Market Overview

The Singapore aircraft switches market is valued at approximately USD ~ million in 2025. The growth of this market is driven by the expansion of Singapore’s aviation sector, particularly through the fleet expansion of Singapore Airlines and the country’s position as a major aviation hub in Asia. Additionally, the demand for more sophisticated control systems in modern aircraft, which require advanced switching technologies for operational efficiency, drives the demand for aircraft switches. Government investments in both commercial and military aviation sectors further fuel this market, as modern aircraft systems increasingly rely on innovative switching solutions for avionics, lighting, and control systems.

Singapore, being a global aviation hub, is a dominant force in the aircraft switches market. The city-state’s extensive airport infrastructure, especially Changi Airport, which handled 68.3 million passengers in 2023, is a key driver for the aviation sector’s growth, creating substantial demand for advanced aircraft systems. Singapore Airlines, a key player with over 250 aircraft, is at the forefront of expanding its fleet, further boosting the demand for advanced switches. Furthermore, Singapore’s strategic position as a major player in military aviation in the Asia-Pacific region ensures a steady demand for specialized switching systems in both commercial and military aircraft.

Market Segmentation

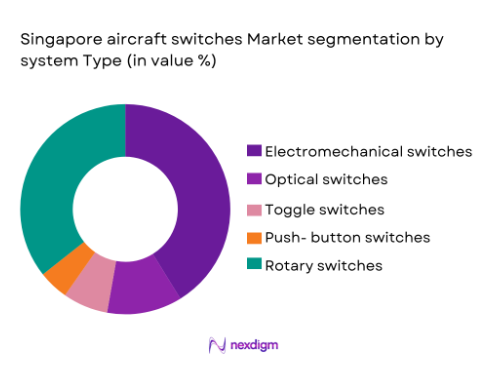

By System Type

The Singapore aircraft switches market is segmented by system type, which includes electromechanical switches, optical switches, toggle switches, push-button switches, and rotary switches. Electromechanical switches dominate the market, largely due to their proven reliability, simplicity, and cost-effectiveness in a wide range of applications within aircraft systems. These switches are integral to cockpit controls, avionics systems, and emergency operations, making them essential for both commercial and military aircraft. The long-established presence of electromechanical switches in the aviation industry, along with their robustness and ease of integration with existing systems, contributes to their dominance in the market.

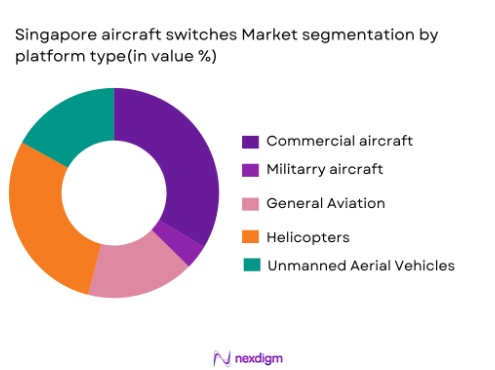

By Platform Type

The market is also segmented by platform type, including commercial aircraft, military aircraft, general aviation, helicopters, and unmanned aerial vehicles (UAVs). The commercial aircraft segment holds the largest share, driven by the strong performance of Singapore Airlines and the continuous expansion of air travel in the Asia-Pacific region. As the demand for new commercial aircraft grows, particularly with the delivery of aircraft such as the Boeing 787 and Airbus A350, the need for advanced control systems, including sophisticated switching technologies, increases. The commercial aviation sector’s demand for efficient, reliable, and high-performance switches continues to dominate the Singapore aircraft switches market.

Competitive Landscape

The Singapore aircraft switches market is characterized by the presence of several prominent players offering high-quality and reliable switching solutions for both commercial and military aircraft. Global leaders such as Honeywell, Safran, Collins Aerospace, Moog, and TE Connectivity dominate the market due to their advanced technological capabilities and strong presence in the aerospace sector. These companies have established themselves as key suppliers to aircraft manufacturers, airlines, and military contractors. Their ability to provide innovative switching solutions that meet stringent safety and operational requirements ensures their continued leadership in the market.

