Market Overview

The Singapore aircraft tugs market current size stands at around USD ~ million, supported by annual shipment volumes of nearly ~ units and an installed operational base of close to ~ systems across major aviation hubs. Capital deployment toward ground support equipment modernization reached approximately USD ~ million, reflecting rising replacement demand and fleet optimization initiatives. Ongoing airport expansion programs and airline capacity additions continue to sustain procurement cycles, positioning aircraft tugs as a critical enabler of airside efficiency and turnaround reliability.

Market activity is concentrated around Changi Airport and Seletar Airport due to their high aircraft movement intensity, advanced ground handling ecosystems, and early adoption of low-emission technologies. Strong regulatory alignment with sustainability goals, mature maintenance infrastructure, and the presence of global aviation service providers reinforce Singapore’s leadership in advanced ground support equipment deployment. The country’s integrated logistics environment and skilled technical workforce further strengthen its role as a regional benchmark for aircraft tug utilization and operational best practices.

Market Segmentation

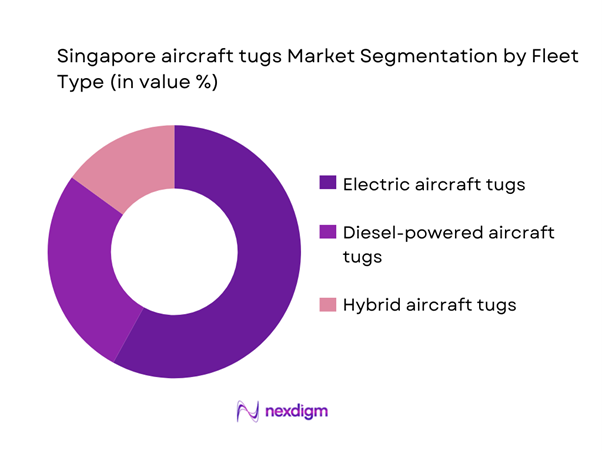

By Fleet Type

Electric aircraft tugs dominate the Singapore market as airport authorities and ground handlers prioritize decarbonization and long-term operating efficiency. The transition away from diesel-powered equipment is being accelerated by sustainability mandates and lifecycle cost advantages associated with electric propulsion. Hybrid tugs maintain relevance in niche applications requiring extended operational range, yet procurement momentum remains firmly with fully electric platforms. As fleet renewal cycles intensify, electric tugs are increasingly viewed not only as compliance solutions but as productivity enhancers due to lower downtime, reduced maintenance complexity, and better integration with smart fleet management systems across airside operations.

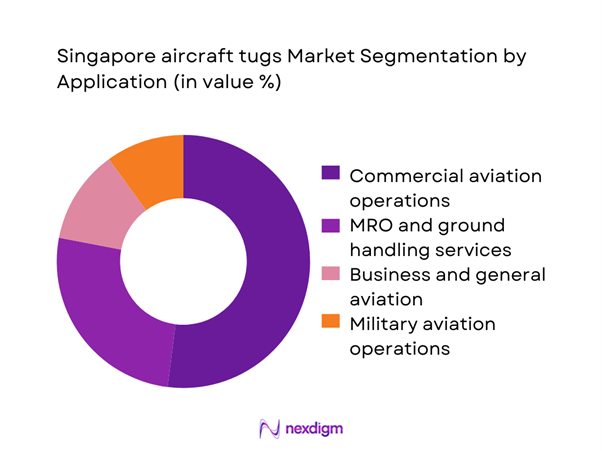

By Application

Commercial aviation operations account for the largest share of aircraft tug demand in Singapore, driven by dense flight schedules and strict turnaround benchmarks at major terminals. Ground handling service providers supporting full-service and low-cost carriers remain the primary volume purchasers, followed by MRO facilities that require specialized towing for maintenance workflows. Business aviation and military aviation form smaller but stable segments, where reliability and equipment customization are prioritized over scale. The application mix reflects Singapore’s status as a global aviation hub, where efficiency, safety compliance, and equipment standardization guide procurement strategies across diverse operational contexts.

