Market Overview

The Singapore aviation augmented and virtual reality market is expected to experience significant growth in the coming years, driven by technological advancements in AR and VR applications. Based on a recent historical assessment, the market size is projected to reach USD ~ billion by the end of the current assessment period, supported by increased adoption of immersive technologies for pilot training, aircraft maintenance, and customer experiences. These technologies enhance operational efficiency and safety, providing value across the aviation sector.

Singapore stands as a key player in the aviation augmented and virtual reality market due to its strong aviation infrastructure, government initiatives, and strategic position as a global aviation hub. Major cities like Singapore attract international investment and collaborate with global tech firms, making it a leader in aviation technology innovation. The country’s regulatory support, alongside a thriving aerospace ecosystem, further bolsters its dominance in the market.

Market Segmentation

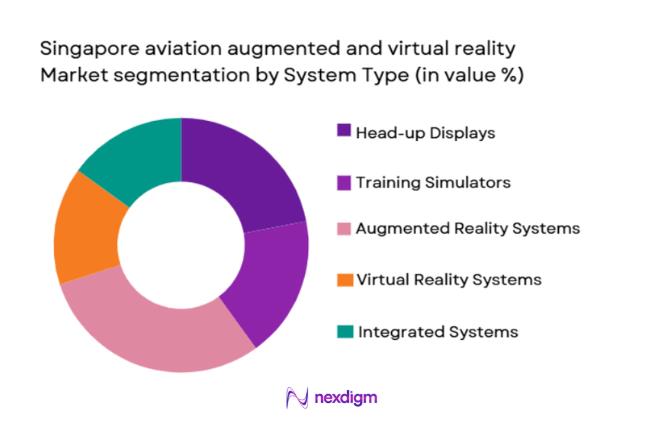

By System Type:

The Singapore aviation augmented and virtual reality market is segmented by system type into head-up displays, training simulators, augmented reality systems, virtual reality systems, and integrated systems. Recently, the augmented reality systems sub-segment has a dominant market share due to factors such as enhanced operational efficiency in training programs and growing demand for immersive experiences in aircraft maintenance. The increasing integration of augmented reality into pilot and crew training systems is making it a preferred solution for various aviation operators. Furthermore, augmented reality systems’ ability to provide real-time data overlays during operations further enhances their demand in the aviation sector.

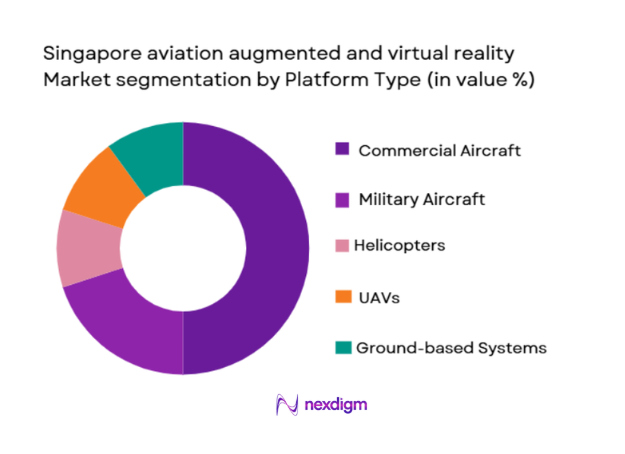

By Platform Type:

The market is segmented by platform type into commercial aircraft, military aircraft, helicopters, UAVs (unmanned aerial vehicles), and ground-based systems. Commercial aircraft dominate this market segment, driven by the increasing adoption of augmented and virtual reality technologies for pilot training, cabin crew training, and maintenance procedures. Commercial airlines prioritize safety, efficiency, and cost-effective training solutions, contributing to the growing adoption of AR and VR technologies. With the rise in commercial air traffic, the demand for such systems in commercial aviation continues to grow, especially for training and simulation purposes.

