Market Overview

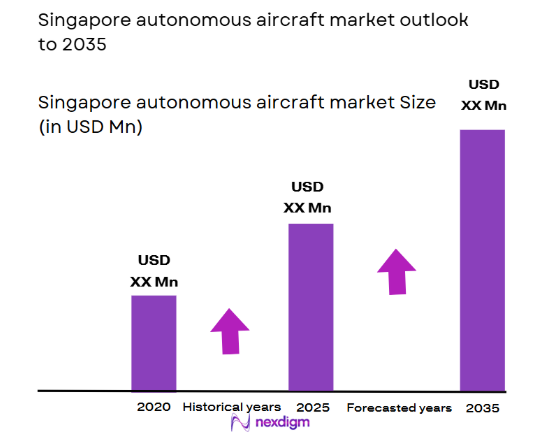

The market for autonomous aircraft in Singapore is expected to witness significant growth in the coming years, driven by advancements in technology and increased demand for efficient air transportation solutions. Based on a recent historical assessment, the market size is projected to reach approximately USD ~ million, reflecting the growing interest in unmanned aerial vehicles (UAVs) and urban air mobility (UAM) systems. These advancements are propelled by key innovations in autonomous flight technology, regulatory support, and the increasing push for sustainability in transportation. The market is expected to grow as autonomous aircraft systems become more reliable, cost-effective, and applicable in a variety of industries.

Singapore continues to dominate the autonomous aircraft market in Southeast Asia, owing to its strategic location, robust aerospace sector, and government-backed initiatives. As a global hub for innovation and technological development, the city-state has become a key player in promoting autonomous systems, particularly in the aviation and mobility sectors. The Singaporean government’s investment in smart city initiatives, urban air mobility infrastructure, and its favorable regulatory environment have helped solidify its position as a leader in autonomous aviation. Additionally, Singapore’s world-class infrastructure, including Changi Airport, provides the necessary facilities to foster the growth of autonomous aircraft technologies.

Market Segmentation

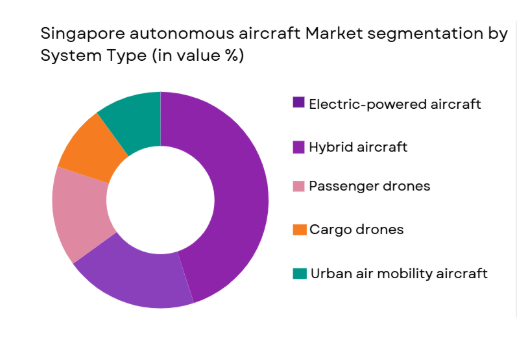

By System Type

The Singapore autonomous aircraft market is segmented by system type into electric-powered aircraft, hybrid aircraft, passenger drones, cargo drones, and urban air mobility (UAM) aircraft. Recently, electric-powered aircraft have gained a dominant market share due to factors such as increasing demand for sustainable and eco-friendly transportation solutions, advancements in battery technology, and favorable government incentives for green technology adoption. The growing focus on reducing carbon emissions and the rising number of urban air mobility initiatives have positioned electric-powered aircraft as the preferred option in this segment.

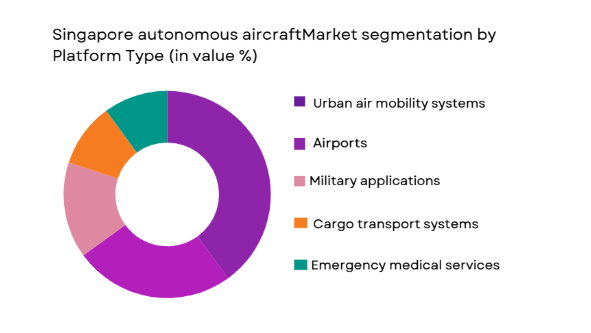

By Platform Type

The Singapore autonomous aircraft market is segmented by platform type into urban air mobility systems, airports, military applications, cargo transport systems, and emergency medical services (EMS). Urban air mobility systems have recently dominated the market due to the rising need for congestion-free, rapid transportation solutions in cities. With the Singaporean government’s push for smart city infrastructure, the demand for UAM systems has grown substantially, particularly in urban and peri-urban areas. These systems are seen as a solution to traffic congestion, providing both personal transportation and public air taxi services for the masses.

