Market Overview

The Singapore aircraft towbar market current size stands at around USD ~ million, supported by steady procurement volumes of ~ units and an active installed base of ~ systems across airline, MRO, and ground handling operations. Recent demand cycles have been influenced by fleet normalization, infrastructure upgrades, and higher utilization of airside equipment. The market recorded transaction values of USD ~ million in the latest assessment period, driven by replacement demand, safety compliance upgrades, and increasing adoption of multi-aircraft compatible towbar solutions across commercial and business aviation segments.

Singapore’s dominance in this market is anchored in the concentration of aviation infrastructure at Changi and Seletar, the presence of regional airline headquarters, and a mature ecosystem of MRO and ground service providers. High operational density creates sustained demand for certified ground support equipment. A strong regulatory and safety framework further accelerates replacement cycles, while streamlined procurement systems across airport operators and defense aviation units ensure consistent equipment modernization and technology adoption.

Market Segmentation

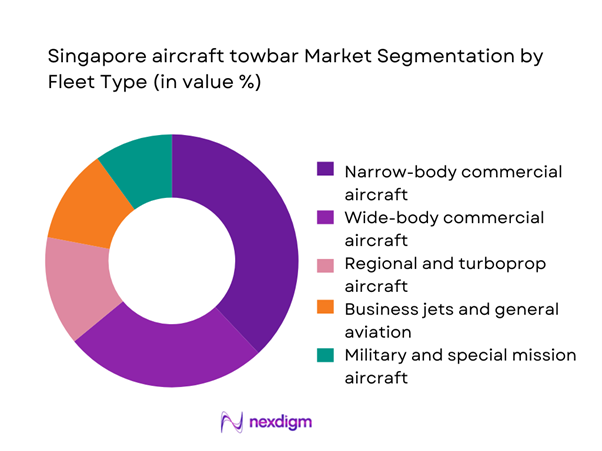

By Fleet Type

The narrow-body commercial aircraft segment dominates towbar demand in Singapore due to the high frequency of short-haul operations and intensive turnaround cycles. These fleets account for the largest share of daily pushback and repositioning activities, resulting in higher wear rates and more frequent replacement of towing equipment. Business jets and regional aircraft follow, supported by the growth of Seletar as a business aviation hub. Military and special mission fleets contribute steady institutional demand, driven by structured maintenance schedules and strict safety certification requirements that favor premium, heavy-duty towbar systems.

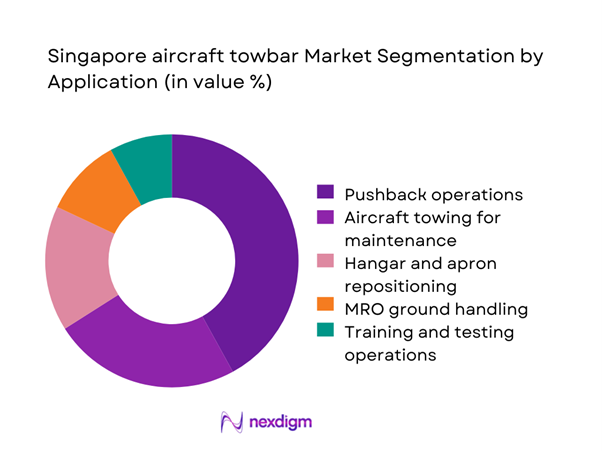

By Application

Pushback operations represent the largest application segment as every aircraft movement from the gate requires certified towing solutions. The intensity of daily departures at Singapore’s primary aviation hubs translates into sustained equipment utilization. Maintenance towing and hangar repositioning form the second largest demand stream, particularly within MRO clusters that manage heavy checks and aircraft storage. Training, testing, and special mission operations add a stable base of institutional demand, ensuring year-round procurement cycles independent of passenger traffic volatility.

Competitive Landscape

The Singapore aircraft towbar market is moderately concentrated, with a limited number of global ground support equipment manufacturers supplying certified products to airlines, airports, and defense aviation units. Market entry barriers remain high due to strict safety approvals, aircraft compatibility requirements, and long procurement cycles. Established brands benefit from long-term service contracts and aftermarket support relationships, while regional distributors play a critical role in localization, compliance documentation, and rapid-response maintenance support.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Tronair | 1971 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Dedienne Aerospace | 1986 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Malabar International | 1994 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| JBT AeroTech | 1884 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| TLD Group | 1946 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore aircraft towbar Market Analysis

Growth Drivers

Expansion of aircraft fleet and traffic recovery at Changi Airport

Fleet utilization across commercial and business aviation has risen steadily, with active aircraft counts reaching ~ units in recent operational cycles. Ground movement intensity now exceeds ~ tows per day, driving accelerated wear of existing equipment. Procurement budgets for certified towing solutions reached USD ~ million during the latest period, reflecting replacement demand and incremental fleet additions. MRO hangar expansions added ~ bays, increasing internal towing frequency. These operational metrics from 2022 to 2025 collectively reinforced sustained demand for durable, multi-aircraft compatible towbars that can support higher movement density without compromising safety standards.