| Company Name | Establishment Year | Headquarters | Product Offering | Market Reach | Innovation Focus | Major Partnerships | Revenue | Product Quality | R&D Investment | Certifications |

| Honeywell Aerospace | 1906 | United States | – | – | – | – | – | – | – | – |

| Safran | 2005 | France | – | – | – | – | – | – | – | – |

| Collins Aerospace | 1930 | United States | – | – | – | – | – | – | – | – |

| Moog | 1951 | United States | – | – | – | – | – | – | – | – |

| TE Connectivity | 2007 | Switzerland | – | – | – | – | – | – | – | – |

Singapore Aircraft Switches Market Dynamics

Growth Drivers

Rising Demand for Safety and Control Systems in Modern Aircraft

With the increasing complexity of modern aircraft systems, the demand for more sophisticated safety and control systems is rising. Modern aircraft require advanced switches for avionics, cockpit controls, emergency systems, and environmental controls. In Singapore, which is a key player in the aviation industry, there has been a continuous push to meet international safety standards, particularly for newly introduced aircraft models such as the Airbus A350 and Boeing 787. The rise in demand for these safety systems is evidenced by the integration of more advanced switches, which ensure reliable operation in the demanding environments of commercial and military aviation.

Government Investments in the Aviation and Aerospace Sectors in Singapore

The Singapore government has made substantial investments in its aviation infrastructure and aerospace sectors, which directly contribute to the demand for aircraft switches. In 2023, the Singapore government allocated USD 10 billion for aviation and aerospace development, focusing on expanding both commercial and military aircraft fleets. These investments are supporting new infrastructure, including the expansion of Changi Airport, which is set to increase passenger capacity significantly. Additionally, military procurement programs, including modern aircraft for defense purposes, are generating demand for advanced switching systems in both commercial and military aircraft.

Market Challenges

High Costs Associated with Advanced Switch Systems Limiting Adoption in Smaller Aircraft Segments

One of the challenges in the Singapore aircraft switches market is the high cost of advanced switching systems, which limits their adoption in smaller aircraft segments. Aircraft switch systems that meet international safety and reliability standards, especially for military or high-end commercial aircraft, can be prohibitively expensive. Smaller operators, including regional airlines and private aviation, often struggle to afford the high upfront costs and maintenance expenses associated with these systems. This makes it difficult for these smaller segments of the market to keep up with larger carriers, who have more financial resources to invest in advanced technology.

Supply Chain Disruptions in the Global Aviation Industry Affecting Timely Delivery of Aircraft Parts

Global supply chain disruptions continue to affect the timely delivery of aircraft components, including switches. The COVID-19 pandemic has caused delays in the manufacturing and distribution of key aviation components, particularly from suppliers in Europe and North America. For instance, in 2023, the World Trade Organization (WTO) reported significant delays in the global supply chain, with delivery times for aircraft components such as avionics and switches stretching from weeks to months. In Singapore, this affects both commercial airlines and military contractors, as they are unable to receive components on time to maintain and upgrade their fleets, hindering growth.

Market Opportunities

Expansion of Singapore Airlines’ Fleet, Increasing Procurement of Advanced Switch Systems for Modern Aircraft

As Singapore Airlines continues to expand its fleet, particularly with the acquisition of new aircraft like the Boeing 787 Dreamliner and Airbus A350, there is a growing opportunity for aircraft switch manufacturers. The procurement of these advanced aircraft, which come equipped with state-of-the-art avionics and control systems, significantly increases the demand for high-quality switches. The Singapore Airlines fleet is expected to grow further in the coming years, with a focus on modern, fuel-efficient aircraft, creating a strong opportunity for suppliers of advanced switching systems that can support these innovations in safety, control, and operational efficiency.

Growing Demand for Smart Switches Offering Improved Efficiency and Safety in Next-Generation Aircraft

The demand for smart switches, which offer improved efficiency and enhanced safety features, is expected to increase as next-generation aircraft become more common in the market. These smart switches integrate multiple functions, such as emergency override, automatic fault detection, and operational status alerts, into a single control interface. The trend toward more integrated and efficient aircraft systems, coupled with Singapore’s push for modernization in aviation, presents an opportunity for manufacturers to innovate and deliver these advanced solutions. These smart switches are particularly in demand in the military sector and modern commercial aircraft in Singapore.

