Market Overview

The Singapore commercial aircraft air data systems market current size stands at around USD ~ million, reflecting sustained demand from line-fit programs, retrofit cycles, and spares provisioning across in-service fleets. The ecosystem spans certified avionics suppliers, authorized repair stations, calibration laboratories, and airline engineering units embedded within integrated maintenance networks. Value creation is driven by certification-intensive components, redundancy architectures, and reliability requirements embedded in flight safety frameworks, with procurement anchored in long-term serviceability commitments and approved parts traceability across regulated maintenance environments.

Demand concentration is anchored in the Singapore aviation hub, where dense airline operations, a mature MRO cluster, and strong airworthiness governance shape purchasing behavior. Infrastructure concentration around Changi aviation complexes, proximity to regional fleet operators, and a dense network of authorized repair stations accelerate turnaround cycles. Policy alignment with international certification regimes supports rapid validation of avionics upgrades. The ecosystem benefits from co-location of airlines, lessors, and engineering organizations, reinforcing adoption of advanced air data architectures and integrated avionics modernization pathways.

Market Segmentation

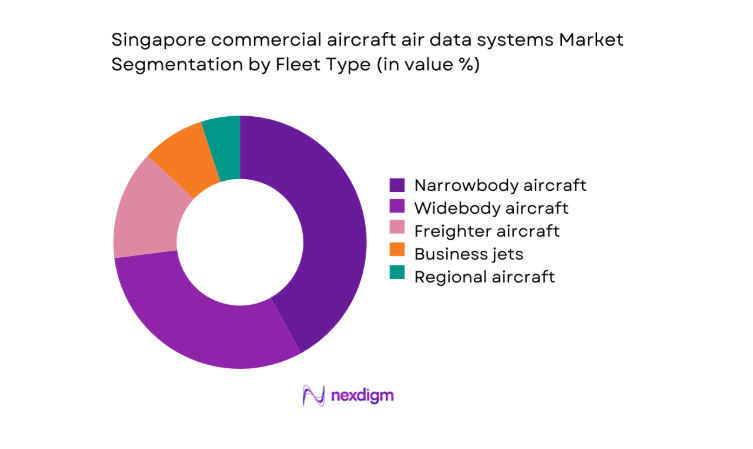

By Fleet Type

Narrowbody fleets dominate demand as high-frequency short-haul operations create accelerated wear cycles for pitot-static sensors and air data computers, intensifying replacement and calibration frequency. Widebody aircraft contribute steady retrofit demand linked to avionics modernization programs and redundancy upgrades aligned with long-haul reliability standards. Freighter conversions add incremental demand through structural modifications requiring air data recalibration and re-certification. Business jets contribute niche volumes through premium maintenance practices and shorter maintenance intervals. Regional aircraft demand is shaped by hub-and-spoke utilization, with higher utilization rates reinforcing preventive maintenance and spares stocking across authorized service networks.

