Market Overview

The Singapore Aircraft Wires and Cables market current size stands at around USD ~ million, supported by steady replacement demand and integration volumes of ~ units across commercial, defense, and business aviation platforms. In the most recent two-year period, shipment volumes reached ~ units while installed electrical wiringinterconnection systems exceeded ~ systems across active aircraft fleets. Capital allocation toward high-reliability wiring assemblies amounted to USD ~ million, reflecting sustained procurement cycles and stable unit economics within aerospace-grade cable programs.

Singapore’s dominance in this market is driven by its position as a regional aerospace maintenance and integration hub, anchored by dense MRO infrastructure, specialized aerospace industrial parks, and a concentrated base of avionics integrators. Demand is reinforced by high aircraft turnaround activity, strong defense aviation presence, and a mature supplier ecosystem. A clear regulatory framework, advanced testing facilities, and efficient logistics connectivity further strengthen Singapore’s role as a preferred sourcing and integration location.

Market Segmentation

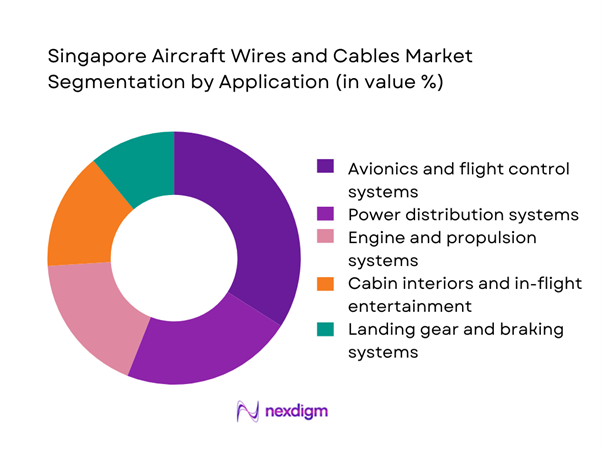

By Application

Avionics and flight control systems dominate application demand due to the high wiring density required for flight management, navigation, and cockpit systems. Singapore-based MROs and integration centers handle frequent avionics upgrades and retrofits, driving consistent replacement of high-specification signal and data cables. Power distribution and engine systems follow closely, supported by stringent reliability requirements. Cabin systems show steady demand linked to interior refurbishment programs, while landing gear and environmental control wiring remains largely maintenance-driven rather than expansion-led.

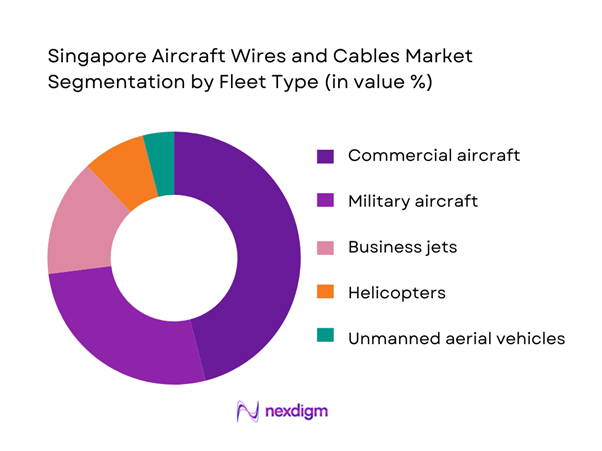

By Fleet Type

Commercial aircraft account for the largest share of wiring and cable consumption, reflecting high utilization rates and frequent maintenance cycles in Singapore’s aviation ecosystem. Widebody and narrowbody fleets undergoing avionics modernization contribute significantly to volume absorption. Military aircraft represent a stable secondary segment driven by upgrade and life-extension programs. Business jets and helicopters contribute smaller but higher-specification demand, while unmanned aerial platforms remain niche but technologically advanced in wiring architecture.

