Market Overview

The Singapore Attack Helicopter Market size, based on a recent historical assessment, has been driven by significant investments in defense infrastructure, technological advancements, and increasing security concerns in the Asia-Pacific region. The market is estimated to be valued at USD ~ billion, with military modernization programs, both local and regional, fueling demand for advanced rotary-wing platforms. These platforms are considered vital for defense forces seeking enhanced capabilities in surveillance, precision strikes, and tactical operations in complex terrains.

Singapore is one of the dominant players in the Asia-Pacific defense industry, supported by its robust military spending and strategic geopolitical positioning. The country’s proximity to global maritime shipping routes and regional conflicts has heightened its focus on advanced defense technologies, including attack helicopters. Moreover, collaborative defense initiatives with countries such as the United States and Australia have further bolstered its position, ensuring continued growth and innovation in the sector.

Market Segmentation

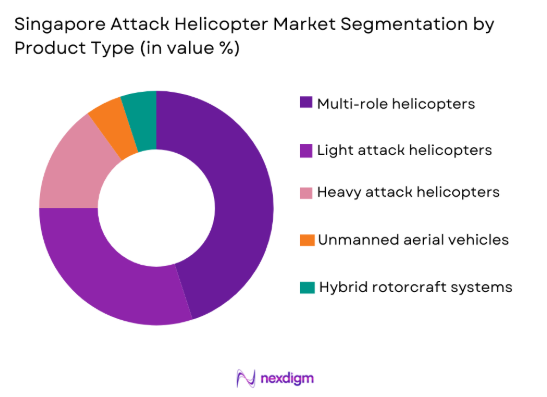

By Product Type

The Singapore Attack Helicopter Market is segmented by product type into multi-role helicopters, light attack helicopters, heavy attack helicopters, unmanned aerial vehicles (UAVs), and hybrid rotorcraft systems. Recently, multi-role helicopters have dominated the market share due to their versatility and ability to perform various missions such as reconnaissance, transport, and combat operations. Their flexibility has made them an essential component of modern air forces, catering to both military and defense needs. These helicopters are in high demand due to their capability to adapt to changing operational environments, further driven by technological advancements that enhance their performance, payload capacity, and endurance in challenging operational conditions. As military forces continue to prioritize flexibility in response to complex threats, multi-role helicopters remain the preferred choice, with substantial investments directed towards their development and procurement.

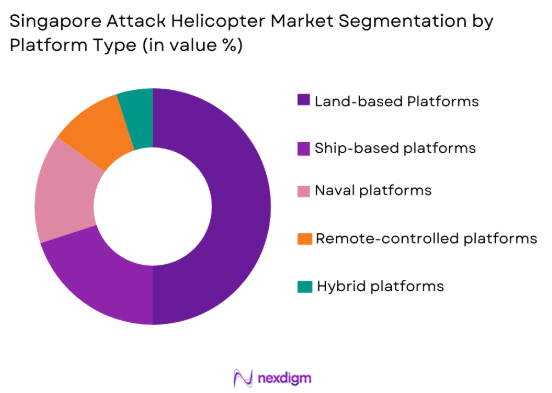

By Platform Type

The market for Singapore attack helicopters is also segmented by platform type into land-based platforms, ship-based platforms, naval platforms, remote-controlled platforms, and hybrid platforms. Among these, land-based platforms have a dominant market share due to their cost-effectiveness and strategic flexibility. Land-based attack helicopters are essential for defending national borders and carrying out ground support missions, especially in urban warfare scenarios. The emphasis on national security and maintaining an effective ground defense strategy has led to the prioritization of land-based platforms, which can be rapidly deployed and supported by the necessary infrastructure. The increasing use of advanced avionics, enhanced payload options, and greater operational efficiency has further bolstered the adoption of land-based platforms.

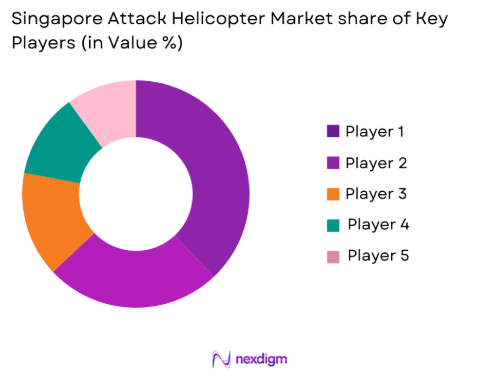

Competitive Landscape

The competitive landscape of the Singapore Attack Helicopter Market is characterized by both established industry giants and new entrants offering advanced technological solutions. Major players have been consolidating their market positions through strategic partnerships, mergers, and acquisitions to maintain a competitive edge. The market remains highly influenced by key defense contractors, whose innovations in rotorcraft design, weapon integration, and avionics continue to push the boundaries of attack helicopter capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Airbus Helicopters | 1969 | France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | USA | ~ | ~ | ~ | ~ | ~ |

