Market Overview

The Singapore combat helicopter simulation market current size stands at around USD ~ million and reflects steady procurement momentum across operational training environments nationwide. Utilization levels continue to rise as simulation becomes a primary training modality across rotary-wing units. Capacity expansion has been driven by structured training pipelines and standardized simulator deployment models. Operational readiness objectives are increasingly supported through integrated training programs that prioritize safety, repeatability, and mission complexity. The market benefits from sustained institutional commitment to synthetic training adoption.

Demand concentrates around air bases and centralized training complexes with advanced secure networks, supported by mature defense infrastructure and integration ecosystems. Urban littoral terrain replication and tropical environment modeling drive concentrated adoption across primary aviation hubs. High-security facilities enable networked mission training across distributed sites, reinforcing centralized scheduling and utilization. Local integration capabilities reduce deployment friction, while established compliance frameworks streamline certification cycles. Policy continuity supports sustained upgrades, and ecosystem maturity anchors long-term service partnerships across critical operational nodes.

Market Segmentation

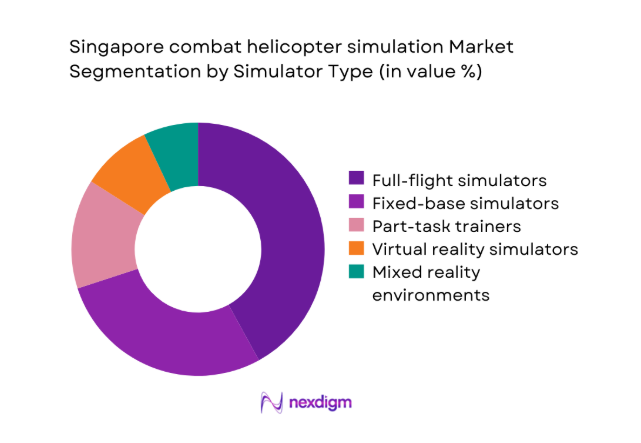

By Simulator Type

Full-flight simulators dominate procurement due to fidelity requirements supporting mission rehearsal, emergency procedures, and crew coordination within controlled training environments. Fixed-base systems expand throughput for routine proficiency maintenance, while part-task trainers address avionics and weapons workflow familiarity. Virtual reality platforms accelerate procedural learning and rapid scenario iteration, supporting early-stage conversion pipelines. Mixed reality environments enhance collaborative rehearsal with synthetic entities, enabling distributed mission training across secure networks. Demand consolidates around modular architectures that permit incremental upgrades to visual systems, databases, and computing stacks, ensuring lifecycle relevance across evolving helicopter avionics baselines and operational doctrines.

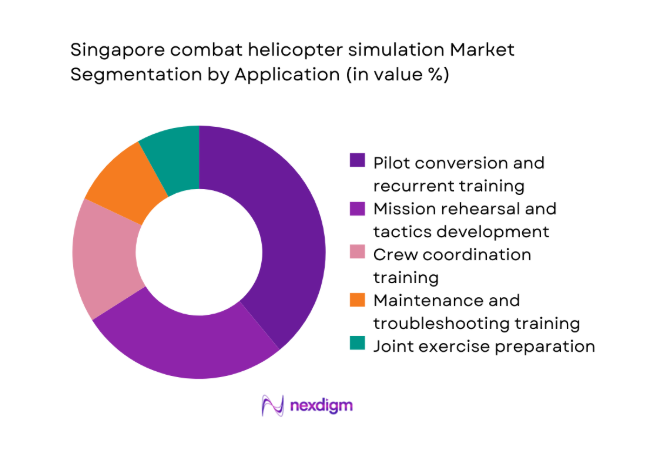

By Application

Pilot conversion and recurrent training represent the largest application cluster, driven by safety mandates and standardized proficiency thresholds. Mission rehearsal expands with complex littoral, urban, and night operations, requiring scenario-rich databases and collaborative rehearsal modes. Crew coordination training benefits from networked environments that synchronize pilot, sensor, and mission commander workflows. Maintenance training adoption grows for avionics diagnostics and fault isolation, reducing live-platform downtime. Joint exercise preparation increases demand for interoperable simulation networks, aligning distributed training across services while maintaining security controls and operational realism within constrained airspace environments.