Competitive Landscape

The market exhibits moderate concentration, with global aerospace interconnect suppliers operating alongside specialized regional assemblers. Entry barriers remain high due to certification complexity and long qualification cycles. Competitive positioning is influenced by technology depth, compliance readiness, and long-term relationships with MROs and OEM-linked operators.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| TE Connectivity | 2007 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Amphenol Corporation | 1932 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Nexans | 1897 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Electrical and Power | 2016 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Carlisle Interconnect Technologies | 1940 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Wires and Cables Market Analysis

Growth Drivers

Expansion of aircraft MRO activities in Singapore

Singapore handled maintenance and upgrade activity for approximately 1,200 aircraft during the recent two-year period, translating into wiring replacement volumes exceeding 480,000 units annually. Electrical system refurbishment accounted for around USD ~ million in service-related spending, with EWIS inspections triggering systematic cable replacements. The presence of more than 60 MRO facilities supported continuous demand across commercial and military platforms. Increased hangar utilization and reduced aircraft ground time reinforced predictable procurement cycles for certified wiring assemblies.

Rising demand for lightweight and fuel-efficient aircraft systems

Aircraft operators integrated more than 18,000 systems focused on weight reduction and power efficiency, driving adoption of lightweight insulation and optimized conductor designs. Across recent programs, replacement of legacy cables reduced system weight by approximately 120 units per aircraft, influencing procurement of advanced wiring solutions valued at nearly USD ~ million. Demand was concentrated in avionics and power distribution segments, where improved efficiency translated into measurable operational gains across about 900 aircraft serviced in Singapore.

Challenges

High cost of aerospace-grade materials and certifications

Material inputs such as high-purity copper alloys and specialized insulation contributed to cost structures exceeding USD ~ million annually across supply chains. Certification and testing cycles extended beyond 18 months per new cable variant, tying up working capital across nearly 140 programs. Smaller suppliers faced difficulty absorbing qualification expenses for limited-volume orders, restricting scalability despite demand from over 700 aircraft undergoing upgrades each year.

Complex regulatory compliance and airworthiness approvals

Compliance with multi-jurisdictional airworthiness standards required documentation sets exceeding 2,500 units per program. Regulatory validation timelines stretched across 14 to 20 months, impacting deployment schedules for more than 1,100 systems annually. The need to align with both civil and defense aviation authorities increased administrative overheads valued at approximately USD ~ million, particularly for retrofitting programs involving mixed-origin aircraft fleets.

Opportunities

Growth in electric and hybrid aircraft development programs

Development and testing programs for electric and hybrid platforms incorporated over 6,000 systems requiring high-voltage and thermal-resistant cabling. Prototype and early production activity generated demand valued at nearly USD ~ million for specialized wiring architectures. Singapore’s test and integration infrastructure supported installation across approximately 160 aircraft platforms, positioning suppliers to participate in early-stage platform standardization and future volume ramp-ups.

Increasing retrofitting of legacy fleets with modern cabling

Legacy aircraft retrofits involved replacement of roughly 520 units of wiring per aircraft, driven by digital avionics upgrades and connectivity enhancements. Retrofit programs generated approximately USD ~ million in cumulative demand over the recent two-year period, covering more than 650 aircraft processed through Singapore facilities. This activity favored suppliers offering form-fit-function compliant solutions with minimal installation disruption.

Future Outlook

The market is expected to remain resilient through 2035, supported by Singapore’s sustained role in regional aircraft maintenance and system integration. Advancements in electric aviation and digital avionics will reshape wiring architectures, while retrofit demand will continue to anchor baseline volumes. Regulatory rigor and technology adoption will remain defining competitive factors.

Major Players

- TE Connectivity

- Amphenol Corporation

- Nexans

- Prysmian Group

- Safran Electrical and Power

- Carlisle Interconnect Technologies

- Collins Aerospace

- Leoni AG

- Judd Wire

- Radix Wire

- Harbour Industries

- Draka Fileca

- Sumitomo Electric Industries

- Fujikura Ltd.