| Russian Helicopters | 2007 | Russia | ~ | ~ | ~ | ~ | ~ |

Singapore Attack Helicopter Market Analysis

Growth Drivers

Defense Modernization Programs

The primary driver for growth in the Singapore Attack Helicopter Market is the ongoing defense modernization programs, particularly those focused on enhancing the combat capabilities of the Singapore Armed Forces (SAF). This expansion is driven by the need for advanced, versatile, and reliable platforms that can conduct precision strikes, surveillance, and tactical operations. As part of its defense strategy, Singapore has heavily invested in state-of-the-art air capabilities to address both regional threats and evolving military strategies. The government’s defense budget allocation continues to rise, ensuring that both the armed forces and private contractors receive the necessary resources to procure and maintain advanced military hardware. Moreover, the shifting defense priorities toward hybrid warfare, asymmetric tactics, and urban conflict are encouraging the SAF to procure more adaptable, multi-role attack helicopters. These platforms provide the necessary flexibility to address the demands of modern warfare, including precision targeting, enhanced survivability in contested environments, and the ability to support joint operations with allied nations. Additionally, the push towards more advanced technologies, such as automated systems, advanced sensors, and weapons integration, is driving further development in the sector, positioning multi-role attack helicopters as a key pillar of Singapore’s defense strategy.

Strategic Defense Alliances

Another critical driver of growth for the Singapore Attack Helicopter Market is the nation’s participation in strategic defense alliances with global powers such as the United States, Australia, and regional neighbors. These partnerships allow Singapore to access cutting-edge technology, advanced training, and joint operations that enhance its defense capabilities. Furthermore, these alliances facilitate arms trade agreements and technology transfers, which help modernize Singapore’s military infrastructure and provide access to high-performance attack helicopters. These strategic ties ensure that Singapore can deploy advanced weaponry and military platforms with the assurance of interoperability with allied forces. Additionally, regional defense initiatives such as the Five Power Defense Arrangements (FPDA) and ongoing military cooperation with ASEAN countries reinforce the need for Singapore to maintain advanced attack helicopters that can respond to regional tensions or security challenges. These collaborations not only strengthen Singapore’s defense posture but also create opportunities for local manufacturers to participate in the global supply chain for military helicopters. As geopolitical tensions continue to evolve, Singapore’s defense alliances and international relations will play a pivotal role in driving future demand for attack helicopters.

Market Challenges

High Maintenance and Operational Costs

One of the significant challenges facing the Singapore Attack Helicopter Market is the high operational and maintenance costs associated with advanced rotorcraft. These helicopters require specialized maintenance, extensive training, and support services to maintain peak operational efficiency. The cost of maintaining sophisticated avionics, weapons systems, and airframe components is considerable, placing a strain on defense budgets. Additionally, the parts and components required for advanced attack helicopters are often expensive, and procurement delays or supply chain disruptions can lead to increased downtime and further costs. Moreover, training costs for pilots and crew members, including the acquisition of simulator systems and technical expertise, are substantial. For a country like Singapore, which emphasizes technological superiority and operational readiness, the cost of maintaining these platforms in optimal conditions can significantly impact overall defense spending. While the benefits of advanced helicopters justify these costs, the financial burden remains a challenge, especially when considering the rapid pace of technological advancements and the need to continually update and upgrade equipment to maintain relevance on the battlefield.

Regulatory and Export Controls

Another challenge that affects the Singapore Attack Helicopter Market is the complex regulatory environment surrounding military equipment, especially in terms of export controls and international agreements. Singapore’s defense procurement processes must adhere to strict government policies regarding the export of sensitive military technologies. This is particularly important for attack helicopters, which are classified as high-performance systems with dual-use capabilities. Stringent export control regulations limit the ability of Singaporean manufacturers and defense contractors to export their products to certain regions, particularly those subject to international sanctions or arms embargoes. Additionally, the restrictions on technology transfer and intellectual property rights can hinder collaboration with foreign partners, limiting the availability of certain advanced components or technologies. Navigating these regulations and maintaining compliance with international agreements can delay the procurement and delivery of attack helicopters, affecting the timeliness of defense operations and potentially influencing market growth. As the demand for military-grade systems continues to rise, the ability to address these regulatory challenges will be crucial for ensuring continued market development.

Opportunities

Defense Export Potential

The Singapore Attack Helicopter Market holds considerable opportunity in terms of defense exports. Singapore’s strong reputation for producing advanced, reliable, and combat-ready military systems has opened avenues for exporting attack helicopters to other Southeast Asian nations and beyond. These helicopters, with their advanced avionics, weapon systems, and multi-role capabilities, are highly sought after by countries looking to modernize their armed forces. Singapore’s strategic alliances with other defense powers further enhance its position as a supplier of choice for these platforms. The growing geopolitical tensions in the Asia-Pacific region, particularly in the South China Sea, have prompted neighboring nations to increase their military spending, making them potential buyers of attack helicopters. As Singapore looks to expand its defense exports, it can leverage its position as a trusted defense partner to offer tailored solutions that meet the specific needs of various nations. Additionally, participation in international defense exhibitions and forums presents opportunities for local manufacturers to showcase their products, generate interest, and secure defense contracts for attack helicopters. Exporting these platforms will not only contribute to the growth of the local defense industry but also strengthen Singapore’s position as a key player in the global defense supply chain.

