Market Overview

The Singapore aircraft survival equipment market is a critical component of the aviation industry, valued at approximately USD ~ million in 2025. This market is driven by the growing demand for enhanced safety protocols in aviation, which are supported by stringent regulatory frameworks and advancements in technology. Innovations in equipment such as life vests, emergency breathing systems, and survival kits further support market growth. The growing need for reliable, life-saving aviation equipment in both commercial and defense sectors is boosting demand, in addition to a heightened focus on passenger safety.

Singapore is a key player in the global aircraft survival equipment market due to its strategic location as a leading aviation hub. The country’s well-established aviation infrastructure, with Changi Airport being one of the busiest and most efficient airports globally, fuels the demand for high-quality survival equipment. Moreover, Singapore’s regulatory framework, which aligns with international aviation safety standards, encourages continuous improvements in survival equipment. Other dominant countries in the Asia-Pacific region, including Japan and South Korea, also contribute significantly, due to their technologically advanced aviation sectors and military defense needs.

Market Segmentation

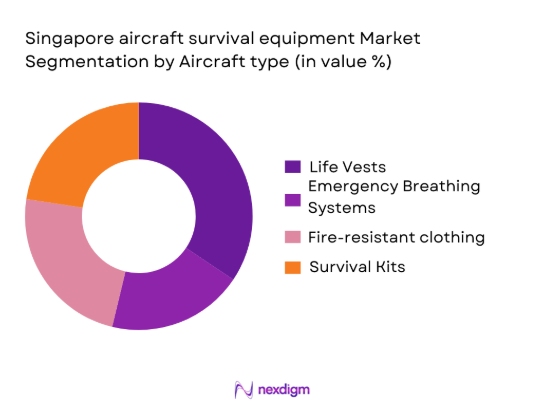

By Product Type

The Singapore aircraft survival equipment market is segmented by product type, which includes life vests, emergency breathing systems, fire-resistant clothing, and survival kits. Among these, life vests dominate the market share, as they are an essential part of aviation safety requirements for both commercial and military flights. The primary reason for their dominance is their indispensable role in ensuring passenger safety during emergency landings or water ditchings. Airlines operating in the region prioritize life vests in their safety protocols, which drives the demand for advanced, high-quality products. Furthermore, increasing passenger traffic and stringent safety regulations push the need for upgraded survival equipment, strengthening the life vest segment’s market share.

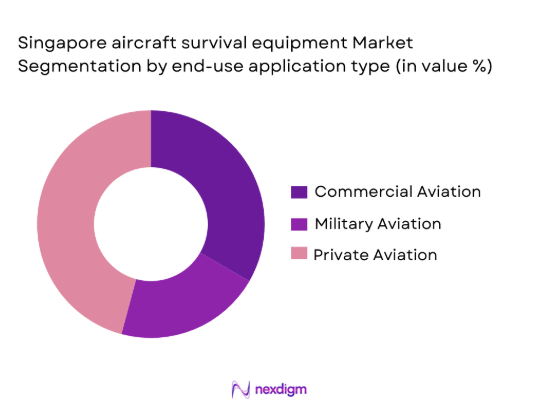

By End-Use Application

The market is also segmented by end-use application, including commercial aviation, military aviation, and private aviation. The commercial aviation segment holds the largest market share, accounting for the majority of aircraft survival equipment sales. This dominance is primarily due to the extensive safety equipment requirements imposed by global aviation authorities such as the International Civil Aviation Organization (ICAO) and the Federal Aviation Administration (FAA). The increasing number of international flights departing from Singapore, combined with rising passenger volumes, ensures that commercial airlines invest significantly in survival equipment. Furthermore, with airlines expanding their fleets, the demand for survival gear tailored to modern aircraft continues to rise.

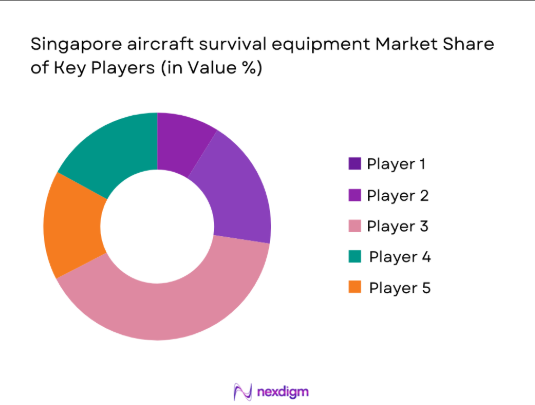

Competitive Landscape

The Singapore aircraft survival equipment market is dominated by a few global and regional players, each contributing to the market’s evolution through innovative products and technological advancements. The competition is marked by the presence of major companies, such as Honeywell International, Survival Systems International, and Safran, which are leaders in the development of safety systems for the aviation industry. These companies have strong brand loyalty and market recognition, enabling them to maintain a significant foothold in the region.

