Market Overview

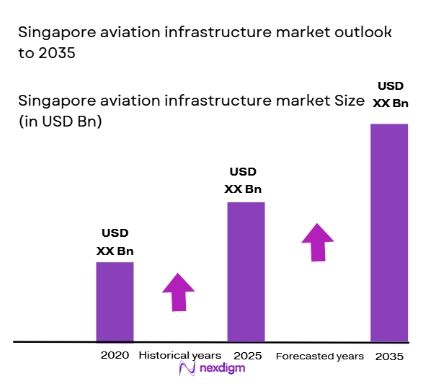

Based on a recent historical assessment, the Singapore aviation infrastructure market was valued at USD ~ billion, supported by large-scale capital expenditure programs disclosed by the Ministry of Transport, Changi Airport Group, and the Civil Aviation Authority of Singapore. The market is driven by sustained investments in terminal expansion, airside modernization, air traffic management upgrades, and aviation security systems. Strong passenger recovery, cargo throughput growth, and long-term infrastructure master plans continue to anchor spending across both civil and dual-use aviation facilities.

Based on a recent historical assessment, Singapore dominates the regional aviation infrastructure landscape due to its role as a global air transit and logistics hub. Changi Airport forms the core of this dominance, supported by integrated cargo zones, advanced air navigation facilities, and proximity to major Southeast Asian air corridors. Singapore’s leadership is reinforced by strong government coordination, regulatory clarity, and consistent funding availability. Regional influence is further strengthened by Singapore-based operators managing overseas airport assets and infrastructure projects.

Market Segmentation

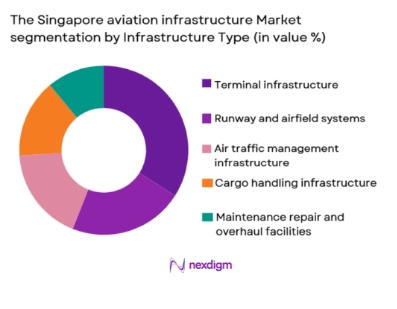

By Infrastructure Type

The Singapore aviation infrastructure market is segmented into terminal infrastructure, runway and airfield systems, air traffic management infrastructure, cargo handling infrastructure, and maintenance repair and overhaul facilities. Recently, terminal infrastructure has held a dominant market share due to sustained investments in passenger processing capacity, terminal automation, and integrated retail and transit facilities. Continuous upgrades at Changi Airport, including smart check-in, baggage handling systems, and inter-terminal connectivity, have driven higher capital allocation toward terminals. The emphasis on passenger experience, operational efficiency, and hub competitiveness has made terminal infrastructure the primary focus of aviation development programs. Strong alignment with tourism, transit traffic, and premium airline operations further reinforces the dominance of this sub-segment.

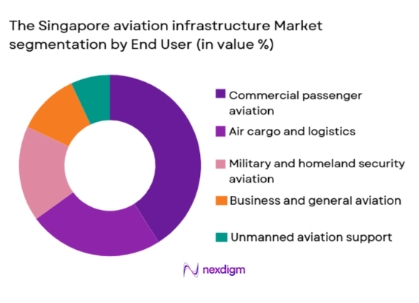

By End-Use Application

The Singapore aviation infrastructure market is segmented into commercial passenger aviation, air cargo and logistics, military and homeland security aviation, business and general aviation, and unmanned aviation support infrastructure. Recently, commercial passenger aviation has accounted for the dominant market share due to Singapore’s position as a major international transit hub and the concentration of long-haul and premium airline operations. Continuous expansion of passenger handling capacity, terminal systems, and airside support infrastructure has prioritized commercial aviation investments. The strong recovery in international travel, coupled with government-backed infrastructure resilience planning, has further elevated spending toward passenger aviation assets, reinforcing its leading position within the market.

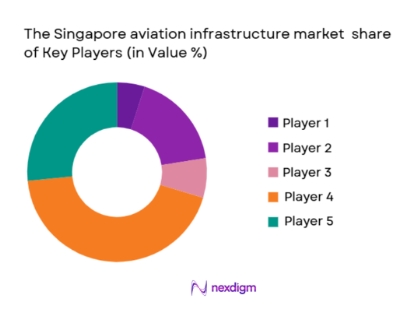

Competitive Landscape

The Singapore aviation infrastructure market is moderately consolidated, with a mix of state-linked enterprises, global aerospace technology providers, and multinational engineering firms. Major players benefit from long-term framework agreements, government partnerships, and high entry barriers created by regulatory compliance and capital intensity. Technology integration capabilities and project execution experience play a decisive role in competitive positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Core Aviation Role |

| Changi Airport Group | 2009 | Singapore | ~ | ~ | ~ | ~ | ~ |

| ST Engineering | 1967 | Singapore | ~ | ~ | ~ | ~ | ~ |

| SATS Ltd | 1972 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Thales Singapore | 1973 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Siemens Mobility Singapore | 1996 | Singapore | ~ | ~ | ~ | ~ | ~ |

