Market Overview

The Singapore cloud computing market is valued at USD 8.51 billion in 2024, based on rigorous industry data, reflecting sustained enterprise adoption across sectors. The growth from 2023, where values trended lower, is propelled by accelerated digital transformation, increased spending on cloud infrastructure, and strategic hyperscaler investments boosting capacity and service offerings.

Singapore and the broader Southeast Asia hub, including Kuala Lumpur and Jakarta, dominate due to exceptional digital infrastructure, strong regulatory frameworks, and Singapore’s status as a regional data transit node. Singapore’s secure, redundant data centers, favorable policy ecosystem, and concentration of financial and tech enterprises drive its leadership, even without citing precise market share numbers.

Market Segmentation

By Service Model

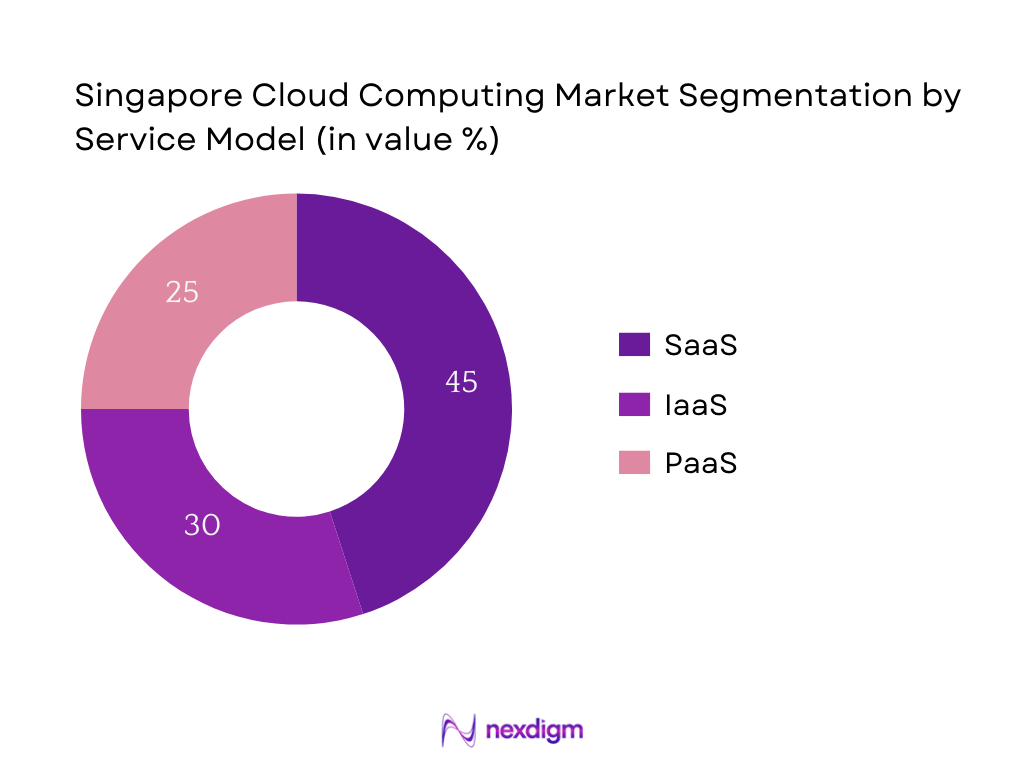

The Singapore cloud computing market is segmented into IaaS, PaaS, and SaaS. Among these, SaaS currently commands the largest market share, thanks to its ready-to-use applications, faster deployment, predictable operating expenses, and strong relevance to remote work and digital collaboration trends. Enterprises, particularly in BFSI, public sector, and SME segments, increasingly adopt productivity, CRM, ERP, and industry-specific SaaS tools to streamline operations. This is bolstered by strong local demand for agile, low-code, subscription-based offerings. Hyperscalers and local ISVs have tailored SaaS packages for compliance and PDPA alignment, reinforcing SaaS’s dominance in Singapore’s cloud market.

