Market Overview

The market for Singapore Aviation Testing Services is valued at USD ~ billion, driven by a rapid expansion in aviation infrastructure and safety compliance requirements. The increasing demand for advanced aircraft safety standards has accelerated the market’s growth, with commercial and military aircraft manufacturers prioritizing high-quality testing procedures. The rise in air traffic and subsequent aircraft utilization rates further fuels this demand, resulting in increased investments by both government and private sectors to meet testing requirements. Additionally, technological advancements, including AI-driven testing methods and automation, are playing a significant role in enhancing the efficiency and scope of aviation testing services.

Singapore has emerged as a key hub in the aviation industry, with its strategic location and robust infrastructure supporting a thriving market for aviation testing services. The country’s well-established regulatory framework ensures compliance with international safety and performance standards, making it an attractive destination for global players. Singapore’s government initiatives in aviation development, including funding for research and advancements in aviation safety technologies, position it as a dominant force in the market. Furthermore, the proximity to other Southeast Asian countries with burgeoning aviation industries strengthens Singapore’s position as a regional leader in aviation testing.

Market Segmentation

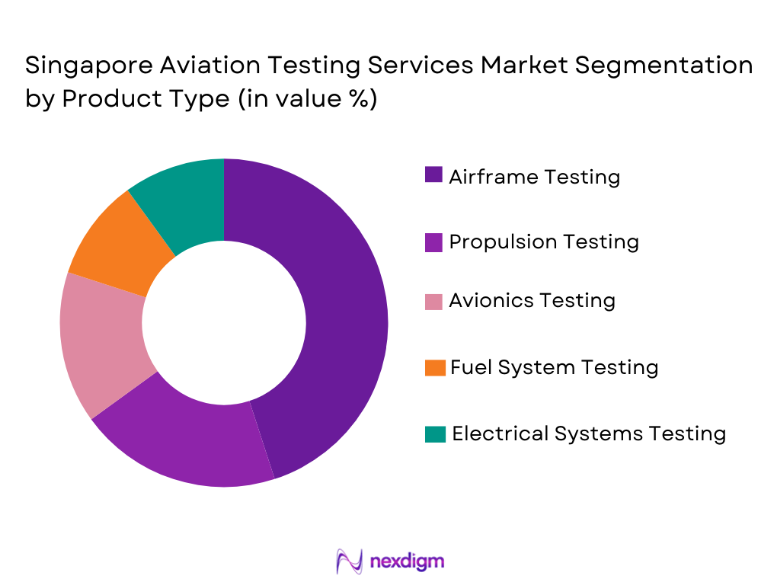

By Product Type

The Singapore Aviation Testing Services market is segmented by product type into airframe testing, propulsion testing, avionics testing, fuel system testing, and electrical systems testing. Recently, airframe testing has had a dominant market share due to its critical role in ensuring the structural integrity and safety of aircraft. Factors such as the increasing demand for commercial and military aircraft, along with regulatory requirements for airframe safety, have driven this dominance. Additionally, advancements in testing technologies, including automated systems for enhanced precision, have further contributed to the growing adoption of airframe testing services, leading to its substantial market presence.