Singapore Aviation Infrastructure Market Analysis

Growth Drivers

Strategic Government-Led Aviation Infrastructure Investment:

Strategic Government-Led Aviation Infrastructure Investment: continues to be a primary force shaping the Singapore aviation infrastructure market as long-term national transport strategies prioritize aviation as a critical economic enabler. Public sector commitments toward airport expansion, air navigation modernization, and security infrastructure provide predictable funding visibility for large projects. These investments are coordinated through multi-agency frameworks that align aviation growth with tourism, trade, and national resilience objectives. High fiscal discipline and centralized planning reduce execution risks and encourage private sector participation. Infrastructure programs are structured to enhance hub competitiveness while meeting future capacity requirements. Continuous reinvestment into existing assets ensures operational reliability and scalability. Government backing also accelerates adoption of advanced technologies across terminals and airside systems. This sustained policy focus underpins stable market expansion and long-term investor confidence.

Regional Hub Position and Passenger Transit Demand:

Regional Hub Position and Passenger Transit Demand: significantly accelerates infrastructure spending as Singapore remains a preferred transfer point for intercontinental travel. High volumes of connecting passengers necessitate advanced terminal layouts, efficient baggage systems, and seamless passenger flow technologies. Airlines operating long-haul and premium services drive demand for high-specification infrastructure and airside support systems. Growth in Southeast Asian travel markets further strengthens transit traffic through Singapore. Infrastructure planning is therefore demand-driven and capacity-focused. Continuous service quality expectations push ongoing upgrades. This reinforces the need for resilient, scalable aviation assets. The hub role sustains continuous infrastructure renewal cycles.

Market Challenges

Land Scarcity and Infrastructure Expansion Constraints:

Land Scarcity and Infrastructure Expansion Constraints: present a structural challenge as aviation infrastructure projects must operate within Singapore’s limited geographic footprint. Airport expansion requires extensive land optimization, reclamation, and vertical development strategies that increase complexity and cost. Balancing aviation needs with urban development priorities intensifies planning constraints. Environmental and sustainability considerations further restrict expansion options. Project timelines are often extended due to multi-layered approvals. High engineering precision is required to avoid operational disruptions. These constraints elevate capital intensity and execution risk. Long-term infrastructure planning must therefore overcome physical limitations while maintaining service continuity.

High Capital Costs and Long Payback Periods:

High Capital Costs and Long Payback Periods: affect investment decision-making as aviation infrastructure assets require substantial upfront expenditure. Returns are typically realized over extended time horizons, increasing exposure to demand volatility and external shocks. Cost escalation risks arise from advanced technology integration and specialized construction requirements. Financing structures must balance public funding with private participation. Budget overruns can strain project viability. Economic uncertainty can delay investment approvals. These financial pressures challenge efficient capital allocation. Market participants must adopt disciplined financial planning.

Opportunities

Smart Airport and Digital Infrastructure Deployment:

Smart Airport and Digital Infrastructure Deployment: offers strong growth potential as Singapore accelerates digital transformation across aviation facilities. Advanced analytics, automation, and integrated data platforms enhance operational efficiency and passenger experience. Digital twins and predictive maintenance systems reduce downtime and lifecycle costs. Biometric processing and AI-driven traffic management improve throughput. These technologies align with national smart city initiatives. Infrastructure digitization creates opportunities for technology vendors and integrators. Continuous innovation strengthens hub competitiveness. The shift toward data-centric infrastructure supports long-term market expansion.

Sustainable and Green Aviation Infrastructure Development:

Sustainable and Green Aviation Infrastructure Development: represents a significant opportunity as regulatory and environmental priorities reshape infrastructure investment. Energy-efficient terminals, sustainable materials, and renewable power integration reduce carbon impact. Green infrastructure enhances regulatory compliance and global reputation. Airlines increasingly prefer airports aligned with sustainability goals. Government incentives support adoption of low-emission technologies. Long-term operational savings justify upfront investment. This transition creates new demand segments. Sustainability becomes a differentiating infrastructure attribute.

