Market Overview

The Singapore autopilot system market has experienced significant growth, driven by advancements in artificial intelligence, machine learning, and sensor technologies. The market is valued in USD ~ billions, with a continued upward trajectory as both government policies and industry demands push for the adoption of autonomous vehicles across multiple sectors. Market expansion is further fueled by technological breakthroughs in vehicle safety systems, as well as growing investments from both public and private sectors in the region. This market is supported by a strong infrastructure of technological development, manufacturing, and high adoption rates in urban environments.

Dominant countries in the market include Singapore, Japan, and South Korea, with Singapore leading in terms of technological adoption and regulatory framework. The city-state has successfully positioned itself as a leader in autonomous vehicle testing, supported by strong governmental support for autonomous mobility. Other countries, like Japan, benefit from significant automotive industry investments in AI, sensor systems, and robotics, while South Korea’s technological advancements further strengthen the region’s dominance in the sector.

Market Segmentation

By Product Type

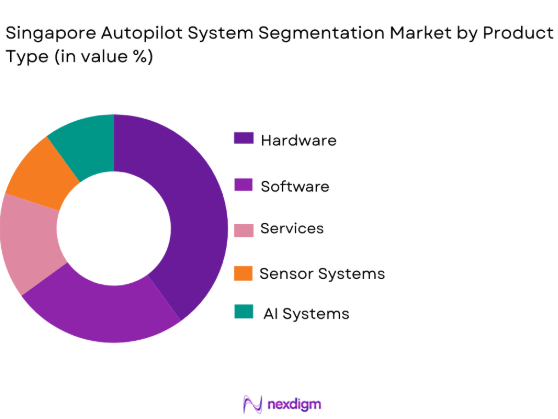

The Singapore Autopilot System market is segmented by product type into hardware, software, services, sensor systems, and AI systems. Recently, the hardware sub-segment has dominated the market share due to the increasing demand for critical components such as LiDAR, radar sensors, cameras, and onboard computing platforms. These hardware components form the backbone of autonomous vehicle systems, enabling real-time decision-making and navigation. The growing investments from automakers and technology companies in developing advanced sensors and processors to enhance vehicle autonomy have driven this segment’s growth. Moreover, the rise of AI-powered autonomous systems further boosts the demand for powerful hardware platforms, making the hardware sub-segment crucial to the market’s expansion.

By Platform Type

The Singapore autopilot system market is segmented by platform type into passenger vehicles, commercial vehicles, two-wheelers, public transport, and heavy machinery. Passenger vehicles dominate the market due to the increasing consumer preference for autonomous driving technologies in personal vehicles. The rapid development of electric autonomous vehicles and growing safety concerns among consumers has further boosted the demand for these systems. As governments push for regulations and provide incentives, the adoption of autopilot systems in personal vehicles is expected to continue growing, solidifying their market dominance.

Competitive Landscape

The competitive landscape of the Singapore autopilot system market is marked by significant consolidation as key players strive to establish themselves as leaders in autonomous vehicle technologies. Major players, including both tech firms and traditional automakers, are collaborating with governments to advance regulatory frameworks and ensure the safe integration of autonomous vehicles into public spaces. The market sees substantial influence from international players like Waymo and Tesla, along with local technology firms innovating alongside established automotive giants.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Innovation Focus |

| Waymo | 2009 | USA | ~ | ~ | ~ | ~ | ~ |

| Tesla | 2003 | USA | ~ | ~ | ~ | ~ | ~ |

| Nuro | 2016 | USA | ~ | ~ | ~ | ~ | ~ |

| Mobileye | 1999 | Israel | ~ | ~ | ~ | ~ | ~ |

| Aptiv | 1994 | USA | ~ | ~ | ~ | ~ | ~ |

Singapore autopilot system Market Analysis

Growth Drivers

Increasing Consumer Demand for Safety and Convenience

With rising concerns over road safety, there is an increasing demand for autonomous driving systems to enhance passenger safety and reduce human error. As consumers become more aware of the benefits of autopilot systems, such as enhanced safety features, less stressful driving experiences, and reduced accident rates, the adoption rate for these technologies continues to grow. Additionally, the development of more affordable and efficient autopilot solutions further fuels demand, making these systems more accessible to a larger segment of consumers. This shift towards safety and convenience is supported by advancements in AI, sensor technologies, and government incentives. Car manufacturers are increasingly incorporating autonomous driving features in new vehicle models to cater to consumer preferences for innovative, secure, and convenient driving solutions. The market will see accelerated growth in the coming years as consumer demand for these features continues to surge, driving market expansion.

