Market Overview

The amphibious aircraft market has seen a significant rise in demand, driven by its versatile applications in both military and commercial aviation sectors. The market size has reached approximately USD ~, primarily fueled by technological advancements and the increasing adoption of amphibious aircraft for tourism, search and rescue operations, and transportation in remote areas. The demand is also spurred by the growing interest in eco-friendly aircraft solutions, which have further increased investment in this market segment. Various governmental initiatives to support eco-friendly transportation alternatives are also contributing to market growth.

The dominance in this market is largely seen in regions with extensive coastlines and water bodies, such as Southeast Asia, North America, and parts of Europe. Cities like Singapore, Vancouver, and Miami are hubs for amphibious aircraft, owing to their strategic positioning near water bodies, which increases the demand for amphibious transportation solutions. Additionally, the global rise in tourism and the need for efficient, flexible transportation solutions are driving regional growth. Furthermore, countries with strong military sectors, such as the United States and China, contribute significantly to the dominance of amphibious aircraft in defense applications.

Market Segmentation

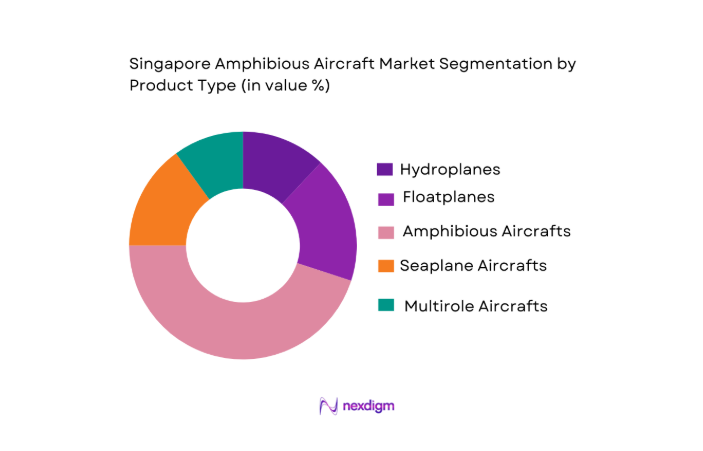

By Product Type:

The amphibious aircraft market is segmented by product type into hydroplanes, floatplanes, amphibious aircrafts, seaplane aircrafts, and multirole aircrafts. Recently, amphibious aircrafts have dominated the market share due to their multi-functional capabilities, such as the ability to operate on both land and water, making them highly desirable for various sectors including military, tourism, and search and rescue. This product type is well-suited for regions with extensive coastlines, islands, and remote water bodies where traditional aircraft may not have access. Their growing popularity for tourism and logistics in hard-to-reach areas has further strengthened their dominance, supported by advancements in aviation technology and increased regulatory support for their operations.

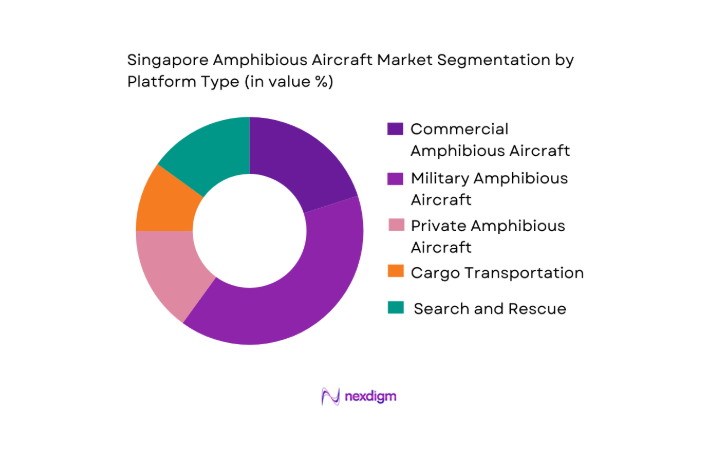

By Platform Type:

The amphibious aircraft market is segmented by platform type into commercial aviation, military aviation, private aviation, cargo transportation, and search and rescue. Military aviation has been a dominant segment, driven by the demand for versatile, quick-response aircraft capable of operating in varied environments, including hostile territories and remote locations. Amphibious aircrafts in the military sector are used for reconnaissance, transport, and rescue missions, providing significant operational advantages. Moreover, the use of amphibious aircraft in cargo transportation, especially in areas with underdeveloped infrastructure, has further contributed to the dominance of this segment. The continued advancements in military technology are expected to keep this platform type as a leading contributor to market growth.

