Market Overview

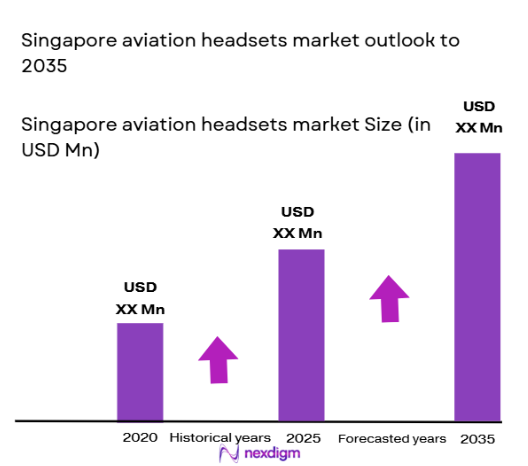

Based on a recent historical assessment, the Singapore aviation headsets market was valued at USD ~ million, supported by strong procurement activity across commercial aviation, business aviation, and rotary-wing operations. Demand is driven by continuous pilot fleet expansion, mandatory cockpit communication compliance requirements, and replacement cycles for active noise reduction and passive headsets. Procurement by flight training academies and MRO-linked distribution channels further contributes to sustained demand, with certified aviation-grade audio equipment remaining a critical operational safety requirement under civil aviation regulations.

Based on a recent historical assessment, Singapore dominates regional aviation headset demand due to its position as a global aviation hub, supported by Changi Airport, Seletar Aerospace Park, and a dense concentration of airlines, MRO facilities, and flight training organizations. Strong regulatory oversight by national aviation authorities, high aircraft movement density, and the presence of business jet and helicopter operators reinforce sustained demand. Regional spillover demand from Southeast Asian operators sourcing through Singapore further strengthens its role as a centralized procurement and distribution market.

Market Segmentation

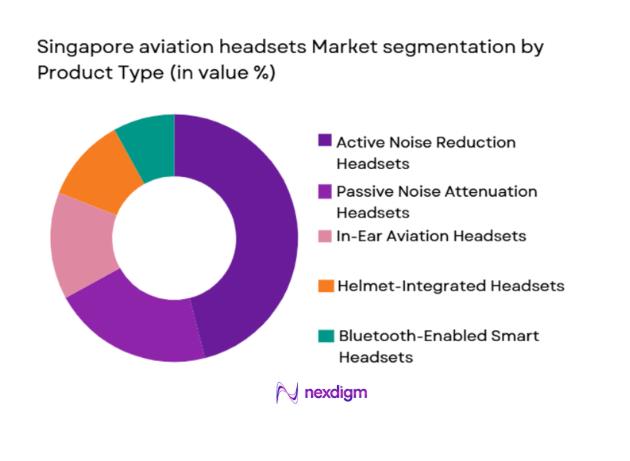

By Product Type

Singapore aviation headsets market is segmented by product type into active noise reduction headsets, passive noise attenuation headsets, in-ear aviation headsets, helmet-integrated headsets, and Bluetooth-enabled smart headsets. Recently, active noise reduction headsets have a dominant market share due to their superior ability to reduce cockpit noise levels, improving pilot concentration and reducing fatigue during long-haul and high-frequency flight operations. Airlines and business aviation operators increasingly mandate ANR headsets to meet safety management system standards and crew comfort expectations. Technological improvements in digital signal processing, lighter materials, and longer battery life have enhanced adoption across both fixed-wing and rotary platforms. Additionally, flight training organizations prefer ANR systems to improve communication clarity for trainee pilots operating in congested airspace. High compatibility with modern avionics and intercom systems further reinforces the dominance of ANR headsets across Singapore’s technologically advanced aviation ecosystem.