Competitive Landscape

The competitive environment is characterized by high barriers to entry driven by certification, security compliance, and long qualification cycles. Buyers prioritize platform fidelity, lifecycle support depth, and networked training interoperability within secure environments. Contracting emphasizes availability performance and upgrade pathways aligned with avionics baselines and mission system evolution.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| CAE | 1947 | Montreal | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | Melbourne | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Rome | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab | 1937 | Stockholm | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore combat helicopter simulation Market Analysis

Growth Drivers

Modernization of rotary-wing fleets within the RSAF

Modernization programs expand training requirements across platforms, driving simulator upgrades supporting evolving avionics and mission systems. Fleet introductions during 2024 increased conversion throughput, necessitating expanded simulator capacity and instructor certification pipelines. Operational doctrines updated during 2025 emphasized multi-ship coordination, raising demand for networked training environments. Digital terrain refresh cycles expanded scenario libraries, improving mission rehearsal realism across urban littoral environments. Increased night operations training requires enhanced visual systems and sensor emulation fidelity across simulator architectures. Interoperability mandates align training networks across bases, improving readiness through shared scenario repositories. Cybersecurity accreditation requirements increase investments in hardened simulation networks supporting sensitive mission rehearsal workflows. Instructor standardization programs enhance training consistency across cohorts using validated scenario frameworks. System modularity enables phased upgrades aligning with avionics block updates across helicopter variants. Policy continuity sustains procurement planning horizons, enabling predictable simulator capacity expansion cycles.

Rising emphasis on synthetic training to reduce live-flight costs

Synthetic training adoption accelerates as operational units prioritize readiness while preserving airframe availability across fleets. Utilization metrics during 2024 indicate increased simulator hours replacing live sorties for routine proficiency cycles. Risk mitigation protocols favor simulated emergency procedures, reducing exposure during complex maneuver training. Distributed mission training enables coordinated exercises without airspace congestion constraints affecting live operations. Weather independent training increases schedule reliability across monsoon periods impacting flight availability. Advanced scenario authoring supports rapid iteration following operational feedback from exercises conducted in 2025. Networked simulators facilitate joint rehearsals, improving crew coordination across geographically separated units. Enhanced debrief analytics improve learning outcomes by capturing telemetry and crew interaction patterns. Synthetic environments accelerate certification timelines for new tactics through repeatable scenario validation cycles. Sustainability policies reinforce simulator utilization to reduce environmental impacts associated with training flights.

Challenges

High capital expenditure and long procurement cycles

Capital constraints complicate procurement planning, extending approval timelines across multi-year budgeting frameworks. Technical evaluations require extensive validation, delaying contract awards for complex simulator configurations. Security accreditation processes lengthen deployment timelines for networked training environments across secure facilities. Customization requirements increase integration complexity with legacy mission systems and databases. Vendor qualification cycles demand comprehensive compliance documentation across export controls and information assurance frameworks. Infrastructure upgrades for power, cooling, and networking introduce dependencies across base modernization schedules. Stakeholder coordination across training commands and operators extends decision cycles for configuration baselines. Testing and acceptance protocols prolong commissioning, delaying operational readiness benefits realization. Change management for instructors requires scheduling windows impacting transition pace to new systems. Lifecycle planning uncertainty complicates synchronization with avionics block upgrades across heterogeneous fleets.

