Market Overview

The Singapore Aircraft Tires market is valued at USD ~ million, reflecting the growing demand for high-quality, durable tires that meet rigorous standards for aviation. The market is primarily driven by the expansion of the aviation industry, with rising passenger traffic and a growing fleet of commercial aircraft. Additionally, the presence of international airlines and a strong aviation infrastructure in Singapore further contributes to this demand. Furthermore, technological innovations in tire materials and performance are increasing their adoption in modern aircraft fleets, which also contributes to market growth.

Singapore, along with key regions such as the broader Asia-Pacific and Southeast Asia markets, dominates the aircraft tires industry due to its strategic location as a global aviation hub. Major airports like Changi Airport and the extensive presence of international airlines contribute significantly to the market. The highly developed aerospace infrastructure in Singapore, coupled with strong governmental support for aviation, facilitates the dominance of this market. Singapore serves as a key logistics and servicing center for airlines operating in the region, further driving demand for aircraft tires.

Market Segmentation

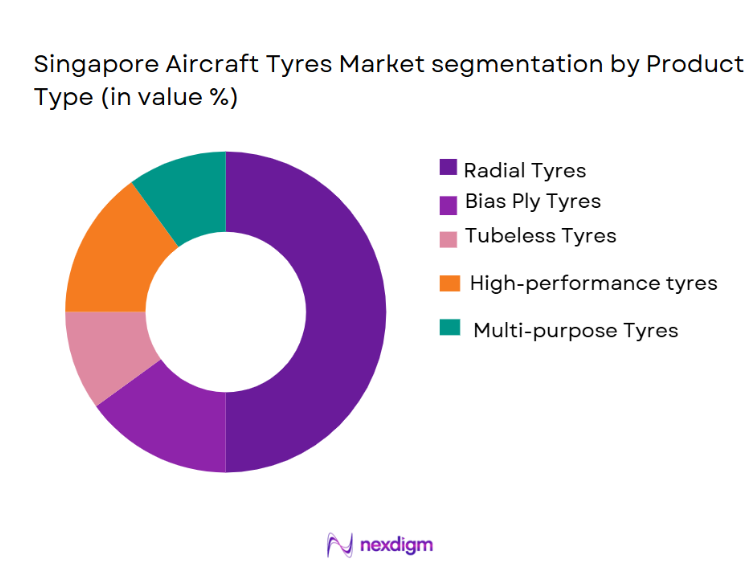

By Product Type

The Singapore Aircraft Tires market is segmented by product type into radial tires, bias ply tires, tubeless tires, high-performance tires, and multi-purpose tires. Radial tires dominate the market due to their superior durability, better fuel efficiency, and lower maintenance costs, making them the preferred choice for commercial airlines operating out of Singapore. As these tires offer greater safety and better overall performance, they are increasingly being adopted by airlines in the region. The growing trend of upgrading to newer aircraft with advanced tire technologies further reinforces the dominance of radial tires in the market.

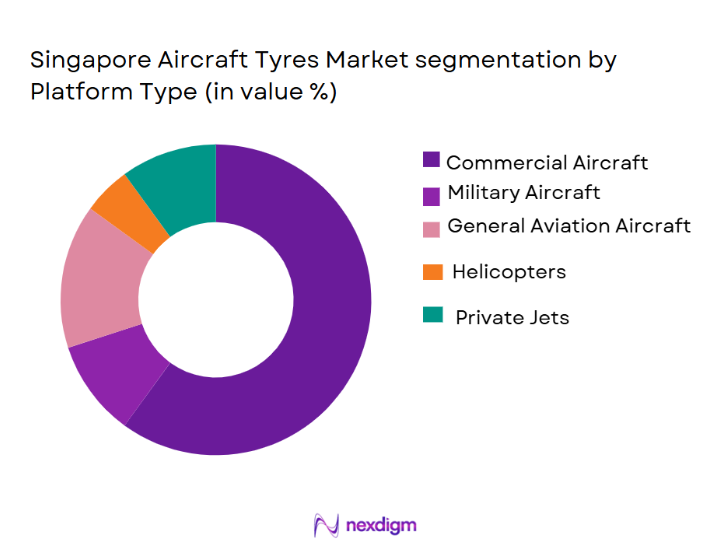

By Platform Type

The market is also segmented based on platform type, including commercial aircraft, military aircraft, general aviation aircraft, helicopters, and private jets. Commercial aircraft dominate the market, accounting for the largest market share, as Singapore is a significant hub for international airlines and air traffic. The continuous expansion of airlines’ fleets, as well as an increase in air travel demand, fuels the dominance of commercial aircraft in the aircraft tire market. This demand is further driven by the high number of international connections and the growing need for modern, efficient tire solutions for large aircraft operating in the region.

