Market Overview

The Singapore apron bus market is expected to grow significantly, driven by increasing demand for efficient ground transportation solutions at airports. The market size for 2024 has been estimated at USD ~ million, driven by factors such as airport infrastructure development, rising air traffic, and the need for sustainable transportation systems. Government initiatives promoting green and electric vehicles are also contributing to the expansion of the market. Additionally, the integration of advanced technologies like automation and electric propulsion systems is enhancing operational efficiency at airports, further driving market growth.

Dominant countries like Singapore, with its world-class airports, lead the market due to high air traffic volumes and the continuous development of airport infrastructure. The country’s position as a major international transit hub fosters demand for modern apron buses. Moreover, its proactive approach toward sustainability, such as the adoption of electric apron buses, contributes to the dominance of Singapore in the market. Other Southeast Asian countries are also growing their airport infrastructure, but Singapore remains a key player in the region.

Market Segmentation

By Product Type

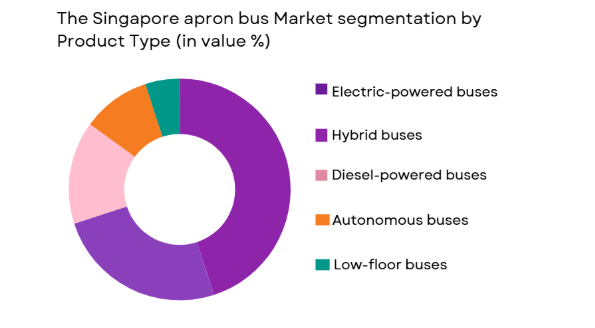

The Singapore apron bus market is segmented by product type into electric-powered, hybrid, diesel, autonomous, and low-floor buses. Recently, electric-powered apron buses have gained dominance in the market due to strong government incentives for green technologies and the increasing adoption of electric vehicles across various industries. The low operating cost, reduced carbon emissions, and the growing focus on sustainability in airport operations have made electric buses the preferred choice for airport operators, despite the higher upfront cost compared to traditional diesel buses.

By Platform Type

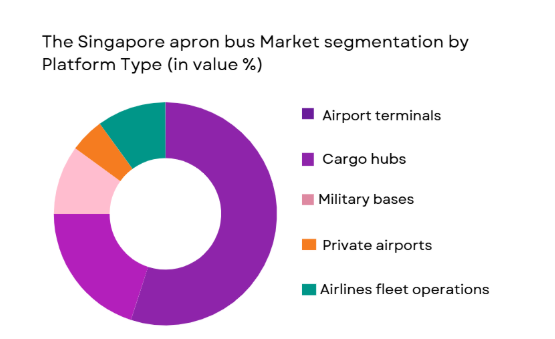

The market is segmented by platform type into airport terminals, cargo hubs, military bases, private airports, and airlines fleet operations. Airport terminals hold the dominant share due to the high demand for efficient ground transportation within terminals, especially in major airports such as Singapore Changi. The ongoing expansion of airport terminals and increasing air traffic has created a need for more apron buses to efficiently transport passengers and crew between gates, terminals, and other airport facilities.

Competitive Landscape

The Singapore apron bus market is highly competitive, with a few major players dominating the market due to technological advancements and strong customer relationships. The market has seen consolidation efforts, as manufacturers of electric and hybrid buses collaborate with airport operators to meet regulatory requirements and improve efficiency. The influence of major players is particularly strong in the electric bus segment, where innovations such as longer battery life, faster charging times, and reduced emissions are driving growth. Leading companies are also working on providing integrated solutions that include infrastructure, maintenance, and fleet management to further enhance their competitive positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market