By Deployment Model

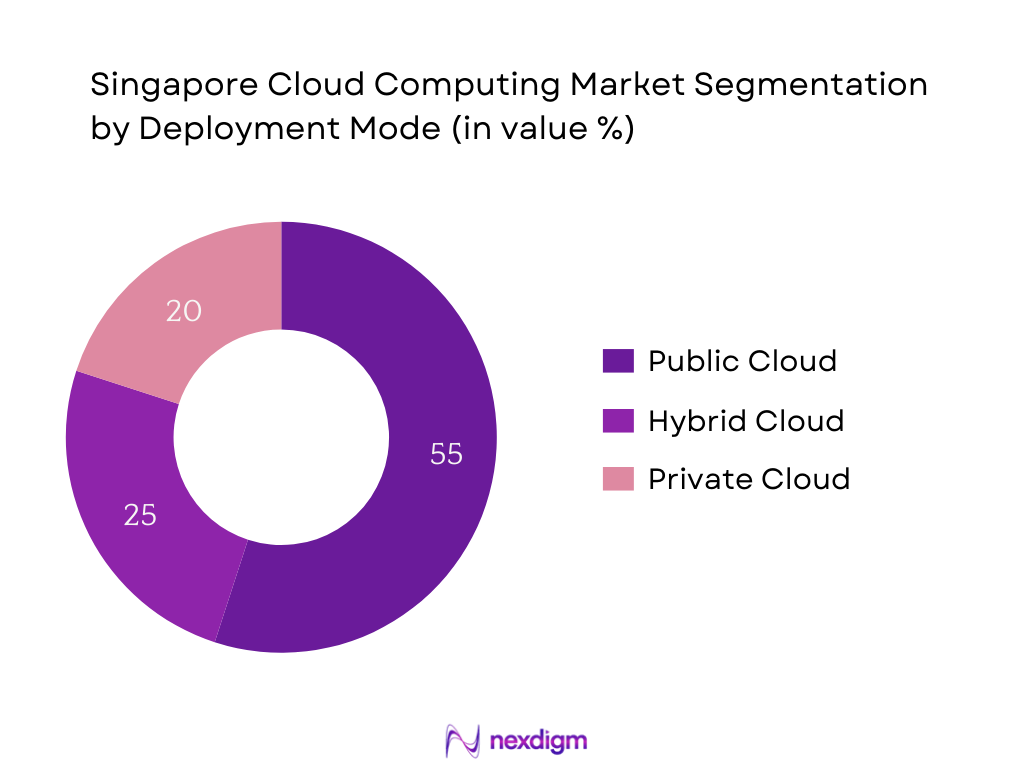

The Singapore cloud computing market is segmented into public, private, and hybrid cloud. Public cloud leads due to its scalability, cost efficiency, and ease of deployment. Enterprises value flexible, pay-as-you-go models, while SMEs especially benefit from not needing large capital investments. Singapore’s robust digital infrastructure, hyperscale data centers, and strong connectivity make public cloud particularly appealing. Regulatory frameworks and PDPA compliance guidelines are increasingly supportive of secure public cloud deployment. The presence of major providers like AWS, Azure, and Google, backed by massive investments—such as AWS’s S$12 billion expansion—boosts public cloud adoption.

Competitive Landscape

The Singapore cloud computing market is dominated by a few major global and regional players, such as AWS, Microsoft Azure, Google Cloud, Alibaba Cloud, Huawei Cloud, IBM Cloud, Oracle Cloud, Salesforce, NCS, Singtel, Tencent Cloud, VMware, DigitalOcean, OVHcloud, and ST Engineering Cloud. This consolidation underscores how hyperscalers and established local ICT leadership shape the competitive framework.

| Company Name | Year of Establishment | Headquarters | Data Centers in SG | Enterprise Focus Area | AI/ML Capabilities | PDPA Compliance Readiness | Green Infrastructure Initiatives | SLAs / Uptime Commitments | Hybrid Cloud Solutions |

| Amazon Web Services | 2006 | USA | – | – | – | – | – | – | – |

| Microsoft Azure | 2008 | USA | – | – | – | – | – | – | – |

| Google Cloud Platform | 2008 | USA | – | – | – | – | – | – | – |

| Alibaba Cloud | 2009 | China | – | – | – | – | – | – | – |

| NCS Group | 1981 | Singapore | – | – | – | – | – | – | – |

Singapore Cloud Computing Market Analysis

Growth Drivers

Government Grants

Singapore’s government has launched substantial grant programmes targeting digital and green tech sectors. For example, the $30 million Green Computing Funding Initiative was announced in early 2024 to co‑develop energy‑efficient computing solutions in the ICT sector. Additionally, the AI Springboard under the 2025 Enterprise Compute Initiative earmarked up to S$150 million to support local enterprises in leveraging AI for transformation. These significant, targeted funding pools reflect strong state commitment to nurturing cloud‑enabling technologies and driving digitalisation. The clear, numerical allocation from government coffers provides uninterrupted backing for hyperscalers and local cloud providers to invest in capabilities that benefit the market’s expansion, without discounting operational costs or market sizing.

Talent Pool Availability

Singapore is continuously strengthening its digital talent pipeline to support the cloud computing market and beyond. The Infocomm Media Development Authority’s (IMDA) Company‑Led Training (CLT) programme accelerates professional development for fresh, mid‑career, and mature PMETs (Professionals, Managers, Executives, Technicians), equipping them with relevant digital competencies. Although specific headcount figures are not quoted, this implies scale and recentness. Moreover, digital economy contribution soared to S$113 billion in 2023, representing around 17.7% of GDP, underscoring the expanding need for digital talent across the ecosystem. The combination of targeted training schemes and a growing digital economy reliably reinforces the availability of skilled professionals—critical for deploying, maintaining, and innovating within cloud infrastructures.