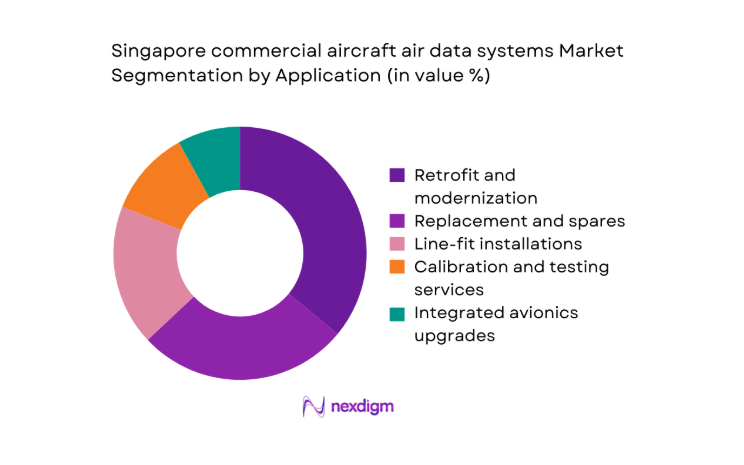

By Application

Retrofit and modernization programs dominate as airlines prioritize avionics harmonization across mixed fleets to meet evolving navigation performance and safety mandates. Replacement and spares form a steady baseline driven by component lifecycles, contamination exposure, and calibration intervals tied to operational intensity. Line-fit demand remains linked to new aircraft inductions routed through Singapore-based delivery and acceptance workflows. Calibration and testing services expand as operators tighten reliability metrics and data integrity thresholds. Integrated avionics upgrade packages gain traction where air data systems are bundled with flight management and monitoring enhancements to streamline certification and reduce downtime across maintenance windows.

Competitive Landscape

The competitive environment is shaped by certification depth, platform coverage, and proximity to authorized maintenance networks in Singapore. Providers differentiate through reliability records, integration capability with digital avionics, and responsiveness to airline engineering requirements. Long-term service agreements, calibration turnaround performance, and regulatory readiness influence vendor positioning within airline and MRO procurement frameworks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Honeywell International | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Electronics & Defense | 1924 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin | 1989 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore commercial aircraft air data systems Market Analysis

Growth Drivers

Rising narrowbody fleet deployments through Singapore hub operations

High-frequency short-haul utilization through Singapore intensified narrowbody flight cycles, increasing pitot-static exposure to moisture and particulate contamination. In 2024, Changi recorded 346000 aircraft movements, sustaining dense daily rotations across ASEAN corridors. Narrowbody active fleets serving Singapore exceeded 1400 aircraft in 2025, driving accelerated calibration intervals and replacement needs. The Civil Aviation Authority of Singapore issued 312 airworthiness directives in 2023 related to sensor integrity and avionics reliability. Expansion of regional routes added 28 new city pairs between 2022 and 2024, elevating utilization hours and maintenance triggers. Airlines reported average daily narrowbody sectors rising from 6 in 2022 to 7 in 2025, reinforcing maintenance throughput.

Increased avionics modernization to meet performance-based navigation mandates

Performance-based navigation compliance tightened across Asia-Pacific, compelling airlines to modernize avionics architectures integrated with air data systems. Between 2022 and 2025, Singapore-approved navigation specifications expanded to cover 19 additional terminal procedures, increasing dependency on precise air data inputs. The number of aircraft undergoing avionics modification checks at Singapore MRO facilities reached 1180 in 2024, reflecting sustained retrofit throughput. Regional regulators conducted 146 conformance audits in 2023 focused on navigation performance and data integrity. Fleet harmonization programs reduced mixed-configuration fleets from 4 to 2 variants per airline between 2022 and 2025, increasing standardized air data computer adoption and installation cadence.

Challenges

High certification and validation lead times for new air data systems

Certification complexity remains a binding constraint as air data systems require multi-authority validation and aircraft-specific approvals. In 2023, average supplemental type certificate processing across Singapore-authorized programs exceeded 210 days, delaying fleet-wide rollouts. Cross-validation with FAA and EASA added 2 parallel review cycles per modification program during 2022 to 2025. Engineering organizations processed 680 conformity inspections in 2024, stretching quality assurance capacity. Documentation packages for avionics modifications expanded to 4200 pages per program in 2025, increasing review overhead. The backlog of certification submissions at authorized offices reached 94 active cases in 2024, slowing retrofit throughput and deferring operational benefits.

Supply chain constraints for precision sensors and electronics

Global electronics supply volatility constrained availability of precision pressure sensors and microelectronics embedded in air data systems. Lead times for avionics-grade components extended from 24 weeks in 2022 to 46 weeks in 2024, disrupting maintenance planning. Singapore MRO inventory turns declined from 7 in 2022 to 5 in 2025, reflecting buffer stock strategies. Import clearances for controlled avionics parts averaged 18 days in 2024, adding logistics friction. Quality acceptance rates at incoming inspection fell to 96 in 2023 due to batch variability, increasing rework cycles. Maintenance deferrals linked to parts availability exceeded 320 events in 2024 across hub-based fleets.

