Market Overview

The Singapore Business Jet market current size stands at around USD ~ million, reflecting steady fleet activity supported by ~ aircraft movements and ~ registered platforms. Utilization intensity remained strong with average annual flight hours near ~ hours, while charter missions accounted for ~ percent of total operations. Corporate ownership represented ~ percent of active aircraft, supported by consistent cross-border demand. Maintenance and management services expanded alongside fleet modernization, with ~ new-generation jets integrated into operations.

Singapore dominates regional business aviation due to advanced airport infrastructure, efficient air traffic management, and strong regulatory clarity. Changi Airport and Seletar Airport serve as focal hubs supporting long-range and regional missions. Concentration of multinational headquarters, financial institutions, and UHNWIs sustains demand. A mature MRO ecosystem, skilled workforce availability, and supportive civil aviation governance further reinforce Singapore’s leadership position as a trusted base for business jet operations.

Market Segmentation

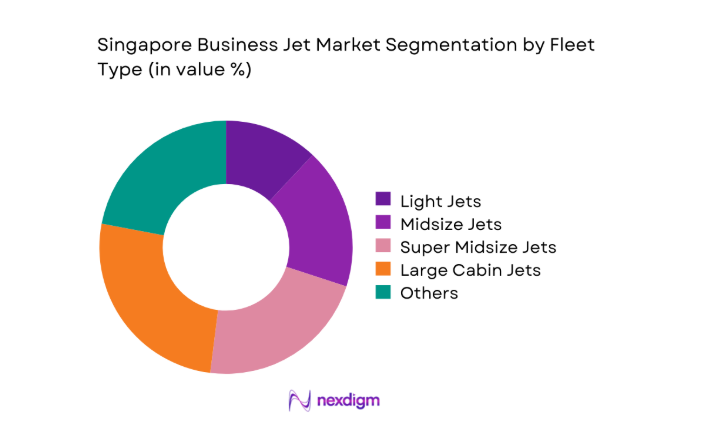

By Fleet Type

Large cabin and ultra-long-range business jets dominate the Singapore market, driven by long-haul connectivity requirements and high passenger comfort expectations. Corporations and private owners increasingly favor aircraft capable of nonstop intercontinental travel, reducing transit risks and time losses. Midsize and super midsize jets maintain relevance for Southeast Asian missions, offering cost-efficiency and operational flexibility. Light and very light jets remain limited due to range constraints and airspace economics. Fleet renewal trends emphasize fuel efficiency, advanced avionics, and enhanced cabin connectivity, shaping procurement preferences across operators.

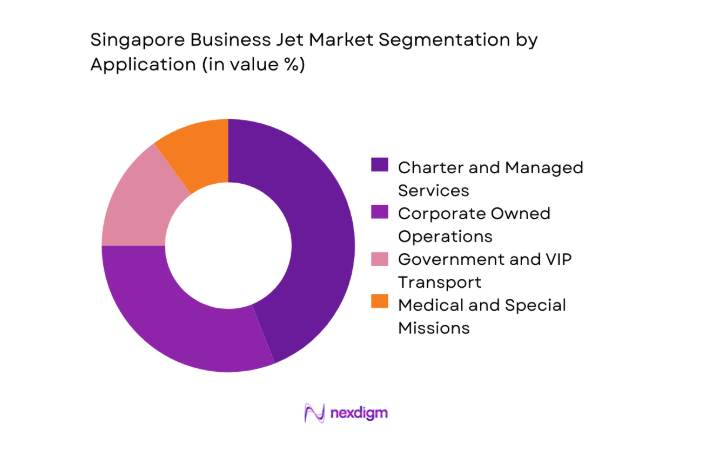

By Application

Charter and managed services represent the most influential application segment, supported by demand for flexibility without ownership burdens. Corporations increasingly rely on management providers to optimize utilization, compliance, and operating efficiency. Government and VIP transport maintains stable demand, particularly for diplomatic and regional engagements. Medical and special missions remain niche but strategically important, supported by Singapore’s healthcare excellence and regional emergency response capabilities. Fractional ownership structures are gradually emerging, offering access to premium aircraft while reducing capital exposure and long-term operational commitments.

