Market Overview

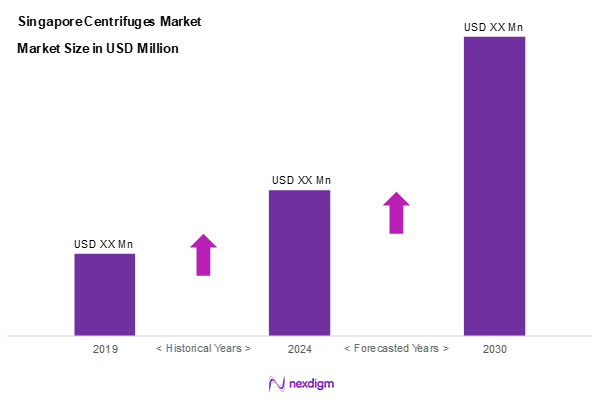

As of 2024, the Singapore centrifuges market is valued at USD 150.7 million, with a growing CAGR of 4.9% from 2024 to 2030, driven by the pharmaceutical, biotechnology, and environmental sectors. Recent trends reveal a heightened investment in R&D activities and advancements in centrifuge technology, facilitating efficient separation processes across various applications. The significant growth in sectors like healthcare and food safety underscores the vital role of centrifuges, making them indispensable tools in modern laboratories and production facilities.

Key cities such as Singapore, Bukit Batok, and Jurong dominate the market due to their strong industrial infrastructure and proximity to major healthcare and biotechnology firms. The well-established logistical systems and investment in innovation within these areas further enhance their competitiveness and allow them to attract international players and startups alike. The combination of governmental support for technological advancement and the concentration of high-tech industries in these cities ensures sustained dominance in the centrifuge market.

Market Segmentation

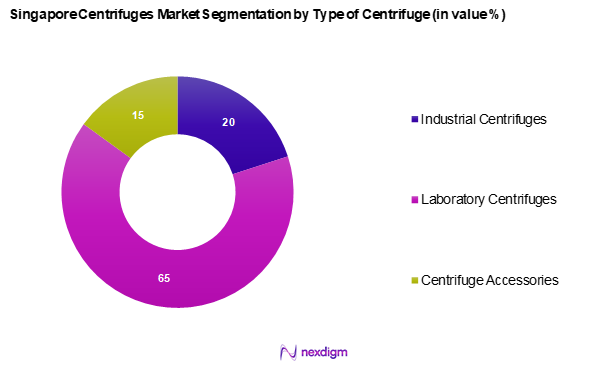

By Type of Centrifuge

The Singapore centrifuges market is segmented into Industrial centrifuges, laboratory centrifuges, and centrifuge accessories. Laboratory centrifuges hold a dominant market share due to their broad application in research and clinical laboratories. Their versatility and ability to efficiently process biological samples, such as blood or tissue, make them essential tools for healthcare providers and researchers. Additionally, the upscale demand for rapid diagnostics has driven the need for more sophisticated laboratory centrifuges, further solidifying this segment’s pre-eminence.

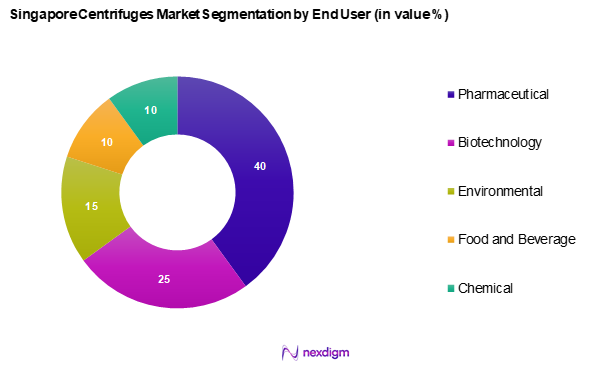

By End-User Industry

Singapore centrifuges market is segmented into pharmaceutical, biotechnology, environmental, food and beverage, and chemical sectors. The pharmaceutical sector is a leading segment in the Singapore Centrifuges Market, spurred by growing clinical trials and production processes that involve complex separation tasks. With stringent regulatory requirements ensuring product purity and safety, pharmaceuticals depend on centrifuge precision. Furthermore, the sector’s ongoing expansion necessitates advanced centrifuge technology to meet increasing product development demands, thereby enhancing the market share of this segment.