Competitive Landscape

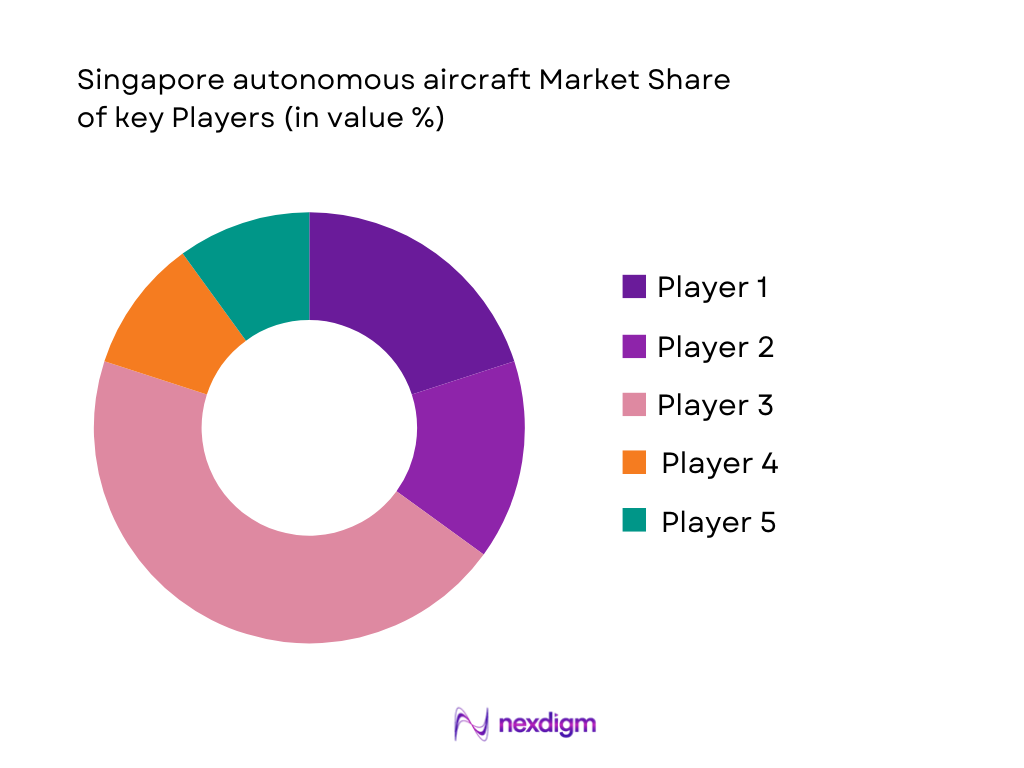

The competitive landscape of the Singapore autonomous aircraft market is dynamic, with key players driving technological advancements and leading market consolidation. The market is influenced by large aerospace firms, emerging startups, and technology companies focused on developing autonomous systems for aviation. As demand for autonomous aircraft systems grows, the competition among these companies intensifies, and strategic partnerships and acquisitions are becoming more common. Major players are focusing on reducing operational costs, improving the safety of autonomous systems, and expanding their global reach.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| Volocopter | 2011 | Germany | ~ | ~ | ~ | ~ | ~ |

| Joby Aviation | 2009 | USA | ~ | ~ | ~ | ~ | ~ |

| Lilium | 2015 | Germany | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ |

| Aurora Flight Sciences | 1989 | USA | ~ | ~ | ~ | ~ | ~ |

Singapore Autonomous Aircraft Market Analysis

Growth Drivers

Urbanization

The demand for autonomous aircraft in Singapore is largely driven by the rapid urbanization of cities and the increasing need for efficient transportation systems. Urban congestion has reached critical levels, with road traffic causing delays in daily commutes and logistics. Autonomous aircraft, especially urban air mobility (UAM) systems, offer a solution to this problem by providing fast, on-demand transportation options that bypass traditional ground traffic. Singapore, known for its strategic focus on innovation and smart city initiatives, has embraced UAM as part of its vision to create a sustainable and efficient transportation ecosystem. The growth of this sector is also fueled by advancements in electric vertical takeoff and landing (eVTOL) technologies, which make autonomous air transportation safer and more affordable. This trend is expected to grow as infrastructure development and regulatory support further pave the way for wider adoption of autonomous aircraft in urban environments.

