Market Overview

The Singapore aircraft water and waste systems market current size stands at around USD ~ million, reflecting steady expansion driven by fleet servicing activity and cabin system modernization. Recent performance indicates an increase from approximately USD ~ million to nearly USD ~ million, supported by rising installation volumes of ~ systems across commercial and business aviation platforms. The market is characterized by consistent aftermarket demand, growing retrofit programs, and sustained investments in hygiene-focused cabin infrastructure aligned with regional aviation safety expectations.

Market dominance is concentrated in Singapore due to its role as a regional aviation services hub supported by dense airline operations, advanced maintenance infrastructure, and a mature aerospace supply ecosystem. The presence of integrated MRO clusters, strong airport connectivity, and favorable regulatory alignment enables faster adoption of advanced water and waste technologies. High aircraft turnaround activity, premium cabin upgrade demand, and strong coordination between operators and system integrators further reinforce Singapore’s leadership position in this specialized segment.

Market Segmentation

By Fleet Type

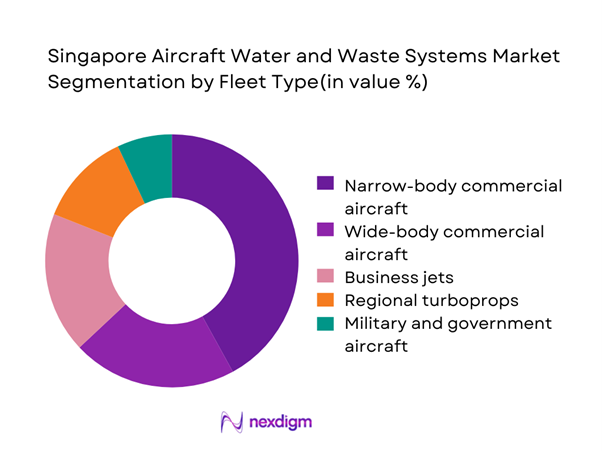

Narrow-body commercial aircraft dominate this segmentation due to their high utilization rates and frequent cabin refurbishment cycles in short-haul operations. Business jets follow closely, driven by premium cabin customization and enhanced hygiene standards. Wide-body aircraft contribute through periodic retrofit programs, while regional turboprops maintain steady but limited demand. Military and government fleets add niche volume, primarily through fleet life-extension projects. Overall, demand concentration aligns with fleet categories that experience higher maintenance intensity and shorter upgrade intervals.

By Application

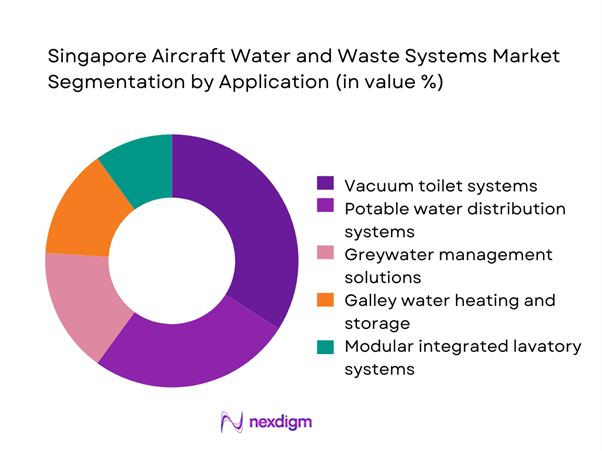

Vacuum toilet systems lead this segmentation as airlines increasingly prioritize water efficiency and waste containment reliability. Potable water distribution follows due to routine compliance-driven replacements. Greywater management and galley water heating systems show steady adoption, particularly in premium cabin configurations. Integrated modular lavatory systems are gaining traction for faster maintenance turnaround and standardized retrofits. Application demand is closely linked to cabin refurbishment cycles and operator emphasis on hygiene differentiation.