Opportunities

Retrofit demand from aging widebody and freighter fleets

Widebody and freighter fleets operating through Singapore continued aging profiles, creating sustained retrofit windows. In 2025, 38 percent of long-haul aircraft serving Singapore exceeded 15 years in service, elevating avionics modernization requirements. Cargo movements reached 1.9 million tonnes in 2024, intensifying freighter utilization cycles and maintenance triggers. Heavy check inductions at Singapore MRO facilities totaled 410 widebody events in 2023, providing retrofit access points. Conversion programs added 74 passenger-to-freighter inductions between 2022 and 2025, requiring recalibration and air data system upgrades. Regulatory focus on redundancy following 2023 safety bulletins increased retrofit inclusion rates within scheduled heavy maintenance windows.

Digital air data systems enabling predictive maintenance services

Digital air data architectures create data streams that enable predictive maintenance integration with airline health monitoring platforms. In 2024, 62 percent of Singapore-based fleets connected air data outputs to centralized maintenance analytics systems. Fault detection intervals declined from 14 days in 2022 to 5 days in 2025 through continuous monitoring adoption. Maintenance task cards incorporating sensor health analytics increased to 920 in 2024, improving early intervention. Engineering teams trained 680 technicians in data-driven diagnostics during 2023 and 2024, strengthening operational readiness. Integration with aircraft health management systems reduced unscheduled removals from 3.8 events per aircraft in 2022 to 2.4 in 2025, supporting scalable service models.

Future Outlook

The market outlook through 2035 reflects sustained retrofit cycles, deeper integration of digital avionics, and continued hub-driven utilization intensity in Singapore. Regulatory alignment and certification capacity expansion will shape adoption velocity. Fleet renewal alongside freighter conversions will sustain demand for redundancy upgrades. MRO digitization will further embed predictive maintenance use cases.

Major Players

- Honeywell International

- Collins Aerospace

- Safran Electronics & Defense

- Thales Group

- Garmin

- Astronics Corporation

- Curtiss-Wright Defense Solutions

- Liebherr-Aerospace

- Elbit Systems

- Ametek

- Parker Aerospace

- Meggitt

- United Technologies Aerospace Systems

- Esterline Technologies

- Sensonor

Key Target Audience

- Commercial airlines operating hub-based fleets

- Cargo and logistics operators with freighter fleets

- Aircraft leasing companies managing regional portfolios

- Maintenance, Repair and Overhaul service providers

- Aircraft original equipment manufacturers

- Avionics integrators and certified repair stations

- Investments and venture capital firms

- Government and regulatory bodies with agency names including Civil Aviation Authority of Singapore

Research Methodology

Step 1: Identification of Key Variables

Variables were defined across fleet composition, maintenance cycles, certification pathways, and avionics integration depth within Singapore-based operations. Scope boundaries were aligned to commercial aircraft applications, excluding defense platforms. Key demand levers were mapped to utilization intensity and regulatory compliance triggers. Data points emphasized operational indicators and maintenance workflows.

Step 2: Market Analysis and Construction

The analytical framework structured demand by fleet type and application across retrofit, replacement, and line-fit contexts. Institutional indicators from aviation authorities and airport operations informed utilization patterns. Maintenance event volumes and certification throughput shaped adoption constraints. Scenario construction emphasized operational readiness and supply chain resilience.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through structured discussions with airline engineering teams, MRO managers, and regulatory compliance specialists. Operational bottlenecks and certification timelines were stress-tested against institutional workflows. Feedback loops refined assumptions on retrofit windows, digital integration, and maintenance productivity.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a coherent market narrative linking operational drivers, regulatory constraints, and technology pathways. Cross-validation ensured internal consistency across segmentation lenses and analysis themes. Final outputs prioritized decision relevance for procurement, integration planning, and service strategy development.