Technological Advancements in UAV Integration

Another significant opportunity in the Singapore Attack Helicopter Market is the integration of unmanned aerial vehicle (UAV) technology with traditional attack helicopters. UAVs offer advantages such as reduced operational costs, enhanced reconnaissance capabilities, and the ability to perform high-risk missions without putting crew members in danger. By incorporating UAVs into attack helicopter operations, the Singapore Armed Forces can significantly expand their operational flexibility and effectiveness. The integration of UAVs with manned helicopters allows for the combination of real-time surveillance, precision targeting, and autonomous flight capabilities, all of which contribute to a more efficient and powerful military operation. Furthermore, the development of advanced UAVs that can seamlessly operate alongside manned platforms presents an opportunity for Singapore to lead the way in developing next-generation hybrid air capabilities. As technological advancements continue to improve the performance and capabilities of both UAVs and manned attack helicopters, this integration will play a pivotal role in enhancing defense operations across the region and globally.

Future Outlook

Over the next five years, the Singapore Attack Helicopter Market is expected to continue its upward trajectory, driven by technological advancements and evolving defense priorities. Key factors influencing growth include increasing demand for multi-role platforms, innovations in hybrid rotorcraft technology, and the integration of unmanned systems for enhanced operational effectiveness. Singapore’s defense initiatives and the emphasis on modernization programs will ensure continued investment in these platforms. Furthermore, collaborations with regional allies and defense contractors will facilitate the development of cutting-edge solutions to address emerging security challenges.

Major Players

- Airbus Helicopters

- Lockheed Martin

- Boeing

- Bell Helicopter

- Russian Helicopters

- Sikorsky

- Northrop Grumman

- Leonardo

- Thales

- General Dynamics

- Bell Textron

- AVIC

- Hindustan Aeronautics

- Turkish Aerospace Industries

- AeroVironment

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military procurement departments

- Aerospace and aviation manufacturers

- Research and development organizations

- Defense ministries and agencies

- Global defense forces

Research Methodology

Step 1: Identification of Key Variables

Identify critical market drivers, restraints, and opportunities affecting the Singapore Attack Helicopter Market, and define key market variables for detailed analysis.

Step 2: Market Analysis and Construction

Analyze market trends, technological advancements, and defense strategies to build a comprehensive understanding of market dynamics and structure.

Step 3: Hypothesis Validation and Expert Consultation

Validate hypotheses through consultations with industry experts, military officials, and defense analysts to ensure alignment with market realities.

Step 4: Research Synthesis and Final Output

Synthesize gathered data, analyze findings, and present final insights into the Singapore Attack Helicopter Market, ensuring clarity and comprehensiveness.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government defense expenditure

Technological advancements in helicopter systems

Rise in regional military collaborations

Upgradation of existing military fleet

Demand for versatile and multi-role attack helicopters - Market Challenges

High maintenance and operational costs

Integration challenges with existing systems

Geopolitical instability in neighboring regions

Technological complexities in system upgrades

Strict government regulations and export controls - Market Opportunities

Increasing demand for modernized defense systems

Growth in joint military exercises and collaborations

Expansion of air defense capabilities in Southeast Asia - Trends

Adoption of autonomous and semi-autonomous systems

Enhanced focus on multi-role and versatile systems

Shift towards hybrid platforms combining rotary and fixed-wing capabilities

Integration of advanced artificial intelligence and machine learning

Growing reliance on real-time data and communications systems - Government Regulations & Defense Policy

Tightening defense export regulations

Increased defense budget allocation for advanced systems

National security policies impacting procurement

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Multi-role helicopters

Light attack helicopters

Heavy attack helicopters

Unmanned aerial vehicles (UAVs)

Hybrid rotorcraft systems - By Platform Type (In Value%)

Land-based platforms

Ship-based platforms

Naval platforms

Remote-controlled platforms

Hybrid platforms - By Fitment Type (In Value%)

Original equipment manufacturer (OEM)

Aftermarket fitment

Retrofitting services

Customized fitment

Upgraded systems - By End User Segment (In Value%)

Military defense forces

Government defense agencies

Private contractors

International military collaborations

Defense research and development agencies - By Procurement Channel (In Value%)

Direct purchase from manufacturers

Government defense procurement programs

Third-party distributors

Military contractors

International defense partnerships - By Material / Technology (in Value%)

Composite materials

Metal alloys

Helicopter-specific avionics

Armament integration systems

Engine technologies

- Market share snapshot of major players

- Cross Comparison Parameters (Price, Innovation, Technological Complexity, Regional Market Presence, Product Range, Government Contracts, Maintenance Support, Aftermarket Services, Operational Efficiency, Customer Loyalty)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Airbus Helicopters

Lockheed Martin

Bell Helicopter

Boeing

Leonardo

Russian Helicopters

Sikorsky

Northrop Grumman

Saab

General Dynamics

Thales

Airbus Defence and Space

Hindustan Aeronautics

AeroVironment

Turkish Aerospace Industries

- Demand from government defense agencies for advanced systems

- Private contractors seeking flexible procurement channels

- International collaborations and exports

- Technological innovations in defense R&D

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035