Market Overview

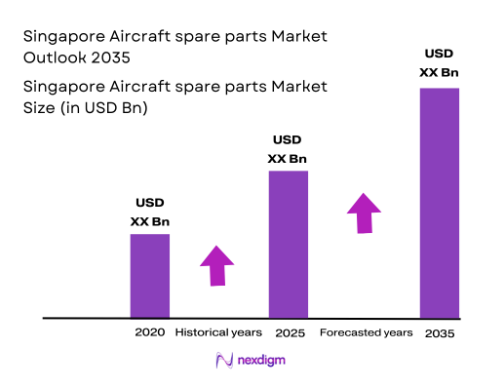

The Singapore Aircraft Spare Parts market is valued at USD ~ billion, driven by an expanding aviation sector and growing air traffic in the region. The demand for aircraft spare parts is fueled by the increasing fleet size, particularly in commercial aviation, and a high rate of international connectivity through Singapore Airlines. This demand is further supported by the nation’s strategic location as a global air travel hub, contributing to steady growth in both the commercial and MRO (maintenance, repair, and overhaul) service sectors.

Singapore is one of the dominant players in the aircraft spare parts market due to its position as a major aviation hub in Southeast Asia. The country’s aviation infrastructure, including Singapore Changi Airport, consistently ranks among the busiest and best-connected airports globally, fostering a high demand for aircraft spare parts. Additionally, Singapore Airlines, with its large fleet and international reach, drives the market for both OEM (Original Equipment Manufacturer) and aftermarket spare parts.

Market Segmentation

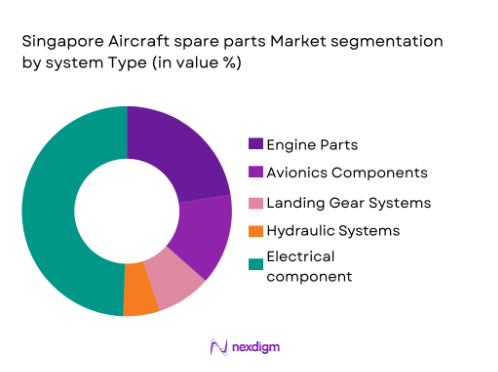

By System Type

The Singapore Aircraft Spare Parts market is segmented by system type, including engine parts, avionics, landing gear systems, hydraulic systems, and electrical components. Engine parts dominate the market due to their critical role in aircraft operations. These parts require regular maintenance and are expensive to replace, driving high demand for both OEM and aftermarket components. The growing fleet of Singapore Airlines, as well as other regional carriers, contributes to the demand for engine parts, with regular engine overhauls and repairs necessary to maintain safety standards and operational efficiency.

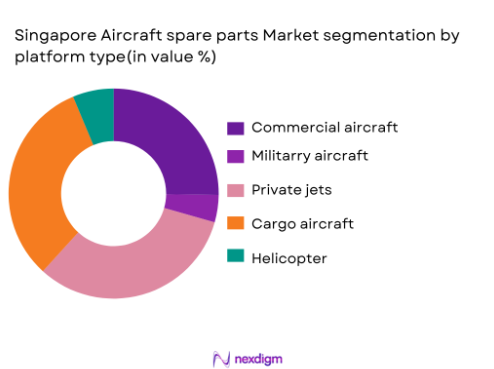

By Platform Type

The Singapore Aircraft Spare Parts market is also segmented by platform type, including commercial aircraft, military aircraft, private jets, cargo aircraft, and helicopters. Commercial aircraft make up the largest portion of the market due to Singapore’s robust airline industry, led by Singapore Airlines, one of the world’s largest and most well-established carriers. The high volume of long-haul flights and the consistent growth of international passenger traffic through Singapore further increase the demand for commercial aircraft spare parts, particularly engines and avionics systems.