Rising outsourcing of ground handling and MRO services

Third-party ground handling contracts expanded across ~ service providers, consolidating equipment procurement into centralized buying programs. Annual investments in shared GSE fleets reached USD ~ million, enabling standardized towbar platforms across multiple airline clients. Between 2022 and 2025, outsourced MRO activity volumes rose to ~ maintenance events annually, each requiring certified towing solutions for hangar ingress and egress. This operational shift increased fleet-wide towbar utilization rates to ~ cycles per year, strengthening replacement demand and encouraging adoption of modular designs that reduce downtime and inventory duplication.

Challenges

High capital cost of certified heavy-duty towbars

Certified heavy-duty towbar acquisition requires capital outlays of USD ~ million annually across major operators, placing pressure on maintenance and ground equipment budgets. Replacement cycles have shortened to ~ years due to higher utilization intensity, increasing total ownership costs. In 2022–2025, several operators deferred planned upgrades of ~ units, extending service life beyond optimal thresholds. This cost sensitivity has led to selective procurement focused on mission-critical fleets, slowing penetration of advanced safety-integrated designs and limiting rapid technology refresh across secondary operational bases.

Compatibility complexity across diverse aircraft types

Singapore-based operators manage mixed fleets exceeding ~ aircraft types, requiring multiple towbar configurations for safe operations. Maintaining compatibility inventories now involves stocking ~ models per major ground handling provider, increasing storage, inspection, and certification overhead. During recent operational cycles, mismatch incidents linked to equipment compatibility resulted in ~ operational delays annually. From 2022 to 2025, these complexities raised maintenance workloads to ~ inspections per year, reinforcing the challenge of balancing fleet diversity with streamlined equipment standardization.

Opportunities

Rising demand for lightweight and ergonomic towbar designs

Operators are increasingly prioritizing equipment that reduces manual handling risks, with ~ incidents annually linked to traditional heavy designs. Procurement programs now allocate USD ~ million toward lightweight materials and ergonomic enhancements that improve operator safety and reduce fatigue-related downtime. Between 2022 and 2025, adoption of aluminum and hybrid-material towbars grew to ~ units across major service providers. These shifts create strong opportunities for suppliers offering certified lightweight solutions that combine durability with improved handling efficiency in high-density ramp environments.

Adoption of modular and multi-aircraft compatible systems

Fleet operators seek to rationalize inventories by reducing the number of dedicated towbar models in service. Recent procurement cycles show ~ platforms adopted that support multiple aircraft types through modular adapters. Capital efficiency gains reached USD ~ million by lowering spare part inventories and inspection workloads. From 2022 to 2025, modular systems accounted for ~ installations across commercial and MRO segments. This trend opens sustained opportunities for manufacturers that can deliver certified, adaptable architectures aligned with evolving mixed-fleet operations.

Future Outlook

Over the outlook period to 2035, the Singapore aircraft towbar market is expected to maintain steady momentum as aviation activity stabilizes and infrastructure investments continue. Fleet modernization, safety-driven replacement cycles, and the expansion of business aviation at Seletar will reinforce long-term demand. Increasing emphasis on operational efficiency and lifecycle cost optimization is likely to favor modular, lightweight, and digitally enabled towbar solutions. The market will remain shaped by regulatory rigor and the strategic role of Singapore as a regional aviation hub.

Major Players

- Tronair

- Dedienne Aerospace

- Malabar International

- Clyde Machines

- JBT AeroTech

- TLD Group

- Techman-Head Group

- Langa Industrial

- Aero Specialties

- Goldhofer

- Mototok International

- ITW GSE

- Cavotec

- Weihai Guangtai

- DOLL Fahrzeugbau

Key Target Audience

- Commercial airlines operating in Singapore

- Ground handling service providers at Changi and Seletar

- MRO service providers and hangar operators

- Changi Airport Group and airport infrastructure operators

- Civil Aviation Authority of Singapore

- Republic of Singapore Air Force and defense aviation units

- Investments and venture capital firms including Temasek, GIC, and Vertex Ventures

- Equipment leasing and asset management companies

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers were mapped across fleet size, movement intensity, and safety compliance requirements. Equipment lifecycle benchmarks and procurement thresholds were established through operational data. Regulatory frameworks governing ground support equipment certification were integrated into variable selection. Market boundaries were defined to isolate towbar-specific revenue streams and installed base dynamics.