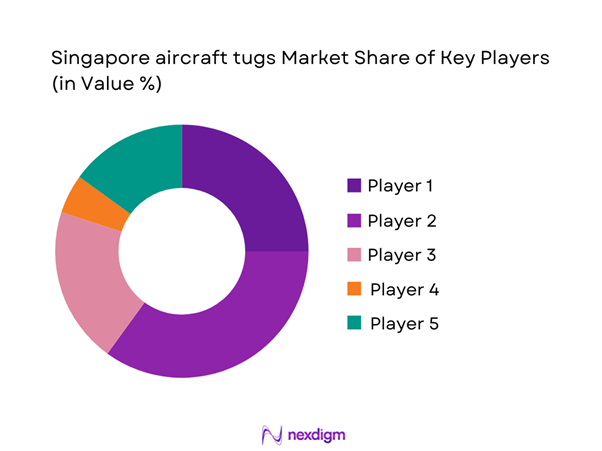

Competitive Landscape

The Singapore aircraft tugs market is moderately concentrated, characterized by the presence of established global equipment manufacturers supported by strong local distribution and service partners. Competition centers on technology differentiation, electric platform depth, and aftersales capability rather than price leadership alone. Long-term service contracts and fleet standardization agreements contribute to vendor stickiness, while new entrants face high barriers due to certification requirements and entrenched procurement relationships with airport operators and ground handling firms.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| JBT AeroTech | 1962 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| TLD Group | 1946 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Goldhofer | 1705 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Kalmar Motor AB | 1945 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

| Mulag Fahrzeugwerk | 1953 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore aircraft tugs Market Analysis

Growth Drivers

Rising aircraft movements and fleet expansion at Changi Airport

Increasing air traffic volumes have directly influenced demand for efficient ground handling assets, with aircraft tug deployments rising to nearly ~ systems in 2024 compared to ~ systems in 2022. Annual towing operations surpassed ~ movements, creating sustained utilization pressure on existing fleets and accelerating replacement cycles. Capital allocation for apron equipment modernization reached approximately USD ~ million over the past two years, reflecting operational urgency to minimize turnaround delays. As fleet size and route density continue to grow, the need for high-reliability towing solutions is becoming central to maintaining service benchmarks across commercial and cargo operations.

Accelerated electrification of ground support equipment to meet sustainability targets

Electric tug adoption expanded from ~ units in 2022 to nearly ~ units by 2025 as airport operators aligned ground operations with national carbon reduction commitments. Public and private sector investments of around USD ~ million were directed toward charging infrastructure and fleet conversion programs. Maintenance cost savings of approximately USD ~ million annually further strengthened the business case for electrification. These financial and regulatory dynamics are reshaping procurement priorities, positioning electric aircraft tugs as the default choice for new acquisitions and long-term fleet planning across Singapore’s aviation ecosystem.

Challenges

High upfront capital cost of electric and towbarless tug systems

Procurement budgets face pressure as next-generation electric and towbarless tugs command acquisition values exceeding USD ~ million per fleet deployment, nearly double the historical outlay for conventional equipment. Between 2022 and 2024, several ground handling operators deferred purchases of ~ units due to constrained capital availability. Financing gaps of roughly USD ~ million have slowed modernization timelines, particularly among mid-sized service providers. Although lifecycle savings are evident, the immediate financial burden continues to challenge adoption rates and extends replacement cycles for aging diesel fleets.

Limited charging infrastructure for large-scale electric GSE fleets

The transition to electric aircraft tugs has outpaced the development of airside charging capacity, with only ~ stations currently supporting a fleet of nearly ~ electric systems. Infrastructure investments of about USD ~ million remain insufficient to meet peak operational demand during high-traffic periods. As a result, utilization efficiency dropped by ~ operational hours annually in some terminals due to charging bottlenecks. This mismatch between fleet growth and energy infrastructure readiness poses a structural constraint on the scalability of electric tug deployment.

Opportunities

Fleet replacement cycles creating demand for next-generation electric tugs

More than ~ legacy diesel tugs are scheduled for phased retirement between 2023 and 2025, creating a substantial replacement window for advanced electric models. Procurement programs valued at approximately USD ~ million are being aligned with broader airport modernization initiatives. The shift presents suppliers with opportunities to introduce modular platforms, extended battery ranges, and digital fleet integration features. As operators seek to standardize equipment across terminals, large-scale replacement contracts are expected to drive volume consistency and long-term service engagements.

Adoption of autonomous and semi-autonomous towing solutions

Pilot deployments of semi-autonomous tug systems increased from ~ units in 2022 to ~ units in 2025, supported by trial investments nearing USD ~ million. Early results indicate potential reductions of ~ operational incidents annually and measurable gains in towing precision. As regulatory frameworks mature and safety validation expands, autonomous towing is positioned to become a differentiator in high-density apron environments. This technological shift opens new revenue avenues linked to software integration, remote operations, and advanced training services.

Future Outlook

The Singapore aircraft tugs market is set to evolve alongside the broader transformation of airport ground operations. Continued emphasis on sustainability, automation, and digital fleet management will shape procurement strategies through the next decade. As infrastructure upgrades and regulatory clarity advance, the market is expected to transition toward fully electric and increasingly autonomous towing ecosystems, reinforcing Singapore’s position as a regional leader in smart aviation ground support solutions.