Technological Advancements and Innovations

The rapid evolution of AI, machine learning, and sensor technology has been a primary driver of the growth of the autopilot system market. As these technologies become more advanced and affordable, the integration of autopilot systems into vehicles has become more feasible. The development of highly accurate sensors, such as lidar and radar, along with improved AI algorithms, has enabled vehicles to navigate complex driving environments autonomously. Furthermore, ongoing investments in research and development from both established automotive manufacturers and tech companies are accelerating innovation in the market, leading to more reliable and efficient systems. This continuous advancement in technology is driving the broader acceptance and implementation of autonomous driving systems across various segments, such as personal vehicles, commercial fleets, and public transportation. The growing technological sophistication of autopilot systems is, therefore, a key growth driver in the market, propelling its expansion.

Market Challenges

High Cost of Implementation and Maintenance

One of the primary challenges in the Singapore autopilot system market is the high cost of both initial implementation and long-term maintenance. Autonomous driving systems require sophisticated sensors, AI-driven technology, and integration with existing vehicle systems, which results in a high upfront investment for manufacturers and consumers. Additionally, the need for regular software updates, system recalibration, and maintenance of complex hardware systems contributes to ongoing operational costs, making adoption more challenging, especially for smaller companies or individual consumers. This cost barrier limits the scalability of autonomous vehicles, especially in developing regions or among price-sensitive consumers. As such, addressing the high costs associated with these systems remains a critical challenge for the market.

Regulatory Uncertainty and Safety Concerns

Another challenge hindering the growth of the Singapore autopilot system market is the regulatory uncertainty surrounding autonomous vehicles. Many governments around the world, including Singapore, are still in the process of developing comprehensive regulations and standards for the deployment of autonomous vehicles. These regulations are crucial to ensuring the safety of both passengers and pedestrians and gaining public trust in these technologies. Additionally, safety concerns remain at the forefront, with high-profile accidents involving autonomous vehicles drawing public attention to potential risks. The lack of standardized testing protocols and the evolving nature of regulatory frameworks create an unpredictable environment for market participants, making it difficult for manufacturers to plan for future developments and deployments. Regulatory clarity and resolution of safety concerns are essential to the widespread adoption of autonomous vehicles.

Opportunities

Expansion of Public Transport Systems with Autonomous Vehicles

As cities around the world move toward smart city concepts, there is a growing opportunity to integrate autonomous vehicles into public transport systems. Autonomous buses, shuttles, and trains could revolutionize urban transportation, offering more efficient, safer, and sustainable mobility solutions. Singapore is focusing on creating an integrated transportation ecosystem, where autonomous vehicles play a key role in reducing congestion, lowering emissions, and improving public transport accessibility. As governments continue to invest in smart infrastructure, there is significant potential for growth in the market for autonomous public transportation systems, creating new avenues for companies in the sector. By leveraging autonomous technologies, public transportation providers can increase operational efficiency and provide better service, especially in urban environments with high traffic.

Integration with Electric Vehicles and Environmental Initiatives

The growing trend towards electric vehicles (EVs) presents another significant opportunity for the autopilot system market. As EV adoption continues to rise globally, the demand for integrated autonomous driving systems in EVs is increasing. Autonomous electric vehicles (AEVs) offer the potential for cleaner, more sustainable transportation solutions, which aligns with global environmental initiatives to reduce carbon emissions. Singapore’s push for eco-friendly, sustainable mobility solutions makes it an ideal market for this integration, as the city-state emphasizes its commitment to a greener future. The convergence of electric vehicle technology and autonomous driving solutions presents a unique opportunity for market players to drive innovation and capture new growth in both the automotive and environmental sectors. Manufacturers investing in AEVs will be positioned to capitalize on the growing consumer interest in eco-friendly, smart mobility solutions.

