Market Overview

The Singapore aircraft strut market is valued at USD ~ million, and its growth is largely driven by increasing aviation traffic, a growing fleet of commercial and cargo aircraft, and the expanding aerospace infrastructure in the region. The market is primarily propelled by the need for advanced aircraft components, driven by the region’s role as a hub for international aviation. The increasing demand for replacement and repair parts further strengthens market growth, supported by the expanding aviation and aerospace industries.

Singapore remains a dominant player in the aircraft strut market, largely due to its strategic location as a regional aviation hub. The country’s robust aerospace infrastructure, including leading aircraft maintenance, repair, and overhaul (MRO) facilities, plays a significant role in the market’s growth. Additionally, Singapore’s reputation for strong regulatory frameworks and its central position in Southeast Asia help attract significant international investments in the aerospace sector, contributing to its dominance.

Market Segmentation

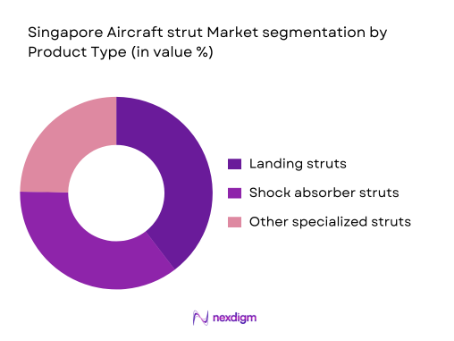

By Product Type

The Singapore aircraft strut market is segmented by product type into landing struts, shock absorber struts, and other specialized struts. The landing struts segment dominates the market, accounting for approximately 40% of the total market share in 2024. This dominance is driven by the critical role landing struts play in aircraft safety and performance, particularly for commercial and cargo aircraft. As these aircrafts operate in varying conditions, the demand for landing struts continues to be a significant contributor, driven by their importance in absorbing shock during landings and take-offs.

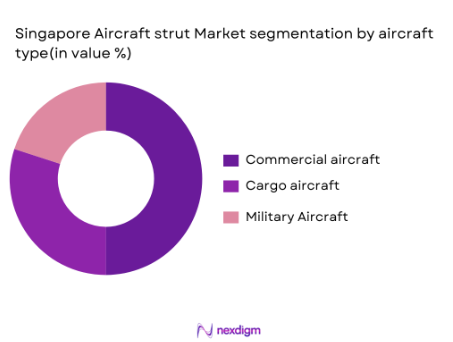

By Aircraft Type

The market is further segmented by aircraft type into commercial aircraft, cargo aircraft, and military aircraft. The commercial aircraft segment dominates the market with a market share of 50% in 2024. This is primarily due to the continuous growth in global air travel, which leads to the expansion of commercial fleets. Additionally, the need for frequent aircraft maintenance and parts replacement in the commercial sector drives the demand for aircraft struts, further cementing the dominance of this segment.

Competitive Landscape

The Singapore aircraft strut market is dominated by a few global players and regional leaders. These companies not only provide critical components but also lead in technological advancements and innovations within the aerospace industry. Among the top companies are Honeywell Aerospace, Safran, and United Technologies, which offer comprehensive product portfolios and are well-established in the MRO services. These companies’ strong partnerships with airlines and aircraft manufacturers further solidify their market positions.

| Company Name | Year of Establishment | Headquarters | Product Portfolio | Market Focus | Regional Reach | Annual Revenue (USD) |

| Honeywell Aerospace | 1906 | Morris Plains, USA | – | – | – | – |

| Safran | 2005 | Paris, France | – | – | – | – |

| United Technologies | 1934 | Farmington, USA | – | – | – | – |

| Collins Aerospace | 2018 | Charlotte, USA | – | – | – | – |

| Liebherr Aerospace | 1949 | Lindenberg, Germany | – | – | – | – |

Singapore Aircraft Strut Market Dynamics

Growth Drivers

Government Initiatives for Aviation Infrastructure Growth

Singapore’s government continues to prioritize the development of its aviation infrastructure. In 2024, Singapore allocated USD ~ billion for the expansion of Changi Airport, which will increase its capacity to handle 85 million passengers per year. This infrastructure expansion is expected to directly stimulate demand for maintenance, repair, and overhaul (MRO) services, including the production and replacement of aircraft struts. The government’s commitment to strengthening Singapore’s aviation sector with modern infrastructure and supporting policies enhances the long-term growth prospects of the aircraft strut market, as new aircraft fleets will require advanced and durable struts.

Rising Demand for Aircraft Maintenance and Repair Services

The demand for aircraft maintenance services in Singapore continues to rise, as the aviation fleet becomes more complex and requires more frequent repairs and part replacements. According to the Ministry of Transport, Singapore’s MRO market saw a growth of 8.5% in 2024, driven by an increase in fleet utilization and the introduction of newer, more sophisticated aircraft. Aircraft components, including struts, are subject to high wear and tear, leading to rising demand for replacement and refurbishment services. The growing fleet and technological advancements in aircraft are contributing significantly to this upward trend, making maintenance services a key factor in market growth.

Market Challenges

High Cost of Advanced Aircraft Strut Components

The high cost of advanced aircraft strut components remains a significant challenge in the Singapore market. As aircraft manufacturers adopt more complex and specialized materials, including carbon composites and titanium, the cost of production for aircraft struts has increased substantially. The adoption of these advanced materials aims to improve the struts’ durability and performance under extreme conditions but comes with a price tag that increases operational costs. According to the Aviation Industry Corporation of China (AVIC), the average cost of a single aircraft strut has increased by approximately 12% over the last two years due to the higher cost of raw materials and manufacturing. This poses a challenge for airlines and MRO companies that need to maintain cost-effective operations.