Specific Parameter |

| EcoTransport Systems | 2005 | Singapore | ~ | ~ | ~ | ~ | ~ |

| GreenBus Technologies | 2010 | Singapore | ~ | ~ | ~ | ~ | ~ |

| AirBus Solutions | 2000 | Singapore | ~ | ~ | ~ | ~ | ~ |

| ProDrive Aviation Systems | 2003 | USA | ~ | ~ | ~ | ~ | ~ |

| Global Aviation Buses | 1995 | Germany | ~ | ~ | ~ | ~ | ~ |

The Singapore apron Market Analysis

Growth Drivers

Technological Advancements in Electric Buses

Electric buses have become a key driver for growth in the Singapore apron bus market. The growing focus on reducing the carbon footprint in airport operations has led to the adoption of electric apron buses as a primary solution. These buses offer several advantages, including lower operating costs, reduced emissions, and improved passenger comfort. Singapore’s government incentives for green technology adoption, such as tax breaks and subsidies, are accelerating the transition from traditional diesel-powered buses to electric alternatives. As electric bus technology continues to improve, with longer battery life and faster charging capabilities, demand is expected to increase, further propelling market growth. Moreover, airports are increasingly adopting electric buses as part of their broader sustainability efforts, reinforcing the demand for these eco-friendly vehicles. The shift towards electric-powered solutions is expected to be one of the most significant drivers in the coming years, particularly as more airports implement eco-friendly infrastructure.

Government Initiatives and Regulations

Another key growth driver is the regulatory support provided by governments, particularly in Singapore, which has introduced a variety of initiatives aimed at reducing emissions and improving air quality. Stringent emission standards for ground vehicles and the push for zero-emission solutions have prompted airport operators to invest in green technologies such as electric buses. Additionally, international airport authorities are adopting stricter environmental regulations, incentivizing investments in sustainable transport options. The government’s role in creating policies that prioritize low-emission buses further supports market growth, as airport operators increasingly look to comply with these regulations to maintain their environmental standards. Furthermore, these policies are complemented by substantial investments in electric vehicle infrastructure, including charging stations, making it easier for airport operators to transition to electric-powered fleets.

Market Challenges

High Initial Cost of Electric Buses

One of the primary challenges facing the Singapore apron bus market is the high initial investment required for electric buses. While these vehicles offer long-term savings in terms of fuel and maintenance costs, the upfront costs are significantly higher compared to traditional diesel-powered buses. This cost barrier is especially challenging for airport operators that have tight budgets and need to prioritize investments in other areas, such as terminal expansions and security upgrades. Although governments are offering subsidies and incentives to offset these costs, the initial investment remains a deterrent for some airport operators. Additionally, the cost of supporting infrastructure, such as charging stations and maintenance facilities, further increases the financial burden. As a result, the market for electric buses is somewhat limited by this financial barrier, which may slow the adoption of these vehicles in airports that are unable to secure sufficient funding or financing options.

Infrastructure Limitations

While the demand for electric buses is growing, the lack of adequate infrastructure to support these vehicles remains a significant challenge. Airports, particularly in regions outside Singapore, often face difficulties in setting up sufficient charging stations, maintenance facilities, and other necessary infrastructure. This is especially true for smaller airports that may not have the resources to invest in large-scale infrastructure projects. Without reliable charging infrastructure, electric buses cannot operate efficiently, leading to potential operational delays and higher costs for airport operators. The infrastructure challenge is exacerbated by the need for rapid advancements in technology to accommodate larger fleets of electric buses. Therefore, the lack of infrastructure development is a key obstacle that could hinder the market’s growth, particularly in regions with limited access to advanced charging and maintenance technologies.

Opportunities

Expansion of Airport Infrastructure

The expansion of airport infrastructure presents a significant opportunity for the Singapore apron bus market. With global air traffic on the rise, airports are increasingly investing in new terminals, runways, and ground support equipment to accommodate the growing demand for air travel. This infrastructure expansion includes the construction of new bus terminals and the upgrading of existing transportation systems. As airports modernize their facilities, there is a corresponding need for efficient apron buses to transport passengers and crew between terminals, gates, and other areas of the airport. This growth in airport infrastructure creates a strong demand for apron buses, particularly in emerging markets where airport development is accelerating. The increasing number of large-scale airport projects worldwide is expected to drive significant demand for new apron bus fleets, providing substantial opportunities for manufacturers in the market.

Public-Private Partnerships for Green Transportation

Public-private partnerships (PPPs) focused on green transportation represent another promising opportunity for the apron bus market. As governments push for greener transport solutions, private companies are collaborating with public authorities to fund and implement sustainable technologies such as electric and hybrid apron buses. These partnerships allow for shared financial investment, which reduces the financial burden on airport operators and accelerates the transition to environmentally friendly transport solutions. Additionally, PPPs often include the development of necessary infrastructure, such as charging stations, making it easier for airports to adopt new technologies. With both governments and private companies invested in the success of these partnerships, there is significant potential for growth in the market, particularly in regions where environmental policies are becoming stricter and the need for sustainable transport solutions is greater.

