Market Overview

Based on a recent historical assessment, the Singapore Aviation Software Market is valued at USD ~ billion. The market is primarily driven by the rising adoption of digital technologies within the aviation sector, such as cloud computing, AI, and data analytics. These innovations streamline operations, enhance efficiency, and improve safety, which has led to the widespread deployment of aviation software solutions across various aviation sub-sectors, including airlines, airports, and military aviation. The rapid modernization and digital transformation of aviation infrastructure have also contributed significantly to the growth of this market.

The dominance of the Singapore Aviation Software Market can be attributed to Singapore’s strategic position as a global aviation hub. The country is home to Changi Airport, one of the busiest and most advanced airports globally, which continually adopts cutting-edge aviation software to optimize operations. Additionally, Singapore’s government initiatives to support technological advancements and smart airport development have spurred growth in this sector. Furthermore, the presence of key players and a well-established aerospace ecosystem makes Singapore a prime location for the continued expansion of aviation software solutions.

Market Segmentation

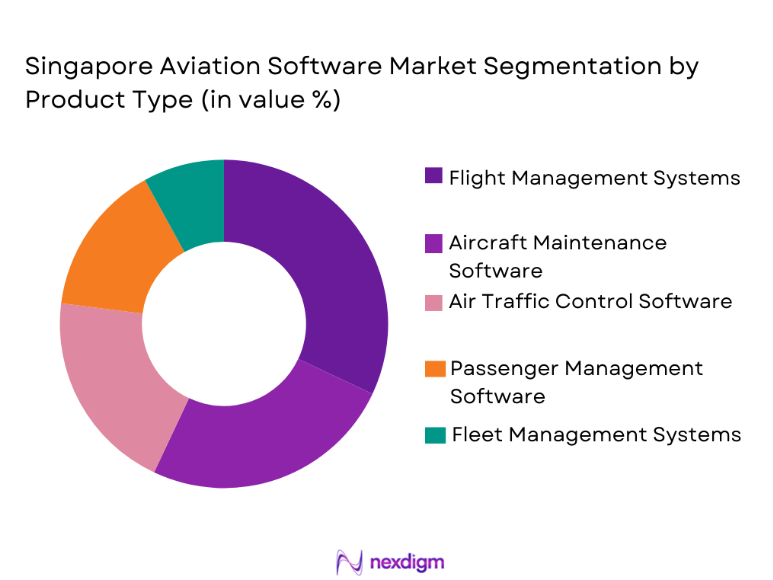

By Product Type

The Singapore Aviation Software Market is segmented by product type into flight management systems, aircraft maintenance software, air traffic control software, passenger management software, and fleet management systems. Recently, the flight management systems sub-segment has a dominant market share due to factors such as increasing air traffic, the need for real-time operational efficiency, and enhanced safety protocols. Flight management systems are critical for optimizing flight routes, managing air traffic, and ensuring smooth operations, especially as international air travel continues to recover. The rising complexity of aviation networks and the demand for smarter air traffic management have contributed significantly to the increased adoption of flight management systems in aviation software.

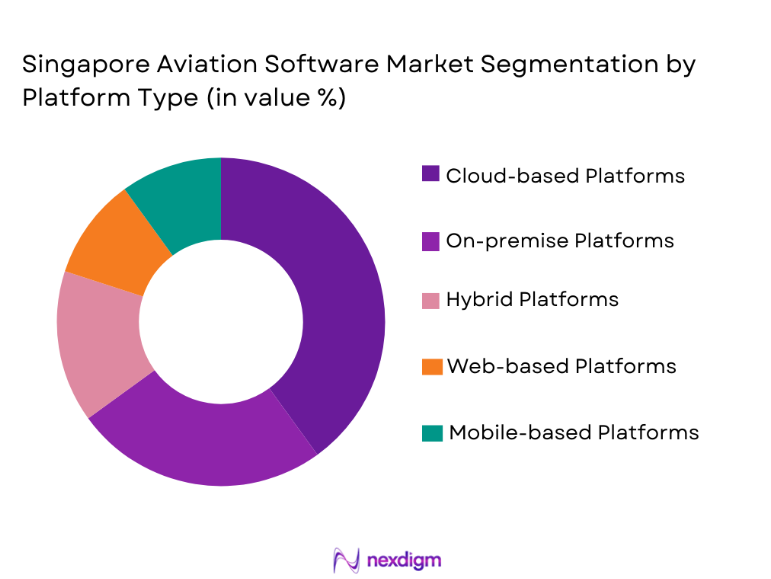

By Platform Type

The Singapore Aviation Software Market is segmented by platform type into cloud-based platforms, on-premise platforms, hybrid platforms, web-based platforms, and mobile-based platforms. Recently, cloud-based platforms have a dominant market share due to the growing demand for scalable, flexible, and cost-effective solutions. The cloud offers enhanced data accessibility, real-time updates, and improved collaboration across various aviation stakeholders, including airlines, airports, and service providers. The trend toward digital transformation and the need for secure data storage and management have made cloud-based platforms the preferred choice for aviation software.

