A surge in passenger traffic and modernization of aging fleets are contributing to the increasing requirement for efficient, precise, and reliable sensors. These sensors are integral to avionics systems that ensure safety, navigation, and flight control. The government’s focus on infrastructure development and the growing aviation sector in the Asia-Pacific region further drives market growth. The rise in defense budgets has also fuelled demand for advanced military aircraft sensors, thereby increasing the market value

Singapore, a key aviation hub in Asia, dominates the aircraft sensors market. Its strategic location at the crossroads of major global flight routes makes it a critical player in the aerospace industry. Additionally, Singapore’s well-established aviation infrastructure, supported by both public and private investment, drives demand for aircraft sensor technologies. The country’s thriving commercial and defense aviation sectors, bolstered by government initiatives and partnerships with global aerospace manufacturers, further solidify Singapore’s leadership in the regional market.

Market Segmentation

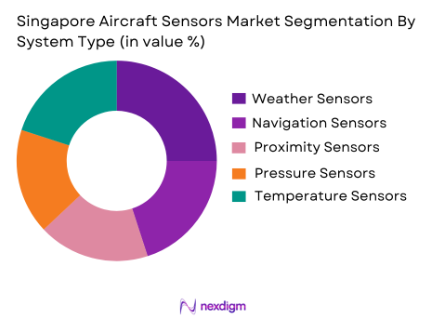

By System Type

The Singapore Aircraft Sensors market is segmented by system type, including weather sensors, navigation sensors, proximity sensors, pressure sensors, and temperature sensors. Weather sensors have a dominant share in the market due to their critical role in flight safety and navigation. These sensors provide real-time atmospheric data, which is essential for aircraft to adjust their flight paths based on changing weather conditions. The advancement in sensor technologies that improve accuracy and reliability is propelling the growth of this segment. Moreover, increasing concerns about weather-related accidents in the aviation industry make weather sensors indispensable, contributing to their dominance.

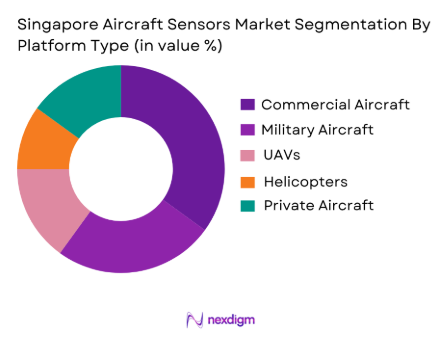

By Platform Type

The market is also segmented by platform type into commercial aircraft, military aircraft, unmanned aerial vehicles (UAVs), helicopters, and private aircraft. Commercial aircraft account for the largest market share due to the ever-increasing global passenger traffic and the demand for modern, more efficient aircraft. Sensors in commercial aircraft are critical for ensuring smooth operations, reducing maintenance costs, and enhancing flight safety. Airlines’ focus on fleet modernization, safety, and cost-efficiency further drives the growth of this segment.

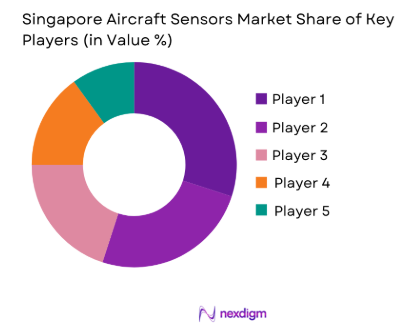

Competitive Landscape

The Singapore Aircraft Sensors market is characterized by the dominance of key players, such as Honeywell Aerospace, Rockwell Collins, and Garmin Ltd., with a strong presence of both local and international companies. The competition in the market is fierce due to technological advancements and the growing demand for innovative sensor systems in both commercial and military aviation.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Focus | R&D Investment | Strategic Initiatives | Technological Capabilities |

| Honeywell Aerospace | 1906 | USA | Avionics, Sensors | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | Flight Controls, Sensors | ~ | ~ | ~ | ~ |

| Garmin Ltd. | 1989 | Switzerland | Navigation, Weather | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | Communication, Sensors | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | USA | Motion Systems, Sensors | ~ | ~ | ~ | ~ |