| Company Name | Establishment Year | Headquarters | Product Offering | Market Presence | Innovation Focus | Major Partnerships | Revenue | Product Quality | R&D Investment | Certifications |

| Honeywell International | 1906 | United States | – | – | – | – | – | – | – | – |

| Survival Systems International | 1982 | United States | – | – | – | – | – | – | – | – |

| Safran | 2005 | France | – | – | – | – | – | – | – | – |

| Zodiac Aerospace | 1896 | France | – | – | – | – | – | – | – | – |

| Reva Aeronautics | 1998 | United Kingdom | – | – | – | – | – | – | – | – |

Singapore Aircraft Survival Equipment Market Dynamics

Growth Drivers

Increase in Air Traffic in the Asia-Pacific Region

The demand for aircraft survival equipment in Singapore is primarily driven by the growth in air traffic within the Asia-Pacific region. In 2022, the International Air Transport Association (IATA) reported that Asia-Pacific’s air passenger numbers reached 1.2 billion, accounting for over 40% of global air traffic. As Singapore continues to be a key aviation hub, its airport, Changi, handled more than 68 million passengers in 2022. This growing number of flights, combined with the high number of international airlines operating in Singapore, boosts the demand for aviation safety equipment. The increased frequency of flights requires airlines to equip their fleets with advanced survival systems to meet stringent safety regulations.

Government Regulations Mandating Safety Equipment

The government of Singapore enforces strict regulations to ensure passenger safety in the aviation sector, including mandatory installation of survival equipment on all aircraft operating within its airspace. These regulations are set by the Civil Aviation Authority of Singapore (CAAS), aligning with international safety standards such as those outlined by the International Civil Aviation Organization (ICAO). As of 2023, CAAS continues to emphasize the importance of safety measures like life vests, emergency breathing systems, and survival kits. With growing enforcement of these standards, particularly after the implementation of ICAO’s more stringent safety measures in 2022, Singapore’s aviation sector continues to see increased demand for advanced survival equipment.

Market Challenges

High Costs of Advanced Survival Equipment

One of the challenges faced by the aircraft survival equipment market is the high cost of advanced technologies and materials. In 2023, it was reported that the cost of specialized survival gear, such as advanced life vests and emergency breathing systems, has risen due to improvements in technology, material quality, and compliance with international standards. The price of advanced fire-resistant clothing and survival kits has been particularly impacted by the increasing cost of raw materials, such as high-performance polymers and lightweight composites. This high cost limits the adoption of such equipment in smaller commercial aircraft and private planes, where budget constraints are a major factor in equipment procurement decisions.

Supply Chain Disruptions

Supply chain disruptions, exacerbated by the COVID-19 pandemic and global logistical challenges, have continued to affect the delivery timelines of critical survival equipment parts. The aviation sector in Singapore has been facing delays in the procurement of survival gear components, including emergency breathing systems and life vests. This is primarily due to global shortages of key materials like high-strength textiles and components for advanced aircrew life support systems. According to the Singapore Air Cargo Association, in 2022, supply chain disruptions led to a delay of up to 30% in the timely delivery of aviation parts, affecting the availability of survival equipment.

Market Opportunities

Expansion of Singapore’s Airline Fleet

Singapore Airlines, a major player in the region, has been expanding its fleet, with plans to acquire over 40 new aircraft in the next few years. This expansion is crucial for the market as it increases the demand for survival equipment across the commercial aviation sector. The purchase of new aircraft, such as the Boeing 787-10 Dreamliner and Airbus A350, requires modern, high-quality survival equipment to meet updated safety regulations. Additionally, with Changi Airport’s growth and its anticipated passenger traffic surpassing 80 million by 2025, the need for enhanced passenger safety equipment is expected to rise. This expansion in fleet size will drive the demand for survival systems, including advanced life vests and fire-resistant clothing.

Government Initiatives to Modernize Singapore’s Military Fleet

The Singapore government has committed to enhancing its military capabilities through the procurement of advanced military aircraft. As part of its ongoing defense modernization efforts, the Singapore Ministry of Defence (MINDEF) has prioritized the acquisition of next-generation fighter jets, such as the F-35 Lightning II, and is expected to enhance its aerial capabilities with the induction of new helicopters and unmanned aerial vehicles. These defense initiatives, with their emphasis on improved military aircraft safety, provide a solid market opportunity for survival equipment manufacturers. The need for advanced survival kits, fire-resistant clothing, and emergency life support systems will continue to rise as Singapore’s military fleet expands.

