Market Overview

Based on a recent historical assessment, the aviation crew management systems market was valued at USD ~billion, supported by verified industry research sources. This market size reflects strong demand driven by airline digital transformation programs, rising operational complexity, and increasing regulatory scrutiny on crew scheduling, duty time limitations, and fatigue risk management. Airlines are adopting integrated crew management platforms to reduce operational disruptions, improve cost efficiency, and enhance crew productivity. Growing air traffic volumes and network expansion have further reinforced sustained investments in advanced crew planning and optimization software solutions.

Based on a recent historical assessment, the market is dominated by advanced aviation hubs with mature airline ecosystems and strong digital aviation infrastructure. Singapore plays a central role due to its position as a global aviation hub, high airline density, and strong regulatory enforcement by civil aviation authorities. The presence of leading full-service and regional carriers, combined with advanced airport infrastructure and strong technology adoption culture, reinforces dominance. Other influential regions include North America and Western Europe, where large airline fleets, complex crew networks, and early adoption of digital aviation systems continue to sustain leadership.

Market Segmentation

By Product Type

Singapore aviation crew management systems market is segmented by product type into crew scheduling and rostering systems, crew tracking and duty time management systems, fatigue risk management systems, crew communication platforms, and compliance and reporting systems. Recently, crew scheduling and rostering systems have a dominant market share due to their direct impact on operational efficiency, cost control, and regulatory compliance. Airlines prioritize these systems because they automate complex scheduling processes, reduce manual errors, and optimize crew utilization across large route networks. Strong integration with flight planning and maintenance systems further enhances their value, while continuous upgrades driven by regulatory requirements sustain high adoption.

By End User

Singapore aviation crew management systems market is segmented by end user into full-service airlines, low-cost carriers, charter and ACMI operators, business aviation operators, and helicopter operators. Recently, full-service airlines have a dominant market share due to their large fleet sizes, complex crew structures, and stringent regulatory obligations. These airlines operate extensive international networks requiring advanced scheduling, compliance monitoring, and fatigue management capabilities. High investment capacity, long-term digital transformation strategies, and integration with enterprise airline IT ecosystems further strengthen adoption, making full-service airlines the most influential end-user segment in this market.

Competitive Landscape

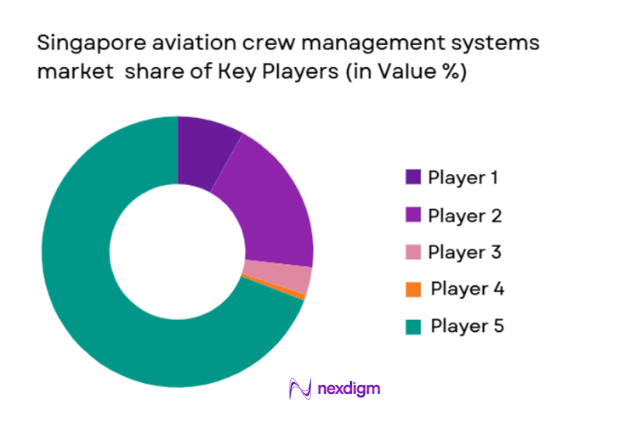

The competitive landscape of the Singapore aviation crew management systems market is moderately consolidated, with global aviation IT providers exerting strong influence through long-term airline contracts and integrated software ecosystems. Major players compete on system reliability, regulatory compliance capabilities, and integration depth with broader airline operations platforms. Strategic partnerships, recurring software upgrades, and SaaS-based delivery models reinforce market positioning and create high switching costs for airline customers.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Deployment Model |

| Sabre Corporation | 1960 | United States | ~ | ~ | ~ | ~ | ~ |

| Amadeus IT Group | 1987 | Spain | ~ | ~ | ~ | ~ | ~ |

| Lufthansa Systems | 1995 | Germany | ~ | ~ | ~ | ~ | ~ |

| IBS Software | 1997 | India | ~ | ~ | ~ | ~ | ~ |

| Jeppesen (Boeing) | 1934 | United States | ~ | ~ | ~ | ~ | ~ |

Singapore aviation crew management systems Market Analysis

Growth Drivers

Digital transformation of airline operations and regulatory compliance automation:

