Market Overview

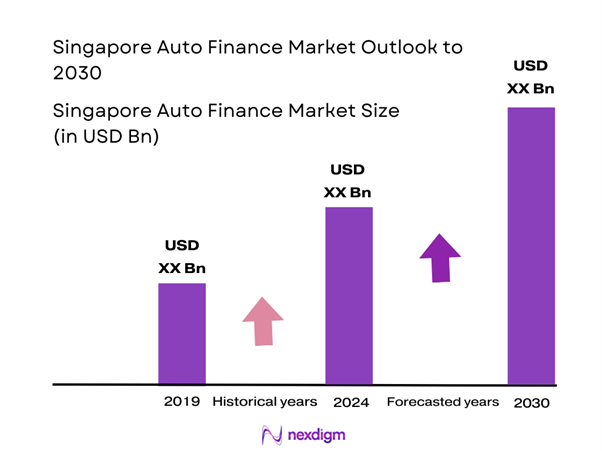

The Singapore Auto Finance Market is valued at approximately USD 10.25 billion in 2024 with an approximated compound annual growth rate (CAGR) of 8% from 2024-2030, buoyed by the robust growth in vehicle sales and the increasing availability of financing options tailored to consumer needs. This market has witnessed significant growth driven by rising disposable incomes and a shift towards convenient digital financing solutions. As of 2024, the strong presence of financial institutions like banks and fintech companies continues to stimulate growth, showcasing the importance of vehicle ownership in Singapore’s urban lifestyle.

In terms of geography, key dominant areas in the Singapore Auto Finance Market include Singapore itself, which serves as a regional hub for financial services and automotive sales. The concentration of a high-income population with a penchant for car ownership, coupled with government policies favoring vehicle purchases, contribute to Singapore’s dominance. Moreover, the growing adoption of innovative financing solutions, such as lease-to-buy and digital loan applications, enhances engagement within the market.

The expansion of fintech solutions in Singapore has revolutionized the auto finance landscape, attracting a significant portion of consumers seeking user-friendly finance options. By 2023, the Monetary Authority of Singapore (MAS) noted that over 80% of fintech firms operated within the financial technology sector were focused on enhancing customer experiences through digital platforms.

Market Segmentation

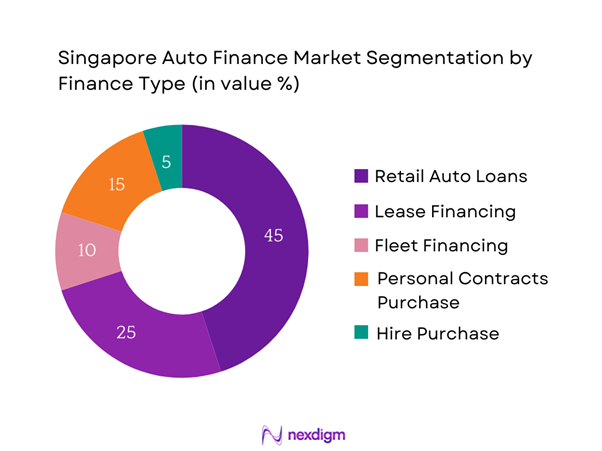

By Finance Type

The Singapore Auto Finance Market is segmented by finance type into retail auto loans, lease financing, fleet financing, personal contracts purchase (PCP), and hire purchase (HP). Retail auto loans account for the largest market share in 2024, primarily due to the substantial number of individuals seeking to own vehicles. This segment is characterized by competitive interest rates offered by banks and financial institutions, making it an attractive option for the average consumer. Furthermore, the ease of navigating available financing options through online platforms simplifies the borrowing process, facilitating a more extensive reach of retail loans among potential buyers.

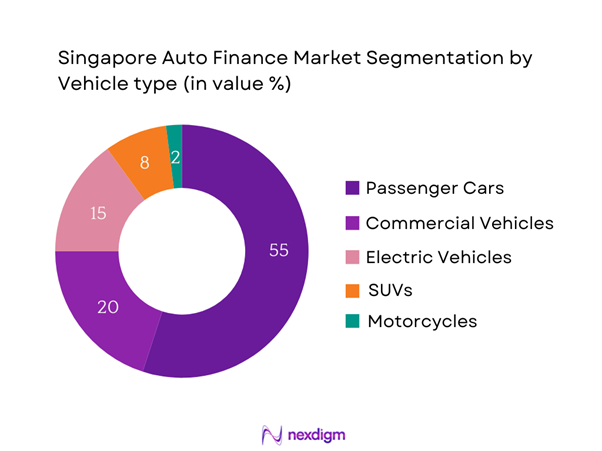

By Vehicle Type

The market for Singapore Auto Finance is also segmented by vehicle type into passenger cars, commercial vehicles, electric vehicles (EVs), SUVs, and motorcycles. Passenger cars dominate this segment in 2024, attributed to the high demand among individuals and families within urban settings. The growth of this sub-segment is primarily driven by the diverse offerings of financing products that cater to various consumer needs, such as flexible repayment options and competitive terms. Additionally, the strong marketing efforts by auto manufacturers further boost consumer interest in new passenger vehicles, further solidifying the position of this segment.

