Market Overview

The Singapore Aircraft Winglets market current size stands at around USD ~ million, supported by steady retrofit activity and new aircraft deliveries adding incremental demand worth USD ~ million. Ongoing sustainability programs and fuel efficiency initiatives have encouraged airlines to prioritize aerodynamic upgrades, resulting in consistent installation volumes of ~ units across commercial and business aviation fleets. Maintenance, repair, and overhaul hubs in the country continue to attract regional modification projects, strengthening aftermarket revenues and long-term service pipelines.

Singapore’s dominance in this market is shaped by its role as a regional aviation services hub with mature MRO infrastructure, high aircraft utilization rates, and strong demand concentration from premium carriers and leasing companies. The presence of advanced aerostructure capabilities, certified modification centers, and a supportive regulatory framework enables faster approval cycles for winglet retrofits. Proximity to major Asia-Pacific traffic corridors further reinforces ecosystem depth, making the country a preferred base for fleet performance upgrades and engineering-led aerodynamic enhancements.

Market Segmentation

By Fleet Type

The Singapore Aircraft Winglets market is led by narrow-body aircraft, reflecting the country’s high reliance on single-aisle fleets for regional connectivity and medium-haul operations. Airlines prioritize winglet upgrades on these aircraft to maximize fuel savings and extend operational range without major airframe modifications. Business jets follow as a strong secondary segment, driven by premium operators seeking performance optimization. Wide-body aircraft contribute steadily through long-haul efficiency programs, while regional jets and special mission aircraft represent niche demand supported by selective retrofit cycles and government fleet modernization efforts.

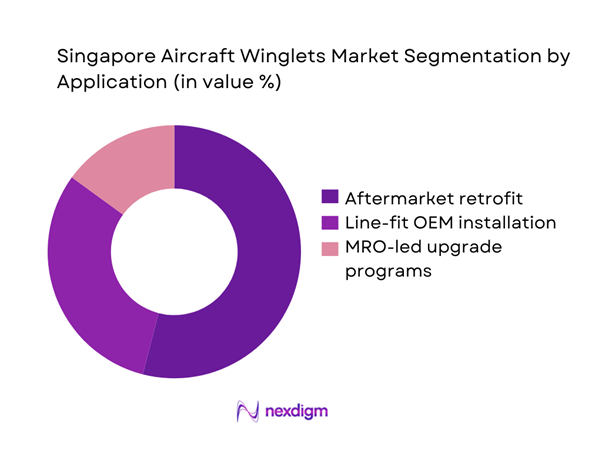

By Application

Aftermarket retrofit dominates the Singapore Aircraft Winglets market due to the large installed base of in-service aircraft requiring efficiency upgrades rather than new airframe replacements. Operators increasingly view winglet retrofits as cost-effective solutions to achieve performance gains while aligning with sustainability targets. Line-fit installations remain important for newly delivered aircraft, especially among premium carriers and leasing firms. MRO-led upgrade programs continue to expand, supported by Singapore’s reputation as a modification and certification hub, enabling faster turnaround times and reliable post-installation support for regional and international operators.

Competitive Landscape

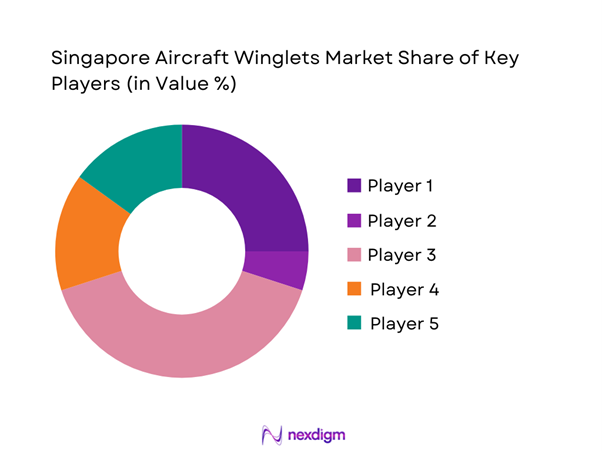

The Singapore Aircraft Winglets market shows moderate concentration, with a mix of global aerostructure leaders and specialized winglet technology providers shaping competition. Market structure is characterized by strong certification barriers and long-term relationships with airlines, lessors, and MROs, which favor established players with proven aerodynamic design capabilities and global service reach.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Aviation Partners Boeing | 1999 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Spirit AeroSystems | 2005 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| ST Engineering | 1968 | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Winglets Market Analysis