Technological Advancements

Technological innovations in artificial intelligence (AI), autonomous systems, and energy storage have played a critical role in driving the growth of the autonomous aircraft market. AI-powered navigation and control systems allow these aircraft to operate safely in complex airspace, making them reliable alternatives to traditional manned aircraft. Moreover, advancements in battery technology have significantly improved the energy efficiency of electric autonomous aircraft, reducing their operating costs and environmental impact. As Singapore continues to push for sustainability and the development of green technologies, the demand for autonomous aircraft systems with low carbon emissions is expected to rise. Furthermore, the integration of autonomous aircraft into existing aviation infrastructure, such as airports and cargo hubs, will be facilitated by continued advancements in communication systems, air traffic control integration, and vehicle-to-vehicle (V2V) communication technology.

Market Challenges

Regulatory Hurdles

One of the major challenges facing the Singapore autonomous aircraft market is navigating the complex regulatory landscape. Autonomous aircraft must comply with stringent aviation safety standards and regulations set by global and regional authorities such as the International Civil Aviation Organization (ICAO) and the Civil Aviation Authority of Singapore (CAAS). These regulations govern the design, testing, and certification of autonomous aircraft, which can significantly slow down the time-to-market for new technologies. Furthermore, regulations around autonomous flight operations, such as flight restrictions in urban areas, airspace management, and passenger safety, remain a major challenge for companies seeking to deploy autonomous aircraft. As these systems become more widespread, regulatory frameworks will need to evolve to keep pace with technological developments, ensuring that safety and efficiency standards are maintained.

Public Perception and Safety Concerns

The adoption of autonomous aircraft is also hindered by public perception and safety concerns. While autonomous vehicles have gained popularity in other sectors, such as land-based transportation, the introduction of autonomous aircraft into the public airspace presents new challenges. Safety is a primary concern for both consumers and regulatory bodies, as the potential consequences of system failures or malfunctions in flight are significant. Additionally, the public’s perception of autonomous technology is still mixed, with some expressing reservations about the reliability of these systems, particularly in the case of passenger flights. To address these concerns, autonomous aircraft manufacturers will need to demonstrate the reliability and safety of their technologies through rigorous testing and transparent communication with the public.

Opportunities

Government Support for Smart Mobility

Singapore’s government has been actively supporting the development of smart mobility solutions, including autonomous aircraft, as part of its long-term vision for urban sustainability. This support comes in the form of funding, incentives, and infrastructure development initiatives aimed at fostering innovation in the transportation sector. The government’s commitment to building a smart city infrastructure is creating a favorable environment for the growth of autonomous systems, including urban air mobility platforms. Moreover, the Singaporean government is also investing in regulatory frameworks that promote the safe integration of autonomous aircraft into the aviation ecosystem. As a result, manufacturers and startups in the autonomous aircraft sector stand to benefit from government-backed programs and initiatives aimed at accelerating the development and deployment of autonomous technologies in urban environments.

Advancements in Electric Propulsion Technology

The shift toward electric propulsion systems in the autonomous aircraft market presents significant opportunities for market players. As electric-powered aircraft become more viable due to improvements in battery efficiency, they offer a cleaner and more sustainable alternative to traditional fuel-based aircraft. In Singapore, the push for environmental sustainability is encouraging the adoption of electric vertical takeoff and landing (eVTOL) aircraft, which are seen as key enablers of urban air mobility. The growth of electric propulsion technology is expected to open new avenues for market expansion, especially in urban environments where noise and air pollution are major concerns. Moreover, advancements in energy storage solutions, such as high-capacity batteries and fast-charging systems, will help overcome the limitations of current electric aircraft, paving the way for greater adoption of these systems in commercial applications.

