Market Overview

The market size for the Singapore Aviation Maintenance Repair and Overhaul MRO Software market is driven by significant technological advancements and increasing demand for digital transformation in the aviation sector. Based on a recent historical assessment, the market for aviation MRO software in Singapore is valued at USD ~ billion. The market is primarily propelled by the rising fleet size, a growing need for operational efficiency, and cost optimization. The demand for cloud-based solutions and predictive maintenance tools further supports this market’s growth, along with the expansion of aviation infrastructure across the region.

Singapore’s dominance in the aviation MRO software market is attributed to its strategic location as a global aviation hub. The country’s advanced infrastructure, such as Changi Airport, combined with its technological advancements, positions it as a leader in aviation services. The aviation sector in Singapore is bolstered by government initiatives supporting digitalization and the adoption of smart technologies, making it a favorable environment for MRO software solutions. Singapore’s role as a regional aviation center continues to make it a dominant player in the market.

Market Segmentation

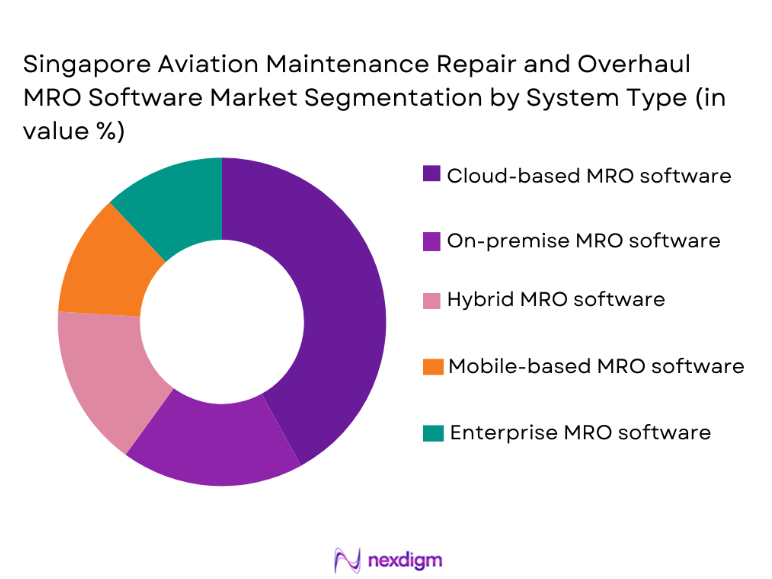

By System Type

The Singapore Aviation Maintenance Repair and Overhaul MRO Software market is segmented by system type into cloud-based MRO software, on-premise MRO software, hybrid MRO software, mobile-based MRO software, and enterprise MRO software. Recently, cloud-based MRO software has a dominant market share due to factors such as the increasing preference for scalable and flexible solutions, the cost-efficiency of cloud infrastructure, and the rising need for real-time data analytics in aviation maintenance. Cloud-based MRO solutions are also seen as an effective way to reduce downtime, streamline maintenance schedules, and improve the efficiency of fleet management, which is driving their popularity in the market.

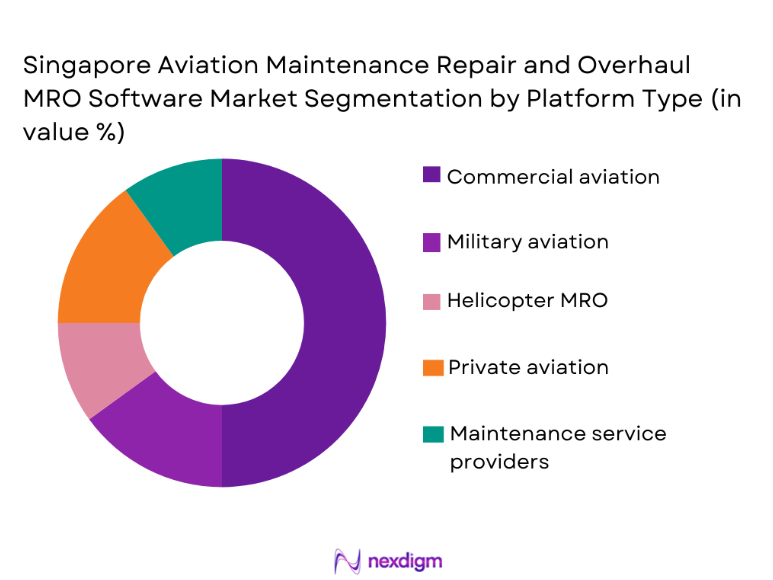

By Platform Type

The Singapore Aviation Maintenance Repair and Overhaul MRO Software market is segmented by platform type into commercial aviation, military aviation, helicopter MRO, private aviation, and maintenance service providers. The commercial aviation platform dominates the market share due to the large fleet size and continuous demand for efficient maintenance operations. Airlines and commercial aviation operators in Singapore increasingly seek MRO software solutions to manage their expansive fleets, optimize maintenance operations, and reduce downtime. This segment’s growth is fueled by both the growing complexity of aircraft and the increasing need for real-time maintenance tracking, making it the dominant segment in the market.