Competitive Landscape

The competitive landscape of the Singapore Aviation Software Market is marked by a high level of consolidation, with several key players dominating the sector. These players include multinational technology companies and specialized aviation software developers, which are actively investing in R&D to enhance their product offerings. Strategic partnerships and acquisitions are common as companies seek to expand their market share and strengthen their technological capabilities. The market is highly competitive, with continuous technological advancements driving innovation and growth.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-specific Parameter |

| SITA | 1949 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Honeywell | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Lufthansa Systems | 1995 | Germany | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1973 | USA | ~ | ~ | ~ | ~ | ~ |

| Amadeus IT Group | 1987 | Spain | ~ | ~ | ~ | ~ | ~ |

Singapore Aviation Software Market Analysis

Growth Drivers

Increased Demand for Operational Efficiency

The Singapore Aviation Software Market is driven by the increasing demand for operational efficiency within the aviation sector. Airlines, airports, and service providers are looking to optimize operations and reduce costs by implementing advanced aviation software solutions. These solutions help streamline flight management, aircraft maintenance, and air traffic control, improving overall efficiency. The ongoing global recovery in air traffic and the expansion of air travel networks have further boosted the demand for such solutions. Airlines and airports are investing heavily in digital transformation initiatives, seeking ways to leverage real-time data for improved decision-making and increased profitability. The emphasis on real-time monitoring and predictive analytics has led to the rapid adoption of cloud-based and AI-powered aviation software. Additionally, government initiatives and regulations promoting the use of advanced technologies to enhance safety and operational performance are expected to drive the market’s growth in the coming years.

Government Support for Smart Airport Development

Another key growth driver for the Singapore Aviation Software Market is the government’s commitment to developing smart airports. Singapore’s Changi Airport is an example of a world-class facility that is actively adopting advanced aviation software to improve its operational processes. The government’s investments in infrastructure and technological advancements in the aviation sector have significantly supported the growth of aviation software solutions. Initiatives such as the Smart Nation program and the ongoing modernization of air traffic management systems have created a conducive environment for the development and deployment of aviation software. The focus on digital infrastructure, automation, and passenger experience optimization has made Singapore a leader in smart airport solutions, contributing to the market’s expansion.

Market Challenges

High Implementation Costs

One of the primary challenges facing the Singapore Aviation Software Market is the high cost of implementing advanced aviation software systems. While these systems offer long-term efficiency benefits, the upfront costs associated with purchasing, installing, and training staff on the new software can be a significant barrier for smaller players in the aviation sector. Furthermore, ongoing maintenance and system updates add to the financial burden, particularly for airports and airlines operating on tight budgets. This challenge is particularly prominent for smaller regional airports, which may find it difficult to justify the investment in high-cost, high-tech solutions. Despite these challenges, the growing need for operational efficiency and safety enhancements is driving the adoption of such systems, but cost remains a major obstacle for market penetration.

Integration with Legacy Systems

Another challenge is the integration of new aviation software with existing legacy systems. Many airports, airlines, and other aviation service providers still rely on older software systems that may not be compatible with newer, more advanced solutions. This creates a complex environment for software vendors, as they must develop solutions that can seamlessly integrate with outdated systems while ensuring security and data integrity. The process of migrating from legacy systems to modern platforms can be time-consuming and expensive, potentially disrupting operations during the transition period. Overcoming this challenge requires careful planning, investment in compatible technologies, and a phased implementation approach to avoid operational disruptions.

Opportunities

Expansion of Cloud-Based Solutions

The rise of cloud computing presents a significant opportunity for growth in the Singapore Aviation Software Market. Cloud-based solutions provide a flexible, scalable, and cost-effective alternative to traditional on-premise systems. The increasing demand for real-time data, collaboration, and accessibility across different platforms has made cloud computing a key enabler of digital transformation in the aviation sector. Cloud solutions allow airlines, airports, and other aviation stakeholders to access data from anywhere, at any time, facilitating smoother operations and decision-making. The market is expected to see a significant increase in the adoption of cloud-based aviation software in the coming years, driven by advancements in cloud infrastructure, improved security protocols, and growing acceptance among aviation industry players.