Future Outlook

Over the next five years, the Singapore aviation infrastructure market is expected to experience steady expansion supported by continuous government investment, technology adoption, and strong regional air traffic fundamentals. Smart airport systems, sustainability initiatives, and capacity optimization will remain central to infrastructure planning. Regulatory stability and long-term transport strategies are likely to encourage private sector collaboration. Demand from passenger transit, cargo logistics, and security modernization will collectively shape future development priorities.

Major Players

- Changi Airport Group

- ST Engineering

- SATS Ltd

- Thales Singapore

- Siemens Mobility Singapore

- Honeywell Aerospace Singapore

- Collins Aerospace Singapore

- Indra Asia Pacific

- NEC Asia Pacific

- Mitsubishi Heavy Industries Asia Pacific

- L3Harris Technologies Singapore

- AECOM Singapore

- Jacobs Asia Pacific

- Balfour Beatty Asia

- Boustead Projects

Key Target Audience

- Airlines and airport operators

- Aviation infrastructure developers

- Aerospace and defense companies

- Smart infrastructure technology providers

- Logistics and cargo operators

- Investments and venture capitalist firms

- Government and regulatory bodies

- Public infrastructure financing agencies

Research Methodology

Step 1: Identification of Key Variables

Market variables were identified through analysis of aviation infrastructure investment programs, regulatory documents, and transport development plans. Key demand, supply, and policy indicators were shortlisted for assessment.

Step 2: Market Analysis and Construction

Qualitative and quantitative inputs were consolidated to structure market segmentation, competitive dynamics, and infrastructure categories relevant to Singapore’s aviation ecosystem.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert opinions, industry publications, and official disclosures to ensure alignment with current market conditions.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured market report, ensuring consistency, clarity, and relevance for strategic decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of regional air passenger and cargo traffic

Strategic positioning as a global aviation hub

Government backed airport modernization initiatives

Integration of smart airport and digital technologies

Rising focus on sustainable aviation infrastructure - Market Challenges

High capital expenditure requirements for infrastructure projects

Land scarcity and spatial constraints

Complex regulatory and compliance frameworks

Skilled workforce availability for advanced systems

Operational disruptions during upgrade activities - Market Opportunities

Development of next generation smart terminal infrastructure

Adoption of sustainable and carbon efficient airport systems

Regional aviation hub services for Southeast Asia - Trends

Automation of passenger processing and terminal operations

Deployment of artificial intelligence in air traffic management

Growth of green and energy efficient airport designs

Integration of biometric and digital identity solutions

Increased resilience planning for climate adaptation - Government Regulations & Defense Policy

Civil aviation authority infrastructure compliance standards

National aviation security and resilience frameworks

Defense airbase modernization and dual use infrastructure policies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Runway and airside infrastructure systems

Passenger terminal infrastructure systems

Air traffic management and navigation systems

Cargo and logistics handling infrastructure

Maintenance repair and overhaul infrastructure - By Platform Type (In Value%)

Commercial aviation infrastructure

Military aviation infrastructure

General aviation infrastructure

Business jet and VIP aviation facilities

Unmanned aviation support infrastructure - By Fitment Type (In Value%)

Greenfield airport infrastructure development

Brownfield airport expansion projects

Modernization and retrofit installations

Capacity optimization and automation upgrades

Sustainability and energy efficiency retrofits - By EndUser Segment (In Value%)

Airport operators and authorities

Air navigation service providers

Airlines and fleet operators

Defense and homeland security agencies

Cargo and logistics operators - By Procurement Channel (In Value%)

Government funded infrastructure programs

Public private partnership contracts

Direct procurement by airport operators

Long term concession and lease agreements

International infrastructure development tenders - By Material / Technology (in Value %)

Advanced construction materials and composites

Digital airport management platforms

Smart surveillance and security technologies

Next generation navigation and communication systems

Sustainable energy and green building technologies

- Cross Comparison Parameters (infrastructure scope, technological capability, project execution expertise, regulatory compliance strength, financial stability, sustainability integration, regional presence, partnership ecosystem, aftersales support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Changi Airports International

ST Engineering

SATS Ltd

Thales Singapore

Indra Asia Pacific

Siemens Mobility Singapore

Honeywell Aerospace Singapore

Collins Aerospace Singapore

Aviation Partnership Singapore

Mitsubishi Heavy Industries Asia Pacific

L3Harris Technologies Singapore

NEC Asia Pacific

Jacobs Asia Pacific Aviation

AECOM Singapore Aviation

Balfour Beatty Asia

- Airport authorities prioritizing capacity optimization and resilience

- Airlines seeking efficient turnaround and passenger handling facilities

- Government agencies focusing on national connectivity and security

- Logistics operators demanding high throughput cargo infrastructure

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035