Market Overview

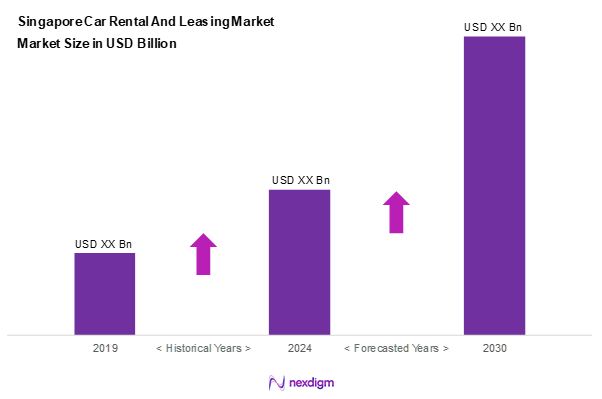

As of 2024, the Singapore car rental and leasing market is valued at USD ~ billion, with a growing CAGR of 5.7% from 2024 to 2030. This market is primarily driven by an increase in urbanization and tourism, which fuels the demand for flexible transportation options. The ongoing infrastructure development and the rising need for short-term vehicle solutions further contribute to market growth, enabling consumers to access a variety of vehicles without the commitment of ownership.

Singapore is home to many dominant players in the car rental and leasing market due to its strategic geographic location and status as a hub for tourism and business. Cities like Singapore continue to attract international tourists and corporate clients, leading to increased activity in the car rental segment. This dominance is also influenced by robust regulatory frameworks that promote the growth of the rental industry, alongside a burgeoning demand for diverse vehicle options catering to varying consumer needs.

Market Segmentation

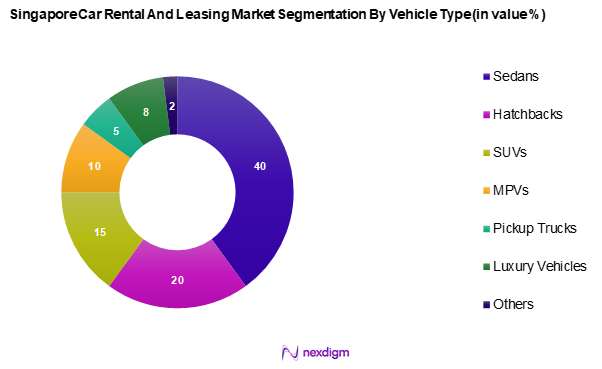

By Vehicle Type

The Singapore car rental and leasing market is segmented into sedans, hatchbacks, SUVs, MPVs, pickup trucks, luxury vehicles, and others. Among these, sedans have emerged as the dominant segment, holding a significant market share. Sedans are favored for their affordability, fuel efficiency, and practicality, making them a preferred choice for both corporate clients and individual consumers. The balance of comfort and cost-effectiveness appeals to businesses seeking reliable transportation for employees as well as tourists who require an efficient mode of travel.

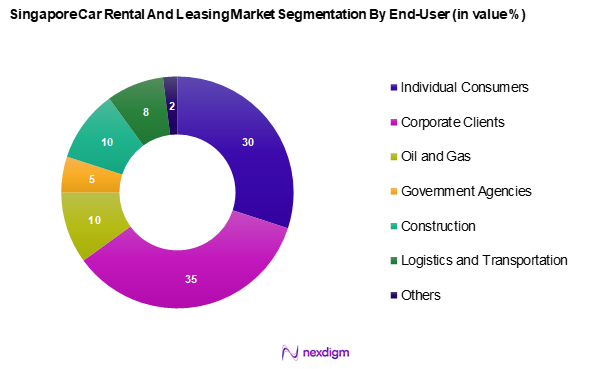

By End-user Type

The Singapore car rental and leasing market is segmented into individual consumers, corporate clients, oil and gas, government militaries and ministries, construction, logistics and transportation, and others. Corporate clients constitute a significant portion of the market share as organizations seek flexible rental agreements that facilitate business travel. The demand from corporate clients is bolstered by the frequent necessity for employee travel for meetings, conferences, and events, thus driving revenue for rental companies.