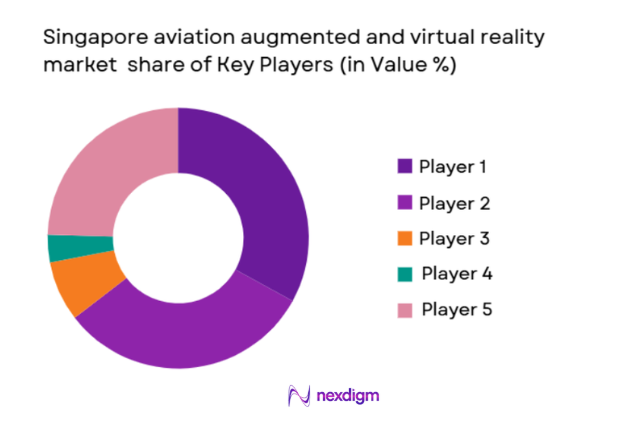

Competitive Landscape

The competitive landscape in the Singapore aviation augmented and virtual reality market is marked by the presence of several major players who are leveraging their technological expertise to expand market presence. Companies like Airbus, Boeing, and Thales Group are actively involved in integrating augmented and virtual reality technologies into their aircraft systems, while start-ups in the AR/VR space also contribute innovative solutions. As the demand for training simulators and real-time operational tools grows, these key players dominate with their strong technological portfolios and strategic partnerships, consolidating their market influence.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market-Specific Parameter |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

Singapore aviation augmented and virtual reality Market Analysis

Growth Drivers

Technological Advancements in AR/VR:

Technological advancements in augmented and virtual reality (AR/VR) are key growth drivers in the aviation sector. With rapid developments in hardware, including headsets and smart glasses, and software for immersive simulations, AR/VR solutions are becoming increasingly efficient, accurate, and cost-effective for aviation applications. In particular, these technologies enhance pilot and crew training by creating realistic, interactive simulations. This reduces training costs and enhances safety by providing high-fidelity learning environments without the need for physical aircraft or on-site training sessions. The growing popularity of AR and VR technologies in aviation, from maintenance procedures to in-flight operations, provides a significant boost to their market adoption. The continuous innovation and enhancements in AR/VR devices, such as improved resolution, user interfaces, and real-time data integration, contribute to the rise in demand within the aviation industry. Moreover, ongoing advancements in artificial intelligence (AI) and machine learning (ML) further enhance the capabilities of AR/VR technologies, enabling better data analysis, predictive maintenance, and real-time decision-making support, driving growth in the aviation augmented and virtual reality market.

Expansion of Aviation Infrastructure in Southeast Asia:

The expansion of aviation infrastructure in Southeast Asia is a significant driver of market growth. With the rapid economic growth in the region, especially in Singapore, there has been an increasing focus on upgrading and modernizing airports, airlines, and aircraft systems. As part of this development, there is a growing need for advanced technologies, such as augmented and virtual reality systems, to improve operational efficiency, enhance training programs, and increase safety protocols. The Singapore government’s ongoing investment in technology-driven infrastructure projects, including digital airports and smart aircraft systems, is accelerating the adoption of AR/VR in the aviation sector. Additionally, the increasing number of regional aviation partnerships and collaborations across Southeast Asia further supports this expansion. As more airlines and aviation operators adopt AR and VR technologies for training, safety, and operational management, the demand for these systems is expected to grow substantially, driving the overall market in the region. The rising need for enhanced operational efficiencies and safety standards within rapidly developing aviation infrastructure also fuels the market’s growth trajectory.

Market Challenges

High Cost of Implementation:

One of the main challenges in the aviation augmented and virtual reality market is the high cost of implementation. Although AR and VR technologies provide significant benefits, such as cost reduction in training and improved operational safety, the initial investment required for high-quality systems remains a barrier for many aviation operators. The infrastructure needed to implement these technologies, including hardware such as headsets, sensors, and integrated systems, is costly. Moreover, the software and applications necessary to operate these systems also require significant investment in terms of development and customization. For smaller airlines or regional carriers with limited budgets, this presents a significant hurdle to adopting AR/VR solutions. Despite the long-term benefits of enhanced training programs, maintenance solutions, and safety enhancements, the upfront costs can be prohibitive, slowing down the widespread adoption of these systems across the industry. Furthermore, the need for continuous upgrades and maintenance of AR/VR systems further adds to the cost burden, making it a challenge for aviation operators to justify the investment in these technologies.