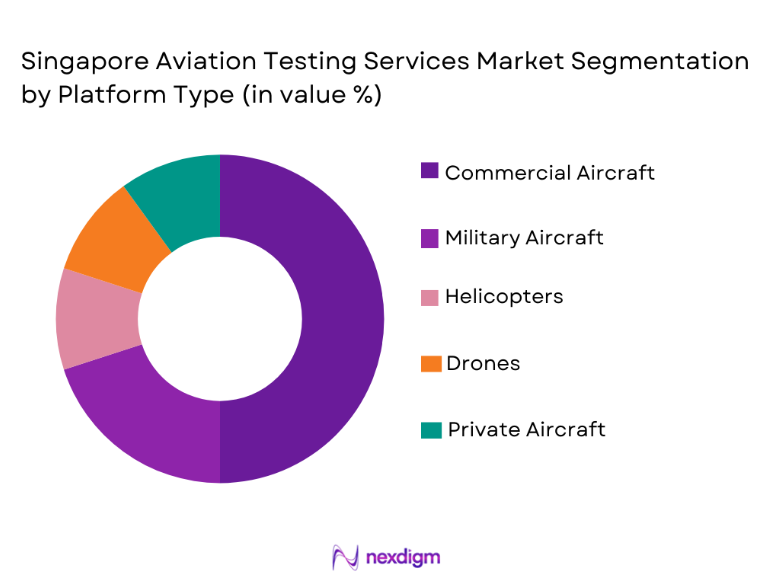

By Platform Type

The market is also segmented by platform type, including commercial aircraft, military aircraft, private aircraft, helicopters, and drones. Commercial aircraft have a dominant market share due to the growing demand for air travel and the continuous expansion of airline fleets worldwide. As the aviation industry expands, so does the need for regular and comprehensive testing services to ensure the safety, functionality, and compliance of these aircraft. The increasing number of passengers and cargo flights, along with government regulations mandating frequent inspections, has boosted the demand for testing services within this segment. Additionally, the focus on enhancing safety standards and operational efficiency in commercial aircraft has contributed to the growth of this sub-segment. The growing preference for lightweight and energy-efficient designs in commercial aircraft also drives the need for specialized testing solutions.

Competitive Landscape

The competitive landscape in the Singapore Aviation Testing Services market is characterized by consolidation, with a few major players dominating the space. These players are influencing the market through technological innovations and strategic partnerships, particularly in the areas of AI-driven testing and automation. Global players, in collaboration with local firms, are creating a strong foothold, ensuring advanced testing capabilities and expanded service offerings. Major companies are also investing in research and development to meet the rising demand for advanced testing services in line with evolving safety and regulatory standards.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Testing Service Focus |

| Singapore Technologies Aerospace | 1975 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| GE Aviation | 1892 | USA | ~ | ~ | ~ | ~ | ~ |

Singapore Aviation Testing Services Market Analysis

Growth Drivers

Increasing Demand for Aircraft Safety Standards

The increasing demand for advanced safety standards in commercial and military aircraft has been a key driver for the aviation testing services market. With the rapid expansion of air travel and the growing importance of stringent safety protocols, the need for regular and reliable testing services has intensified. Airlines, aircraft manufacturers, and defense contractors are investing heavily in ensuring their fleets meet the highest safety standards, thus propelling the demand for comprehensive testing solutions. Furthermore, government regulations require consistent and thorough testing of various aircraft systems to maintain airworthiness certifications, which has been a significant contributor to the market growth. The rise in global air traffic also correlates with a higher demand for regular aircraft maintenance and checks, including propulsion and structural testing, which adds to the market’s growth. As aviation companies strive to maintain operational efficiency, there is an increased focus on optimizing testing processes through automation and the use of advanced technologies. The implementation of digital twins and AI-powered testing systems has significantly reduced testing time, enabling faster turnarounds for aircraft, further driving demand in the market. With these advancements in technology and the global push for higher safety standards, the aviation testing market is expected to continue its growth trajectory.

Expansion of Aviation Infrastructure in Southeast Asia

The expansion of aviation infrastructure in Southeast Asia has created an environment conducive to the growth of the aviation testing services market. Countries within the region, including Singapore, are experiencing rapid growth in their aviation sectors, driven by increased passenger and cargo traffic, as well as heightened defense needs. This surge in demand for aviation services has prompted governments and private players to expand their testing capabilities, ensuring that new aircraft and aviation systems meet safety and performance standards. In Singapore, the government’s commitment to making the country a regional aviation hub has spurred investments in research, development, and technological advancements in aviation testing services. Additionally, the integration of smart technologies into aircraft testing procedures, such as IoT-based monitoring systems, is driving innovation within the market. With the continued growth in air traffic, the aviation industry is under pressure to maintain high safety standards, and this demand is expected to fuel the expansion of aviation testing services. New airports and aviation-related facilities are being established throughout Southeast Asia, particularly in countries like Indonesia, Malaysia, and Thailand, which increases the need for aviation testing services to support these developments. This expansion of infrastructure is providing significant opportunities for companies operating within the aviation testing market, positioning the sector for long-term growth.