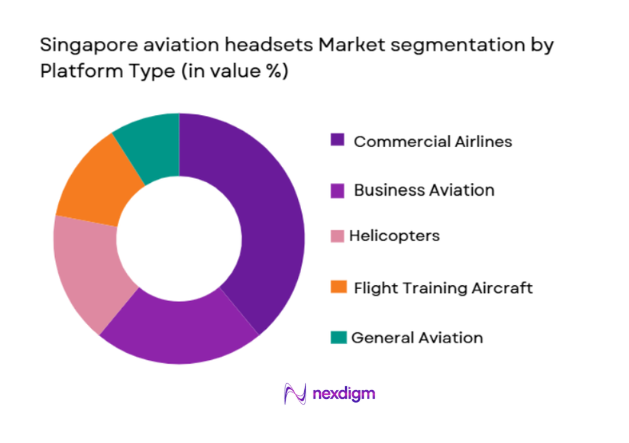

By Platform Type

Singapore aviation headsets market is segmented by platform type into commercial airlines, business aviation, helicopters, flight training aircraft, and general aviation. Recently, commercial airlines have dominated market share due to high pilot headcount, standardized equipment policies, and frequent replacement cycles driven by intensive utilization. Singapore-based and regional carriers operate high-frequency short- and medium-haul routes, accelerating wear and tear on cockpit equipment. Regulatory emphasis on standardized communication equipment across fleets also supports bulk procurement contracts with headset manufacturers. Furthermore, airline-driven demand benefits from centralized procurement and long-term maintenance agreements through MRO providers. The presence of multiple international carriers operating from Singapore further increases aggregate demand for airline-grade headsets, reinforcing the dominance of this platform segment.

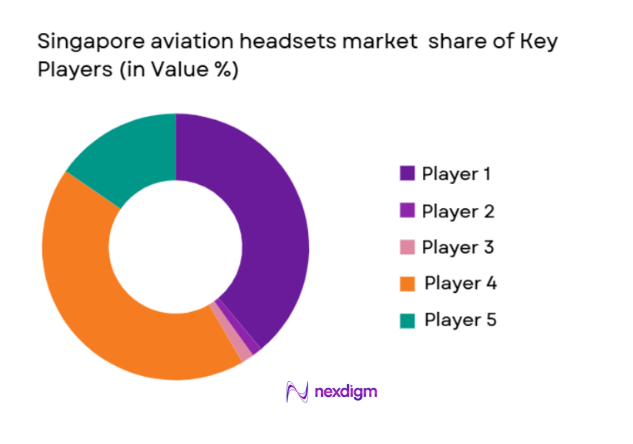

Competitive Landscape

The Singapore aviation headsets market is moderately consolidated, with a small group of global manufacturers holding strong brand recognition and long-term relationships with airlines, training academies, and MRO providers. Major players benefit from established certification portfolios, distributor networks, and aftermarket support capabilities. Competitive intensity is shaped by technology differentiation in noise reduction, comfort, and connectivity, while smaller players compete through niche offerings and pricing strategies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary End-Use Focus |

| Bose Aviation | 1964 | United States | ~ | ~ | ~ | ~ | ~ |

| Lightspeed Aviation | 1996 | United States | ~ | ~ | ~ | ~ | ~ |

| David Clark Company | 1935 | United States | ~ | ~ | ~ | ~ | ~ |

| Sennheiser Aviation | 1945 | Germany | ~ | ~ | ~ | ~ | ~ |

| Telex Communications | 1936 | United States | ~ | ~ | ~ | ~ | ~ |

Singapore Aviation Headsets Market Analysis

Growth Drivers

Fleet Expansion and Pilot Workforce Growth:

Fleet expansion and pilot workforce growth continues to significantly drive demand within the Singapore aviation headsets market as airlines, charter operators, and training organizations scale operations to meet rising regional air traffic. Singapore-based carriers consistently induct new aircraft across narrowbody, widebody, and business aviation categories, each requiring certified cockpit communication equipment for flight crews. Increasing aircraft utilization rates intensify headset replacement cycles due to wear, hygiene requirements, and technical obsolescence. Pilot recruitment programs by airlines and training academies directly translate into higher procurement volumes for entry-level and professional-grade headsets. Regulatory requirements mandate individual crew equipment allocation, preventing shared usage and accelerating unit demand. Additionally, foreign airlines operating regional routes procure headsets locally due to logistical efficiency and certification assurance. The combination of fleet growth, crew expansion, and safety-driven equipment policies ensures sustained baseline demand. This structural driver remains resilient to short-term market fluctuations due to its operational necessity.