Integration with Legacy Systems:

Another challenge facing the adoption of augmented and virtual reality systems in aviation is the complexity of integrating these technologies with existing legacy systems. Many aviation operators still rely on older equipment and software for operations, training, and maintenance, and integrating new AR/VR solutions with these legacy systems can be a complex and costly process. Compatibility issues, data transfer protocols, and system configuration challenges may arise during the integration phase, leading to delays and additional expenses. Moreover, training staff to effectively use these new systems alongside legacy equipment requires significant effort and time. While AR/VR technologies offer substantial advantages, their integration into aviation operations requires a careful, well-planned approach that ensures seamless communication between old and new technologies. The reluctance to disrupt existing workflows and the fear of operational downtime further complicate the integration process, hindering the rapid adoption of AR/VR systems in aviation.

Opportunities

Growing Demand for Immersive Training Solutions:

One of the most promising opportunities in the aviation augmented and virtual reality market is the growing demand for immersive training solutions. As aviation operators seek more cost-effective and efficient training methods, augmented and virtual reality technologies are becoming an essential tool for providing realistic, interactive learning experiences. Traditional training methods often require physical aircraft, flight simulators, or real-world training scenarios that are costly, time-consuming, and limited in scope. AR/VR technologies, on the other hand, allow for realistic simulations without the need for physical resources, enabling pilots, crew members, and maintenance staff to practice skills in a controlled, risk-free environment. The rise of immersive training solutions is particularly valuable for training complex maneuvers, emergency scenarios, and maintenance procedures, which would otherwise be difficult to replicate. Furthermore, AR/VR training systems offer a scalable solution for global aviation operators, allowing for consistent training standards across multiple locations. With the increasing recognition of the benefits of immersive learning, the demand for AR/VR training solutions in aviation is expected to rise, presenting a substantial opportunity for growth in the market.

Expanding Use of Augmented Reality in Aircraft Maintenance:

The expanding use of augmented reality in aircraft maintenance presents another significant opportunity for the market. Augmented reality systems can provide real-time, on-site guidance to maintenance technicians, overlaying critical data, repair instructions, and safety protocols directly onto the equipment being serviced. This improves the efficiency and accuracy of maintenance tasks while reducing the likelihood of human error. AR technologies also enable remote assistance, allowing experts to provide live guidance to technicians in the field, even in remote locations. The demand for more efficient maintenance solutions, particularly in the face of increasing air traffic and the growing complexity of modern aircraft, further drives the need for augmented reality systems. Additionally, as airlines and maintenance service providers strive to reduce operational downtime and enhance aircraft reliability, AR technologies are becoming an integral tool for predictive maintenance and troubleshooting. The expanding use of augmented reality for aircraft maintenance offers a substantial growth opportunity for the aviation AR/VR market, as it helps streamline operations and improve overall fleet efficiency.

Future Outlook

The future outlook for the Singapore aviation augmented and virtual reality market is positive, with strong growth expected over the next five years. As technological advancements continue to drive innovation, there will be increasing demand for AR and VR systems in training, maintenance, and safety applications. Regulatory support for the adoption of immersive technologies will further propel market growth, especially in aviation hubs like Singapore, which are investing heavily in advanced technologies. Demand-side factors, including the need for more efficient, cost-effective training solutions and improved operational safety, will also play a pivotal role in shaping the market’s future trajectory.