Market Challenges

High Cost of Advanced Testing Technologies

One of the key challenges in the Singapore Aviation Testing Services market is the high cost of advanced testing technologies and equipment. The sophisticated testing procedures required for various aircraft systems, such as propulsion, avionics, and airframes, demand cutting-edge technologies that come with high upfront costs. Smaller players in the market, as well as emerging economies, may find it difficult to invest in these technologies, potentially limiting their market access. Moreover, the integration of new technologies like artificial intelligence and machine learning into testing systems requires specialized knowledge and substantial investment in research and development. This, in turn, creates a financial burden for companies attempting to keep up with technological advancements. Additionally, maintaining testing equipment, ensuring calibration standards, and training personnel further add to operational costs. While the larger companies in the aviation sector can absorb these costs, smaller businesses may struggle to keep pace, which can stifle competition and innovation. Overcoming this challenge will require strategic partnerships, investment in scalable technologies, and government incentives to support the market’s growth. Companies need to find ways to reduce operational costs while maintaining high-quality standards in testing procedures.

Complexity and Time-Consuming Nature of Testing Procedures

Another challenge facing the market is the complexity and time-consuming nature of aviation testing procedures. Testing various aircraft components, such as airframes, engines, and avionics, requires a meticulous and highly specialized approach. The industry is bound by strict safety regulations, which mandate exhaustive tests and inspections before any aircraft can be cleared for operation. These regulatory requirements, while essential for ensuring passenger safety, can result in delays and increased costs for aviation companies. In a competitive global market, the ability to quickly bring aircraft to market is crucial, and testing delays can hamper business performance. Furthermore, as aviation technology becomes increasingly complex, testing procedures are becoming more intricate and require additional time to perform. While there is a growing emphasis on improving testing efficiency through automation and digital tools, overcoming the barriers posed by legacy testing systems and human resource limitations remains a significant challenge. As the industry continues to expand, addressing these bottlenecks and enhancing testing speed will be vital for ensuring that market demand is met without compromising safety or quality.

Opportunities

Adoption of Digital Twin Technology

The increasing adoption of digital twin technology presents a significant opportunity for the aviation testing services market. Digital twins, which are virtual representations of physical aircraft systems, allow for real-time monitoring and testing of various components without the need for physical tests. This technology enables companies to simulate testing scenarios and predict potential failures, offering significant cost savings and reducing the time required for physical testing. As the aviation industry continues to evolve, digital twin technology has the potential to revolutionize the testing process, making it more efficient and scalable. By leveraging advanced simulations, aviation companies can perform more comprehensive tests in a virtual environment, thereby reducing downtime and improving operational efficiency. This shift toward digital testing solutions is being driven by the growing demand for faster turnaround times, cost-effective solutions, and enhanced precision in testing. Furthermore, digital twins provide the ability to monitor the condition of aircraft components throughout their lifecycle, enabling predictive maintenance and reducing the likelihood of costly repairs or operational disruptions. This technology is poised to become a key enabler of innovation in the aviation testing services market, creating opportunities for market players to invest in new digital solutions.

Growing Demand for Drone Testing Services

The growing demand for drone testing services represents another significant opportunity for the aviation testing services market. As unmanned aerial vehicles (UAVs) become increasingly popular in commercial, military, and civil applications, there is a rising need for specialized testing services to ensure that these systems meet safety, regulatory, and performance standards. Drones are being utilized for a wide range of purposes, including surveillance, delivery services, and industrial inspections, and each application presents unique challenges in terms of testing and certification. Companies offering aviation testing services are capitalizing on this trend by developing dedicated drone testing facilities and services, which focus on ensuring the reliability, functionality, and compliance of UAVs. This opportunity is particularly relevant as drone technology advances, with more sophisticated systems being introduced that require robust testing methods. Governments and regulatory bodies are also increasing their focus on drone safety, creating a supportive environment for the growth of drone testing services. As the adoption of drones continues to rise, the demand for specialized aviation testing services tailored to UAVs will increase, providing significant growth potential for market players in this segment.