Competitive Landscape

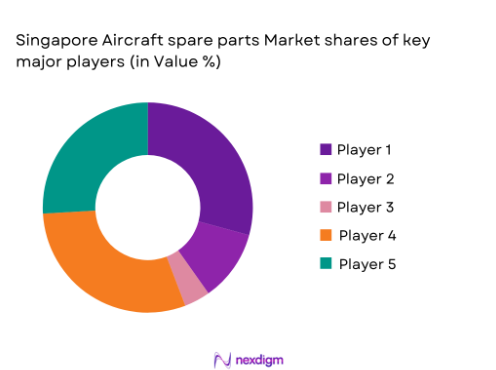

The Singapore Aircraft Spare Parts market is highly competitive, with a blend of global giants and regional players. International companies such as Boeing, Rolls-Royce, and Honeywell Aerospace play a key role, leveraging their large-scale operations and advanced technologies to meet the demands of local carriers. Singapore also hosts regional suppliers that specialize in specific parts and MRO services. This competitive landscape reflects the diverse needs of Singapore’s aviation sector, which spans commercial, military, and private aviation.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Presence | Technology Innovation | Supply Chain Network |

| Boeing | 1916 | Chicago, USA | – | – | – | – |

| Rolls-Royce | 1904 | Derby, UK | – | – | – | – |

| Safran | 2005 | Paris, France | – | – | – | – |

| Honeywell Aerospace | 1999 | Phoenix, USA | – | – | – | – |

| Collins Aerospace | 2018 | Charlotte, USA | – | – | – | – |

Singapore Aircraft Spare Parts Market Dynamics

Growth Drivers

Increase in Air Traffic and Fleet Expansion

Singapore’s position as a global aviation hub has led to consistent growth in air traffic, with Changi Airport handling over 68 million passengers in 2023. This growth is further complemented by fleet expansion, particularly by Singapore Airlines, which added 10 aircraft in 2023. The International Air Transport Association (IATA) forecasts that Southeast Asia’s air traffic will continue to grow at 4.6% annually until 2025, pushing the demand for aircraft spare parts. The expansion of airlines and the increasing number of flights directly increase the need for regular maintenance and spare parts, including engines and avionics.

Government Initiatives for Aviation Infrastructure Growth

The Singapore government has heavily invested in the aviation sector, with the expansion of Changi Airport set to increase its capacity to 90 million passengers by 2025. Additionally, the government is focusing on making Singapore a regional MRO (maintenance, repair, and overhaul) hub. In 2023, the Singapore Economic Development Board allocated USD 1 billion to enhance aerospace capabilities, which will directly impact the aircraft spare parts market by boosting demand for MRO services and parts. This growth is expected to continue as Singapore strengthens its position as an aviation leader in the Asia-Pacific region.

Market Challenges

High Cost of Advanced Aircraft Spare Parts

The cost of aircraft spare parts, especially high-end components like engines and avionics, continues to rise due to the technological complexity and the need for precision manufacturing. The International Civil Aviation Organization (ICAO) estimates that the cost of aircraft maintenance and repair is expected to account for over 40% of airlines’ operational costs. In Singapore, this is exacerbated by the reliance on international suppliers for many critical parts, which adds transportation costs and increases the price of spare parts. Additionally, the high cost of aircraft parts can limit smaller operators from upgrading or maintaining their fleets effectively.

Supply Chain Disruptions in the Global Market

Global supply chains for aircraft spare parts have been disrupted by events such as the COVID-19 pandemic, logistical bottlenecks, and geopolitical tensions. These disruptions have delayed the delivery of critical components to Singapore, affecting the timely maintenance of aircraft. In 2022, the World Trade Organization (WTO) reported a slowdown in trade, which resulted in increased lead times for spare parts delivery, particularly for complex systems like engines and avionics. Such disruptions hinder the ability of Singapore’s airlines to perform on-time repairs and maintenance, thereby creating operational challenges.

Market Opportunities

Expanding Tourism Sector Driving Aircraft Fleet Growth

Singapore’s tourism sector continues to grow, with tourist arrivals increasing to 6.1 million in 2023. This rise in tourism directly drives the need for additional flights, as airlines expand their fleets to meet demand. Singapore Airlines has been increasing its fleet size to cater to both regional and international travelers. As airlines expand their operations, the demand for aircraft spare parts, particularly for newer aircraft models, will rise. The expansion of fleets to accommodate tourism growth provides a significant opportunity for the aircraft spare parts market, particularly for engine and avionics components.

