Market Overview

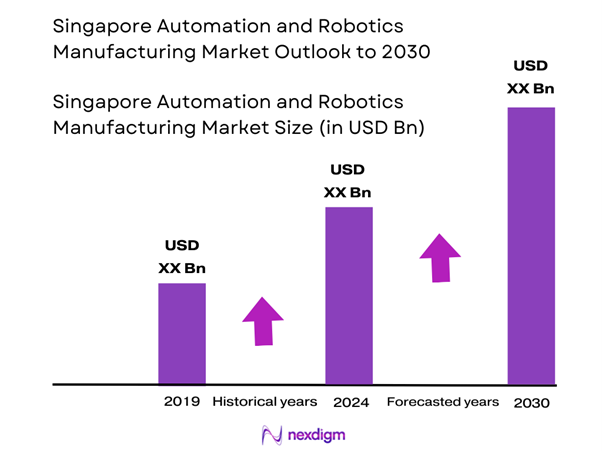

The Singapore Automation and Robotics Manufacturing Market is valued at USD 87.6 million in 2024 with an approximated compound annual growth rate (CAGR) of 6% from 2024-2030, supported by a robust industrial base and the nation’s commitment to embracing advanced manufacturing technologies. The market is primarily driven by increasing demand for automation solutions that enhance operational efficiency and reduce costs in various sectors, including manufacturing and logistics.

Singapore, as a global hub for technology and innovation, houses prominent cities that dominate the automation and robotics manufacturing landscape. Cities like Singapore itself, as well as regions attracting multinational corporations, benefit from significant investments in research and development. The government’s proactive initiatives, such as the “Industry Transformation Maps,” encourage technology adoption, thereby attracting major local and international players to the region.

The Singapore government actively promotes technology adoption through initiatives such as the Industry Transformation Maps (ITMs), which strategically support various sectors, including manufacturing. The government allocated SGD 1.6 billion to enhance productivity and technology. Notably, Singapore’s commitment to its Smart Nation initiative emphasizes the integration of technology across all aspects of society. In 2022, the total investment in R&D reached approximately SGD 12.5 billion, a 15% increase from 2021, reflecting the nation’s focus on innovation as a growth driver.

Market Segmentation

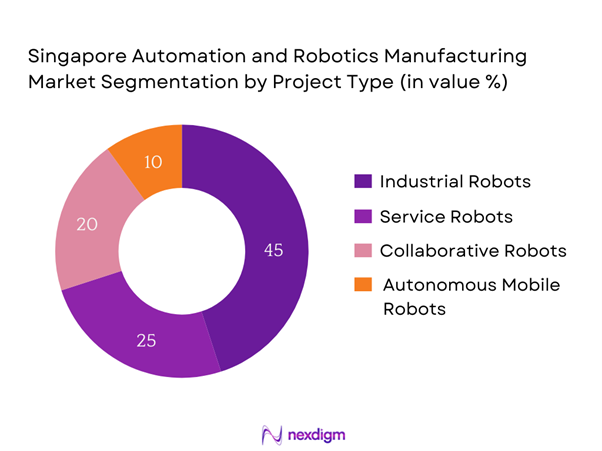

By Product Type

The Singapore Automation and Robotics Manufacturing Market is segmented by product type into industrial robots, service robots, collaborative robots (cobots), and autonomous mobile robots (AMRs). Industrial robots hold a dominant market share in Singapore due to their widespread application in manufacturing processes. These robots enhance precision, speed, and safety in operations while significantly reducing labor costs. Their versatility in handling various tasks, from assembly to packaging, makes them indispensable within sectors such as automotive and electronics. Major companies are continuously investing in R&D to innovate and improve the functionality of industrial robots, further solidifying their leading position.

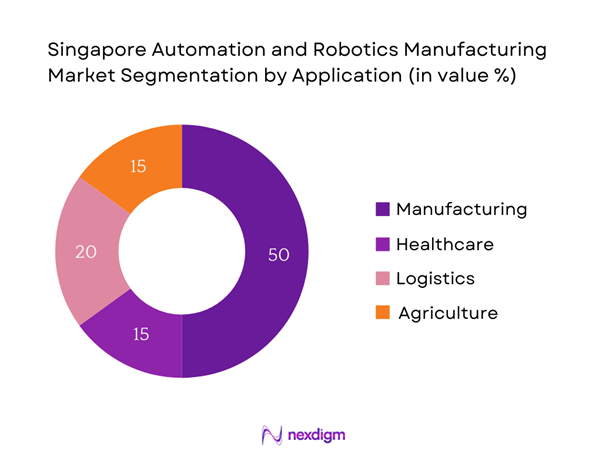

By Application

The market is also categorized by application into manufacturing, healthcare, logistics, and agriculture. The manufacturing sector dominates the market share, thanks to its increasing reliance on automation to achieve operational efficiency and quality control. In Singapore, many manufacturing firms are integrating advanced automated systems to streamline production lines and improve turnaround time. The push for smart manufacturing, characterized by the use of IoT and AI technologies, propels the demand for automation solutions in this segment as companies aim to meet the high standards of productivity and quality required in today’s competitive landscape.