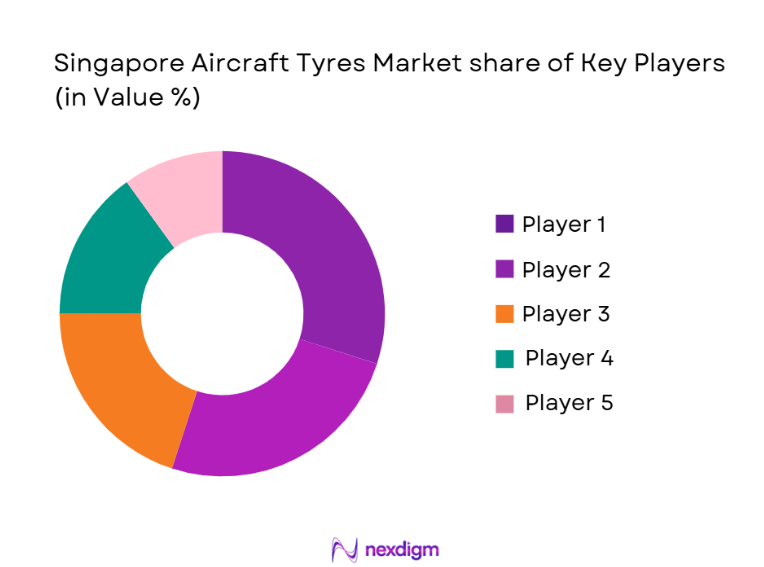

Competitive Landscape

The Singapore Aircraft Tires market is dominated by a few key players who have established strong footholds in the region. The market is highly competitive, with both global and local manufacturers vying for market share. Companies like Michelin, Goodyear, and Bridgestone are major players, contributing to the market’s growth by continuously advancing their technologies and offering specialized solutions for the aviation industry. These companies are known for their innovation and commitment to high-performance tires that meet the stringent demands of modern aviation. The competitive landscape is marked by strategic partnerships and product innovations tailored to meet the specific needs of airlines operating in Singapore.

| Company Name | Establishment Year | Headquarters | Tire Type Focus | Global Reach | Technological Advancements | Partnerships with Airlines |

| Michelin | 1889 | Clermont-Ferrand, France | ~ | ~ | ~ | ~ |

| Goodyear | 1898 | Akron, USA | ~ | ~ | ~ | ~ |

| Bridgestone | 1931 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Dunlop | 1889 | Birmingham, UK | ~ | ~ | ~ | ~ |

| Trelleborg | 1905 | Trelleborg, Sweden | ~ | ~ | ~ | ~ |

Singapore Aircraft Tires Market Analysis

Growth Drivers

Expansion of Aviation Industry in Singapore

The continued growth of commercial airlines and the increasing number of air passengers in Singapore fuel the demand for high-performance aircraft tires. The region’s strategic location as a global aviation hub, particularly through Changi Airport, enhances the need for durable and reliable tires for both commercial and cargo aircraft.

Technological Advancements in Tire Manufacturing

Continuous innovations in tire materials and designs, such as the development of wear-resistant, eco-friendly, and more fuel-efficient tires, are propelling the demand for advanced aircraft tires in the market. These technological improvements lead to longer tire lifespans and reduced maintenance costs, which are highly attractive to airlines.

Market Challenges

High Cost of Aircraft Tires

The premium cost of high-performance aircraft tires, driven by advanced materials and technology, poses a significant challenge for airlines. This increases operational expenses, particularly for low-cost carriers and smaller regional airlines that may struggle with the initial investment required for these specialized tires.

Stringent Regulatory and Certification Requirements

Aircraft tires must comply with strict regulatory standards set by aviation authorities, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). These regulations add complexity and cost to tire manufacturing and distribution processes, potentially slowing down market growth.

Opportunities

Growth of Low-Cost Carriers in the Asia-Pacific Region

The rise of low-cost carriers (LCCs) in Singapore and the broader Asia-Pacific region presents a significant opportunity for the aircraft tire market. As these airlines expand their fleets, they require cost-effective and durable tire solutions to maintain profitability and meet the growing demand for air travel.