Future Outlook

The future of the Singapore Aviation Testing Services market looks promising, with expected growth driven by advancements in testing technologies, increased infrastructure development, and growing demand for safety and regulatory compliance. The market is poised for expansion, supported by government initiatives and investments in aviation safety. Technological developments such as AI-driven testing, digital twin technology, and automation are expected to enhance testing efficiency, driving the market forward. As the aviation industry continues to grow, the demand for innovative testing services will increase, creating new opportunities for service providers.

Major Players

- Singapore Technologies Aerospace

- Boeing

- Airbus

- Honeywell Aerospace

- GE Aviation

- Testia

- Thales Group

- L3 Technologies

- Rockwell Collins

- Embraer

- Pratt & Whitney

- Avionics Interface Technologies

- SAAB

- CAV Aerospace

- Fujitsu

Key Target Audience

- Airlines

- Aircraft Manufacturers

- Aviation Safety Regulators

- Military and Defense Contractors

- Airports and Ground Operations

- UAV and Drone Companies

- Aviation Maintenance Providers

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

Identifying the key variables includes understanding the market drivers, challenges, segmentation, and technological trends that influence the market dynamics.

Step 2: Market Analysis and Construction

This step involves constructing a comprehensive market model based on qualitative and quantitative research, including primary and secondary data sources.

Step 3: Hypothesis Validation and Expert Consultation

We validate market assumptions through consultations with industry experts and stakeholders to ensure the relevance and accuracy of the findings.

Step 4: Research Synthesis and Final Output

The final stage synthesizes all collected data into actionable insights, forming the basis for the market report’s conclusions and recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of the Aviation Sector

Increased Demand for Aircraft Safety Standards

Government Investments in Aviation Infrastructure

Technological Advancements in Testing Equipment

Rising Air Traffic and Aircraft Utilization Rates - Market Challenges

High Testing Equipment Costs

Regulatory Compliance Requirements

Complexity of Testing Procedures

Lack of Skilled Labor in Testing

Security and Data Protection Concerns - Market Opportunities

Advancements in Drone and UAV Testing

Integration of AI and Machine Learning in Testing

Growth in Aviation Infrastructure in Southeast Asia - Trends

Increased Automation in Aircraft Testing

Sustainability in Aviation Testing Practices

Advancements in Digital Twin Technology for Aircraft

Demand for More Efficient Testing Methods

Growth in Demand for Remote and Virtual Testing - Government Regulations & Defense Policy

ICAO Safety Regulations

Government Funding for Aircraft Testing

Aviation Safety Standards and Compliance - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Airframe Testing

Propulsion Testing

Avionics Testing

Fuel System Testing

Electrical Systems Testing - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Aircraft

Helicopters

Drones - By Fitment Type (In Value%)

OEM Aviation Testing

Aftermarket Aviation Testing

Integrated Aviation Testing

Customized Aviation Testing

Field Testing - By EndUser Segment (In Value%)

Airlines

Aerospace Manufacturers

Defense Contractors

Aircraft Leasing Companies

Aviation Maintenance Providers - By Procurement Channel (In Value%)

Direct Procurement

Through Dealers/Distributors

Online Procurement

Third-Party Procurement

Government Procurement - By Material / Technology (in Value%)

Composite Materials

Metal Alloys

Avionics Components

Advanced Testing Equipment

Fuel Management Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Testing Equipment Performance, Cost-Effectiveness, Regulatory Compliance, Technological Innovation, Market Penetration, Customer Satisfaction, Product Portfolio, Geographic Reach, Customer Base, Brand Recognition)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Singapore Technologies Aerospace

Boeing

Airbus

L3 Technologies

Honeywell Aerospace

GE Aviation

Testia

Avionics Interface Technologies

Thales Group

SAAB

Pratt & Whitney

Rockwell Collins

Embraer

CAV Aerospace

Fujitsu

- Increased Focus on Safety in Commercial Aviation

- Aerospace Manufacturers Seeking Cost-effective Testing Solutions

- Growing Demand for Military Aircraft Testing

- Shift Toward Digital and Remote Testing Methods

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035