Competitive Landscape

The Singapore Automation and Robotics Manufacturing Market is characterized by a highly competitive environment with several key players. Major companies include local and international firms that dominate the sector by leveraging innovation and advanced technologies. For instance, companies such as ABB Ltd. and Fanuc Corporation are known for their strong product portfolios and significant market presence due to their commitment to R&D and customer-centric solutions.

| Company | Establishment Year | Headquarters | Product Offerings | Revenue (USD) | Market Focus |

| ABB Ltd. | 1988 | Zurich, Switzerland | – | – | – |

| Fanuc Corporation | 1956 | Oshino, Japan | – | – | – |

| Yaskawa Electric Corp. | 1915 | Kitakyushu, Japan | – | – | – |

| KUKA AG | 1898 | Augsburg, Germany | – | – | – |

| Siemens AG | 1847 | Munich, Germany | – | – | – |

Singapore Automation and Robotics Manufacturing Market Analysis

Growth Drivers

Rise in Manufacturing Efficiency Requirements

As global competition intensifies, Singapore’s manufacturing sector increasingly adopts automation to enhance operational effectiveness. The productivity of the manufacturing sector improved by about 8% in 2022, largely due to the implementation of advanced manufacturing processes, including robotics and automation technologies. Specific sectors, such as electronics, saw productivity boosts exceeding 10%. Furthermore, the manufacturing output in Singapore reached SGD 128 billion in 2022, indicating a robust focus on efficiency through innovative manufacturing practices.

Expansion of Smart Factories

The rise of Industry 4.0 is leading to a marked expansion of smart factories in Singapore. As of 2023, it was estimated that over 50% of factories in the country had begun implementing smart technologies. This expansion is driven by advancements in IoT, AI, and automation, with nearly SGD 1 billion invested in smart factory initiatives. A study indicated that smart factories can achieve operational efficiency improvements of 20-30%. This transition aligns with global manufacturing trends, asserting Singapore’s leadership in automation and smart manufacturing.

Market Challenges

High Initial Investment Costs

Implementing automation and robotics solutions typically involves significant initial costs. In Singapore, manufacturing companies reported that the average capital investment required to establish automated systems is approximately SGD 2 million per facility. As of 2022, several businesses cited budget constraints as a primary barrier to upgrading their technology. Despite the potential ROI, the elevated initial costs deter smaller firms from automation adoption, limiting their competitiveness in the global market. This challenge influences overall market growth and necessitates tailored financial support from the government.

Skills Gap in Workforce

There is a notable skills gap within Singapore’s workforce that poses challenges for automation adoption. Approximately 80% of employers expressed difficulty in finding talent with the necessary technical skills for robotics and automation roles as of 2023. The labor force statistics reveal that by 2022, only 35% of Singaporean workers were equipped with advanced manufacturing skills, whereas the demand for such skills continues to rise sharply. This disparity highlights a critical need for targeted training programs to ensure a skilled workforce capable of managing advanced technologies.

Opportunities

Growth in E-commerce

The burgeoning e-commerce sector presents significant growth opportunities for automation and robotics manufacturing. In 2023, Singapore’s e-commerce market generated approximately SGD 5.4 billion in sales, representing an annual increase of 15%. The rise in online shopping has driven retailers and logistics providers to adopt automation solutions to enhance order fulfillment efficiency. By streamlining operations with automated warehouses, companies can improve turnaround times and customer satisfaction—indicative of strong future growth potential as e-commerce continues to expand.

Rising Demand for Automation in SMEs

The increasing necessity for SMEs to adopt cost-effective operational solutions in Singapore creates a significant opportunity for automation technologies. Approximately 60% of SMEs reported plans to invest in automation technologies to increase productivity and competitiveness as of 2023. The government’s support programs encouraging technology adoption among SMEs contributed to a surge in demand—driving an estimated SGD 400 million investment into automation solutions. As SMEs explore automation, the potential for market growth in this segment remains robust.

Future Outlook

The Singapore Automation and Robotics Manufacturing Market is anticipated to experience significant growth driven by continuous technological advancements and increasing consumer demand for efficiency-oriented solutions. Factors such as the Singapore government’s commitment to fostering innovation, growing investments in smart manufacturing, and the proliferation of IoT technologies are expected to facilitate market expansion. The forecasted CAGR for the 2024-2030 period stands at 6%, underscoring a strong outlook for the automation sector.

Major Players

- ABB Ltd.

- Fanuc Corporation

- Yaskawa Electric Corporation

- KUKA AG

- Siemens AG

- Mitsubishi Electric Corporation

- Universal Robots

- Omron Corporation

- Cognex Corporation

- Rockwell Automation

- Intel Corporation

- Teradyne Inc.

- Epson Robots

- Honeywell International Inc.

