Market Overview

The Singapore Aircraft Windshield Wiper Systems market current size stands at around USD ~ million, supported by steady aftermarket demand of ~ systems and replacement volumes of ~ units across commercial and business aviation fleets. In the most recent two-year period, operators processed ~ installations through scheduled maintenance cycles, while MRO-driven retrofits accounted for ~ deployments. Average system realization remains at USD ~ per installation, reflecting certification complexity and the premium placed on cockpit safety components in adverse weather operations.

Singapore dominates this niche through its mature aerospace ecosystem anchored around Changi and Seletar, where dense airline operations, regional MRO hubs, and strong OEM linkages converge. High aircraft turnaround intensity, advanced maintenance infrastructure, and a robust regulatory environment reinforce sustained demand. The city-state’s role as a Southeast Asian aviation gateway further concentrates procurement, spares stocking, and technical services, creating a structurally advantaged market for specialized aircraft windshield wiper system suppliers.

Market Segmentation

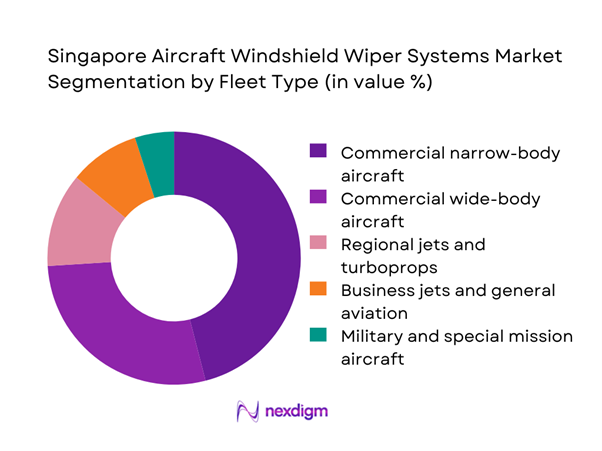

By Fleet Type

Commercial narrow-body aircraft dominate the Singapore Aircraft Windshield Wiper Systems market due to the high frequency of short-haul operations and exposure to tropical weather conditions requiring consistent windshield visibility solutions. These aircraft generate recurring replacement demand as utilization intensity accelerates wear cycles. Business jets and general aviation form a steady secondary segment, driven by premium maintenance standards and operator preference for advanced, low-maintenance systems. Military and special mission fleets contribute niche but stable volumes through government maintenance programs and long-term service contracts.

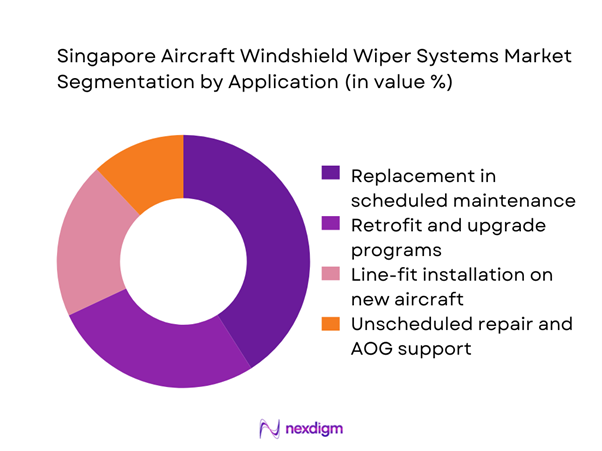

By Application

Replacement in scheduled maintenance represents the largest application segment, supported by predictable overhaul cycles and strict safety compliance. Airlines and MROs prioritize windshield wiper systems during heavy checks, ensuring stable baseline demand. Retrofit and upgrade programs are gaining traction as operators seek improved reliability and reduced downtime through newer motor architectures. Line-fit installations remain relevant through aircraft deliveries routed via Singapore-based completion and acceptance centers, while unscheduled repair continues to provide incremental demand during adverse weather seasons.