Integration complexity with legacy avionics and mission systems

Legacy avionics interfaces limit simulator fidelity without extensive reverse engineering and validation workflows. Data rights constraints restrict access to proprietary mission system models required for accurate emulation. Configuration drift across fleet blocks complicates scenario standardization within networked training environments. Software update cadences differ between simulators and aircraft, creating synchronization challenges for training realism. Interface control documents require continuous updates to maintain compatibility with evolving subsystems. Validation testing consumes operational availability windows needed for instructor qualification and acceptance trials. Cyber hardening requirements introduce additional latency in integrating external databases and tools. Limited documentation quality across older platforms increases risk of integration defects. Environmental model accuracy depends on sensor emulation fidelity constrained by legacy interfaces. Interoperability across multi-vendor components requires governance frameworks to manage version control.

Opportunities

Upgrades from legacy simulators to high-fidelity visual systems

Visual system upgrades enhance training realism, supporting complex urban and littoral mission rehearsal. Display refresh programs improve night vision goggle compatibility and sensor fusion emulation fidelity. Computing accelerators introduced during 2025 enable higher resolution terrain rendering and dynamic weather effects. Modular visual channels permit phased upgrades without extended downtime for training operations. Improved collimation and field of view enhance depth perception for low altitude maneuver training. Database modernization expands scenario diversity, supporting joint exercise preparation across services. Image generator upgrades reduce latency, improving pilot comfort during aggressive maneuver rehearsals. Interoperable visual standards facilitate content sharing across networked training nodes. Enhanced visual realism improves instructor confidence in substituting live sorties for simulator sessions. Lifecycle support contracts align visual refresh cycles with avionics block updates.

Adoption of distributed mission training with allied forces

Distributed mission training enables joint rehearsals across secure networks, improving coalition interoperability. Network gateways support synchronized scenarios across geographically separated training nodes. Standardized scenario packages facilitate shared doctrine rehearsal without exposing sensitive operational details. Time zone coordinated exercises increase training throughput without airspace constraints affecting live operations. Secure identity management frameworks enable controlled access for allied participants. Interoperability testing during 2024 validated cross-domain training workflows across multiple mission systems. Data governance frameworks ensure compliance with security policies during collaborative scenario execution. Synthetic adversary models enhance realism for coalition planning exercises. Debrief analytics aggregate multi-site telemetry for comprehensive performance assessment. Persistent scenario libraries accelerate joint readiness cycles across recurring exercise programs.

Future Outlook

The market is expected to prioritize networked training architectures, cybersecurity accreditation, and modular upgrade pathways. Distributed mission training will expand through interoperable standards and shared scenario governance. Visual system modernization and analytics-driven debriefing will shape procurement priorities. Policy continuity and lifecycle support models will anchor long-term capacity planning across secure training ecosystems.

Major Players

- CAE

- L3Harris Technologies

- Thales Group

- Leonardo

- Saab

- Boeing Defense

- Lockheed Martin

- Elbit Systems

- Indra Sistemas

- Collins Aerospace

- Kongsberg Defence & Aerospace

- TRU Simulation + Training

- Cubic Corporation

- Simlat

- Rheinmetall

Key Target Audience

- Air force training commands

- Defense procurement agencies

- Program management offices for rotary-wing platforms

- System integrators and training service providers

- Operations and readiness directorates

- Cybersecurity accreditation authorities

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Core variables were defined across simulator fidelity, network interoperability, lifecycle support, and accreditation pathways. Taxonomy aligned platforms, applications, and deployment environments within secure facilities. Variables captured operational readiness outcomes and training throughput dynamics. Data structures supported longitudinal comparison across upgrade cycles.

Step 2: Market Analysis and Construction

Demand drivers were mapped across fleet modernization, training doctrines, and networked rehearsal requirements. Scenario workflows and integration dependencies informed configuration baselines. Capacity planning incorporated instructor availability, utilization patterns, and acceptance testing constraints. Analytical frameworks aligned lifecycle pathways with avionics evolution.