Major Players

- JBT AeroTech

- TLD Group

- Goldhofer

- Kalmar Motor AB

- Mulag Fahrzeugwerk

- Tronair

- Textron GSE

- Charlatte Manutention

- NMC-Wollard

- Eagle Tugs

- Mototok International

- Trepel Airport Equipment

- Douglas Equipment

- B-Pick

- Oshkosh AeroTech

Key Target Audience

- Airport operators and infrastructure owners

- Airline ground operations departments

- Independent ground handling service providers

- Military and government aviation units

- MRO service organizations

- Fleet management and asset leasing firms

- Investments and venture capital firms focused on transportation technology

- Government and regulatory bodies including Civil Aviation Authority of Singapore and Ministry of Transport Singapore

Research Methodology

Step 1: Identification of Key Variables

Assessment of aircraft movement intensity, ground handling workflows, fleet age profiles, and electrification readiness across major aviation facilities. Mapping of regulatory frameworks governing airside equipment safety, emissions compliance, and operational certification. Identification of procurement cycles and service contract structures shaping market demand patterns.

Step 2: Market Analysis and Construction

Development of demand models integrating fleet replacement schedules and infrastructure investment pipelines. Evaluation of technology adoption curves for electric and autonomous towing platforms. Construction of scenario frameworks reflecting policy, sustainability, and operational efficiency drivers.

Step 3: Hypothesis Validation and Expert Consultation

Validation of demand assumptions through structured discussions with airport operations managers and fleet supervisors. Cross-verification of technology trends with engineering and maintenance professionals. Refinement of market outlook assumptions based on operational feasibility and regulatory readiness.

Step 4: Research Synthesis and Final Output

Integration of quantitative and qualitative insights into a cohesive market narrative.

Standardization of findings across segmentation, competitive dynamics, and opportunity assessment. Finalization of strategic implications for stakeholders across the aviation ground support ecosystem.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft tug taxonomy across conventional electric and towbarless systems, market sizing logic by airport traffic and GSE fleet deployment, revenue attribution across equipment sales leasing and service, primary interview program with airports ground handlers and MROs, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care or usage pathways

- Ecosystem structure

- Supply chain or channel structure

- Regulatory environment

- Growth Drivers

Rising aircraft movements and fleet expansion at Changi Airport

Accelerated electrification of ground support equipment to meet sustainability targets

Tight turnaround time requirements driving demand for high-performance towbarless tugs

Increased outsourcing of ground handling services to specialized operators

Government incentives for low-emission airport operations

Modernization of military and government aviation infrastructure - Challenges

High upfront capital cost of electric and towbarless tug systems

Limited charging infrastructure for large-scale electric GSE fleets

Operational constraints in congested apron environments

Stringent safety and compliance requirements increasing certification timelines

Dependence on imported equipment and extended lead times

Workforce skill gaps in maintaining advanced electric and autonomous tugs - Opportunities

Fleet replacement cycles creating demand for next-generation electric tugs

Adoption of autonomous and semi-autonomous towing solutions

Expansion of MRO facilities boosting ground equipment demand

Digital fleet management and predictive maintenance integration

Public-private partnerships in airport infrastructure upgrades

Export of operational best practices to regional aviation hubs - Trends

Shift from diesel to fully electric aircraft tug fleets

Growing preference for towbarless technology for narrowbody and widebody aircraft

Integration of telematics for asset tracking and utilization optimization

Focus on lifecycle cost over upfront procurement pricing

Increasing standardization of safety and operator training protocols

Pilot deployments of autonomous towing systems in controlled airside zones - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Electric aircraft tugs

Diesel-powered aircraft tugs

Hybrid aircraft tugs - By Application (in Value %)

Commercial aviation operations

Business and general aviation

Military aviation operations

MRO and ground handling services - By Technology Architecture (in Value %)

Towbarless aircraft tugs

Towbar aircraft tugs

Semi-autonomous and remote-controlled tugs - By End-Use Industry (in Value %)

Airports and airport operators

Airlines and airline ground operations

Independent ground handling service providers

Military airbases and government operators - By Connectivity Type (in Value %)

Standalone and non-connected tugs

Telematics-enabled fleet systems

IoT-connected smart tug platforms

Integrated airport fleet management systems - By Region (in Value %)

Changi Airport and associated terminals

Seletar Airport

Military airbases

MRO and aviation industrial zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product range breadth, electric tug portfolio, towbarless technology capability, autonomous readiness, aftersales network strength, local service presence, total cost of ownership, delivery lead time)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

TLD Group

JBT AeroTech

Textron GSE

Tronair

Mulag Fahrzeugwerk

Goldhofer

Kalmar Motor AB

Charlatte Manutention

NMC-Wollard

Eagle Tugs

Mototok International

Trepel Airport Equipment

Douglas Equipment

B-Pick

Oshkosh AeroTech

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035