Technological Advancements in Noise Reduction and Connectivity:

Technological advancements in noise reduction and connectivity are reshaping purchasing preferences within the Singapore aviation headsets market by elevating performance expectations among professional users. Active noise reduction systems now incorporate advanced digital signal processing capable of adapting to variable cockpit noise profiles. Lightweight composite materials reduce head and neck strain, improving pilot comfort during extended duty cycles. Integrated Bluetooth and USB connectivity allow seamless interaction with electronic flight bags and cockpit communication systems. These features enhance operational efficiency and situational awareness, making advanced headsets a preferred investment. Airlines increasingly standardize technologically advanced models to support digital cockpit strategies. Training organizations also adopt modern headsets to align trainee experience with airline operational environments. Continuous innovation therefore sustains premium segment growth and replacement demand.

Market Challenges

Certification and Interoperability Constraints:

Certification and interoperability constraints represent a persistent challenge in the Singapore aviation headsets market due to the stringent compliance requirements imposed by aviation authorities. Headsets must meet specific technical standards for electromagnetic compatibility, audio clarity, and intercom integration across multiple aircraft types. Operators with mixed fleets face compatibility issues that limit cross-platform deployment of a single headset model. Certification delays for new technologies can slow market entry and adoption. Additionally, retrofitting advanced headsets into older aircraft may require additional approvals, increasing procurement complexity. These constraints raise operational costs and limit flexibility for both buyers and manufacturers. Smaller vendors often struggle to meet certification thresholds, reducing competitive diversity. As avionics systems evolve, maintaining interoperability remains a continuous technical and regulatory challenge.

High Cost Sensitivity in Bulk Procurement:

High cost sensitivity in bulk procurement affects purchasing decisions, particularly among airlines and training academies operating under tight operating margins. Premium ANR headsets command significantly higher prices, creating budgetary pressure when procuring equipment for large pilot cohorts. Replacement parts such as ear seals and batteries add to lifecycle costs. Training organizations with high trainee turnover prioritize durability over advanced features, limiting adoption of premium models. Currency fluctuations and import duties can further impact pricing stability. Cost pressures also encourage extended usage cycles, delaying replacement purchases. This challenge constrains revenue growth potential despite underlying demand fundamentals.

Opportunities

Aftermarket Refurbishment and Lifecycle Services:

Aftermarket refurbishment and lifecycle services present a significant opportunity in the Singapore aviation headsets market as operators seek cost-efficient asset management solutions. Refurbishment programs including ear seal replacement, microphone upgrades, and ANR module servicing extend product life while maintaining compliance. Airlines and training schools increasingly outsource headset maintenance to certified service providers. Subscription-based maintenance models can generate recurring revenue streams for manufacturers and distributors. Centralized MRO infrastructure in Singapore supports scalable service operations. Growing emphasis on hygiene and comfort further drives demand for replacement kits. This opportunity aligns with sustainability objectives by reducing equipment disposal.

Special Mission and Helicopter Segment Customization:

Special mission and helicopter segment customization offers strong growth potential due to Singapore’s offshore, emergency medical, and security aviation activities. These operations require headsets with high noise isolation, secure fitment, and compatibility with helmets and mission equipment. Customized solutions command premium pricing and face limited competition. Government and commercial operators increasingly specify mission-optimized communication equipment. Integration with night vision and tactical communication systems enhances value proposition. Singapore’s role as a regional service hub supports export opportunities for specialized headset solutions. This niche segment provides margin expansion potential beyond mainstream commercial aviation.

Future Outlook

The Singapore aviation headsets market is expected to maintain steady growth over the next five years, supported by continued fleet activity, pilot workforce expansion, and technological upgrades. Advancements in digital noise reduction, lightweight materials, and cockpit connectivity will shape product development. Regulatory emphasis on communication safety and standardization will sustain baseline demand. Growing aftermarket services and specialized mission requirements are expected to further diversify revenue streams.