Competitive Landscape

The Singapore centrifuges market is dominated by a few major players, including both local and international manufacturers. The presence of established companies signifies their substantial influence in the market, delivering a variety of advanced centrifuge solutions that cater to diverse industrial needs.

| Company | Establishment Year | Headquarters | Annual Revenue | Product Offerings | Market Focus |

| Thermo Fisher Scientific | 1956 | Waltham, MA, USA | – | – | – |

| Eppendorf AG | 1945 | Hamburg, Germany | – | – | – |

| Beckman Coulter | 1935 | Brea, CA, USA | – | – | – |

| Alfa Laval | 1883 | Lund, Sweden | – | – | – |

| Sartorius AG | 1870 | Göttingen, Germany | – | – | – |

Singapore Centrifuges Market Analysis

Growth Drivers

Increase in Industrialization

The rapid industrialization across Singapore is a significant driver for the centrifuges market, driven by the manufacturing sector’s expansion. The government is focused on strengthening manufacturing capabilities through initiatives aimed at integrating digital technologies into production processes. As industries modernize to enhance efficiency, the demand for advanced equipment like centrifuges grows. This infrastructure development aligns with Singapore’s vision of being a global innovation hub, stimulating further industrial activities in key sectors such as pharmaceuticals and biotechnology.

Growing Demand from Biotechnology and Pharmaceutical Sectors

The biotechnology and pharmaceutical industries are witnessing an increase in demand due to Singapore’s emphasis on innovative healthcare solutions. With significant investments in research and development, these sectors require high-quality separation technologies, including centrifuges. The expansion of pharmaceutical manufacturing reflects the need for efficient drug development and production processes, further driving the adoption of centrifuge applications in laboratories and production facilities.

Market Challenges

High Initial Capital Investment

The substantial initial capital investment required for advanced centrifuge systems poses a challenge for market entry and expansion. The costs associated with sophisticated laboratory centrifuges, along with total equipment expenses in laboratory installations, indicate a significant financial burden for organizations, particularly smaller laboratories and startups. This economic barrier may limit access to essential technologies that enhance productivity, potentially slowing market growth.

Regulatory Compliance and Quality Standards

Regulatory compliance and stringent quality standards present additional challenges in the centrifuge market. Singapore enforces high manufacturing and operational standards through regulatory bodies overseeing medical device compliance. With a broad range of approved medicines and medical devices, meeting these stringent requirements can be both time-consuming and costly. Compliance regulations impact the speed at which new technologies are adopted, creating a bottleneck that may slow innovation and market responsiveness.

Opportunities

Technological Advancements in Centrifuge Design

Innovations in centrifuge design present significant opportunities for market growth. Advancements such as smart centrifuges leveraging AI and IoT enhance operational efficiency and enable precise separation processes. Increasing investments in automation technology further drive the adoption of advanced laboratory equipment, including centrifuges. These innovations attract investment and promote growth in related sectors, with an emphasis on enhancing productivity and reducing operational costs.

Untapped Markets in Emerging Sectors

Emerging sectors such as renewable energy and waste management present untapped opportunities for centrifuge applications in Singapore. The growing green technology market fosters new applications for centrifuges in waste treatment and resource recovery. Diversification into these non-traditional markets allows manufacturers to expand their product offerings while supporting environmental sustainability. As regulatory frameworks evolve to promote green initiatives, there is increasing demand for centrifuge innovations that contribute to these sectors.