Competitive Landscape

The market shows moderate concentration with a mix of global aerospace system specialists and regionally embedded service providers. Competitive positioning is shaped by certification depth, installed base presence, and long-term service support capabilities, with switching costs remaining relatively high for operators due to integration and compliance requirements.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Aerosystems | 1924 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| JAMCO Corporation | 1955 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| ST Engineering Aerospace | 1970 | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Water and Waste Systems Market Analysis

Growth Drivers

Expansion of Singapore’s MRO hub and fleet servicing volumes

The expansion of maintenance and overhaul activity has directly increased demand for water and waste systems across retrofits and heavy checks. Recent service throughput exceeded ~ aircraft annually, driving installations of ~ systems in narrow-body and business aviation platforms. Capital inflows of USD ~ million into hangar expansion and cabin modification lines have strengthened local capacity, accelerating system replacement cycles. Higher aircraft dwell time for refurbishment has raised average system replacement frequency to ~ cycles per aircraft, reinforcing aftermarket revenue streams and supporting sustained market momentum.

Rising passenger traffic driving aircraft utilization intensity

Growing passenger flows have increased average aircraft utilization to ~ flight hours per year, accelerating wear on lavatory and water handling components. Airlines reported servicing intervals shortening by ~ months, leading to higher replacement volumes of ~ units annually. Cabin hygiene differentiation investments of USD ~ million across premium and regional carriers have further boosted demand for advanced waste containment and water distribution modules. This operational intensity translates into a larger installed base of ~ systems requiring continuous maintenance and periodic upgrades.

Challenges

High certification and compliance costs for system upgrades

Certification requirements impose significant financial and time burdens on system suppliers and operators. Recent approval programs for modified waste evacuation units averaged USD ~ million per platform, extending deployment timelines by ~ months. Smaller operators face budget constraints when upgrading fleets of ~ aircraft, often delaying adoption of advanced systems. Compliance-driven testing cycles of ~ phases add complexity, reducing speed to market and increasing total ownership cost, which limits faster penetration of innovative water efficiency technologies.

Complex integration with legacy aircraft platforms

Integration challenges persist across older aircraft fleets where cabin architecture limits compatibility with modern modular systems. Retrofitting programs typically require ~ engineering hours per aircraft and cost approximately USD ~ million for full lavatory reconfiguration. Airlines operating mixed fleets of ~ aircraft types face standardization issues, increasing spare inventory levels to ~ units per system category. These technical constraints slow fleet-wide adoption and elevate downtime risks during scheduled maintenance cycles.

Opportunities

Growth in predictive maintenance-enabled smart water systems

Digital monitoring integration is opening new value pools through condition-based maintenance models. Recent pilot deployments covered ~ aircraft, generating service optimization savings of USD ~ million annually. Sensors tracking ~ parameters per system reduce unplanned removals by ~ events per year, improving dispatch reliability. Airlines investing ~ budgets into connected cabin solutions are accelerating uptake, creating strong prospects for vendors offering analytics-enabled water and waste platforms with scalable retrofit compatibility.

Rising retrofit demand for aging regional and narrow-body fleets

Aging aircraft cohorts exceeding ~ years in service represent a significant upgrade opportunity. Regional operators managing fleets of ~ aircraft are allocating USD ~ million toward phased cabin refurbishments, prioritizing lavatory modernization. Retrofit programs replacing ~ systems annually are gaining traction as operators seek to extend asset life while meeting hygiene expectations. This structural demand supports sustained volumes across modular and lightweight system categories.

Future Outlook

The market is expected to maintain steady expansion through 2035 as Singapore strengthens its position as a regional aviation services nucleus. Continued fleet renewal, increased adoption of smart cabin systems, and tighter hygiene standards will shape procurement priorities. Collaboration between operators, integrators, and regulators will remain central to accelerating technology diffusion. Sustainability-driven water efficiency initiatives are also set to influence future system design and investment decisions.

Major Players

- Collins Aerospace

- Safran Aerosystems

- Diehl Aviation

- JAMCO Corporation

- Zodiac Aerospace

- AIM Altitude

- KID-Systeme

- Bucher Leichtbau

- Crane Aerospace and Electronics

- Parker Hannifin Aerospace

- Honeywell Aerospace

- Liebherr-Aerospace

- ST Engineering Aerospace

- FACC AG

- J&C Aero

Key Target Audience

- Commercial airline fleet management teams

- Business aviation operators and completion centers

- Aircraft maintenance, repair, and overhaul providers

- Aircraft interior refurbishment specialists

- Investments and venture capital firms

- Civil Aviation Authority of Singapore

- Changi Airport Group regulatory and operations teams

- Defense Science and Technology Agency procurement units

Research Methodology

Step 1: Identification of Key Variables

Demand drivers, fleet profiles, and retrofit cycles were mapped across commercial and business aviation segments. System lifecycle parameters and compliance requirements were structured to define core market boundaries. Stakeholder roles across operators, integrators, and service providers were identified to ensure holistic coverage.