Competitive Landscape

The competitive landscape of the Singapore Aviation MRO Software market is highly consolidated, with key players influencing the market through technological innovations and strategic partnerships. Major players, such as IBM, SAP, and Oracle, dominate the market with their comprehensive software solutions, including cloud-based platforms and predictive analytics tools. These companies continue to innovate and collaborate with regional airlines and MRO service providers to capture the growing demand for digital MRO solutions. This competitive environment is characterized by the presence of both large-scale global technology firms and niche providers offering specialized solutions to cater to specific aviation needs.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Product Innovation |

| IBM Corporation | 1911 | USA | ~ | ~ | ~ | ~ | ~ |

| SAP SE | 1972 | Germany | ~ | ~ | ~ | ~ | ~ |

| Oracle Corporation | 1977 | USA | ~ | ~ | ~ | ~ | ~ |

| GE Aviation | 1892 | USA | ~ | ~ | ~ | ~ | ~ |

| Ramco Systems | 1992 | India | ~ | ~ | ~ | ~ | ~ |

Singapore Aviation MRO Software Market Analysis

Growth Drivers

Increasing demand for operational efficiency

The increasing pressure on aviation companies to enhance operational efficiency is a significant driver of the Singapore Aviation MRO Software market. As airlines and MRO service providers are focused on reducing costs while improving the reliability and safety of their operations, the adoption of MRO software solutions has become essential. The growing complexity of modern aircraft and the need for real-time monitoring have further amplified this demand, as MRO software allows for streamlined maintenance schedules and predictive maintenance capabilities, reducing downtime and ensuring optimal fleet performance. Additionally, the integration of technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) with MRO software offers unprecedented insights into fleet performance, enabling airlines to address potential issues before they lead to costly delays or repairs. The ability to monitor and manage aircraft health through predictive analytics is accelerating the adoption of MRO software, especially in fast-growing aviation markets such as Singapore, where the aviation sector is witnessing significant growth.

Government support for digital transformation

Government initiatives in Singapore play a crucial role in accelerating the digital transformation of the aviation sector, which is a key growth driver for the MRO software market. The Singaporean government has been actively promoting smart technologies, such as AI, machine learning, and cloud computing, in the aviation industry to improve safety, reduce costs, and enhance operational efficiency. These initiatives, coupled with funding support for digital infrastructure, create a favorable environment for the adoption of advanced MRO software solutions. The government’s commitment to supporting the growth of the aviation sector, combined with its focus on smart airport initiatives, has positioned Singapore as a leader in aviation services. This regulatory push is driving the adoption of advanced MRO software solutions among local and regional aviation operators, contributing to the expansion of the MRO software market in the country.

Market Challenges

High upfront cost of MRO software

The high initial investment required for implementing MRO software remains a significant challenge for many companies in the aviation sector. While the long-term benefits of MRO software, such as improved efficiency, reduced downtime, and enhanced maintenance scheduling, are evident, the upfront cost of these solutions can be prohibitive, particularly for smaller operators or those with limited budgets. Additionally, the complexity of integrating MRO software with existing legacy systems further increases the overall implementation costs, making it challenging for some organizations to adopt these advanced solutions. In Singapore, while the aviation sector is relatively advanced, the cost barrier remains a concern for mid-sized MRO providers that may not have the capital to invest in comprehensive software solutions. This challenge may result in slower adoption rates, particularly among smaller players in the market.

Integration with legacy systems

Many companies in the aviation sector continue to rely on outdated legacy systems for their MRO operations. The integration of modern MRO software with these legacy systems can be a complex and time-consuming process. The challenge lies in ensuring compatibility between new MRO software solutions and older systems, which may not support the latest cloud-based technologies or data-sharing protocols. This issue is particularly pronounced in established companies that have been using their legacy systems for decades. In Singapore, where the aviation industry is highly developed, several key players face the challenge of migrating from traditional systems to modern MRO software without disrupting daily operations. The lack of seamless integration capabilities and the potential for operational downtime during the transition are major barriers that must be addressed for the widespread adoption of MRO software.

Opportunities

Adoption of AI and machine learning in MRO software

One of the key opportunities in the Singapore Aviation MRO Software market is the integration of Artificial Intelligence (AI) and machine learning technologies into MRO systems. These technologies have the potential to significantly enhance the predictive capabilities of MRO software by analyzing vast amounts of data from aircraft systems, sensors, and historical maintenance records. By utilizing AI and machine learning algorithms, airlines and MRO providers can predict component failures, optimize maintenance schedules, and reduce unplanned downtime. The ability to foresee maintenance needs before they arise not only minimizes operational disruptions but also helps in extending the lifespan of critical components. This advanced capability is poised to revolutionize the aviation MRO landscape, making AI-powered MRO software solutions highly sought after in the market. As Singapore continues to embrace digital transformation, the adoption of AI-driven MRO software presents a significant growth opportunity for both local and international vendors.