Competitive Landscape

The Singapore Auto Finance Market is characterized by a mix of established financial institutions and emerging fintech companies, creating a dynamic competitive landscape. Major players include DBS Bank, OCBC Bank, UOB, Citibank, and Standard Chartered, which provide a wide range of financing options for consumers. The presence of these key players underscores the competitive nature of the market, enhancing customer choices through differentiated products and services.

| Company | Establishment Year | Headquarters | Retail Auto Loans | Lease Financing | Fleet Financing | Financing Options | Market Strategy | Customer Base |

| DBS Bank | 1968 | Singapore | – | – | – | – | – | – |

| OCBC Bank | 1932 | Singapore | – | – | – | – | – | – |

| UOB | 1935 | Singapore | – | – | – | – | – | – |

| Citibank | 1902 | New York, USA | – | – | – | – | – | – |

| Standard Chartered | 1853 | London, UK | – | – | – | – | – | – |

Singapore Auto Finance Market Analysis

Growth Drivers

Rising Disposable Income

Rising disposable income in Singapore has significantly contributed to the growth of the auto finance market. According to the Department of Statistics Singapore, the gross monthly income from work has increased from SGD 4,600 in 2022 to SGD 4,800 in 2023, facilitating greater purchase capacity for consumers. As a result, individuals possess increased financial freedom to consider vehicle ownership, thus driving the demand for financing options. Higher disposable income correlates with enhanced consumer confidence, allowing for more substantial investments in household assets, including automobiles. Consequently, this influx of disposable income supports the overall performance of the Singapore Auto Finance Market.

Growth in Vehicle Sales

The rise in vehicle sales within Singapore serves as a crucial driver for the auto finance market. In 2022, registered vehicle sales totaled approximately 82,000 units, with a steady increase of 10,000 units reported in the first half of 2023 alone, evidencing a continued uptick in demand for automobiles. This demand has been driven by various factors, including the introduction of new car models and improved vehicle financing options. With increased vehicle ownership, consumers are turning to diverse auto finance solutions, thereby reinforcing the market’s growth trajectory and ensuring that financing remains a vital aspect of the auto purchasing process.

Market Challenges

Rising Interest Rates

Rising interest rates pose a significant challenge to the Singapore Auto Finance Market. In 2022, Singapore saw an increase in the Singapore Interbank Offered Rate (SIBOR) as the global economic environment tightened. By early 2023, the rate reached 3.5%, influencing borrowing costs across various sectors, including auto financing. With higher borrowing costs, potential car buyers may delay or forgo financing options as monthly repayments become less affordable. This upward trend in interest rates can adversely affect loan origination volumes and limit growth in new vehicle purchases, complicating market dynamics for both lenders and consumers.

Regulatory Compliance

Regulatory compliance remains a formidable challenge for the auto finance market in Singapore. The Financial Industry Review 2022 highlighted stringent regulatory controls evolving in response to rising consumer debt levels, necessitating that lenders adhere to robust credit assessment practices and risk-management frameworks to promote sustainable lending. Moreover, in 2023, the Monetary Authority of Singapore implemented new guidelines for responsible lending, resulting in a more complex compliance landscape for financial institutions offering auto loans. Increased compliance requirements may lead to higher operational costs for lenders, potentially stifling market growth by limiting the availability of financing products.

Opportunities

Shift Towards Electric Vehicles

The ongoing shift towards electric vehicles (EVs) presents tremendous opportunities for growth within the Singapore Auto Finance Market. From 2022 to 2023, registrations of EVs surged by over 160%, with approximately 17,000 EVs sold in 2023, showcasing the increasing consumer inclination towards sustainable transportation solutions. The Singapore government has committed to expanding its EV infrastructure, with plans to install 60,000 EV charging points by 2030. As consumer acceptance of EVs grows, the demand for tailored financing solutions that cater to the unique characteristics of electric cars will undoubtedly expand, thus driving further market growth.