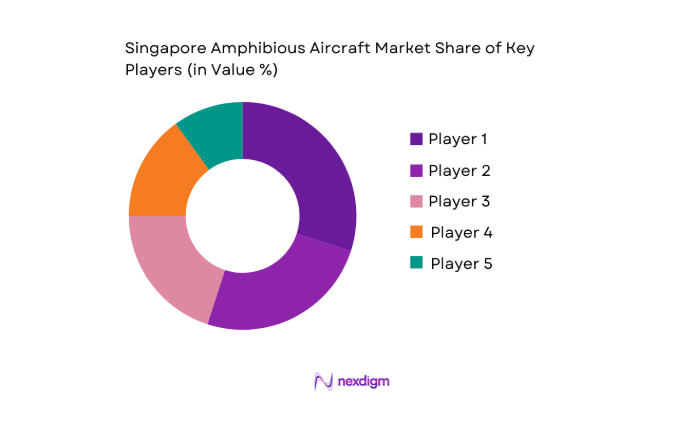

Competitive Landscape

The competitive landscape of the amphibious aircraft market is marked by a significant level of consolidation, with key players leading the market. The industry’s growth is influenced by major companies that drive innovation in technology, aircraft designs, and global expansion. Companies like Boeing, Lockheed Martin, and ShinMaywa Industries dominate the market through technological advancements and extensive production capabilities. The competition has led to strategic partnerships and collaborations, especially in the military sector, while also expanding product offerings in the commercial and private sectors. As demand for amphibious aircraft rises, these companies are likely to intensify their focus on cost-effective solutions and environmental sustainability.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ |

| ShinMaywa Industries | 1949 | Japan | ~ | ~ | ~ | ~ |

| Bombardier | 1942 | Montreal, Canada | ~ | ~ | ~ | ~ |

| Viking Air | 1970 | British Columbia | ~ | ~ | ~ | ~ |

Singapore Amphibious Aircraft Market Analysis

Growth Drivers

Technological Advancements

The growth of the amphibious aircraft market has been significantly driven by advancements in aircraft technology. These include the development of more efficient propulsion systems, lightweight materials, and improved water-landing technologies, which enhance the operational capabilities of amphibious aircraft. The incorporation of hybrid and electric propulsion systems also plays a crucial role in reducing operational costs and minimizing the environmental footprint. As the aviation industry increasingly prioritizes sustainability, these innovations in technology are fueling the demand for amphibious aircraft, particularly in environmentally conscious markets. Additionally, continuous improvements in avionics and navigation systems have enhanced the safety and reliability of amphibious aircraft, leading to increased confidence among end-users, especially in the military and commercial aviation sectors.

Regulatory Support and Environmental Focus

Another key driver is the increased support from governments for sustainable aviation solutions. Several regions have introduced policies and incentives aimed at promoting the adoption of eco-friendly aviation technologies, including subsidies for the development of hybrid and electric amphibious aircraft. Governments are also providing financial support for infrastructure development, such as building water-landing zones and providing regulatory approval for amphibious aircraft operations in sensitive regions. This is particularly important in markets with growing tourism industries, where the need for unique travel experiences is driving demand for amphibious aircraft. Moreover, the rising focus on environmental conservation and eco-tourism has prompted the shift toward low-emission aviation solutions, further promoting the growth of amphibious aircraft in these regions.

Market Challenges

High Maintenance Costs

One of the major challenges facing the amphibious aircraft market is the high cost of maintenance and repairs. These aircraft, due to their complex design and dual capabilities, require specialized maintenance that involves both aviation and marine technologies. This results in higher operational and upkeep costs compared to traditional aircraft. The need for frequent servicing of amphibious hulls, water-based landing gear, and seals also contributes to higher maintenance expenses. As a result, operators in commercial and military sectors face significant financial burdens, particularly in regions where amphibious aircraft operations are frequent. These factors can limit the growth of the market, especially in price-sensitive segments such as private aviation and tourism, where cost-effectiveness is a key consideration.

Regulatory and Safety Barriers

The amphibious aircraft market also faces challenges related to regulatory and safety requirements. Different regions have varying regulations for aircraft operations on both land and water, which can lead to delays in product approvals and deployment. The complexity of obtaining certifications for amphibious aircraft, particularly in highly regulated airspace, poses a challenge for manufacturers. Additionally, amphibious aircraft must adhere to stringent safety standards to ensure safe land and water operations, which requires continuous improvements in design and technology. These regulatory hurdles can increase the time-to-market for new amphibious aircraft and slow down the adoption rate, particularly in emerging markets where regulatory frameworks are still evolving.