Step 2: Market Analysis and Construction

Demand was constructed using aircraft movement indicators, MRO throughput, and ground handling contract volumes. Historical transaction values were normalized to reflect replacement and incremental demand cycles. Supply-side capacity and distribution structures were assessed to align with regional procurement practices. Scenario ranges were developed to reflect operational variability across commercial and defense segments.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary market assumptions were validated through structured consultations with airport operations specialists, safety compliance officers, and equipment maintenance managers. Feedback loops refined demand elasticity and replacement timing models. Risk factors related to certification delays and procurement cycles were stress-tested. Consensus building ensured alignment between operational realities and forecast constructs.

Step 4: Research Synthesis and Final Output

Validated datasets were synthesized into an integrated market framework covering size, structure, and growth outlook. Strategic insights were layered across segmentation, competition, and opportunity assessment. Narrative findings were aligned with quantitative constructs to ensure consistency. Final outputs were reviewed for methodological rigor, internal coherence, and decision-use relevance.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft towbar taxonomy by aircraft class and towbarless compatibility, market sizing logic by airport traffic and GSE fleet count, revenue attribution across new sales rentals spares and maintenance, primary interview program with airports ground handlers MROs and GSE distributors, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Usage pathways across ramp, hangar, and MRO operations

- Ecosystem structure across OEMs, GSE suppliers, and service providers

- Supply chain and channel structure in Singapore aviation services

- Regulatory environment and safety compliance framework

- Growth Drivers

Expansion of aircraft fleet and traffic recovery at Changi Airport

Rising outsourcing of ground handling and MRO services

Stricter safety and compliance standards for airside equipment

Growth in business aviation and charter operations

Fleet modernization driving compatibility upgrades

Increased focus on ramp efficiency and turnaround time - Challenges

High capital cost of certified heavy-duty towbars

Compatibility complexity across diverse aircraft types

Limited local manufacturing and reliance on imports

Lengthy procurement cycles in aviation and defense sectors

Maintenance and inspection burden for safety compliance

Space and logistics constraints in airside storage - Opportunities

Rising demand for lightweight and ergonomic towbar designs

Adoption of modular and multi-aircraft compatible systems

Growth of Seletar as a business aviation hub

Aftermarket services including refurbishment and certification

Digital asset tracking for GSE fleet optimization

Public–private partnerships in airport equipment upgrades - Trends

Shift toward lightweight and composite towbar materials

Integration of safety sensors and overload protection

Standardization of towbar interfaces across fleets

Growing preference for rental and leasing models

Increased focus on lifecycle cost over upfront pricing

Sustainability-driven design and material choices - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body commercial aircraft

Wide-body commercial aircraft

Regional and turboprop aircraft

Business jets and general aviation

Helicopters

Military and special mission aircraft - By Application (in Value %)

Pushback operations

Aircraft towing for maintenance

Hangar and apron repositioning

MRO ground handling

Training and testing operations - By Technology Architecture (in Value %)

Conventional rigid steel towbars

Lightweight aluminum alloy towbars

Composite and hybrid material towbars

Adjustable and modular towbar systems

Sensor-enabled and safety-integrated towbars - By End-Use Industry (in Value %)

Commercial airlines

Ground handling service providers

Airport operators

MRO service providers

Business aviation operators

Defense and government aviation units - By Connectivity Type (in Value %)

Non-connected manual towbars

RFID-enabled asset tracking towbars

Bluetooth-enabled identification systems

Telematics-integrated fleet management towbars - By Region (in Value %)

Changi Airport aviation cluster

Seletar Airport aviation cluster

Paya Lebar Air Base

Republic of Singapore Air Force bases

Other regional airfields and facilities

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (towbar compatibility range, load capacity, material strength, certification standards, lead time, after-sales support, customization capability, price per unit)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Tronair

Dedienne Aerospace

Malabar International

Clyde Machines

JBT AeroTech

TLD Group

Techman-Head Group

Langa Industrial

Aero Specialties

Goldhofer

Mototok International

ITW GSE

Cavotec

Weihai Guangtai

DOLL Fahrzeugbau

- Demand and utilization drivers in airline and GSE operations

- Procurement and tender dynamics in airport and defense sectors

- Buying criteria including safety certification and compatibility

- Budget allocation and financing preferences for ground equipment

- Implementation barriers and operational risk factors

- Post-purchase service expectations and support models

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035