- Bosch Rexroth AG

Key Target Audience

- Manufacturing Companies

- Logistics Providers

- Healthcare Facilities

- Agricultural Businesses

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Trade and Industry, Economic Development Board)

- Technology Developers

- Automation System Integrators

Research Methodology

Step 1: Identification of Key Variables

The initial phase of the research involved constructing an ecosystem map that encompassed all major stakeholders within the Singapore Automation and Robotics Manufacturing Market. This step was underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary focus was to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Singapore Automation and Robotics Manufacturing Market was compiled and analyzed. This involved assessing market penetration rates, the ratio of marketplaces to service providers, and resultant revenue generation. An evaluation of service quality statistics was also conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provided valuable operational and financial insights directly from industry practitioners, which were instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with multiple automation and robotics manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction served to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Singapore Automation and Robotics Manufacturing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Initiatives and Policies

Rise in Manufacturing Efficiency Requirements

Expansion of Smart Factories - Market Challenges

High Initial Investment Costs

Skills Gap in Workforce - Opportunities

Growth in E-commerce

Rising Demand for Automation in SMEs - Trends

Focus on Sustainability and Energy Efficiency

Integration of Robotics with AI Technologies - Government Regulations

Safety and Compliance Standards

Investment Incentives - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Industrial Robots

– Articulated Robots

– SCARA Robots

– Cartesian Robots

– Parallel Robots

– Delta Robots

Service Robots

– Domestic Service Robots

– Professional Cleaning Robots

– Security and Surveillance Robots

Agricultural Robots

– Crop Monitoring Drones

– Autonomous Tractors

– Milking Robots

– Harvesting Systems

Collaborative Robots (Cobots)

– Lightweight Assembly Cobots

– Safety-Focused Cobots

– Precision Cobots for Electronics

Autonomous Mobile Robots (AMRs)

– Warehouse Robots

– Delivery Robots

– Industrial Mobile Platforms - By Application (In Value %)

Manufacturing

– Assembly Line Automation

– Material Handling

– Packaging and Palletizing

Oil and Gas

– Pipeline Inspection Robots

– Drilling Assistance Robots

– Offshore Maintenance Robots

Healthcare

– Surgical Robots

– Rehabilitation Robots

– Hospital Logistics Robots

Logistics

– Sorting Robots

– Pick-and-Pack Robots

– Last-Mile Delivery Robots

Agriculture

– Smart Irrigation Systems

– Soil Monitoring Robots

– Seeding and Fertilizing Robots - By End-User Industry (In Value %)

Automotive

– Robotic Welding Systems

– Paint and Coating Robots

– Component Assembly Automation

Electronics

– Microchip Handling Robots

– Precision Inspection Robots

– PCB Assembly Automation

Food and Beverage

– Robotic Food Handling

– Beverage Bottling Robots

– Quality Control Robots

Pharmaceuticals

– Drug Dispensing Robots

– Sterile Packaging Robots

– Lab Automation Systems

Retail

– Inventory Scanning Robots

– Self-Service Fulfillment Bots

– Customer Assistance Robots - By Technology (In Value %)

Artificial Intelligence (AI)

– Predictive Maintenance Systems

– Smart Path Planning

– Cognitive Vision Systems

Internet of Things (IoT)

– Connected Robotics Platforms

– Real-time Performance Monitoring

– Sensor-Integrated Robots

Machine Learning (ML)

– Adaptive Learning Algorithms

– Anomaly Detection

– Autonomous Navigation Systems

Computer Vision

– Defect Detection Systems

– Barcode and OCR Scanning

– Object Recognition Systems

Blockchain

– Secure Robot-to-Robot Communication

– Robotic Audit Trails

– Supply Chain Transparency Tools - By Region (In Value %)

Central Singapore

Northern Singapore

Western Singapore

Eastern Singapore

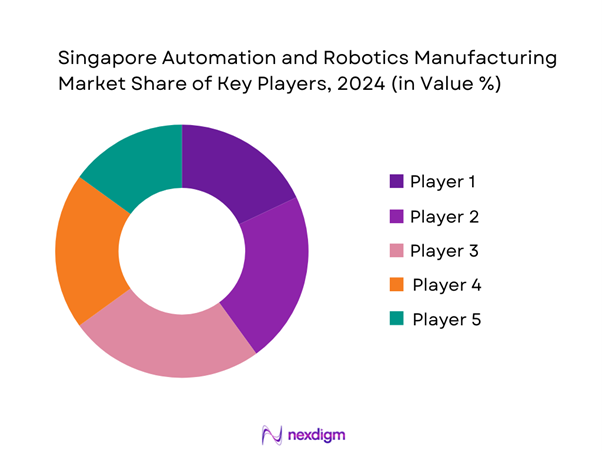

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Product Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

ABB Ltd.

Fanuc Corporation

Yaskawa Electric Corporation

KUKA AG

Siemens AG

Mitsubishi Electric Corporation

Universal Robots

Teradyne Inc.

Omron Corporation

Epson Robots

Rockwell Automation

Cognex Corporation

Intel Corporation

Honeywell International Inc.

Bosch Rexroth AG

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030