Expansion of aircraft fleets in emerging economies

The expansion of aircraft fleets in emerging economies presents a major opportunity for the Singapore Aviation MRO Software market. As airlines in Southeast Asia and other emerging markets invest in expanding their fleets to meet the growing demand for air travel, the need for efficient and effective MRO services becomes more critical. Singapore, with its strategic position as a regional aviation hub, is well-positioned to cater to this growing demand. The availability of advanced MRO software solutions in Singapore, coupled with the expertise of local MRO providers, positions the country as a key player in the maintenance of aircraft fleets across the region. As fleet operators seek to optimize their maintenance operations and reduce costs, the demand for advanced MRO software that integrates predictive maintenance, real-time monitoring, and cloud-based data analytics is expected to rise significantly, creating lucrative opportunities for market players.

Future Outlook

The future of the Singapore Aviation Maintenance Repair and Overhaul MRO Software market is optimistic, with continued growth expected in the coming years. Technological advancements such as AI, machine learning, and IoT integration will drive the demand for more sophisticated MRO solutions, offering predictive capabilities that reduce downtime and optimize fleet management. Additionally, the ongoing regulatory support for digital transformation in aviation, particularly in Singapore, will encourage further adoption of cloud-based MRO systems. As the aviation sector continues to expand, both locally and regionally, the need for efficient and cost-effective MRO operations will further fuel the demand for advanced MRO software solutions. In the coming years, MRO software vendors can expect continued growth, driven by the expansion of aircraft fleets, increasing operational efficiency demands, and government support for digital innovation.

Major Players

- IBM Corporation

- SAP SE

- Oracle Corporation

- GE Aviation

- Ramco Systems

- Honeywell Aerospace

- Rockwell Collins

- Lufthansa Technik AG

- InnoVairSolutions

- Aviatar

- UltramainSystems

- ComponentControl

- SITA

- Quantum Dynamics

- Infotech Enterprises

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines

- MRO service providers

- Aviation OEMs

- Fleet operators

- Airport authorities

- Private aviation companies

Research Methodology

Step 1: Identification of Key Variables

Key variables, such as market size, growth drivers, challenges, and customer preferences, are identified based on primary and secondary research.

Step 2: Market Analysis and Construction

Market analysis is conducted by studying historical data, trends, and technological advancements in MRO software, followed by the construction of a detailed market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through consultations with industry experts, MRO software vendors, and aviation operators to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

Data is synthesized and analyzed to create a comprehensive report, focusing on actionable insights, market segmentation, and future opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for automation in MRO processes

Government support for digitalization in aviation

Rising fleet size and aircraft complexity

Cost optimization through cloud-based software

Technological advancements in predictive maintenance - Market Challenges

High upfront cost of MRO software

Integration issues with legacy systems

Data privacy and security concerns

Complexity in training personnel

Lack of skilled professionals - Market Opportunities

Adoption of AI and machine learning in MRO software

Expansion of aircraft fleets in emerging economies

Integration of IoT for real-time monitoring - Trends

Shift towards cloud-based MRO solutions

Growth of mobile and remote MRO services

Increased adoption of predictive maintenance tools

Focus on cybersecurity in aviation software

Rising demand for data-driven decision-making tools - Government Regulations & Defense Policy

Aviation safety regulations

Regulations on software data storage

Government initiatives for digital transformation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Cloud-based MRO software

On-premise MRO software

Hybrid MRO software

Mobile-based MRO software

Enterprise MRO software - By Platform Type (In Value%)

Commercial aviation

Military aviation

Helicopter MRO

Private aviation

Maintenance service providers - By Fitment Type (In Value%)

OEM MRO software

Aftermarket MRO software

Integrated MRO software

Custom MRO software

Cloud-based MRO solutions - By EndUser Segment (In Value%)

Airlines

MRO service providers

Aviation OEMs

Private fleet operators

Military aviation agencies - By Procurement Channel (In Value%)

Direct purchase from software vendors

Third-party platform providers

Cloud-based subscription services

OEM partnerships

Channel distribution networks - By Material / Technology (In Value%)

Cloud computing technology

Big data analytics

IoT integration

Artificial Intelligence

Augmented Reality

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Price, System Compatibility, Support Services, Deployment Time, Integration Flexibility, Customer Base, Maintenance Services, Customization, Data Security, Scalability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

IBM Corporation

SAP SE

GE Aviation

Dassault Systèmes

IFS AB

Ramco Systems

Honeywell Aerospace

Oracle Corporation

Ultramain Systems

Component Control

Quantum Dynamics

InnoVair Solutions

Aviatar

SITA

Lufthansa Technik AG

- Increased demand for operational efficiency in airlines

- Strong preference for cloud-based MRO software

- Shift towards preventive maintenance among aviation operators

- Preference for integrated solutions over standalone software

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035