Singapore Aircraft Sensors Market Analysis

Growth Drivers

Technological Advancements in Aviation Sensors

The continuous innovation in sensor technology is a significant driver for the growth of the aircraft sensors market in Singapore. Emerging technologies like Artificial Intelligence (AI), Internet of Things (IoT), and advanced data analytics are being integrated into sensor systems, making them more efficient, accurate, and reliable. Sensors used in flight control systems, weather monitoring, and safety features benefit greatly from these advancements. As global aviation standards continue to rise and as aircraft operators seek to improve operational efficiency and safety, the demand for more sophisticated sensors in both commercial and military aviation grows. Singapore, being a hub for aviation and aerospace industries, is well-positioned to capitalize on these technological trends, with companies and research institutions continuously working towards enhancing sensor performance for the entire aviation ecosystem.

Government Support for Aviation and Aerospace Industry

The Singaporean government’s strong commitment to growing its aerospace industry acts as a key growth driver for the aircraft sensors market. With initiatives such as the Aerospace Industry Transformation Map (ITM), which aims to strengthen Singapore’s position as a global leader in aerospace manufacturing and innovation, the country is investing heavily in cutting-edge technologies. These investments include funding research and development (R&D) in aerospace technologies and encouraging collaborations between local and international players in the aerospace sector. Additionally, the Civil Aviation Authority of Singapore (CAAS) promotes advanced safety protocols, stimulating demand for more sophisticated sensor systems in both aircraft and airport operations. The governmental focus on positioning Singapore as a key player in the global aviation sector bolsters the aircraft sensors market.

Market Challenges

High Initial Investment Costs

One of the primary challenges facing the aircraft sensors market in Singapore is the high initial investment required for advanced sensor systems. The development and deployment of these sensors involve significant research and development (R&D) costs, as well as extensive testing and regulatory approvals. This makes the overall price point of high-quality sensors relatively high, which can deter smaller airlines or aviation businesses from making such investments. Furthermore, the integration of these sensors into existing aircraft fleets requires additional costs in terms of retrofit and system compatibility. While these systems promise long-term benefits such as improved safety, efficiency, and fuel savings, the high upfront costs may slow down the widespread adoption of advanced sensors, particularly among smaller or regional operators in Singapore’s competitive aviation market.

Regulatory Challenges and Compliance

The aircraft sensors market in Singapore is heavily influenced by stringent aviation regulations and compliance standards set by both local and international aviation bodies, such as the International Civil Aviation Organization (ICAO) and the Civil Aviation Authority of Singapore (CAAS). These regulations govern everything from sensor technology safety to data handling and cybersecurity protocols. As aviation sensor technology evolves rapidly, keeping up with these regulations while ensuring that new products meet all safety and compliance standards presents a significant challenge for manufacturers and integrators. This dynamic regulatory environment adds layers of complexity and time delays to the sensor development and approval process. Compliance with these regulations is critical for market players to avoid potential safety risks and regulatory fines, impacting the speed and cost of introducing new sensor solutions to the market.

Opportunities

Growth of Smart Airports

The growth of smart airports presents a significant opportunity for the aircraft sensors market in Singapore. As Singapore positions itself as a key aviation hub in Asia, the country has been investing in smart airport technologies to enhance operational efficiency, security, and passenger experience. Aircraft sensors play a critical role in this transformation, with applications such as automated baggage handling, predictive maintenance, and enhanced air traffic management. Sensors that monitor aircraft health in real time or provide vital data to air traffic control systems are in high demand. Additionally, the integration of IoT and AI technologies into airport operations creates opportunities for the sensors market to grow, providing solutions for better safety, optimized traffic flow, and reduced turnaround times. As the aviation sector recovers from the impacts of the pandemic, the adoption of these technologies is expected to accelerate, thus boosting sensor demand.

Rise of Electric and Hybrid Aircraft

The increasing interest in electric and hybrid aircraft technologies opens new opportunities for the aircraft sensors market in Singapore. With the global push for sustainable aviation and the need to reduce carbon emissions, Singapore is investing in electric aircraft research and development. Sensors are crucial to the operation and safety of these next-generation aircraft, as they monitor various parameters, including battery health, power management systems, and performance during flight. The growing focus on sustainability and the green aviation agenda creates demand for advanced sensors that support the operation of electric propulsion systems, energy-efficient aircraft design, and sustainable air transport solutions. As the global aviation industry moves toward green technologies, Singapore’s efforts to remain at the forefront of aviation innovation provide a significant opportunity for sensor manufacturers to develop and integrate cutting-edge solutions in this emerging field.