Adoption of Retreaded Tires

The increasing acceptance of retreaded aircraft tires in the market offers a cost-efficient alternative to purchasing new tires. As airlines seek to optimize operational costs and improve sustainability, retreading services have the potential to boost tire sales in the replacement market.

Future Outlook

Over the next five years, the Singapore Aircraft Tires market is expected to experience significant growth. This will be driven by continued demand for both new tires and replacement tires, as well as the increasing number of flights in and out of Singapore. The growth of low-cost carriers and the expansion of regional airlines will further fuel the demand for durable and cost-effective tire solutions. Additionally, technological advancements in tire materials and performance will contribute to market evolution. As airlines continue to invest in more fuel-efficient aircraft, the adoption of high-performance tires is expected to rise.

Key Players

- Michelin

- Goodyear

- Bridgestone

- Dunlop

- Trelleborg

- AeroTire

- Cheng Shin Rubber Industry

- Cooper Tire & Rubber Company

- Continental AG

- Hankook Tire

- Rubber World International

- Aviall

- Boeing

- Airbus

- MRO Services

Key Target Audience

- Airlines and aircraft operators

- Aircraft manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense agencies

- Maintenance, Repair, and Overhaul service providers

- Tire distributors and resellers

- Aviation supply chain and logistics companies

Research Methodology

Step 1: Identification of Key Variables

In this phase, an ecosystem map will be constructed, identifying key stakeholders in the Singapore Aircraft Tires market. This includes airlines, tire manufacturers, distributors, and MRO service providers. Desk research and analysis of secondary data will be used to identify variables that affect market dynamics.

Step 2: Market Analysis and Construction

Historical data will be gathered to analyze the market’s size, growth trends, and segmentation. The impact of regional economic growth, aviation traffic, and fleet expansion will be evaluated. Service quality statistics will be assessed to ensure the reliability of the forecast.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through expert consultations. Industry experts, including executives from tire manufacturers and airlines, will provide insights into operational challenges and future trends. These consultations will help refine the data and validate the market model.

Step 4: Research Synthesis and Final Output

The final output will be a comprehensive analysis of the market. Interviews with key stakeholders will help corroborate the findings and finalize the report. The analysis will be refined using a bottom-up approach to ensure accuracy and completeness.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of airline fleets in Asia-Pacific

Increased air travel demand in Singapore and surrounding regions

Government investments in aerospace infrastructure - Market Challenges

Stringent regulatory standards for aircraft components

High cost of specialized aircraft tires

Supply chain disruptions affecting tire availability - Market Opportunities

Growth of low-cost carriers driving tire replacement demand

Technological advancements in tire durability and performance

Increase in private jet ownership and demand for high-performance tires - Trends

Rising demand for eco-friendly and sustainable tire options

Shift towards smart tire technology with real-time monitoring

Growing focus on safety and performance optimization

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Radial Aircraft Tires

Bias Ply Aircraft Tires

Tubeless Aircraft Tires

High-Performance Aircraft Tires

Multi-Purpose Aircraft Tires - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

General Aviation Aircraft

Helicopters

Private Jets - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM)

Replacement Tires

Retreaded Tires

Customized Tires

Premium Performance Tires - By EndUser Segment (In Value%)

Commercial Airlines

Air Freight Carriers

Private Jet Owners

Military and Defense Agencies

MRO Service Providers - By Procurement Channel (In Value%)

Direct OEM Sales

Aftermarket Procurement

Third-Party Distributors

Online Marketplaces

Regional Resellers

- Market Share Analysis

- CrossComparison Parameters (Price per Tire, Market Share by OEM, Market Share by Platform Type, Regional Demand Growth, Technological Innovation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Michelin Aircraft Tires

Goodyear Aviation

Bridgestone Aircraft Tire Co.

Dunlop Aircraft Tyres

Airbus Helicopters

Boeing

Hankook Tire

Continental AG

AeroTire

Trelleborg

Cheng Shin Rubber Industry

Cooper Tire & Rubber Company

MRO Services

Aviall

Rubber World International

- Airlines focusing on cost-efficiency for tire maintenance

- Private jet owners demanding high-quality, long-lasting tires

- Military agencies investing in specialized tires for defense aircraft

- MRO providers emphasizing tire retreading and servicing

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035