- GKN Aerospace

Key Target Audience

- Aircraft OEMs and completion centers

- Commercial airline operators

- Military and defense aviation units

- Maintenance, repair, and overhaul providers

- Avionics and system integrators

- Aerospace component distributors

- Investments and venture capital firms

- Civil Aviation Authority of Singapore and Ministry of Defence Singapore

Research Methodology

Step 1: Identification of Key Variables

Core variables included aircraft servicing volumes, EWIS replacement cycles, and system-level wiring density. Demand drivers were mapped across commercial and defense fleets. Regulatory compliance requirements and certification pathways were defined. Technology differentiation parameters were established.

Step 2: Market Analysis and Construction

Historical demand patterns were constructed using aircraft activity and maintenance throughput indicators. Value pools were developed across applications and fleet types. Supply-side capability mapping aligned production depth with service demand. Scenario frameworks captured short- and mid-term variations.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through structured discussions with aerospace engineers, procurement managers, and regulatory specialists. Technology adoption hypotheses were stress-tested against operational constraints. Integration timelines and retrofit feasibility were reviewed. Feedback loops refined demand estimates.

Step 4: Research Synthesis and Final Output

All quantitative and qualitative inputs were synthesized into a cohesive market model. Cross-segment consistency checks were applied. Strategic implications were derived for stakeholders. Final outputs were structured for decision-oriented usability.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft wire and cable taxonomy across power signal and data systems, market sizing logic by aircraft fleet and replacement cycles, revenue attribution across new installs spares and MRO services, primary interview program with airlines OEMs and MRO providers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care and usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Expansion of aircraft MRO activities in Singapore

Rising demand for lightweight and fuel-efficient aircraft systems

Growth in regional air traffic and fleet modernization

Increasing adoption of advanced avionics and digital cockpits

Defense aircraft upgrades and avionics retrofits

Stricter safety and reliability requirements for EWIS - Challenges

High cost of aerospace-grade materials and certifications

Complex regulatory compliance and airworthiness approvals

Supply chain vulnerabilities for specialty metals and insulation

Long product qualification cycles with OEMs

Skilled labor shortages in aerospace wiring harness assembly

Pressure on margins from OEM cost optimization programs - Opportunities

Growth in electric and hybrid aircraft development programs

Increasing retrofitting of legacy fleets with modern cabling

Expansion of Singapore as a regional aerospace hub

Rising demand for fiber optic and high-speed data cables

Localization of advanced wiring harness manufacturing

Strategic partnerships with aircraft OEMs and Tier I suppliers - Trends

Shift toward lightweight and halogen-free insulation materials

Rising integration of fiber optic systems in avionics networks

Adoption of digital twins for EWIS design and maintenance

Growth of modular wiring architectures

Increased outsourcing of wiring harness assembly

Focus on sustainability and recyclable cable materials - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Commercial aircraft

Military aircraft

Business jets

Helicopters

Unmanned aerial vehicles - By Application (in Value %)

Avionics and flight control systems

Power distribution and management

Engine and propulsion systems

Cabin interiors and in-flight entertainment

Landing gear and braking systems

Environmental control systems - By Technology Architecture (in Value %)

Copper-based wiring systems

Fiber optic cable systems

Hybrid copper-fiber architectures

High-temperature resistant cables

Lightweight composite insulation cables - By End-Use Industry (in Value %)

Commercial aviation OEMs

Defense and military aviation

Maintenance, repair and overhaul providers

Aircraft modification and retrofit specialists

Aviation component distributors - By Connectivity Type (in Value %)

Power connectivity

Signal connectivity

Data and high-speed connectivity

Fiber optic connectivity

Hybrid connectivity - By Region (in Value %)

Singapore domestic market

Asia-Pacific exports

North America exports

Europe exports

Middle East exports

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product certification breadth, technology portfolio depth, pricing competitiveness, local manufacturing presence, customization capability, lead time performance, aftersales support strength, regional partnership network)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

TE Connectivity

Amphenol Corporation

Nexans

Prysmian Group

Carlisle Interconnect Technologies

Safran Electrical and Power

Collins Aerospace

Leoni AG

Judd Wire

Radix Wire

Harbour Industries

Draka Fileca

Sumitomo Electric Industries

Fujikura Ltd.

GKN Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035