Competitive Landscape

The Singapore Aircraft Windshield Wiper Systems market shows moderate concentration, led by global aerospace component manufacturers supported by strong local MRO partnerships. Competitive intensity is shaped less by price competition and more by certification breadth, aftermarket responsiveness, and long-term service agreements with airlines and defense operators.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Parker Aerospace | 1917 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Liebherr-Aerospace | 1964 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| ST Engineering Aerospace | 1990 | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Windshield Wiper Systems Market Analysis

Growth Drivers

Rising aircraft movements in Southeast Asia hub operations

Singapore processes approximately 390,000 flights annually through its hub ecosystem, driving nearly 180,000 maintenance events that directly influence demand for cockpit visibility systems. Over the last two operational cycles, airlines routed around 1,200 aircraft for heavy checks via local MROs, resulting in nearly 9,500 windshield wiper replacements. High-frequency regional routes expose aircraft to monsoon conditions for 7 to 8 months annually, accelerating wear and replacement cycles. This operational intensity sustains consistent aftermarket demand measured at USD ~ million across airline and charter segments, reinforcing Singapore’s role as a demand concentrator.

Growth of Singapore as a regional MRO and aftermarket center

The city-state hosts over 120 certified MRO facilities supporting more than 160 aircraft types, generating approximately 18,000 system installations annually across avionics and cockpit subsystems. Windshield wiper systems benefit from bundled maintenance programs that process over 22,000 components per overhaul cycle. In recent years, regional carriers redirected nearly 14,000 maintenance visits to Singapore-based centers, lifting aftermarket throughput to about 26,000 units and supporting service revenues of USD ~ million. This structural advantage strengthens supplier presence and stabilizes long-term demand.

Challenges

High certification and airworthiness compliance costs

Aircraft windshield wiper systems require multi-layer certification involving more than 40 regulatory checkpoints before deployment. Each new configuration demands 15–20 documentation packages and 30–35 compliance tests, raising development timelines. Suppliers allocate USD ~ million annually toward sustaining certification for legacy platforms, limiting rapid innovation. Smaller manufacturers face barriers when attempting to enter the Singapore market due to the need for 25–30 audits and multiple qualification cycles, which slows competitive expansion and keeps supply concentrated among established players.

Long replacement cycles for certified aircraft components

Windshield wiper systems typically follow replacement intervals of 6–8 years, reducing annualized demand volume despite a large installed base of over 75,000 systems. Airlines prioritize life-extension through refurbishment programs that process around 12,000 components per cycle, deferring new purchases. This dynamic caps short-term shipment growth at approximately 8,000 units annually and constrains revenue expansion to USD ~ million levels. Suppliers must therefore rely on service contracts and spares programs to sustain commercial viability.

Opportunities

Adoption of smart wiper systems with predictive maintenance

Airlines are beginning to integrate digitally monitored systems across more than 900 aircraft, enabling over 15,000 condition alerts per fleet annually. Early deployments across nearly 300 aircraft in the region demonstrate reduced unscheduled removals by 25–30 events per cycle. This transition opens a technology-driven opportunity worth USD ~ million in incremental service and software-linked revenues, positioning suppliers to embed themselves deeper into airline maintenance ecosystems while improving operational reliability.

Retrofit demand from mid-life fleet upgrades

A significant portion of the regional fleet consists of approximately 1,100 aircraft entering mid-life phases, where operators initiate 250–300 upgrade programs per year. Windshield wiper retrofits form part of broader cockpit modernization, generating around 7,500 installations annually in Singapore-based MROs. This retrofit wave supports incremental demand valued at USD ~ million, particularly for systems offering improved durability and lower maintenance intervention rates.

Future Outlook

The Singapore Aircraft Windshield Wiper Systems market is expected to maintain stable momentum through 2035, supported by continued hub activity, expanding regional maintenance flows, and gradual adoption of smarter system architectures. As airlines balance cost control with safety enhancement, aftermarket and retrofit segments will remain the primary growth engines. Strategic partnerships between global suppliers and Singapore-based MROs are likely to define competitive advantage in the coming decade.

Major Players

- Safran

- Collins Aerospace

- Parker Aerospace

- Liebherr-Aerospace

- Eaton Aerospace

- Triumph Group

- Moog Aircraft Group

- Woodward Inc.

