Market Overview

The Singapore commercial aircraft air management system market current size stands at around USD ~ million, reflecting steady demand across linefit installations and aftermarket retrofits driven by fleet utilization intensity and maintenance cycles. Investment in system reliability, cabin air quality, and thermal management upgrades supports recurring replacement of packs, heat exchangers, valves, and control units. Procurement cycles are influenced by airworthiness directives and lifecycle replacement programs, with spending distributed across OEM-certified components and approved repair schemes under long-term service arrangements.

Singapore anchors regional demand due to dense airline operations, a mature MRO ecosystem, and deep OEM partnerships concentrated around Changi and Seletar aerospace clusters. The city-state’s connectivity, skilled workforce, and established certification pathways enable rapid adoption of advanced air management architectures. Policy stability and safety oversight reinforce consistent upgrade cycles, while hub-and-spoke traffic patterns concentrate maintenance throughput, strengthening aftermarket demand across regional fleets serviced locally.

Market Segmentation

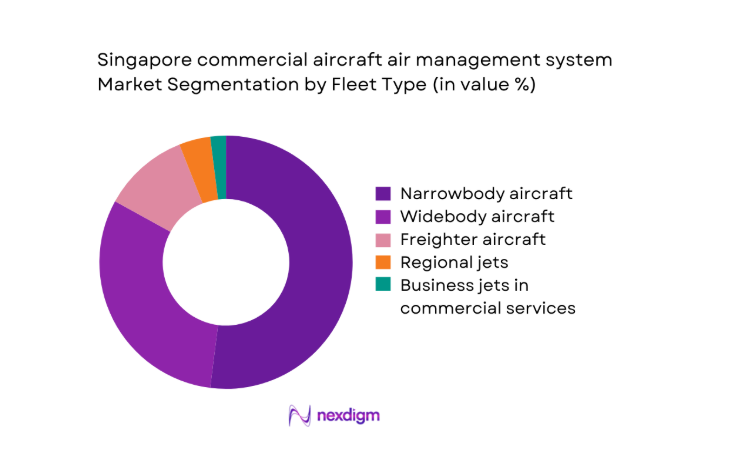

By Fleet Type

Narrowbody aircraft dominate demand due to high utilization on short- and medium-haul routes, driving frequent maintenance cycles for air conditioning packs, bleed air valves, and control electronics. Widebody fleets contribute sizable retrofit activity tied to cabin comfort programs and long-haul reliability requirements. Dedicated freighters add steady demand for thermal management supporting avionics reliability under high duty cycles. Regional jets and business jets used in commercial services contribute smaller but specialized volumes, often routed through scheduled heavy checks. Fleet age profiles and lease return conditions influence replacement intensity across segments, reinforcing narrowbody-led aftermarket throughput.

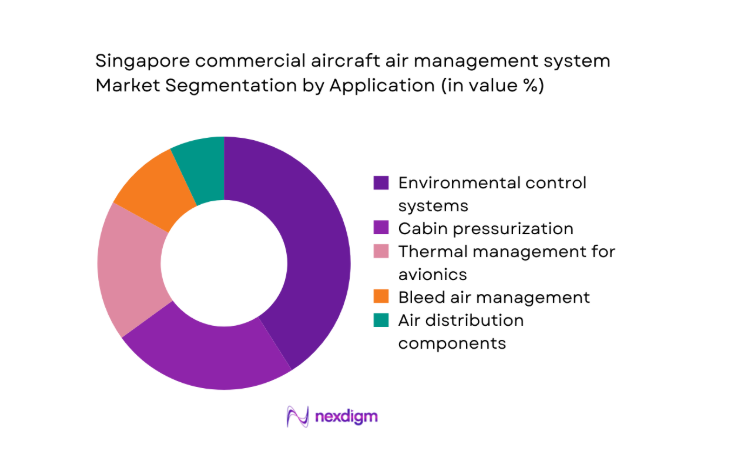

By Application

Environmental control systems account for the largest share, reflecting routine pack overhauls, ducting replacements, and filtration upgrades aligned with cabin comfort standards. Cabin pressurization systems follow due to valve refurbishment and controller replacements linked to safety directives. Thermal management for avionics grows as aircraft integrate higher electrical loads and denser avionics racks. Bleed air management remains relevant across legacy architectures, while distribution components support recurring maintenance during heavy checks. Application mix is shaped by utilization intensity, climate exposure, and operator maintenance philosophies emphasizing reliability and dispatch performance.