Future Outlook

Over the next five years, the autonomous aircraft market in Singapore is expected to see strong growth, driven by advances in electric propulsion systems, AI-powered navigation, and urban air mobility (UAM) platforms. Regulatory support, along with increased demand for sustainable and efficient air transportation solutions, will play a critical role in shaping the future of this market. The ongoing development of UAM infrastructure and the expansion of smart city initiatives will provide the necessary foundation for the widespread adoption of autonomous aircraft in urban environments. As technological developments continue to reduce costs and improve safety, autonomous aircraft are likely to become a common feature of urban air transport systems in Singapore and beyond.

Major Players

- Volocopter

- Joby Aviation

- Lilium

- Airbus

- Aurora Flight Sciences

- Vertical Aerospace

- Skyports

- Elroy Air

- Kitty Hawk

- Terrafugia

- Lift Aircraft

- Bell Helicopter

- Boeing

- Urban Aeronautics

- Intel

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aviation authorities

- Urban planners and city infrastructure developers

- Aerospace manufacturers

- Cargo and logistics companies

- Emergency medical service providers

- Transportation technology developers

Research Methodology

Step 1: Identification of Key Variables

We identified critical variables, including market drivers, regulatory environments, technology trends, and consumer preferences, influencing the autonomous aircraft market in Singapore.

Step 2: Market Analysis and Construction

We conducted a comprehensive market analysis, examining historical data, trends, and forecasts, using both primary and secondary research sources to construct an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

We validated our findings by consulting with industry experts, stakeholders, and regulatory bodies, ensuring our market model accurately reflects the evolving landscape.

Step 4: Research Synthesis and Final Output

We synthesized the collected data, insights, and expert inputs to create a detailed market report, offering strategic recommendations and actionable insights for stakeholders in the autonomous aircraft industry.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for urban air mobility

Technological advancements in autonomous systems

Rising fuel prices pushing for electric aircraft

Government initiatives and support

Growing need for efficient cargo transport solutions - Market Challenges

High cost of autonomous aircraft development

Regulatory hurdles for autonomous systems

Lack of infrastructure for autonomous aircraft

Concerns around safety and airspace integration

Limited consumer trust in autonomous transportation - Market Opportunities

Technological advancements in electric propulsion

Government investments in smart city infrastructure

Rising interest in autonomous air freight solutions - Trends

Growth of Urban Air Mobility (UAM) networks

Integration of AI and machine learning in autonomous aviation

Development of eco-friendly and energy-efficient aircraft

Advancements in autonomous air traffic management systems

Increase in global investments in aerospace technology - Government Regulations & Defense Policy

National aviation safety standards for autonomous aircraft

Air traffic management regulations for autonomous vehicles

Defense sector investments in autonomous systems - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric Autonomous Aircraft

Hybrid Autonomous Aircraft

Passenger Autonomous Aircraft

Cargo Autonomous Aircraft

Urban Air Mobility (UAM) Aircraft - By Platform Type (In Value%)

Urban Air Mobility Systems

Airports and Aviation Hubs

Military and Defense Applications

Cargo and Freight Operations

Emergency Medical Services (EMS) - By Fitment Type (In Value%)

OEM Autonomous Aircraft

Aftermarket Autonomous Aircraft

Customizable Autonomous Aircraft

Modular Autonomous Aircraft

Integrated Autonomous Aircraft - By End-user Segment (In Value%)

Commercial Airlines

Cargo Operators

Military and Defense

Medical Transportation Services

Private Aviation and Corporates - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Distribution Networks

E-commerce and Online Platforms

Leasing and Financing Services

Government and Defense Contracts - By Material / Technology (in Value%)

Lightweight Composite Materials

Electric Powertrain Technology

Autonomous Control Systems

Battery Technology

Sensor and Navigation Technology

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (System Type, Platform Type, Fitment Type, End User Segment, Procurement Channel, Material/Technology, Market Value, Growth Drivers, Challenges, Opportunities)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Singapore Airlines

Volocopter

Joby Aviation

Lilium

Airbus

Boeing

Aurora Flight Sciences

Urban Aeronautics

Embraer

Vertical Aerospace

Skyports

Elroy Air

Kitty Hawk

Terrafugia

Lift Aircraft

- Demand from commercial airlines and urban mobility providers

- Military applications for autonomous reconnaissance

- Growth in cargo and freight transportation by air

- Rising investment in medical transportation services

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035