Digital transformation of airline operations and regulatory compliance automation is a critical growth driver as airlines increasingly rely on integrated digital platforms to manage complex crew operations efficiently. Advanced crew management systems automate scheduling, duty time monitoring, and compliance reporting, reducing operational risks and penalties. Airlines operating dense and international networks face constant regulatory oversight, driving adoption of automated compliance tools. Integration with flight operations and maintenance planning enhances operational visibility. Real-time analytics improves disruption management. Cloud deployment enables scalability. Regulatory harmonization increases standardization needs. Cost optimization pressures reinforce investment decisions. Long-term efficiency gains justify sustained adoption.

Rising air traffic complexity and workforce optimization requirements:

Rising air traffic complexity and workforce optimization requirements drive airlines to deploy advanced crew management systems capable of handling dynamic operational conditions. Expanding route networks, increased flight frequencies, and diverse aircraft types create scheduling challenges. Crew shortages and aging workforce trends intensify the need for optimized utilization. Automation reduces reliance on manual planning. Predictive analytics supports proactive disruption mitigation. Integration with mobile platforms enhances crew communication. Airlines seek systems that balance cost efficiency with crew welfare. These operational realities sustain strong demand across hub-centric aviation markets.

Market Challenges

High system integration complexity with legacy airline IT infrastructure:

High system integration complexity with legacy airline IT infrastructure remains a major challenge for market adoption. Many airlines operate fragmented IT environments developed over decades. Integrating modern crew management platforms requires extensive customization. Data migration risks disrupt operations. Interoperability challenges increase implementation timelines. High upfront costs strain budgets. Change management demands extensive training. Resistance from operational staff slows adoption. Cybersecurity compliance adds complexity. These factors collectively hinder rapid deployment despite clear operational benefits.

Data security and regulatory compliance risks in cloud-based deployments:

Data security and regulatory compliance risks in cloud-based deployments challenge market growth as crew data includes sensitive personal and operational information. Airlines must comply with strict data protection regulations. Cross-border data hosting raises legal concerns. Cyber threats increase operational risk exposure. Compliance audits demand robust security frameworks. Vendor accountability becomes critical. Any breach damages airline reputation. Regulatory uncertainty slows cloud migration. Balancing scalability with security remains a persistent obstacle for widespread adoption.

Opportunities

Adoption of artificial intelligence-driven predictive crew optimization:

Adoption of artificial intelligence-driven predictive crew optimization presents a significant opportunity as airlines seek proactive decision-making capabilities. AI algorithms analyze historical and real-time data. Predictive scheduling reduces disruptions. Machine learning improves crew utilization efficiency. Automated scenario planning enhances resilience. Integration with weather and ATC data strengthens accuracy. Airlines gain cost savings through reduced delays. Improved crew satisfaction supports retention. Continuous learning models improve over time. These benefits create strong incentives for next-generation system adoption.

Expansion of SaaS-based crew management platforms among regional carriers:

Expansion of SaaS-based crew management platforms among regional carriers offers strong growth potential due to lower entry barriers and flexible pricing models. Subscription-based solutions reduce capital expenditure. Cloud platforms enable rapid deployment. Smaller operators gain access to advanced tools. Standardized compliance features simplify regulatory adherence. Mobile access improves crew engagement. Vendors benefit from recurring revenues. Regional aviation growth supports adoption. Scalability aligns with fleet expansion strategies.

Future Outlook

Over the next five years, the market is expected to experience steady growth supported by increasing digitalization of airline operations, wider adoption of AI-driven optimization tools, and supportive regulatory frameworks. Demand will be reinforced by rising operational complexity, workforce optimization needs, and cloud-based deployment models. Technological advancements in analytics, mobility, and system integration will further enhance value propositions. Regulatory emphasis on crew welfare and compliance will continue to stimulate sustained investments.