- Executive Summary

- Research Methodology (Market Definitions and scope for commercial aircraft air data systems in Singapore MRO and OEM integration, Fleet and platform taxonomy mapping across narrowbody, widebody, business jet and regional aircraft operating in Singapore, Bottom-up market sizing using line-fit counts, replacement cycles and retrofit penetration in Singapore-based fleets)

- Definition and Scope

- Market evolution

- Usage and integration pathways within avionics suites

- Ecosystem structure across OEMs, Tier-1 suppliers and Singapore MROs

- Supply chain and distribution through authorized repair stations

- Regulatory environment under CAAS, FAA and EASA validations

- Growth Drivers

Rising narrowbody fleet deployments through Singapore hub operations

Increased avionics modernization to meet performance-based navigation mandates

Growth in cargo fleet utilization driving higher replacement cycles

Expansion of Singapore MRO capacity for avionics retrofits

Airline focus on safety-critical sensor redundancy upgrades

OEM adoption of solid-state air data architectures - Challenges

High certification and validation lead times for new air data systems

Supply chain constraints for precision sensors and electronics

Long aircraft downtime windows limiting retrofit throughput

Stringent CAAS and OEM approval processes for aftermarket parts

Price sensitivity among low-cost carriers operating narrowbody fleets

Dependence on global OEM production schedules for line-fit demand - Opportunities

Retrofit demand from aging widebody and freighter fleets

Digital air data systems enabling predictive maintenance services

Growth in business jet traffic through Singapore Changi

Localization of repair and calibration capabilities within Singapore MROs

Partnerships between OEMs and Singapore-based avionics specialists

Adoption of connected maintenance platforms linked to air data outputs - Trends

Shift from pneumatic to solid-state air data sensors

Integration of air data with flight data monitoring systems

Increased redundancy and fault-tolerant architectures

Use of digital twins for air data system performance monitoring

Growth of power-by-the-hour service contracts for avionics

Standardization of interfaces for next-generation avionics suites - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrowbody aircraft

Widebody aircraft

Regional aircraft

Business jets

Freighter and cargo-converted aircraft - By Application (in Value %)

Line-fit installations on new aircraft deliveries

Retrofit and modernization programs

Replacement and spares for in-service fleets

Calibration and testing services

Integrated avionics upgrade packages - By Technology Architecture (in Value %)

Pneumatic air data systems

Solid-state air data systems

Smart air data computers with integrated sensors

Redundant multi-channel architectures

Digital avionics-integrated air data suites - By End-Use Industry (in Value %)

Commercial passenger airlines

Cargo and logistics operators

Aircraft leasing companies

Business aviation operators

Maintenance, Repair and Overhaul providers - By Connectivity Type (in Value %)

ARINC 429-based systems

ARINC 664/AFDX-enabled systems

Ethernet-based avionics interfaces

Wireless maintenance data offload-enabled systems

Hybrid legacy-digital interfaces - By Region (in Value %)

Singapore domestic operations

Southeast Asia inbound fleets serviced in Singapore

East Asia transit and hub operations

Long-haul intercontinental fleets supported in Singapore

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product reliability and certification status, breadth of aircraft platform coverage, local MRO support footprint in Singapore, retrofit and line-fit capability, pricing competitiveness in aftermarket, lead times and supply assurance, digital diagnostics and connectivity features, regulatory approval breadth)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Honeywell International

Collins Aerospace

Safran Electronics & Defense

Thales Group

Meggitt

Parker Aerospace

Garmin

Astronics Corporation

Curtiss-Wright Defense Solutions

United Technologies Aerospace Systems

Liebherr-Aerospace

Elbit Systems

Ametek

Esterline Technologies

Sensonor

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035