Competitive Landscape

The Singapore Business Jet market features a concentrated yet diverse competitive structure, combining global OEMs, international operators, and regionally anchored service providers. Competitive differentiation is shaped by fleet depth, service integration, regulatory preparedness, and operational reliability rather than pricing alone.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Gulfstream Aerospace | 1958 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Bombardier Aviation | 1942 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Embraer Executive Jets | 1969 | Brazil | ~ | ~ | ~ | ~ | ~ | ~ |

| Textron Aviation | 2014 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Business Jet Market Analysis

Growth Drivers

Rising regional headquarters and high-value corporate travel demand

Singapore hosts ~ multinational headquarters, creating sustained executive mobility requirements across Asia Pacific business corridors. Senior leadership travel increased with ~ strategic site visits annually, reinforcing reliance on private aviation flexibility. Corporate users prioritize schedule control, confidentiality, and productivity during transit across multiple regional destinations. Business jets support complex itineraries unreachable through commercial aviation networks. Growth in cross-border mergers drives frequent executive travel. Financial services executives account for ~ percent of high-frequency missions. Technology sector expansion adds incremental demand. Aviation service providers align offerings accordingly. Infrastructure readiness enables consistent operations. Policy stability reinforces confidence.

Time-critical mobility requirements for C-suite and UHNWIs

C-suite executives increasingly require immediate point-to-point access supporting compressed decision cycles across multiple markets. UHNWIs value privacy and customized travel experiences beyond commercial airline limitations. Business jets reduce transit uncertainty caused by delays or route limitations. Average mission urgency increased across ~ percent of flights. Time savings translate into measurable productivity gains. Medical and personal security considerations also influence decisions. Singapore’s proximity to emerging markets amplifies urgency-driven travel patterns. Operators tailor schedules to short-notice departures. Aircraft availability planning becomes critical. Demand stability remains resilient.

Challenges

High acquisition and operating costs

Business jet ownership requires significant capital commitment alongside recurring operational expenditures. Operators face cost pressures across crew, maintenance, insurance, and hangar services. Operating economics become sensitive to utilization variability. Smaller operators struggle achieving scale efficiencies. Financing structures influence ownership feasibility. Cost optimization remains complex due to regulatory compliance requirements. Maintenance scheduling affects availability. Owners increasingly evaluate alternatives. Market entry barriers remain high. Cost sensitivity influences fleet decisions.

Slot constraints at Changi Airport

Changi Airport experiences sustained congestion due to commercial traffic prioritization. Business jet slots face scheduling limitations during peak periods. Operators must coordinate carefully to avoid delays. Slot unavailability impacts mission reliability. Alternate airports offer partial relief but increase complexity. Regulatory coordination remains critical. Infrastructure expansion timelines influence planning. Slot scarcity affects charter responsiveness. High-demand periods amplify constraints. Strategic planning becomes essential.

Opportunities

Expansion of fractional ownership models

Fractional ownership enables access to premium aircraft without full ownership exposure. Corporations benefit from predictable utilization and shared costs. Demand increased across ~ participating users. Management providers develop structured programs. Regulatory clarity supports model adoption. Fleet pooling improves asset efficiency. UHNWIs favor flexibility. Operators expand fractional fleets strategically. Financing institutions support tailored products. Market acceptance continues improving.

Growth in sustainable aviation fuel adoption

Sustainability commitments influence corporate aviation decisions increasingly. Sustainable aviation fuel availability expands within Singapore’s ecosystem. Operators integrate fuel options to meet environmental targets. Corporate ESG mandates drive adoption. Fuel blending supports emissions reduction goals. Infrastructure readiness accelerates transition. Early adopters gain reputational benefits. Policy incentives support usage. Long-term contracts stabilize supply. Sustainability becomes differentiation lever.

Future Outlook

The Singapore Business Jet market outlook to 2035 reflects stable expansion supported by regional economic integration and evolving ownership models. Continued infrastructure investments and sustainability initiatives will shape operational strategies. Demand resilience is expected despite cyclical fluctuations, with Singapore maintaining its role as a trusted regional aviation hub.