Future Outlook

Over the next decade, the Singapore Aircraft Sensors market is expected to show substantial growth. This will be driven by the continuous technological advancements in sensor systems, the rising demand for more efficient and accurate sensors in commercial and military aircraft, and the increasing focus on safety and automation. Additionally, the government’s focus on expanding Singapore’s aviation infrastructure and supporting technological innovation in the aerospace sector will further accelerate market expansion.

Major Players

- Honeywell Aerospace

- Rockwell Collins

- Garmin Ltd.

- Thales Group

- Moog Inc.

- GE Aviation

- AeroVironment

- L3 Technologies

- SENSATA Technologies

- UTC Aerospace Systems

- Leidos

- Meggitt PLC

- Boeing

- SAAB AB

- Teledyne Technologies

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aircraft Manufacturers

- Aircraft Maintenance, Repair, and Overhaul (MRO) Service Providers

- Aerospace System Integrators

- OEM Suppliers

- Aviation Technology Firms

- Defense Agencies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves gathering key data on the Singapore Aircraft Sensors market, identifying critical variables such as sensor types, platforms, and end-users. This is done by conducting desk research, utilizing both secondary data and proprietary databases. The focus is on defining the major factors that influence the market dynamics.

Step 2: Market Analysis and Construction

Here, historical data on the aircraft sensors market is analyzed, including market size, technology adoption rates, and the balance of demand across different aircraft segments. Statistical tools are employed to validate trends and ensure accuracy in market projections.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses developed in the previous steps are tested and validated through expert interviews and consultations. These insights, obtained from industry professionals, help refine the market model and validate the assumptions made during the market analysis phase.

Step 4: Research Synthesis and Final Output

The final analysis combines data from all steps, cross-checking information with industry reports, interviews, and market trends. The outcome is a comprehensive report that provides actionable insights into the Singapore Aircraft Sensors market, which is then validated with key stakeholders in the industry.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in aircraft production and fleet size in Singapore

Rising demand for advanced sensor technology in avionics

Government regulations driving safety and performance standards - Market Challenges

High cost of advanced sensor systems

Integration complexity in existing aircraft platforms

Concerns over data security and sensor vulnerabilities - Market Opportunities

Growing market for unmanned aerial vehicle (UAV) sensors

Technological advancements in IoT and sensor networks

Strategic collaborations between aerospace companies and tech startups - Trends

Integration of artificial intelligence and machine learning in aircraft sensors

Emerging trends in wireless sensor networks for aircraft

Increased focus on sensor miniaturization and weight reduction

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Weather sensors

Navigation sensors

Proximity sensors

Pressure sensors

Temperature sensors - By Platform Type (In Value%)

Commercial aircraft

Military aircraft

Unmanned aerial vehicles (UAVs)

Helicopters

Private aircraft - By Fitment Type (In Value%)

OEM fitment

Aftermarket fitment

Upgraded sensors

Retrofit sensors

Integrated systems - By End User Segment (In Value%)

Aircraft manufacturers

Maintenance, repair, and overhaul (MRO) services

OEM suppliers

Aerospace system integrators

Government and defense agencies - By Procurement Channel (In Value%)

Direct sales

Distributors and resellers

Online procurement platforms

B2B partnerships

Third-party procurement

- Market Share Analysis

- Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Innovation, Regional Presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Honeywell Aerospace

Garmin Ltd.

Rockwell Collins

Thales Group

Moog Inc.

GE Aviation

AeroVironment

L3 Technologies

SENSATA Technologies

UTC Aerospace Systems

Leidos

Meggitt PLC

Boeing

SAAB AB

Teledyne Technologies

- Increasing demand for advanced avionics by commercial airlines

- Rising adoption of smart sensors by the military for defense applications

- Growing interest in predictive maintenance and sensor-based diagnostics

- Expansion of UAV applications requiring advanced sensor systems

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035