Competitive Landscape

The Singapore car rental and leasing market is dominated by several key players, including local companies and international brands. Major players such as Avis and Hertz leverage their global presence, while local firms like Skylink Group Holdings and Mova Automotive cater specifically to the needs of Singapore’s diverse clientele. The competitive landscape is characterized by a focus on customer service, innovative booking solutions, and fleet diversification.

| Company | Establishment Year | Headquarters | Fleet Size | Market Focus | Online Booking Options | Specialty Services |

| Skylink Group Holdings | 1991 | Singapore | – | – | – | – |

| Mova Automotive Pte Ltd. | 1986 | Singapore | – | – | – | – |

| Avis | 1946 | New Jersey, U.S.A. | – | – | – | – |

| Hertz | 1918 | Florida, U.S.A. | – | – | – | – |

| Sixt | 1912 | Pullach, Germany | – | – | – | – |

Singapore Car Rental and Leasing Market Analysis

Growth Drivers

Increasing Urbanization

Singapore is widely recognized as one of the most urbanized countries in the world, with nearly the entire population residing in urban settings. This high urban density leads to unique transportation challenges, including limited parking space and increasing costs of vehicle ownership. Consequently, more residents are turning to car rental and leasing services as a practical alternative to owning a car. The urban lifestyle, coupled with efficient public infrastructure, supports the demand for flexible mobility solutions, where car rentals are increasingly preferred for occasional use, business needs, or weekend getaways. This shift is further supported by data from transport authorities indicating growing activity in the vehicle rental segment.

Rise in Tourism

Tourism in Singapore has shown strong signs of recovery, driven by government initiatives and global travel resumption. With international visitor numbers rebounding and tourism campaigns actively encouraging exploration, the demand for convenient transportation solutions like car rentals is on the rise. Tourists are increasingly opting for vehicle hire services to explore Singapore at their own pace, making rentals an integral part of the visitor experience. The government’s continued investment in revitalizing the tourism sector is expected to further stimulate the car rental market, especially among short-term visitors seeking comfort and flexibility.

Market Challenges

Regulatory and Compliance Issues

Operating within Singapore’s car rental and leasing market involves navigating a stringent regulatory environment. Authorities have established detailed guidelines covering licensing, safety checks, and fleet compliance. While these measures aim to uphold public safety and service standards, they also introduce operational complexities for rental companies. Compliance requirements often lead to higher costs and administrative burdens, particularly for smaller players. Keeping up with changing regulations demands agility and proactive investment in systems and training to maintain competitiveness in a tightly controlled industry landscape.

Fluctuation in Fuel Prices

Fuel cost volatility remains a pressing challenge for car rental operators. As global and regional fuel prices shift unpredictably, operating expenses can rise sharply, squeezing profit margins. This often results in rental price adjustments, which may deter cost-conscious consumers. Moreover, uncertainty around fuel prices has prompted rental firms to reassess their fleet composition, with a growing interest in adopting alternative fuel vehicles as a hedge against future cost pressures. The impact of fuel pricing trends is not only financial but also strategic, influencing long-term fleet planning and consumer pricing models.

Opportunities

Growth of Electric Vehicle Rentals

The electric vehicle (EV) segment in Singapore is gaining momentum, backed by strong government support and rising environmental consciousness among consumers. As sustainability becomes a key factor in purchasing and rental decisions, the appeal of EV rentals is expanding among both residents and tourists. Rental companies that invest in electric fleets stand to benefit from this green shift, aligning with national sustainability goals while differentiating their services in a competitive market. The improving EV infrastructure, including expanded charging networks, is further facilitating this transition and opening new growth avenues.

Technological Advancements in Booking Platforms

Digital innovation is reshaping the car rental experience in Singapore. A growing number of consumers prefer online channels for booking, fueled by high smartphone usage and demand for convenience. Rental firms leveraging mobile apps and integrated online platforms are well-positioned to attract tech-savvy customers, streamline operations, and improve service delivery. Enhanced features like real-time availability, instant payments, and user-friendly interfaces are now essential for customer engagement. As digital adoption continues to rise, companies that embrace this trend can unlock new customer segments and build long-term loyalty.