Step 2: Market Analysis and Construction

Installation flows, replacement patterns, and aftermarket service intensity were analyzed to construct baseline demand scenarios. Operational throughput and maintenance frequency were modeled to estimate system turnover rates. Segmentation logic was validated against fleet utilization structures.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were reviewed through structured consultations with aviation operations specialists and cabin systems engineers. Assumptions around retrofit adoption and digital system penetration were stress-tested. Regulatory and compliance perspectives were incorporated to refine adoption timelines.

Step 4: Research Synthesis and Final Output

Insights were consolidated into a cohesive analytical framework linking demand, technology, and policy dynamics. Quantitative indicators were harmonized with qualitative trends to ensure consistency. Final outputs were structured to support strategic planning and investment evaluation.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft water and waste system taxonomy across potable water and vacuum waste solutions, market sizing logic by aircraft fleet and retrofit cycles, revenue attribution across system sales spares and MRO services, primary interview program with airlines OEMs and MROs, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care or usage pathways

- Ecosystem structure

- Supply chain or channel structure

- Regulatory environment

- Growth Drivers

Expansion of Singapore’s MRO hub and fleet servicing volumes

Rising passenger traffic driving aircraft utilization intensity

Increasing focus on cabin hygiene and onboard sanitation standards

Fleet modernization and retrofitting of narrow-body aircraft

Growth in business aviation and VIP aircraft completions

Stringent aviation safety and water quality regulations - Challenges

High certification and compliance costs for system upgrades

Complex integration with legacy aircraft platforms

Supply chain dependency on specialized aerospace components

Skilled labor shortages in aircraft interiors and systems maintenance

Pressure on airlines to reduce non-fuel operating costs

Extended maintenance turnaround times for lavatory retrofits - Opportunities

Growth in predictive maintenance-enabled smart water systems

Rising retrofit demand for aging regional and narrow-body fleets

Expansion of Singapore-based MRO services for regional airlines

Adoption of lightweight materials to reduce system weight

Increasing demand for premium cabin lavatory upgrades

Partnerships between OEMs and local aerospace engineering firms - Trends

Shift toward vacuum-based low-water-consumption systems

Integration of digital health monitoring in cabin systems

Use of antimicrobial surfaces and touchless lavatory features

Modular lavatory designs for faster maintenance turnaround

Greater standardization of components across aircraft families

Sustainability-driven focus on water efficiency and waste reduction - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body commercial aircraft

Wide-body commercial aircraft

Regional jets and turboprops

Business jets

Military and government transport aircraft - By Application (in Value %)

Potable water distribution systems

Waste water evacuation systems

Vacuum toilet systems

Galley water heating and storage units

Greywater management solutions - By Technology Architecture (in Value %)

Vacuum-based waste systems

Gravity-based drainage systems

Recirculating water systems

Sensor-enabled smart water management

Modular integrated lavatory systems - By End-Use Industry (in Value %)

Commercial airlines

Business and private aviation operators

Military and government fleets

MRO service providers

Aircraft OEMs and completion centers - By Connectivity Type (in Value %)

Standalone mechanical systems

Line-fit digitally integrated systems

Wireless monitoring-enabled systems

IoT-enabled predictive maintenance systems - By Region (in Value %)

Singapore

Rest of Southeast Asia

East Asia

South Asia

Middle East and Australia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio breadth, installed base in Singapore fleets, lifecycle cost efficiency, water consumption performance, waste system reliability, digital monitoring capabilities, MRO support strength, certification and platform coverage)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Collins Aerospace

Safran Aerosystems

Diehl Aviation

JAMCO Corporation

Zodiac Aerospace

AIM Altitude

KID-Systeme

Bucher Leichtbau

Crane Aerospace and Electronics

Parker Hannifin Aerospace

Honeywell Aerospace

Liebherr-Aerospace

ST Engineering Aerospace

FACC AG

J&C Aero

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035