Major Players

- Sabre Corporation

- Amadeus IT Group

- Lufthansa Systems

- IBS Software

- Jeppesen (Boeing)

- SITA

- CAE

- Thales Group

- AIMS International

- NAVBLUE

- Ramco Systems

- Hexaware Aviation

- Aviolinx

- Leon Software

- The Weather Company Aviation

Key Target Audience

- Airlines and airline groups

- Aviation IT vendors

- Airport operators

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft leasing companies

- Aviation operations managers

- Defense aviation operators

Research Methodology

Step 1: Identification of Key Variables

Key operational, regulatory, technological, and financial variables influencing aviation crew management systems were identified through secondary research and industry databases.

Step 2: Market Analysis and Construction

Data was analyzed to structure market segmentation, competitive dynamics, and adoption patterns using validated analytical frameworks.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and aviation professionals were consulted to validate assumptions, trends, and operational insights.

Step 4: Research Synthesis and Final Output

Findings were consolidated, cross-verified, and structured into a comprehensive market report.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of airline operations and flight frequencies in Singapore hub operations

Rising regulatory focus on crew duty time and fatigue compliance

Increasing adoption of digital airline operations management platforms

Operational cost optimization through automated crew scheduling

Integration of crew systems with flight and maintenance planning tools - Market Challenges

High implementation and integration complexity with legacy airline IT systems

Data security and compliance risks associated with cloud deployments

Customization challenges for diverse airline operating models

High initial investment for advanced optimization platforms

Change management and crew adoption resistance - Market Opportunities

Adoption of AI driven predictive crew optimization solutions

Growth in SaaS based crew management platforms among regional operators

Integration of crew management with airport and ATC digital systems - Trends

Increased use of real time crew tracking and mobile connectivity

Shift toward cloud native and subscription based deployment models

Growing use of analytics for crew productivity and utilization

Integration of fatigue risk modeling into scheduling engines

Interoperability with airline enterprise resource planning systems - Government Regulations & Defense Policy

Strengthening of civil aviation authority compliance monitoring frameworks

Data protection and cybersecurity regulations affecting aviation IT systems

Alignment with international aviation safety and crew welfare standards - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Crew Scheduling and Rostering Systems

Crew Tracking and Duty Time Management Systems

Fatigue Risk Management Systems

Crew Communication and Alert Systems

Compliance and Regulatory Management Systems - By Platform Type (In Value%)

Web Based Crew Management Platforms

Cloud Hosted Crew Management Platforms

On Premise Crew Management Platforms

Mobile Optimized Crew Management Platforms

Hybrid Deployment Crew Management Platforms - By Fitment Type (In Value%)

Line Fit Crew Management Solutions

Retrofit Crew Management Solutions

Modular Upgrade Fitment Solutions

Integrated Airline IT Suite Fitment

Standalone Crew Management Fitment - By EndUser Segment (In Value%)

Full Service Airlines

Low Cost Carriers

Charter and ACMI Operators

Business Aviation Operators

Helicopter and Regional Operators - By Procurement Channel (In Value%)

Direct Vendor Contracts

System Integrator Led Procurement

Airline Group Framework Agreements

Government and Authority Led Procurement

Software as a Service Subscriptions - By Material / Technology (in Value %)

Artificial Intelligence Based Optimization

Rule Based Scheduling Algorithms

Cloud Computing Infrastructure

Mobile Application Interfaces

Data Analytics and Reporting Engines

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Functionality, Deployment Model, Integration Capability, Regulatory Compliance Coverage, Scalability, User Interface Design, Analytics Capability, Data Security Standards, Pricing Model)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Sabre Corporation

Amadeus IT Group

Jeppesen Boeing

Lufthansa Systems

IBS Software

AIMS International

Hexaware Aviation Solutions

NAVBLUE

Ramco Systems

The Weather Company Aviation

Aviolinx

SITA

CAE

Thales Group

Leon Software

- Airlines prioritize operational reliability and regulatory compliance

- Crew management efficiency directly impacts on time performance

- End users demand high system configurability and scalability

- Strong preference for systems supporting mobile crew interfaces

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035