Future Outlook

The future outlook for the Singapore autopilot system market is promising, with expected growth driven by advancements in technology, regulatory support, and increasing consumer demand for autonomous solutions. Technological developments, such as the refinement of AI and machine learning algorithms, will continue to enhance the reliability and efficiency of autonomous driving systems. Additionally, government policies supporting sustainable mobility, such as incentives for electric vehicles and autonomous public transport, will further encourage adoption. Over the next five years, the market is expected to see robust growth, with significant developments in infrastructure, regulations, and consumer acceptance of fully autonomous vehicles.

Major Players

- Waymo

- Tesla

- Nuro

- Mobileye

- Aptiv

- Uber Technologies

- Apple

- Baidu

- Aurora Innovation

- Zoox

- Cruise Automation

- Continental AG

- Bosch

- Denso

- Qualcomm

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- OEM manufacturers

- Fleet management companies

- Automotive technology developers

- Smart city developers

- Public transport authorities

- Electric vehicle manufactur

Research Methodology

Step 1: Identification of Key Variables

Identifying and understanding the key factors influencing the autopilot system market, including technological trends, regulatory developments, and consumer behavior.

Step 2: Market Analysis and Construction

Conducting primary and secondary research to analyze market size, growth trends, and industry dynamics, followed by constructing market models for forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Validating the research hypotheses through consultation with industry experts, stakeholders, and market leaders to ensure accuracy and reliability.

Step 4: Research Synthesis and Final Output

Synthesizing findings from all research phases to generate a comprehensive market report, with actionable insights and strategic recommendations.

- Executive Summary

- Market Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for autonomous vehicles

Advancements in AI and machine learning for improved system efficiency

Government incentives for autonomous vehicle development

Growing adoption of electric and hybrid vehicles

Rising focus on safety and accident reduction - Market Challenges

High cost of advanced autopilot systems

Regulatory uncertainties and lack of uniform standards

Consumer hesitation towards fully autonomous vehicles

Technical challenges in sensor accuracy and reliability

Cybersecurity concerns in autonomous vehicle systems - Market Opportunities

Expansion in the commercial transport and logistics sectors

Integration with smart city infrastructure

Collaborations with tech companies for system advancements - Trends

Shift towards Level 4 and Level 5 autonomous driving

Increased use of cloud-based systems for data processing

Integration of AI and machine learning in autopilot features

Focus on energy efficiency and eco-friendly technologies

Collaboration between automakers and technology firms - Government Regulations & Defense Policy

Stricter safety and testing standards for autonomous vehicles

Government support for R&D in autonomous driving technologies

Policies for autonomous vehicle integration in urban infrastructure - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Autonomous Driving Systems

Assisted Driving Systems

Hybrid Systems

Adaptive Cruise Control Systems

Lane-Keeping Assistance Systems - By Platform Type (In Value%)

Passenger Vehicles

Commercial Vehicles

Two-Wheelers

Public Transport

Heavy Machinery - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket Systems

Retrofit Systems

Integrated Systems

Standalone Systems - By End User Segment (In Value%)

Private Car Owners

Fleet Operators

Public Transport Authorities

Automotive Manufacturers

Logistics and Freight Companies - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Retail & E-commerce Platforms

Third-Party Distributors

Fleet Purchase Programs

OEM Partnerships - By Material / Technology (In Value%)

Lidar Technology

Radar Sensors

Camera-Based Systems

Artificial Intelligence & Machine Learning

Vehicle-to-Vehicle (V2V) Communication

- Market share snapshot of major players

- Cross Comparison Parameters (Price, Performance, Technology Adoption, Regulatory Compliance, Market Reach, Innovation, Customer Satisfaction, Brand Recognition, Delivery Timeliness)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Waymo

Tesla

Uber Technologies

Mobileye

Nuro

Aurora Innovation

Aptiv

Zoox

Uber Freight

Cruise Automation

Apple

Baidu

Aptiv

Delphi Technologies

Continental AG

- Private car owners’ growing interest in autonomous features

- Fleet operators increasingly adopting autopilot systems for efficiency

- Public transport authorities exploring autonomy for safety and cost reduction

- Automotive manufacturers investing in developing autonomous vehicles

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035