Future Outlook

Over the next decade, the Singapore aircraft switches market is expected to experience significant growth. The expansion of Singapore Airlines’ fleet and the continued modernization of military aircraft will drive demand for advanced switching technologies. As newer aircraft models with more sophisticated systems are introduced, there will be an increasing need for smart, multifunctional switches that enhance operational efficiency and safety. Additionally, Singapore’s strong military procurement and regional aviation growth will sustain demand for aircraft switches, particularly in commercial aviation and defense sectors, making the market outlook positive for the coming years.

Major Players

- Honeywell Aerospace

- Safran

- Collins Aerospace

- Moog

- TE Connectivity

- Rockwell Collins

- Meggitt

- Curtiss-Wright

- L3 Technologies

- Diehl Aviation

- General Electric

- United Technologies Corporation

- Thales

- Zodiac Aerospace

- Avionics Systems Inc.

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Commercial Aviation Operators

- Military Aircraft Manufacturers

- Original Equipment Manufacturers (OEMs)

- Aerospace Component Suppliers

- Aircraft Maintenance and Repair Organizations (MROs)

- Defense Contractors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key stakeholders in the Singapore aircraft switches market, including manufacturers, end-users, and regulatory bodies. The goal is to establish the critical variables that influence the dynamics of the market, utilizing secondary research from industry reports and proprietary databases.

Step 2: Market Analysis and Construction

This phase involves collecting historical data on market performance, product adoption, and technological trends. We will assess data on the number of aircraft in service, market penetration of different switch types, and revenue generation from various platforms to construct a reliable market model.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market hypotheses will be validated through expert consultations with key players from aviation OEMs, MROs, and industry associations. These insights will help refine the data and validate market trends, ensuring accuracy in the forecasts.

Step 4: Research Synthesis and Final Output

The final stage synthesizes the findings, producing a comprehensive report on the Singapore aircraft switches market. The report will integrate data on market segmentation, competitive dynamics, growth drivers, and challenges, ensuring a thorough understanding of the market’s trajectory.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing aircraft fleet size in the Middle East and Asia-Pacific, particularly in Singapore,

driving demand for advanced switches.

Rising demand for safety and control systems in modern aircraft, leading to more sophisticated switches.

Government investments in the aviation and aerospace sectors in Singapore supporting infrastructure and procurement. - Market Challenges

High costs associated with advanced switch systems limiting adoption in smaller aircraft segments.

Supply chain disruptions in the global aviation industry affecting the timely delivery of aircraft

parts.

Regulatory hurdles for certification of new switching technologies in the aviation sector. - Market Opportunities

Expansion of Singapore Airlines’ fleet, increasing procurement of advanced switch systems for modern aircraft.

Growing demand for smart switches that offer improved efficiency and safety in next-generation

aircraft.

Rising focus on enhancing military aircraft capabilities in Singapore, boosting demand for specialized switches. - Trends

Adoption of more intuitive, touch-based switches in modern commercial and military aircraft.

Integration of multi-functional switches that combine several controls into a single device.

Technological advancements driving the evolution of durable, lightweight, and energy-efficient switches.

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Electromechanical Switches

Optical Switches

Toggle Switches

Push-Button Switches

Rotary Switches - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

General Aviation

Helicopters

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

Linefit

Retrofit

Maintenance and Overhaul

Original Equipment Manufacturers (OEM)

Aftermarket - By End User Segment (In Value%)

Commercial Aviation Operators

Military Operators

OEMs and Suppliers

Private Aviation Owners

Aerospace Component Manufacturers - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Aftermarket Suppliers

OEM Channels

Government Procurement

Online Retail

- Market Share Analysis

- Cross Comparison Parameters (Product Innovation, Market Reach, Supply Chain Efficiency, Cost Leadership, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Honeywell Aerospace

Safran

Collins Aerospace

Rockwell Collins

Moog

Thales

L3 Technologies

Diehl Aviation

Curtiss-Wright

Meggit

TE Connectivity

General Electric

Sierra Nevada Corporation

United Technologies Corporation

Boeing

Airbus

- Commercial airlines in Singapore looking for highly reliable and innovative switches for fleet upgrades.

- Military contractors requiring advanced switching systems to enhance the operational capabilities of fighter jets.

- OEMs investing in smart switches for enhanced control and safety in new aircraft models.

- Private aviation owners seeking advanced switches for increased cockpit comfort and functionality.

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035