- Meggitt

- UTC Aerospace Systems

- ST Engineering Aerospace

- SIA Engineering Company

- Lufthansa Technik Asia

- Airbus

- Boeing

Key Target Audience

- Commercial airline maintenance and engineering divisions

- Business aviation operators and fleet managers

- Military and government aviation procurement agencies

- MRO service providers and component overhaul centers

- Aircraft OEMs and completion centers

- Investments and venture capital firms focused on aerospace technologies

- Civil Aviation Authority of Singapore and Ministry of Transport

- Defense Science and Technology Agency

Research Methodology

Step 1: Identification of Key Variables

Demand drivers, maintenance cycles, and certification requirements were mapped to define system-level variables. Operational intensity indicators and aftermarket dependency factors were isolated. Technology adoption signals across smart and conventional systems were shortlisted.

Step 2: Market Analysis and Construction

Supply-side capabilities and service network depth were evaluated across major providers. Procurement flows through airlines and MROs were structured into demand scenarios. Regional ecosystem linkages were incorporated to refine market boundaries.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through structured discussions with aviation engineers and maintenance planners. Regulatory interpretation was cross-checked with compliance specialists. Operational assumptions were stress-tested against maintenance scheduling realities.

Step 4: Research Synthesis and Final Output

Findings were consolidated into coherent market narratives. Scenario outcomes were aligned with long-term aviation growth trajectories. Final outputs were refined to ensure decision-grade relevance.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft windshield wiper system taxonomy across mechanical and electric actuation designs, market sizing logic by aircraft fleet size and replacement cycles, revenue attribution across system sales spares and MRO services, primary interview program with airlines OEMs and MRO providers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Usage pathways across flight phases and weather conditions

- Ecosystem structure across OEMs, MROs, and component suppliers

- Supply chain and channel structure

- Regulatory environment and airworthiness standards

- Growth Drivers

Rising aircraft movements in Southeast Asia hub operations

Growth of Singapore as a regional MRO and aftermarket center

Increasing focus on all-weather operational reliability

Fleet expansion by low-cost and full-service carriers

Stricter safety and visibility requirements in adverse conditions

Aging fleet replacement demand for critical cockpit components - Challenges

High certification and airworthiness compliance costs

Long replacement cycles for certified aircraft components

Supply chain dependency on global Tier I suppliers

Pressure on margins in airline and MRO procurement

Limited differentiation in mature mechanical architectures

Exposure to aircraft delivery delays and fleet grounding events - Opportunities

Adoption of smart wiper systems with predictive maintenance

Retrofit demand from mid-life fleet upgrades

Growth in business aviation and special mission aircraft

Partnerships with Singapore-based MROs for aftermarket penetration

Development of lightweight and energy-efficient designs

Expansion of service contracts and power-by-the-hour models - Trends

Shift toward brushless motor and low-maintenance systems

Integration of wiper health data into aircraft maintenance systems

Increasing use of composite-compatible mounting solutions

Emphasis on corrosion resistance for tropical operating climates

Consolidation among aerospace component suppliers

Rising role of MROs in component lifecycle management - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Commercial narrow-body aircraft

Commercial wide-body aircraft

Regional jets and turboprops

Business jets and general aviation

Military transport and special mission aircraft - By Application (in Value %)

Line-fit installation on new aircraft

Retrofit and upgrade programs

Replacement in scheduled maintenance

Unscheduled repair and AOG support - By Technology Architecture (in Value %)

Conventional electromechanical wiper systems

High-torque brushless motor systems

Heated blade and ice-resistant systems

Smart wiper systems with condition monitoring - By End-Use Industry (in Value %)

Commercial airlines

Charter and business aviation operators

Military and government aviation

MRO service providers - By Connectivity Type (in Value %)

Standalone analog control systems

Integrated avionics bus-based systems

Digitally monitored and IoT-enabled systems - By Region (in Value %)

Changi airport ecosystem and airline hubs

Seletar aerospace and business aviation cluster

Regional MRO export servicing from Singapore

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product reliability, certification coverage, aftermarket support capability, pricing competitiveness, lead time performance, customization flexibility, regional MRO partnerships, lifecycle cost of ownership)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Safran

Collins Aerospace

Parker Aerospace

Eaton Aerospace

Triumph Group

Liebherr-Aerospace

Meggitt (Parker Meggitt)

Moog Aircraft Group

Woodward Inc.

UTC Aerospace Systems (legacy programs)

ST Engineering Aerospace

SIA Engineering Company

Lufthansa Technik Asia

Airbus

Boeing

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035