Future Outlook

Over the next five years, the Singapore centrifuges market is expected to witness robust growth driven by technological advancements, increased healthcare spending, and a shift towards automation in laboratory processes. Enhanced R&D activities and regulatory support will continue to provide a conducive environment for market expansion, with an anticipated CAGR of around 6% from 2024 to 2030. This growth trajectory is underpinned by the rising adaptability of centrifuges across various applications and sectors, particularly in healthcare and research, thus ensuring a dynamic market landscape.

Major Players

- Thermo Fisher Scientific

- Eppendorf AG

- Beckman Coulter

- Alfa Laval

- Sartorius AG

- Sigma Laborzentrifugen

- NVT Technology

- Hettich Benelux

- VWR International

- Cat No.

- Celeros Flow Technology

- Process Systems

- Da Vinci Group

- Vortex Recovery

- Harzgerate GmbH

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies

- Ministry of Health (Singapore)

- National Environment Agency (NEA)

- Pharmaceutical and Biotechnology Companies

- Research Institutes and Laboratories

- Food and Beverage Manufacturers

- Environmental Testing Facilities

- Medical Device Manufacturers

- Quality Assurance Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map that encompasses all major stakeholders within the Singapore centrifuges market. This step is supported by extensive desk research utilizing both secondary and proprietary databases to gather comprehensive industry-level information. The primary aim is to identify and define the critical variables that influence market dynamics, including regulatory factors, technological advancements, and market trends.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Singapore centrifuges market. This includes assessing market penetration rates, the ratio of end-users to equipment providers, and the resultant revenue generation. A thorough investigation of service quality and operational statistics will be conducted to ensure reliability and accuracy in revenue estimates, highlighting key performance indicators across different industry sectors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse range of companies within the centrifuge market. These expert consultations will provide operational insights and market perspectives directly from practitioners, which are instrumental in refining and corroborating the gathered data and hypotheses.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple centrifuge manufacturers to acquire intricate insights into product segments, sales performance, and consumer preferences. This interaction aims to verify and complement statistics derived from the top-down and bottom-up approaches, ultimately ensuring a comprehensive, accurate, and validated analysis of the Singapore Centrifuges Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increase in Industrialization

Growing Demand from Biotechnology and Pharmaceutical Sectors - Market Challenges

High Initial Capital Investment

Regulatory Compliance and Quality Standards - Opportunities

Technological Advancements in Centrifuge Design

Untapped Markets in Emerging Sectors - Market Trends

Shift Towards Automation

Increasing Use of Eco-friendly Centrifuge Technologies - SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Type of Centrifuge (In Value %)

Industrial Centrifuges

– Batch Centrifuge

– Continuous Centrifuge

Laboratory Centrifuges

– Floor-Standing Centrifuges

– Benchtop Centrifuges

Centrifuge Accessories - By End-User Industry (In Value %)

Pharmaceutical

Biotechnology

Environmental

Food and Beverage

Chemical - By Application (In Value %)

Sedimentation

Liquid-Liquid Separation

Solid-Liquid Separation - By Speed (In Value %)

High-Speed Centrifuges

Low-Speed Centrifuges - By Region (In Value %)

Central Singapore

East Singapore

North Singapore

West Singapore

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Centrifuge Segment, 2024 - Cross Comparison Parameters (Company Overview, Market Share, Business Strategies, Innovation, Financial Performance, Product Offering, Customer Base, Distribution Network, Strength, Weakness, Revenue, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Thermo Fisher Scientific

Eppendorf AG

Beckman Coulter

Alfa Laval

GE Healthcare

Sartorius AG

Sigma Laborzentrifugen

NVT Technology

Hettich Benelux

VWR International

Cat No.

Celeros Flow Technology

Process Systems

Da Vinci Group

Vortex Recovery

- Demand Patterns and Utilization Rates

- Budget Allocations by End-User

- Regulatory Impact on Centrifuge Usage

- Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030