Market Challenges

High Power Usage Effectiveness

Energy efficiency is a pressing concern for data centres underpinning cloud infrastructure. Singapore’s data centres have achieved PUE (Power Usage Effectiveness) ratings near 1.35 in recent facilities, with newer ones aiming below 1.3, reflecting incremental improvements. The Green Data Centre Roadmap (updated as of Jan 2025) and BCA‑IMDA Green Mark revisions will raise standards by end‑2024 and establish standards for IT equipment and liquid cooling by 2025. Such numeric benchmarks reflect ongoing efforts—but the high PUE ± 1.3 footprint still implies substantial overhead energy usage, presenting a restraint on cost efficiencies and sustainability, especially as cloud workloads scale. Addressing PUE remains a tangible challenge with clear numeric demonstration of the energy burden, absent any broad market‑wide efficiency.

Data Sovereignty

Singapore places great emphasis on maintaining control over data through robust security and regulatory frameworks—a key consideration for cloud adoption. The globally pioneering MTCS (Multi‑Tier Cloud Security) standard, first introduced in 2020, provides tiered certifications aligned to infrastructure security needs, reinforcing trust in cloud operations. Similarly, Singapore launched sustainability standards for data centres in tropical climates in mid‑2023, including guidelines for operating at higher temperature settings while optimising energy efficiency. These numeric markers (e.g., certification tiers, launch year) underscore structural measures to preserve data integrity and control. However, compliance complexity and alignment with standards such as MTCS can slow or complicate cross‑border cloud deployment and integration, especially for enterprises requiring localised data handling—even as they seek scalability.

Market Opportunities

Green Data Centres

Singapore is actively nurturing a market for greener data centre infrastructure. Notably, SingTel secured a S$643 million green loan in early 2025 to build a 58‑MW data centre in Tuas, designed for high‑density AI workloads and lower carbon footprint. Meanwhile, Keppel aims to expand its data centre portfolio from 650 MW to 1.2 GW, attracting capital investments (doubling its funds under management) amid growing AI demand. These quantified developments illustrate tangible investments in sustainable infrastructure. While these do not directly reference future figures, the scale of current capital deployment demonstrates a clear opportunity: cloud providers and enterprises can leverage efficient, green‑certified capacity to align with sustainability goals and regulatory expectations.

Sovereign Cloud

While explicit numeric data on sovereign cloud uptake is limited, supporting infrastructure stats suggest favorable conditions. Singapore has granted conditional licences for 2 GW of low‑carbon electricity imports and conditional approvals for an additional 1.4 GW from Indonesia to support power‑intensive operations like data centres. Combined with the Power Usage Effectiveness targets (PUE ≤ 1.3) in data centre standards, this reliable low‑carbon power supply foundation enables sovereign cloud propositions—where sensitive data remains in‑country, secured within hybrid government‑controlled environments, yet powered sustainably. The quantified magnitude of green energy imports signals robust infrastructure capability to underpin sovereign cloud offerings.

Future Outlook

Over the forecast period to 2030, the Singapore cloud computing market is expected to experience steady, sustained expansion. Growth will be propelled by hyperscaler infrastructure investments, continuous digital transformation across key sectors (e.g., finance, government), and rising demand for advanced AI-native and hybrid cloud solutions. Singapore’s strategic emphasis on Smart Nation initiatives, AI governance frameworks, and sustainability in digital infrastructure will further fuel cloud adoption, particularly in enterprise and public sectors. Regulatory stability, skilled manpower, and innovation-led ecosystems offer a strong foundation for long-term growth.

Major Players

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- Alibaba Cloud

- Huawei Cloud

- IBM Cloud

- Oracle Cloud

- Salesforce

- VMware

- Tencent Cloud

- NCS Group

- Singtel (Cloud services division)

- DigitalOcean

- OVHcloud

- ST Engineering Cloud

Key Target Audience

- Chief Technology Officers (CTOs) of enterprise corporations

- Chief Information Officers (CIOs) at government agencies like IMDA (Infocomm Media Development Authority) and MAS (Monetary Authority of Singapore)

- Chief Digital Officers (CDOs) in BFSI institutions

- IT Program Directors in public sector digital transformation agencies

- Infrastructure Heads at large financial institutions (e.g., DBS, OCBC, UOB)

- Cloud Solutions Procurement Heads for SMEs

- Investments and Venture Capital firms (e.g., Temasek, GIC)

- Government and Regulatory Bodies (IMDA, MAS)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map covering hyperscalers, local cloud service providers, enterprise segments, and regulatory agencies. This is grounded in extensive secondary research using credible databases, industry reports, and public filings to identify market drivers, deployment models, and regulatory parameters.