Major Players

- Airbus

- Boeing

- Thales Group

- Collins Aerospace

- Lockheed Martin

- Raytheon Technologies

- Honeywell

- General Electric

- L3 Technologies

- Indra Sistemas

- Rockwell Collins

- Elbit Systems

- BAE Systems

- Northrop Grumman

- CAE

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines and aviation operators

- Aircraft manufacturers

- Airport operators

- Aviation training and simulation providers

- MRO service providers

- Technology integrators

Research Methodology

Step 1: Identification of Key Variables

The key variables driving the market were identified, including technological advancements, demand patterns, regulatory frameworks, and key application areas such as training and maintenance.

Step 2: Market Analysis and Construction

A detailed market analysis was conducted, focusing on key trends, competitive landscape, and market drivers and challenges.

Step 3: Hypothesis Validation and Expert Consultation

Experts in the field of aviation and augmented reality technologies were consulted to validate hypotheses and ensure the accuracy of market projections.

Step 4: Research Synthesis and Final Output

Findings were synthesized into the final report, combining primary and secondary data, expert insights, and market forecasts to provide a comprehensive overview.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for pilot training and simulation systems

Adoption of augmented reality for aircraft maintenance

Rising investment in next-generation aviation technologies

Technological advancements in head-up displays and VR systems

Expansion of aviation infrastructure in Asia Pacific - Market Challenges

High cost of augmented and virtual reality systems

Regulatory hurdles in aviation technology adoption

Integration complexity with legacy systems

Lack of standardization in augmented reality systems

Technological limitations of current VR and AR hardware - Market Opportunities

Growing demand for immersive training environments

Emerging markets in Southeast Asia for aviation technologies

Adoption of AR for in-flight entertainment systems - Trends

Rising use of augmented reality for airport navigation

Technological convergence between aviation and gaming industries

Shift towards remote training and maintenance solutions

Increased focus on data visualization and real-time analytics

Development of next-gen AR glasses for aviation applications - Government Regulations & Defense Policy

Regulations for augmented reality use in commercial aircraft

Government support for technological advancements in aviation

National security concerns driving AR adoption in defense aviation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Head-Up Displays

Training Simulators

Augmented Reality Systems

Virtual Reality Systems

Integrated Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Helicopters

UAVs (Unmanned Aerial Vehicles)

Ground-Based Systems - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Hybrid Fitment

Modular Fitment

Custom Fitment - By EndUser Segment (In Value%)

Airlines

Defense Contractors

Airport Operators

Aircraft Manufacturers

MRO (Maintenance, Repair, and Overhaul) Service Providers - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Authorized Distributors

Third-party Online Retailers

Government and Defense Procurement

Airport Infrastructure Development - By Material / Technology (In Value%)

OLED Displays

Transparent Conductive Materials

Mixed Reality Glasses

Sensor Technology

Battery Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Price, Performance, Integration, Support, Scalability, Technology, Innovation, User Experience, Regulatory Compliance)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Boeing

Lockheed Martin

Airbus

Thales Group

Honeywell

Collins Aerospace

L3 Technologies

Indra Sistemas

Elbit Systems

Augmented Reality Systems Inc.

Walmart Technologies

Microsoft

Apple

Vuzix Corporation

Magic Leap

- Increased adoption of AR/VR in pilot and crew training programs

- Demand for enhanced aircraft maintenance procedures

- Growth of AR/VR-based in-flight entertainment systems

- Increase in government contracts for military aviation AR/VR systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035

- By System Type (In Value%)

Head-Up Displays

Training Simulators

Augmented Reality Systems

Virtual Reality Systems

Integrated Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Helicopters

UAVs (Unmanned Aerial Vehicles)

Ground-Based Systems - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Hybrid Fitment

Modular Fitment

Custom Fitment - By EndUser Segment (In Value%)

Airlines

Defense Contractors

Airport Operators

Aircraft Manufacturers

MRO (Maintenance, Repair, and Overhaul) Service Providers - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Authorized Distributors

Third-party Online Retailers

Government and Defense Procurement

Airport Infrastructure Development - By Material / Technology (In Value%)

OLED Displays

Transparent Conductive Materials

Mixed Reality Glasses

Sensor Technology

Battery Technologies