Major Players

- Bose Aviation

- Lightspeed Aviation

- David Clark Company

- Sennheiser Aviation

- Telex Communications

- Pilot Communications USA

- Faro Aviation

- Clarity Aloft

- Flightcom Corporation

- Avee Aviation

- InFlight Corporation

- ASA Aviation

- Rohde and Schwarz Aviation

- ST Engineering Aerospace

- A20 Aviation

Key Target Audience

- Commercial airlines

- Business aviation operators

- Helicopter operators

- Flight training academies

- MRO service providers

- Aircraft leasing companies

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Market boundaries, product categories, platform usage, regulatory requirements, and demand drivers were identified through secondary aviation industry sources and regulatory publications.

Step 2: Market Analysis and Construction

Data was compiled from manufacturer disclosures, trade statistics, aviation authority records, and procurement patterns to construct market size and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Industry inputs from pilots, MRO specialists, and aviation procurement professionals were used to validate assumptions and refine market structure.

Step 4: Research Synthesis and Final Output

All validated data points were synthesized into a coherent market model, ensuring internal consistency and relevance to stakeholder decision-making.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising pilot training throughput and simulator to aircraft transition needs

Fleet utilization intensity in short haul operations driving wear replacement

Operational safety emphasis on clear ATC communications in dense airspace

Growth in helicopter EMS offshore and charter missions requiring high isolation

Preference for ANR and lightweight designs to reduce crew fatigue - Market Challenges

Certification and compatibility constraints across aircraft intercom standards

High procurement costs for premium ANR models in multi crew fleets

Battery management and electronics reliability issues in humid environments

Counterfeit risk and gray market imports affecting warranty and compliance

Supply lead times for spare parts ear seals and microphone assemblies - Market Opportunities

Retrofit demand for Bluetooth audio and EFB interface capable headsets

Service programs for refurbishment and hygiene kits for high utilization operators

Special mission headsets for maritime patrol law enforcement and SAR aviation - Trends

Shift from passive to ANR as a standard for professional cockpit use

Growth of in ear and lightweight models for hot climate operations

Integration of USB power and smart audio mixing for cockpit workflows

Dealer bundling of headsets with avionics upgrades and cockpit refurbishments

Rising demand for hygiene replacement kits and quick swap components - Government Regulations & Defense Policy

Civil aviation headset and avionics interoperability compliance requirements

Operator safety management systems encouraging standardization of crew equipment

Defense and homeland security procurement favoring ruggedized mission variants - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Active noise reduction headsets

Passive noise attenuation headsets

In-ear aviation headsets

Helmet integrated aviation headsets

Bluetooth enabled cockpit headsets - By Platform Type (In Value%)

Commercial airline flight deck

Business aviation and private jets

Helicopter operations

Flight training aircraft

General aviation piston and turboprop - By Fitment Type (In Value%)

OEM line fit for new aircraft

Aftermarket retrofit and replacement

Lease return and refurbishment fitment

Instructor and dual control fitment

Special mission kit fitment - By EndUser Segment (In Value%)

Airline pilots and flight crew

Flight training academies

Business aviation operators

Helicopter charter and EMS operators

MRO and service centers - By Procurement Channel (In Value%)

Direct purchase from headset manufacturers

Authorized aviation dealers and distributors

Airline and operator procurement contracts

MRO bundled procurement with maintenance

E commerce aviation specialty retailers - By Material / Technology (in Value %)

Electret and dynamic microphone systems

ANR digital signal processing modules

Gel ear seals and ergonomic headbands

Lightweight composite earcup structures

Smart audio with Bluetooth and USB interfaces

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (ANR performance, passive attenuation, weight and comfort, microphone clarity, intercom compatibility, power options, durability and warranty, availability of spares, total cost of ownership)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Bose Aviation

Lightspeed Aviation

David Clark Company

Sennheiser Aviation

Telex Communications

Pilot Communications USA

Faro Aviation

A20 Aviation

ASA Aviation Headsets

Clarity Aloft

Flightcom Corporation

Avee Aviation

InFlight Corporation

Rohde and Schwarz Aviation Communications

ST Engineering Aerospace

- Airline flight crews prioritize reliability standard intercom compatibility and fast spares access

- Flight schools focus on durability hygiene kits and high turnover replacement cycles

- Business aviation operators value premium ANR comfort and multi device connectivity

- Helicopter operators emphasize high clamp stability wind noise control and helmet compatibility

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035