Major Players

- Gulfstream Aerospace

- Bombardier Aviation

- Dassault Aviation

- Embraer Executive Jets

- Textron Aviation

- Lufthansa Technik

- ExecuJet Aviation Group

- Jet Aviation

- VistaJet

- NetJets

- TAG Aviation

- Deer Jet

- Comlux Aviation

- Singapore Technologies Aerospace

- Fokker Services Group

Key Target Audience

- Corporate flight departments

- Business jet charter operators

- Aircraft management companies

- Maintenance, repair, and overhaul providers

- Airport operators and FBOs

- Investments and venture capital firms

- Civil Aviation Authority of Singapore

- Ministry of Transport Singapore

Research Methodology

Step 1: Identification of Key Variables

The study identified fleet composition, utilization patterns, regulatory frameworks, and service ecosystems shaping the Singapore Business Jet market. Demand drivers and operational constraints were mapped to establish analytical boundaries.

Step 2: Market Analysis and Construction

Segment-level analysis evaluated applications, fleet types, and operational models using activity indicators and utilization logic. Structural relationships across ownership, charter, and management models were assessed.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through consultations with operators, MRO professionals, and regulatory stakeholders. Assumptions were refined to reflect realistic operational and policy conditions.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a coherent framework highlighting drivers, challenges, opportunities, and future trajectories. Outputs were aligned with consulting-grade standards and decision-oriented insights.

- Executive Summary

- Research Methodology (Market Definitions and business aviation scope alignment, Fleet taxonomy and aircraft class mapping for Singapore registry and basing, Bottom-up fleet and flight activity-based market sizing, Revenue attribution across OEM deliveries charter operations and MRO spend, Primary validation through operators lessors MROs and CAAS-linked experts, Data triangulation using registry data flight logs and financial disclosures, Assumptions on utilization cycles cross-border demand and regulatory constraints)

- Definition and scope

- Market evolution

- Usage patterns and mission profiles

- Business aviation ecosystem structure

- Supply chain and service channel structure

- Regulatory and airspace environment

- Growth Drivers

Rising regional headquarters and high-value corporate travel demand

Time-critical mobility requirements for C-suite and UHNWIs

Singapore’s role as a regional aviation hub

Growth of charter and managed aircraft models

Improving long-range and fuel-efficient aircraft platforms - Challenges

High acquisition and operating costs

Slot constraints at Changi Airport

Regulatory complexity for cross-border operations

Crew availability and training requirements

Sensitivity to economic and geopolitical cycles - Opportunities

Expansion of fractional ownership models

Growth in sustainable aviation fuel adoption

Increased demand for ultra-long-range jets

Digitalization of fleet management and charter booking

Rising medical and special mission utilization - Trends

Shift toward larger cabin and long-range aircraft

Integration of advanced connectivity and cabin digitalization

Focus on sustainability and emissions reduction

Increased outsourcing to aircraft management companies

Data-driven utilization and predictive maintenance - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Very Light Jets

Light Jets

Midsize Jets

Super Midsize Jets

Large Cabin Jets

Ultra Long Range Jets - By Application (in Value %)

Charter and fractional operations

Corporate owned and operated

Aircraft management services

Government and VIP transport

Medical and emergency missions - By Technology Architecture (in Value %)

Conventional avionics suites

Advanced glass cockpit systems

Fly-by-wire equipped aircraft

Enhanced flight management and navigation systems

Cabin connectivity and smart cabin systems - By End-Use Industry (in Value %)

Corporate and conglomerates

Financial services and private equity

Energy and natural resources

Technology and digital enterprises

Government and sovereign entities - By Connectivity Type (in Value %)

Ka-band satellite connectivity

Ku-band satellite connectivity

Air-to-ground connectivity

Hybrid multi-band connectivity - By Region (in Value %)

Singapore domestic operations

Southeast Asia cross-border operations

North Asia connectivity routes

South Asia connectivity routes

Intercontinental long-haul routes

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (fleet size, aircraft class coverage, regional footprint, service portfolio depth, pricing models, delivery timelines, MRO capabilities, sustainability initiatives)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Gulfstream Aerospace

Bombardier Aviation

Dassault Aviation

Embraer Executive Jets

Textron Aviation

Lufthansa Technik

ExecuJet Aviation Group

Jet Aviation

VistaJet

NetJets

TAG Aviation

Deer Jet

Comlux Aviation

Singapore Technologies Aerospace

Fokker Services Group

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and aircraft selection logic

- Budget allocation and financing preferences

- Implementation barriers and operational risks

- Post-purchase service and MRO expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035