Future Outlook

Over the next five years, the Singapore car rental and leasing market is expected to exhibit steady growth, bolstered by increasing urbanization and advancements in technology that enhance the customer experience. The shift towards electric vehicles and sustainability in transport is anticipated to play a crucial role in shaping market dynamics. As businesses seek more eco-friendly options and cities aim to reduce carbon footprints, the demand for electric vehicle rentals is likely to rise significantly.

Major Players

- Skylink Group Holdings Pte. Ltd.

- Mova Automotive Pte Ltd.

- Avis

- Hertz

- Sixt

- Asia Express Car Rental Singapore

- Roset Limousine Services Pte Ltd.

- Ace Drive Pte Ltd.

- KINTO Singapore Pte. Ltd.

- CL LEAS

- Eurokars Leasing (a Subsidiary of Eurokars Group)

- Sime Darby Services

- Tokyo Century Leasing (Singapore) Pte. Ltd.

- C & P Rent-A-Car Pte Ltd.

- SG Car Choice Pte Ltd

Key Target Audience

- Corporate Organizations

- Government and Regulatory Bodies (e.g., Land Transport Authority)

- Transportation and Logistics Firms

- Investors and Venture Capitalist Firms

- Tourism and Hospitality Companies

- Event Management Companies

- Automotive Fleet Operators

- Oil and Gas Sector Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore car rental and leasing market. This step integrates extensive desk research, utilizing various secondary data sources and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Singapore car rental and leasing market. This includes assessing market penetration, understanding the ratio of market participants to service providers, and evaluating resultant revenue generation. A thorough evaluation of service quality metrics will also be conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through consultations with industry experts through computer-assisted telephone interviews (CATI). These experts represent a diverse array of companies operating within the rental and leasing sector. Their insights will provide valuable operational and financial data, crucial for refining and corroborating the market information.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with multiple car rental firms to acquire detailed insights into their service segments, sales performance, consumer preferences, and other relevant factors. This investigative process will help to verify and complement the statistics derived from the bottom-up approach, ensuring a thorough, accurate, and validated analysis of the Singapore car rental and leasing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Urbanization

Rise in Tourism - Market Challenges

Regulatory and Compliance Issues

Fluctuation in Fuel Prices - Opportunities

Growth of Electric Vehicle Rentals

Technological Advancements in Booking Platforms - Trends

Shift Towards Digital Platforms

Rise of Subscription Models - Government Regulation

Licensing Requirements

Emission Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Daily Rental Rate, 2019-2024

- By Vehicle Type, (In Value %)

Sedans

Hatchback

SUVs

MPVs

Pickup Trucks

Luxury Vehicles

Others - By Rental Duration, (In Value %)

1 Year

2 Year

3 Year

4 Years & Above - By End-user Type, (In Value %)

Individual Consumers

Corporate Clients

Oil and Gas

Government militaries & ministries

Construction

Logistics and Transportation

Others - By Fuel Type, (In Value %)

Gasoline

Diesel

Electric - By Booking Type, (In Value %)

Offline Booking

Online Booking - By Services Type, (In Value %)

Airport Transfers

Interstate Services

Intrastate Services - By Rental Type, (In Value %)

Business Rental

Chauffeur Drive

Self-Driving

Special Events - By Market Structure, (In Value %)

Organized

Unorganized

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Vehicle Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenue, Distribution Channels, Number of Locations, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

SKYLINK GROUP HOLDINGS PTE. LTD.

Mova Automotive Pte Ltd.

AVIS

Sixt

Asia Express Car Rental Singapore

Roset Limousine Services Pte Ltd

Hertz

Ace Drive Pte Ltd.

KINTO Singapore Pte. Ltd.

CL LEASING

Eurokars Leasing ( a Subsidiary of Eurokars Group)

Sime Darby Services

Tokyo Century Leasing (Singapore) Pte. Ltd.

C & P Rent-A-Car Pte Ltd.

SG Car Choice Pte Ltd

Others

- Market Demand and Utilization Rate

- Purchasing Power and Behavioural Insights

- Regulatory Compliance and Customer Preferences

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Daily Rental Rate, 2025-2030