Technological Innovations

Technological innovations in the financial services sector are opening avenues for enhanced customer experiences in auto financing. The integration of artificial intelligence (AI) and machine learning (ML) has enabled financial institutions to streamline loan applications and credit assessments, reducing the approval time from weeks to just a few hours. Furthermore, 2023 saw a marked rise in mobile app usage for financial transactions, with approximately 70% of Singaporeans using mobile banking apps regularly for managing their finances.

Future Outlook

Over the next five years, the Singapore Auto Finance Market is expected to show substantial growth driven by the continuous innovation in fintech solutions, consumer demand for convenience, and the growing importance of sustainable vehicle options such as electric cars. Government incentives promoting EV adoption, combined with a rapid shift towards digital financing methods, are anticipated to reshape the landscape of auto finance in Singapore. As the market evolves, competition among players is expected to intensify, enhancing service offerings and accessibility for consumers.

Major Players

- DBS Bank

- OCBC Bank

- UOB

- Citibank

- Standard Chartered

- Maybank

- HSBC

- Bank of China

- RHB Bank

- Singtel

- Carro

- Carsome

- Grab Finance

- Tokopedia

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Monetary Authority of Singapore)

- Automotive Manufacturers

- Financial Technology Providers

- Banking Institutions

- Insurance Companies

- Car Dealerships

- Fleet Management Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping the ecosystem of stakeholders within the Singapore Auto Finance Market. This involves conducting extensive desk research to gather qualitative and quantitative data from reputable sources, aiming to identify the critical variables that impact market dynamics, including consumer preferences and financing trends.

Step 2: Market Analysis and Construction

This phase entails gathering and analyzing historical data relating to the Singapore Auto Finance Market. Key areas of focus include examining total loan amounts, average interest rates, market penetration rates, and the relative proportions of various financing options. This analysis assists in projecting future market trajectories and revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through consultations with industry experts across different sectors, including banking, automotive sales, and fintech solutions. Engaging experts via interviews and surveys is crucial to gain firsthand insights and validate findings, ensuring the research accurately reflects current market conditions.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data and insights, with consultations from auto financing leaders to fine-tune comprehensive market profiles. This stage ensures that the analyses are well-rounded, capturing diverse perspectives on consumer behaviors, emerging trends, and potential opportunities, thereby producing a robust market report.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Industry Landscape

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Disposable Income

Growth in Vehicle Sales

Expansion of Fintech Solutions - Market Challenges

Rising Interest Rates

Regulatory Compliance - Opportunities

Shift Towards Electric Vehicles

Technological Innovations - Trends

Digitalization in Financial Services

Customer-centric Financing Models - Government Regulation

Financial Regulatory Frameworks

Consumer Protection Laws - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume (Number of Loans), 2019–2024

- By Average Loan Amount, 2019-2024

- By Finance Type (In Value %)

Retail Auto Loans

– New Car Loans

– Used Car Loans

Lease Financing

– Operational Leasing

– Financial Leasing

Fleet Financing

– Corporate Fleet Loans

– Government & Institutional Leasing

Personal Contract Purchase (PCP)

– PCP for New Cars

– PCP for Used Cars

Hire Purchase (HP)

– Fixed Interest HP

– Balloon Payment HP - By Vehicle Type (In Value %)

Passenger Cars

– Private Ownership

– Personal Lease

Commercial Vehicles

– Light Commercial Vehicles (LCVs)

– Heavy Vehicles & Vans

Electric Vehicles (EVs)

– Battery Electric Vehicles (BEVs)

– Plug-in Hybrid Electric Vehicles (PHEVs) - By Distribution Channel (In Value %)

Direct Lending

– Bank Loans

– NBFC Loans

Car Dealerships

– In-house Financing

– Dealer-Bank Tie-ups

Online Platforms

– Digital Auto Loan Aggregators

– Fintech Lending Platforms - By Borrower Type (In Value %)

Individual Borrowers

– First-time Car Buyers

– Repeat Car Owners

Corporate Borrowers

– SMEs

– Large Enterprises

– Ride-hailing Fleets - By Loan Tenure (In Value %)

Short-Term Loans

Long-Term Loans

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Auto Finance Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Market Positioning, Product Offerings, Customer Base, Pricing Strategies, Distribution Channels, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

DBS Bank

OCBC Bank

UOB

Maybank

Citibank

Standard Chartered

RHB Bank

Bank of China

Singtel

Tokopedia

Carro

Carsome

Grab Finance

Lenddo

BigPay

- Market Demand Analysis

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Consumer Preferences Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume (Number of Loans), 2025-2030

- By Average Loan Amount, 2025-2030