Growth Drivers

Rising fuel efficiency mandates among Singapore-based carriers

Fuel efficiency requirements have accelerated winglet adoption as airlines target measurable reductions in operating costs and emissions. Performance improvement programs across regional and long-haul fleets are generating incremental retrofit demand valued at USD ~ million, with annual installation activity reaching 120 units. Sustainability-linked financing and internal carbon reduction targets further reinforce this trend. Operators increasingly prioritize aerodynamic upgrades that deliver near-term fuel burn savings without major airframe changes, making winglets a preferred investment for carriers seeking operational efficiency and regulatory alignment.

Expansion of narrow-body fleets driving winglet retrofits

The steady growth of narrow-body aircraft in Singapore-based fleets has created a strong base for retrofit-led demand. Fleet expansion programs involving 260 aircraft have increased the installed base eligible for winglet upgrades, translating into service contracts worth USD ~ million. Airlines deploying long-range single-aisle aircraft emphasize performance optimization to improve route economics. This structural shift toward narrow-body utilization strengthens the long-term outlook for winglet suppliers, especially in the aftermarket and modification segments.

Challenges

High certification and airworthiness compliance costs

Stringent airworthiness requirements raise development and approval costs for winglet solutions, often exceeding USD ~ million per certification cycle. The need for extensive flight testing, documentation, and regulatory coordination can delay market entry and limit participation by smaller technology providers. Airlines may also face higher retrofit expenses due to compliance-driven engineering work, reducing adoption speed among cost-sensitive operators. These factors collectively constrain innovation cycles and increase the financial risk associated with introducing new winglet architectures.

Complex retrofit installation and aircraft downtime concerns

Winglet retrofits require aircraft ground time that can extend to 10 days per installation, affecting fleet availability and revenue generation. For operators managing 85 aircraft with high utilization rates, even short downtime translates into significant opportunity costs. Scheduling challenges within busy MRO facilities further complicate execution. As a result, some airlines postpone upgrades despite long-term efficiency gains, slowing near-term market momentum and placing pressure on service providers to deliver faster turnaround solutions.

Opportunities

Growing retrofit demand for aging A320 and B737 fleets

A substantial portion of in-service narrow-body aircraft in Singapore’s operating ecosystem is approaching mid-life cycles, creating retrofit opportunities valued at USD ~ million. Operators seek performance enhancements that extend aircraft relevance without committing to fleet replacement. Winglet upgrades offer measurable efficiency benefits for 190 aircraft, supporting fuel savings and emissions goals. This demand dynamic positions retrofit programs as a stable revenue stream for technology providers and MRO partners focused on lifecycle optimization.

Development of smart winglets with structural health monitoring

Emerging smart winglet concepts integrating sensors and digital monitoring systems present a high-value opportunity for differentiation. Early deployments across 60 aircraft could generate incremental revenues of USD ~ million through premium service packages and data-driven maintenance offerings. Airlines increasingly value predictive maintenance capabilities that reduce unscheduled downtime and improve asset utilization. The convergence of aerodynamics and digital engineering enables suppliers to move beyond hardware sales into long-term performance management solutions.

Future Outlook

The Singapore Aircraft Winglets market is expected to maintain steady expansion through the next decade as sustainability mandates and fleet modernization programs gain momentum. Growth will be shaped by increasing retrofit penetration, deeper MRO collaboration, and the gradual introduction of digitally enabled winglet systems. As regulatory pathways become more streamlined, innovation cycles are likely to shorten, supporting faster adoption of advanced aerodynamic solutions across commercial and business aviation segments.

Major Players

- Airbus

- Boeing

- Aviation Partners Boeing

- Spirit AeroSystems

- ST Engineering

- GKN Aerospace

- FACC

- Safran

- Collins Aerospace

- RUAG Aerostructures

- Daher

- Latecoere

- Kaman Aerospace

- Korean Air Aerospace Division

- Triumph Group

Key Target Audience

- Commercial airlines and fleet operators

- Aircraft leasing and asset management companies

- Maintenance, repair, and overhaul service providers

- Business jet operators and charter service firms

- Defense and government aviation agencies including the Civil Aviation Authority of Singapore

- Sustainability and environmental compliance bodies within transport ministries

- Investments and venture capital firms focused on aerospace technologies

- Airport authorities and aviation infrastructure operators

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined through analysis of fleet composition, retrofit potential, and technology adoption pathways. Key variables included aircraft age profiles, utilization intensity, and regulatory compliance requirements. Demand drivers and constraints were mapped to understand short- and medium-term market behavior.