Growth in Military Aviation Software

Another opportunity for the Singapore Aviation Software Market is the increasing demand for advanced software solutions in the military aviation sector. Military forces across the world are adopting sophisticated aviation software to enhance operational efficiency, improve flight safety, and streamline maintenance processes. Singapore’s military is also investing in advanced technologies, including aviation software, to modernize its defense infrastructure. The growing demand for secure and efficient air traffic control, fleet management, and predictive maintenance solutions in the defense sector presents significant opportunities for software vendors to expand their offerings in this niche market. As global military expenditure rises and the need for advanced defense capabilities increases, this segment is expected to drive demand for specialized aviation software.

Future Outlook

The future of the Singapore Aviation Software Market looks promising, with continued growth expected due to advancements in technology, increasing demand for efficient operations, and government support for smart airport initiatives. The market will likely experience significant growth in the adoption of cloud-based solutions, AI, and machine learning technologies, enabling airlines, airports, and other stakeholders to optimize their operations further. Technological developments, coupled with the recovery in global air traffic, are expected to drive demand for more advanced aviation software solutions. Additionally, regulatory support for digital transformation and infrastructure modernization will play a key role in sustaining market growth.

Major Players

- SITA

- Honeywell

- Lufthansa Systems

- Rockwell Collins

- Amadeus IT Group

- Jeppesen

- Navblue

- Garmin

- Cavok

- Ramco Systems

- Indra Sistemas

- MRO Software Solutions

- AeroSoft

- IthosGlobal

- IBM

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines

- Airports

- Military aviation

- Aerospace technology providers

- Aviation service providers

- Fleet operators

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables influencing the market, including technological trends, regulatory frameworks, and economic factors affecting demand.

Step 2: Market Analysis and Construction

In this step, data is collected and analyzed to construct a comprehensive market model based on historical data, trends, and expert opinions.

Step 3: Hypothesis Validation and Expert Consultation

Experts and industry professionals are consulted to validate hypotheses and refine market models, ensuring the research accurately reflects real-world dynamics.

Step 4: Research Synthesis and Final Output

All data is synthesized to produce a final market report, including analysis, insights, and forecasts, providing a clear picture of the market’s future.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for efficient flight operations

Government initiatives for aviation modernization

Increasing reliance on AI for operational efficiency

Surge in international air traffic

Technological advancements in aviation software - Market Challenges

High implementation costs

Complex regulatory environment

Cybersecurity concerns in aviation software

Data privacy issues

Integration challenges with legacy systems - Market Opportunities

Growing need for air traffic management solutions

Expanding demand for data analytics platforms

Opportunities in military and defense aviation software - Trends

Adoption of cloud-based aviation software

Shift toward AI and machine learning for predictive maintenance

Use of blockchain for aviation data security

Rising adoption of passenger self-service technologies

Focus on real-time data processing and analytics - Government Regulations & Defense Policy

Aviation safety regulations

Data security and privacy regulations

Government support for smart airport initiatives - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight Management Systems

Aircraft Maintenance Software

Air Traffic Control Software

Passenger Management Software

Fleet Management Systems - By Platform Type (In Value%)

Cloud-based Platforms

On-premise Platforms

Hybrid Platforms

Web-based Platforms

Mobile-based Platforms - By Fitment Type (In Value%)

OEM Aviation Software

Aftermarket Aviation Software

Integrated Aviation Software

Custom Aviation Software

Upgrade Aviation Software - By EndUser Segment (In Value%)

Airlines

Airports

Aviation Service Providers

Military Aviation

Corporate Jet Operators - By Procurement Channel (In Value%)

Direct Purchase

Distributors

Online Channels

OEMs

Third-Party Resellers - By Material / Technology (In Value%)

AI and Machine Learning Technologies

Big Data Analytics

Cloud Computing Technologies

IoT-based Solutions

Blockchain Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Product Features, Pricing Strategy, Market Reach, Innovation, Customer Support, Market Position, Strategic Partnerships, Sales Channels, Operational Efficiency, Customer Loyalty)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

SITA

Honeywell

Lufthansa Systems

Aviation Software Development Group

Rockwell Collins

Jeppesen

Amadeus IT Group

Navblue

Garmin

Cavok

Ramco Systems

Indra Sistemas

MRO Software Solutions

AeroSoft

Ithos Global

- Airlines increasingly adopting digital tools for operational efficiency

- Airports investing in automation and software upgrades

- Military aviation seeking more secure and advanced software solutions

- Corporate jet operators moving toward integrated aviation management systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035