Step 3: Hypothesis Validation and Expert Consultation

Operational assumptions were validated through practitioner workshops and technical reviews. Configuration tradeoffs were stress-tested against security compliance and integration feasibility. Scenario realism benchmarks were reviewed by training leadership. Iterative feedback refined taxonomy and readiness metrics.

Step 4: Research Synthesis and Final Output

Findings were synthesized into coherent narratives aligned with procurement realities and operational constraints. Cross-validation reconciled scenario usage, utilization patterns, and lifecycle dependencies. Outputs emphasized actionable insights for planning and capability development. Documentation ensured clarity for decision alignment.

- Executive Summary

- Research Methodology (Market Definitions and simulator scope boundaries, Platform taxonomy mapping across helicopter fleets, Bottom-up procurement and installed-base sizing, Revenue attribution by contract type and support lifecycle, Primary interviews with RSAF, OEMs, and integrators, Triangulation using tender data, budgets, and delivery schedules, Assumptions on upgrade cycles and training hours utilization)

- Definition and scope

- Market evolution in Singapore defense training

- Training and mission rehearsal use cases

- Ecosystem structure

- Supply chain and contracting channels

- Regulatory and security compliance environment

- Growth Drivers

Modernization of rotary-wing fleets within the RSAF

Rising emphasis on synthetic training to reduce live-flight costs

Expansion of joint and networked mission training requirements

Higher operational tempo and complex mission profiles

Safety and risk mitigation in high-threat training scenarios

Lifecycle extension programs requiring updated training systems - Challenges

High capital expenditure and long procurement cycles

Stringent security and export control compliance requirements

Integration complexity with legacy avionics and mission systems

Limited local supplier base and dependence on foreign OEMs

Long certification timelines for new simulator configurations

Rapid technology obsolescence in visual and computing systems - Opportunities

Upgrades from legacy simulators to high-fidelity visual systems

Adoption of distributed mission training with allied forces

Expansion into maintenance and mission support training modules

Use of mixed reality for cost-effective scenario rehearsal

Long-term support and performance-based logistics contracts

Localization and customization for tropical and urban environments - Trends

Shift toward networked and interoperable training environments

Increased use of synthetic battlespace and AI-driven scenarios

Modular simulator architectures for faster upgrades

Greater focus on cybersecurity in training networks

Blending of live, virtual, and constructive training constructs

Outcome-based contracting for availability and performance - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis - Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base or Active Systems, 2020–2025

- By Average Selling Price or Unit Economics, 2020–2025

- By Fleet Type (in Value %)

Attack helicopters

Utility helicopters

Reconnaissance helicopters

Light attack and trainer helicopters - By Application (in Value %)

Pilot conversion and recurrent training

Mission rehearsal and tactics development

Crew coordination and multi-ship training

Maintenance and troubleshooting training

Joint and coalition exercise preparation - By Technology Architecture (in Value %)

Full-flight simulators

Fixed-base simulators

Part-task trainers

Virtual reality based simulators

Mixed reality and synthetic environment systems - By End-Use Industry (in Value %)

Air force and defense aviation units

Defense training academies

OEM training centers

Private defense training providers

Government research and test establishments - By Connectivity Type (in Value %)

Standalone systems

Networked multi-simulator suites

Distributed mission training environments

Secure cloud-enabled training networks - By Region (in Value %)

Singapore

ASEAN

Asia-Pacific

Europe

North America

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (Simulator fidelity level, Platform coverage, Networked training capability, Localization and customization depth, Lifecycle support and upgrades, Cybersecurity compliance, Delivery timelines, Total cost of ownership) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

CAE

L3Harris Technologies

Thales Group

Rheinmetall

Leonardo

Saab

Boeing Defense

Lockheed Martin

Elbit Systems

Indra Sistemas

Collins Aerospace

Kongsberg Defence & Aerospace

TRU Simulation + Training

Cubic Corporation

Simlat

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base or Active Systems, 2026–2035

- By Average Selling Price or Unit Economics, 2026–2035