Step 2: Market Analysis and Data Construction

In this phase, we compile and analyze historical and current data such as revenue by service and deployment model, data center spend, and cloud usage across sectors. Sources include published industry studies, government IT investment disclosures, and infrastructure announcements to ensure accuracy in sizing and trend analysis.

Step 3: Hypothesis Validation through Expert Consultation

Market hypotheses regarding growth drivers, segmentation, and future adoption are validated via interviews with cloud infrastructure leads at enterprises, government digital agencies, and hyperscaler representatives. These insights refine model assumptions and ensure alignment with on-ground realities.

Step 4: Research Synthesis and Final Report Output

The final phase synthesizes quantitative insights with qualitative validation. Direct engagement with cloud providers, enterprise CIO offices, and public-sector ICT teams ensures comprehensive coverage across use cases, deployment models, and regulatory impacts—culminating in a validated and detailed market analysis report.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Evolution of the Cloud Ecosystem in Singapore

- Singapore’s Digital Infrastructure Landscape

- Government and Policy Support Timeline

- Market Entry Barriers and Enablers

- Value Chain and Data Center Interlinkages

- Tech Talent and Skills Ecosystem

- Growth Drivers (Government Grants, Talent Pool Availability, Cross-border Compliance Support, Data Localization Requirements, 5G & IoT Integration, Strategic Regional Hub, Green Cloud Infrastructure, Cloud-Native Start-up Ecosystem)

- Market Challenges (High Power Usage Effectiveness, Data Sovereignty, Legacy IT Transformation Costs, Interoperability Issues, Rising Talent Costs, Complex Licensing Models)

- Emerging Market Opportunities (Green Data Centers, Sovereign Cloud, Quantum-Safe Encryption, FinTech Cloud Bundles, Edge Computing Partnerships)

- Trends (Cloud Sustainability Goals, Zero Trust Security, Generative AI in Cloud Ops, Rise of Kubernetes-as-a-Service)

- Government Regulations (IMDA Cloud Adoption Policies, PDPA Compliance, MAS TRM Guidelines, Cross-border Transfer Rules)

- Technology Stack and Ecosystem Analysis

- SWOT Analysis

- Porter’s Five Forces Analysis

- Stakeholder Ecosystem Mapping (ISVs, MSPs, SI Partners, Hyperscalers, Regulatory Bodies)

- By Revenue, 2019-2024

- By Workload Deployment, 2019-2024

- By Data Storage Volume, 2019-2024

- By Number of Active Enterprise Cloud Users, 2019-2024

- By Cloud Service Provider Capacity Installed (MW), 2019-2024

- By Deployment Model (In Value %)

Public Cloud

Private Cloud

Hybrid Cloud

Multi-cloud - By Service Model (In Value %)

Infrastructure as a Service (IaaS)

Platform as a Service (PaaS)

Software as a Service (SaaS)

Function as a Service (FaaS)

Backend as a Service (BaaS) - By End User Industry (In Value %)

Banking, Financial Services, and Insurance (BFSI)

Healthcare & Life Sciences

E-commerce & Retail

IT & Telecom

Government & Public Sector

Manufacturing

Logistics & Transportation - By Workload Type (In Value %)

Data Storage & Backup

Application Hosting

Database Management

Business Intelligence & Analytics

Web Hosting - By Company Size (In Value %)

Large Enterprises

SMEs

Startup

Government Agencies

Academic & Research Institutions

- Market Share of Major Players by Revenue

- Cross Comparison Parameters (Company Overview, Cloud Portfolio Breadth, Number of Data Centers in SG, Customer Segments, Service Uptime SLAs, AI/ML Capabilities, Sustainability Metrics, Public Sector Partnerships)

- SWOT Analysis of Key Competitors

- Benchmarking by SLAs & Data Residency Offerings

- Detailed Company Profiles

Amazon Web Services (AWS)

Microsoft Azure

Google Cloud Platform (GCP)

Alibaba Cloud

Huawei Cloud

IBM Cloud

Oracle Cloud

Salesforce

VMware

Tencent Cloud

NCS Group

Singtel (Cloud services division)

DigitalOcean

OVHcloud

ST Engineering Cloud

- Adoption by Enterprise Type

- Budget Allocation by Sector

- Key Cloud Use Cases by Industry

- CXOs’ Decision Criteria

- Procurement Patterns & Constraints

- By Revenue, 2025-2030

- By Workload Deployment, 2025-2030

- By Data Storage Volume, 2025-2030

- By Number of Active Enterprise Cloud Users, 2025-2030

- By Cloud Service Provider Capacity Installed (MW), 2025-2030