Future Outlook

The Singapore apron bus market is expected to experience steady growth in the next five years, fueled by the increasing demand for green and efficient ground transportation at airports. Technological developments, particularly in electric and autonomous buses, are expected to drive innovation and enhance the performance of airport fleets. Government policies promoting sustainability, coupled with increased air traffic and infrastructure development, will continue to shape the market. As airport operators focus on reducing their carbon footprint and enhancing operational efficiency, the demand for modern apron buses is likely to increase. Additionally, the shift towards integrated ground transportation solutions, including smart buses and charging infrastructure, will play a key role in shaping the future of the market.

Major Players

- EcoTransport Systems

- GreenBus Technologies

- AirBus Solutions

- ProDrive Aviation Systems

- Global Aviation Buses

- Mobility Systems Inc

- NextGen Transport Solutions

- AeroBus International

- SkyTransport Corp

- FleetPro Ground Services

- ElectricBus Enterprises

- HybridTech Motors

- ProTransport Solutions

- TransFleet Logistics

- EcoRide Solutions

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport operators and authorities

- Airlines and air carriers

- Ground service providers

- Fleet management companies

- Electric vehicle infrastructure providers

- Commercial vehicle manufacturers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables influencing the market, including product types, technologies, and regional factors. The variables help in creating a structured analysis of the market.

Step 2: Market Analysis and Construction

Data collection from primary and secondary sources is carried out to construct a comprehensive market model, focusing on market size, growth trends, and competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, the initial findings are validated through expert consultations and discussions with industry stakeholders to ensure accuracy and reliability.

Step 4: Research Synthesis and Final Output

The final output involves synthesizing all collected data into a detailed report, presenting market insights, forecasts, and key recommendations based on the findings.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for sustainable transport solutions

Technological advancements in electric and hybrid propulsion

Rising adoption of autonomous vehicle systems in aviation

Government push for cleaner airport operations

High volume of air traffic requiring efficient apron transportation - Market Challenges

High initial investment for electric apron buses

Regulatory challenges for autonomous apron buses

Limited infrastructure for charging electric buses at airports

Maintenance costs for hybrid and electric buses

Reluctance towards rapid technological adoption in some regions - Market Opportunities

Government initiatives for green transportation in airports

Partnerships between airport operators and bus manufacturers

Expansion of airport infrastructure requiring more apron buses - Trends

Growing focus on environmental sustainability

Increased collaboration between airports and tech companies

Rise of autonomous apron buses for cost efficiency

Advancements in electric battery technology

Shift towards integrated ground transportation solutions - Government Regulations & Defense Policy

Strict environmental regulations on airport emissions

Government funding for green transport initiatives

Safety standards for autonomous airport vehicles - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric-powered apron buses

Hybrid apron buses

Traditional diesel apron buses

Autonomous apron buses

Low-floor apron buses - By Platform Type (In Value%)

Airport terminals

Cargo hubs

Military bases

Private airports

Airlines fleet operations - By Fitment Type (In Value%)

OEM apron buses

Aftermarket apron buses

Integrated apron buses

Customized apron buses

Electric charging stations for apron buses - By EndUser Segment (In Value%)

Airports

Ground service providers

Airlines

Government and defense

Logistics companies - By Procurement Channel (In Value%)

Direct procurement from manufacturers

Procurement through distributors

Leasing options

Government contracts

Third-party service providers - By Material / Technology (in Value%)

Electric battery technology

Hybrid engine systems

Diesel engine technology

Automation and AI integration

Lightweight materials for apron buses

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters(Technology, Price, Performance, Energy Efficiency, Support Services )

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Siemens Mobility

Vinci Airports

Nabtesco Corporation

TLD Group

Mototok

Global Ground Support

Airbus Ground Handling

AeroTech Transport Systems

DB Schenker

Cavotec

Konecranes

JBT Corporation

Swissport International

Volvo Group

BYD Auto Co.

- Airports expanding green transport fleets

- Airlines adopting low-emission buses for sustainability goals

- Ground service providers integrating advanced apron vehicles

- Logistics companies focusing on electric vehicle fleets for operations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035