Growth of Low-Cost Carriers Increasing Demand for Spare Parts

The rise of low-cost carriers (LCCs) in Southeast Asia, particularly in Singapore, has contributed to increased demand for affordable aircraft spare parts. Carriers like Scoot and AirAsia have expanded their fleets to cater to the budget-conscious travel segment. In 2023, Scoot increased its fleet by 8%, leading to a higher demand for low-cost spare parts for regular maintenance. The cost-effective nature of LCCs necessitates a steady supply of spare parts that are both affordable and durable, creating growth opportunities for suppliers in the aftermarket segment.

Future Outlook

The Singapore Aircraft Spare Parts market is expected to continue its growth trajectory, driven by increasing air travel and ongoing investments in aviation infrastructure. The demand for spare parts is anticipated to remain strong due to the expansion of Singapore Airlines’ fleet and the nation’s strategic initiatives to maintain its position as a leading air travel hub. Furthermore, technological advancements in aircraft systems and parts, including more fuel-efficient and sustainable components, will contribute to the evolution of the market. With continued growth in passenger traffic and fleet size, Singapore’s aircraft spare parts market is poised for a strong future.

Major Players in the Market

- Boeing

- Rolls-Royce

- Safran

- Honeywell Aerospace

- Collins Aerospace

- Pratt & Whitney

- MTU Aero Engines

- GE Aviation

- Liebherr Aerospace

- Embraer

- Northrop Grumman

- Thales Group

- Lockheed Martin

- United Technologies

- SIA Engineering

Key Target Audience

- Airlines operating within the Asia-Pacific region

- Aircraft Fleet Operators

- Government Agencies

- Defense Ministries

- Aviation Regulatory Bodies

- Investments and Venture Capitalist Firms

- Aircraft Component Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the key variables that influence the Singapore Aircraft Spare Parts market. This phase is guided by extensive secondary research, focusing on data from industry publications, government sources, and expert interviews. The primary aim is to identify trends, key drivers, and the leading companies shaping the market.

Step 2: Market Analysis and Construction

This stage involves compiling and analyzing historical market data, such as demand patterns and component pricing, to construct an accurate view of the current market. Segment-wise market construction is done by assessing the adoption rate of different parts and platforms, along with a detailed analysis of service providers and end-users.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through consultations with industry experts, including those from major airlines, MRO service providers, and aircraft part suppliers. These interviews validate assumptions and offer deeper insights into market challenges, trends, and competitive strategies.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data into actionable insights. Engagement with key market participants, including aircraft manufacturers and airlines, is used to refine data and produce a comprehensive market report that includes future projections, trends, and competitive dynamics.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in air traffic and fleet expansion

Government initiatives for aviation infrastructure growth

Rising demand for aircraft maintenance and repair services - Market Challenges

High cost of advanced aircraft spare parts Supply chain disruptions in the global market

Stringent regulatory and certification requirements - Market Opportunities

Expanding tourism sector driving aircraft fleet growth

Growth of low-cost carriers increasing demand for spare parts

Technological advancements driving innovation in spare parts - Trends

Shift toward digitalization in spare parts procurement

Growing preference for eco-friendly aircraft parts

Integration of predictive maintenance technologies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Engine Parts

Avionics Components

Landing Gear Systems

Hydraulic Systems

Electrical Components - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Cargo Aircraft

Helicopters - By Fitment Type (In Value%)

OEM Parts

Aftermarket Parts

MRO Services

Engine Overhaul Parts

Refurbished Parts - By End User Segment (In Value%)

Airlines

MRO Service Providers

Private Jet Owners

Government & Military

Air Cargo Operators - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Authorized Distributors

Third-Party Resellers

Online Platforms

Fleet Operators

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Revenue, Product Portfolio, Regional Reach, Technological Innovation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Boeing

Airbus

GE Aviation

Rolls-Royce

Safran

Honeywell Aerospace

Collins Aerospace

Pratt & Whitney

MTU Aero Engines

GE Aviation

Embraer

Northrop Grumman

Liebherr Aerospace

SABCA

Thales Group

- Airlines focusing on reducing aircraft downtime

- MRO providers expanding services to cover new aircraft models

- Private jet owners investing in high-quality spare parts

- Military operators upgrading fleet maintenance capabilities

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035