Future Outlook

Over the next 5 years, the Singapore aircraft survival equipment market is expected to experience significant growth driven by an increasing emphasis on passenger safety, new regulatory standards, and technological advancements in survival equipment. As the aviation industry continues to expand in Asia, especially in Singapore, the demand for innovative and reliable survival gear will rise. Furthermore, evolving threats in military aviation and the growing commercial aviation sector will continue to fuel the need for enhanced safety systems.

Major Players in the Market

- Honeywell International

- Survival Systems International

- Safran

- Zodiac Aerospace

- Reva Aeronautics

- BAE Systems

- Aviation Life Support Systems

- Martin-Baker Aircraft Company

- Collins Aerospace

- The Boeing Company

- Airbus Group

- Alpaero

- JPR Systems

- Cubic Corporation

- Desser Tire & Rubber Company

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aviation Equipment Manufacturers

- Commercial Airlines

- Military and Defense Forces

- Private Aviation Operators

- Aerospace Equipment Suppliers

- Airport Authorities

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process involves identifying and mapping the key stakeholders in the Singapore aircraft survival equipment market. This includes manufacturers, regulators, and consumers. Data from secondary sources, such as government reports, market studies, and industry white papers, will help define the critical variables affecting the market dynamics.

Step 2: Market Analysis and Construction

This step involves the analysis of historical data, including product type performance, regulatory impacts, and trends in demand from both the commercial and military sectors. Insights into supply chain dynamics and cost structures will also be assessed to understand the factors influencing market behavior.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated based on collected data and tested through in-depth consultations with industry experts. Interviews with key figures from airlines, military sectors, and regulatory bodies will provide firsthand insights into market trends and emerging demands for survival equipment.

Step 4: Research Synthesis and Final Output

In the final phase, all data collected will be synthesized to produce a comprehensive overview of the Singapore aircraft survival equipment market. This will include an in-depth examination of market segmentation, competitive landscapes, and key growth drivers, ensuring a complete and accurate report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in air traffic in the Asia-Pacific region, particularly in Singapore, driving demand for advanced survival equipment.

Government regulations mandating safety equipment for all aircraft operating in Singapore, fueling demand in commercial and military sectors.

The growing defense budget of Singapore leading to increased military aircraft procurement and the need for enhanced survival systems. - Market Challenges

High costs of advanced survival equipment, impacting adoption in private and smaller commercial aircraft.

Supply chain disruptions affecting the timely delivery of critical survival equipment parts.

Regulatory hurdles in certifying new survival equipment technologies in compliance with international aviation safety standards. - Market Opportunities

Expansion of Singapore’s airline fleet, providing opportunities for increased procurement of survival equipment.

Government initiatives to modernize Singapore’s military fleet, leading to a rise in demand for survival systems.

The rise in international tourism boosting demand for enhanced passenger safety systems in aircraft. - Trends

Increased demand for integrated survival systems combining multiple safety features.

Adoption of lightweight, durable materials in survival equipment to improve efficiency and reduce operational costs.

Growing interest in eco-friendly survival equipment solutions with sustainable material sourcing.

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Life Rafts

Life Vests

Survival Kits

Ditching Systems

Emergency Locator Transmitters - By Platform Type (In Value%)

Commercial Aircraft

Cargo Aircraft

Military Aircraft

Business Jets

Helicopters - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Retrofit

Replacement

New Installation - By End User Segment (In Value%)

Airlines

Private Aircraft Owners

Military Organizations

Cargo Operators

MRO Service Providers - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Third-Party Suppliers

Government Contracts

Distributor Partnerships

Online Sales

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Product Innovation, Geographic Reach, Procurement Strategy, Price Competitiveness)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Honeywell Aerospace

Safran

Collins Aerospace

Zodiac Aerospace

Liebherr Aerospace

Thales Group

GE Aviation

Meggitt PLC

Rockwell Collins

AeroDesigns

Aviall Services

AAR Corporation

United Technologies

Boeing

Airbus

- Airlines focusing on enhancing safety features and meeting regulatory compliance requirements.

- Private aircraft owners investing in advanced survival systems to improve safety standards.

- Military agencies upgrading survival equipment in line with modernization and defense strategies.

- MRO service providers increasingly offering retrofitting solutions for survival equipment in older aircraft.

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035