Step 2: Market Analysis and Construction

A structured framework was used to evaluate supply-side capabilities, certification pathways, and service ecosystem maturity. Market sizing logic incorporated retrofit cycles, line-fit penetration, and aftermarket service revenues to build a coherent industry model.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were refined through structured interactions with engineering specialists, airline operations managers, and MRO planners. Insights focused on adoption barriers, installation timelines, and emerging technology priorities influencing procurement decisions.

Step 4: Research Synthesis and Final Output

All qualitative and quantitative insights were consolidated into an integrated market narrative. Analytical findings were aligned with strategic implications to deliver a consulting-grade outlook supporting investment, partnership, and expansion decisions.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft winglet taxonomy across blended split scimitar and sharklet designs, market sizing logic by aircraft fleet and retrofit penetration, revenue attribution across new installations kits and MRO services, primary interview program with airlines OEMs and MRO providers, data triangulation validation assumptions and limitations)

- Definition and scope

- Market evolution and technology adoption trajectory

- Aircraft performance and fuel efficiency impact pathways

- Ecosystem structure and value chain dynamics

- Supply chain and aftermarket channel structure

- Regulatory and airworthiness environment

- Growth Drivers

Rising fuel efficiency mandates among Singapore-based carriers

Expansion of narrow-body fleets driving winglet retrofits

Growth of MRO and aircraft leasing hub in Singapore

Sustainability targets and carbon emission reduction programs

Increased utilization of long-range narrow-body aircraft

OEM emphasis on aerodynamic performance upgrades - Challenges

High certification and airworthiness compliance costs

Complex retrofit installation and aircraft downtime concerns

Dependence on global supply chains for advanced composites

Price sensitivity among low-cost carriers

Limited local manufacturing scale for aerostructures

Extended product qualification cycles - Opportunities

Growing retrofit demand for aging A320 and B737 fleets

Development of smart winglets with structural health monitoring

Expansion of Singapore as a regional modification and STC hub

Partnerships between MROs and winglet technology providers

Rising demand from regional business jet operators

Supportive green aviation financing and incentives - Trends

Shift toward lightweight composite and hybrid materials

Adoption of split-tip and multi-surface winglet designs

Integration of digital twins for aerodynamic optimization

OEM-MRO collaboration for faster retrofit programs

Increasing focus on lifecycle cost reduction

Standardization of winglet kits across fleet families - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body aircraft

Wide-body aircraft

Regional jets

Business jets

Military and special mission aircraft - By Application (in Value %)

Line-fit OEM installation

Aftermarket retrofit

MRO-led upgrade programs - By Technology Architecture (in Value %)

Blended winglets

Split scimitar winglets

Sharklets

Raked wingtips

Adaptive and morphing wingtip concepts - By End-Use Industry (in Value %)

Commercial passenger aviation

Business and private aviation

Defense and government aviation

Air cargo and logistics operators - By Connectivity Type (in Value %)

Sensor-enabled connected winglets

Non-connected conventional winglets - By Region (in Value %)

Singapore domestic market

ASEAN regional operators

Asia-Pacific export markets

Middle East operators

Europe operators

North America operators

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology differentiation, certification coverage, retrofit turnaround time, pricing flexibility, regional MRO partnerships, composite manufacturing capability, digital engineering support, aftermarket service network)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Aviation Partners Boeing

Aviation Partners Group

Airbus

Boeing

Spirit AeroSystems

GKN Aerospace

FACC

Daher

Kaman Aerospace

RUAG Aerostructures

Safran

Collins Aerospace

Latecoere

ST Engineering

Korean Air Aerospace Division

- Demand and fleet utilization drivers among airlines and lessors

- Procurement cycles and tendering practices

- Buying criteria including ROI, fuel savings, and certification scope

- Budget allocation and financing preferences

- Implementation barriers and operational risk factors

- Post-purchase service, warranty, and upgrade expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035