Supply Chain Disruptions in the Global Market

Supply chain disruptions continue to pose challenges to the timely availability of aircraft struts in Singapore. The global semiconductor shortage, which affected multiple industries, also impacted the production of aerospace components, including aircraft struts. The World Trade Organization (WTO) reported that global supply chain disruptions resulted in delays in component deliveries, with some suppliers experiencing lead times that stretched up to 8 months. This has caused delays in aircraft production and maintenance schedules in Singapore, affecting the availability of critical components like aircraft struts. The situation has been exacerbated by geopolitical tensions and fluctuations in raw material availability.

Market Opportunities

Expanding Tourism Sector Driving Aircraft Fleet Growth

Singapore’s tourism sector continues to expand, with over ~ million visitors expected in 2025, according to the Singapore Tourism Board (STB). This influx of visitors contributes to the increased demand for air travel, prompting airlines to expand their fleets to accommodate rising passenger numbers. Low-cost carriers, such as Scoot and AirAsia, have also increased their fleet size in response to the growing demand for affordable travel options. This expansion of fleets, particularly among low-cost carriers, presents a significant opportunity for the aircraft strut market, as more aircraft will require the installation and maintenance of aircraft struts to ensure operational safety.

Growth of Low-Cost Carriers Increasing Demand for Struts

The growth of low-cost carriers (LCCs) in Singapore is a key driver for the demand for aircraft struts. LCCs, which have seen a surge in popularity due to affordability and increased travel routes, require a significant number of aircraft parts, including struts, to maintain their fleets. According to the International Air Transport Association (IATA), the number of low-cost carriers operating in Singapore grew by 10% in 2025, reflecting the increase in passenger demand for budget-friendly air travel. The expansion of these airlines contributes to a rising need for cost-effective and durable aircraft components, further driving the growth of the aircraft strut market.

Future Outlook

Over the next five years, the Singapore aircraft strut market is expected to experience steady growth. This growth is anticipated to be driven by the continuous expansion of the aviation industry, with increasing passenger traffic and the ongoing renewal of aircraft fleets. Moreover, advancements in material technology and aerospace engineering are expected to further enhance the performance of aircraft struts, contributing to the market’s expansion. Additionally, the increasing focus on reducing maintenance costs through the use of durable and high-performance struts will foster continued market growth.

Major Players in the Market

- Honeywell Aerospace

- Safran

- United Technologies

- Collins Aerospace

- Liebherr Aerospace

- Parker Hannifin Corporation

- Airbus S.A.S.

- Boeing Company

- Rockwell Collins

- Meggitt PLC

- Triumph Group

- GE Aviation

- UTC Aerospace Systems

- AAR Corporation

- Aviall Services, Inc.

Key Target Audience

- Aircraft manufacturers

- Aerospace component suppliers

- Aviation maintenance, repair, and overhaul (MRO) companies

- Airlines and aircraft operators

- Aviation investors and venture capitalist firms

- Government and regulatory bodies

- Airlines’ purchasing and procurement departments

- Aerospace engineering firms

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the key drivers and variables that impact the Singapore aircraft strut market. This includes gathering data on the aerospace industry, aircraft fleet sizes, and regional MRO activities through extensive desk research and secondary data sources, ensuring a robust foundation for market analysis.

Step 2: Market Analysis and Construction

During this phase, historical data pertaining to aircraft strut demand, production, and market trends will be collected. The focus will be on segmenting the market by product type and aircraft type to assess the distribution of market share and the factors influencing demand for each category.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations with aerospace engineers, aircraft manufacturers, and MRO providers will help validate market hypotheses. These insights will be gathered through interviews and surveys to ensure accuracy and relevance in the market analysis.

Step 4: Research Synthesis and Final Output

The final phase consolidates the data from various sources and expert opinions to synthesize an accurate and comprehensive analysis of the Singapore aircraft strut market. The results will be cross-verified with industry experts and leading companies in the aerospace sector to ensure validity.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in air traffic and fleet expansion

Government initiatives for aviation infrastructure growth

Rising demand for aircraft maintenance and repair services - Market Challenges

High cost of advanced aircraft strut components

Supply chain disruptions in the global market

Stringent regulatory and certification requirements - Market Opportunities

Expanding tourism sector driving aircraft fleet growth

Growth of low-cost carriers increasing demand for struts

Technological advancements in materials and design improving strut durability - Trends

Shift toward digitalization in spare parts procurement

Growing preference for eco-friendly aircraft components

Integration of advanced materials in aircraft strut manufacturing

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Landing Gear Struts

Shock Absorber Struts

Hydraulic Struts

Engine Mount Struts

Wing Struts - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Cargo Aircraft

Helicopters - By Fitment Type (In Value%)

OEM Parts

Aftermarket Parts

MRO Services

Refurbished Parts

Upgraded Parts - By End User Segment (In Value%)

Airlines

MRO Service Providers

Private Jet Owners

Government & Military

Air Cargo Operators - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Authorized Distributors

Third-Party Resellers

Online Platforms

Fleet Operators

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Revenue, Product Portfolio, Regional Reach, Technological Innovation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Boeing

Airbus

GE Aviation

Rolls-Royce

Safran

Honeywell Aerospace

Collins Aerospace

Pratt & Whitney

MTU Aero Engines

GE Aviation

Embraer

Northrop Grumman

Liebherr Aerospace

SABCA

Thales Group

- Airlines focusing on reducing aircraft downtime

- MRO providers expanding services to cover

- new aircraft models

- Private jet owners investing in high-quality struts

- Military operators upgrading fleet maintenance capabilities

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035