Opportunities

Expansion of Eco-Friendly Aircraft

One of the most significant opportunities in the amphibious aircraft market lies in the growing demand for eco-friendly, hybrid, and electric amphibious aircraft. With increasing concerns about climate change and the aviation sector’s environmental impact, there is a significant push for more sustainable aviation solutions. Hybrid and electric amphibious aircraft offer reduced carbon emissions and lower fuel consumption compared to traditional combustion engine-based aircraft, making them attractive options for environmentally conscious consumers and governments. As the technology improves and infrastructure for charging and supporting electric aircraft expands, the market for eco-friendly amphibious aircraft is expected to grow rapidly. Companies that invest in developing and scaling these technologies are well-positioned to capture a significant portion of the market in the coming years.

Strategic Partnerships for Market Growth

Another opportunity lies in the potential for strategic partnerships and collaborations between aircraft manufacturers, governmental bodies, and private enterprises. With the increasing interest in amphibious aircraft for tourism, search and rescue, and military applications, joint ventures between industry players can help overcome challenges related to infrastructure and regulatory barriers. Partnerships can also provide access to additional funding, enabling companies to invest in research and development and expand their product offerings. Additionally, collaborations can help manufacturers tap into new geographic markets, particularly those with large coastlines or extensive inland waterways where amphibious aircraft are particularly useful. This collaborative approach can create synergies that accelerate growth and innovation in the amphibious aircraft market.

Future Outlook

The future of the amphibious aircraft market looks promising, with continued technological advancements expected to drive growth. Over the next five years, we anticipate a rise in demand for eco-friendly amphibious aircraft, especially in regions focused on sustainable transportation. Technological innovations, such as electric and hybrid-powered amphibious aircraft, will gain traction, supported by increased government regulations favoring environmentally friendly solutions. Moreover, demand from the tourism and military sectors is expected to remain strong, while infrastructure improvements will facilitate the expansion of amphibious aircraft operations globally.

Major Players

- Boeing

- Lockheed Martin

- ShinMaywa Industries

- Bombardier

- Viking Air

- Airbus Defence and Space

- Textron Aviation

- General Atomics

- L3 Technologies

- Northrop Grumman

- ATR Aircraft

- Piper Aircraft

- DHC Aerospace

- Beechcraft Corporation

- AeroVironment

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Commercial aviation companies

- Military and defense contractors

- Aerospace manufacturers

- Tourism and hospitality providers

- Aircraft leasing companies

- Private aviation operators

Research Methodology

Step 1: Identification of Key Variables

In this step, we identify critical market variables such as demand patterns, technology trends, and regulatory frameworks that influence market growth.

Step 2: Market Analysis and Construction

This phase involves the collection of primary and secondary data, segmentation analysis, and the formulation of market trends to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

We validate the hypotheses derived from market data through consultations with industry experts and stakeholders to ensure the accuracy of findings.

Step 4: Research Synthesis and Final Output

In this final step, we synthesize the research findings, integrate feedback from expert consultations, and produce the final market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in demand for multi-functional aviation solutions

Growing tourism industry with focus on unique travel experiences

Rising adoption of hybrid aircraft for eco-friendly solutions - Market Challenges

High cost of amphibious aircraft maintenance

Limited infrastructure for amphibious aircraft operations

Regulatory hurdles and certification delays - Market Opportunities

Expansion of amphibious aircraft in remote and island areas

Integration of advanced avionics for improved efficiency

Collaborations between private and government sectors for fleet expansion - Trends

Rise in hybrid and electric amphibious aircraft

Growing preference for autonomous flight systems

Advancements in amphibious aircraft design for better fuel efficiency - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

By Market Value, 2020-2025

By Installed Units, 2020-2025

By Average System Price, 2020-2025

By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Hydroplanes

Floatplanes

Amphibious Aircrafts

Seaplane Aircrafts

Multirole Aircrafts - By Platform Type (In Value%)

Commercial Aviation

Military Aviation

Private Aviation

Cargo Transportation

Search and Rescue - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Upgrade Fitment

Custom Fitment - By EndUser Segment (In Value%)

Government and Military

Private Owners

Tourism Operators

Aviation Leasing

Aerospace Contractors - By Procurement Channel (In Value%)

Direct Purchase

Leasing

Government Contracts

- Market Share Analysis

- Cross Comparison Parameters (Platform Type, System Type, Fitment Type, End User Segment, Procurement Channel)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Singapore Technologies Aerospace

Daimler Aerospace

Dornier Seawings

Viking Air

Airbus Defence and Space

ShinMaywa Industries

Aviation Industry Corporation of China

Bombardier Aerospace

AeroVironment

General Atomics

L3 Technologies

Lockheed Martin

Northrop Grumman

Embraer

Textron Aviation

- Government and Defense Agencies

- Commercial Airlines

- Tourism Operators

- Aviation Maintenance and Service Providers

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035