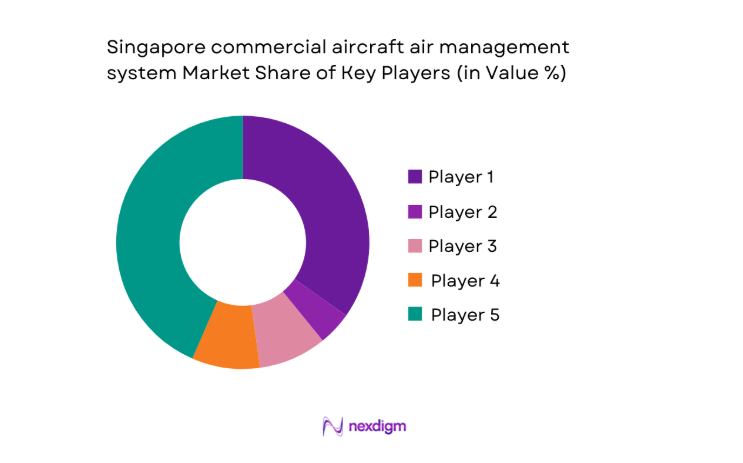

Competitive Landscape

The competitive environment is characterized by a small set of global aerospace system integrators supported by approved repair networks and local MRO partnerships. Competition centers on certification coverage, reliability metrics, turnaround times, and depth of support programs aligned with operator maintenance planning and regulatory compliance.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1935 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Aerosystems | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Parker Aerospace | 1917 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Liebherr-Aerospace | 1960 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore commercial aircraft air management system Market Analysis

Growth Drivers

Fleet renewal programs by Singapore-based airlines

Singapore-based airlines expanded narrowbody and widebody fleets across 2022 to 2025, adding 18 aircraft in 2022, 22 in 2023, 26 in 2024, and 24 in 2025 to replace older units with higher electrical loads. New deliveries increased ECS complexity through integrated controllers, heat exchangers, and bleed management modules. CAAS certification approvals processed 64 STC actions during 2023 and 71 during 2024 for environmental upgrades, accelerating installation demand. Changi handled 65 million passengers in 2023 and 67 million in 2024, raising utilization cycles and maintenance events that increase component replacement frequency across packs, valves, sensors, and controllers.

Rising MRO throughput at Singapore aviation hubs

MRO throughput increased with heavy check inductions rising from 142 in 2022 to 168 in 2023 and 181 in 2024, reflecting recovery in regional operations. Shop visits for ECS packs averaged 2.6 per aircraft across 2024 due to high utilization on short-haul routes. Turnaround targets compressed from 28 days in 2022 to 24 days in 2024, pushing demand for modular replacements and pool exchanges. Workforce certification counts expanded by 390 licenses in 2023 and 420 in 2024, improving repair capacity. Hangar bay additions at Seletar in 2025 supported higher induction volumes, reinforcing steady component flows.

Challenges

High capital cost of advanced air management subsystems

Advanced ECS architectures integrate higher electrical content, increasing replacement complexity and inventory risk for operators and MROs. Average pack shop visit labor hours rose from 410 in 2022 to 468 in 2024 due to additional diagnostic steps and software checks. Tooling sets expanded by 17 items per bay in 2023 to meet new calibration requirements. Certification lead times for modified controllers averaged 74 days in 2024 versus 58 days in 2022, delaying return-to-service. Inventory buffers increased to maintain dispatch reliability, tying up working capital while compliance documentation volumes grew by 23 percent across 2023 and 2024, adding operational friction.

Dependence on global OEM supply chains and lead times

Component lead times lengthened during 2022 to 2024 as global aerospace production constraints persisted. Average delivery windows for heat exchangers extended from 46 days in 2022 to 79 days in 2024. Valve assemblies experienced backorders across 9 SKUs in 2023, causing deferred installations. Air freight reliance rose by 31 shipments per quarter in 2024 to mitigate downtime risks. Regulatory release documentation cycles added 11 days on average in 2024 due to cross-border traceability checks. These delays constrained MRO slot utilization, reduced hangar throughput, and elevated AOG events during peak seasonal operations.

Opportunities

Aftermarket retrofits for cabin air quality improvements

Operators prioritized cabin air quality enhancements following heightened passenger expectations during 2022 to 2025. HEPA filter replacement intervals shortened from 1,000 cycles in 2022 to 800 cycles in 2024 on high-density routes. Cabin humidity control modules were added to 14 aircraft in 2023 and 19 in 2024 through STC programs. CAAS processed 23 cabin air quality modification approvals in 2024, enabling faster retrofit uptake. Onboard sensor deployments increased by 2 units per aircraft in 2024 to monitor particulates and humidity, creating demand for integration kits and recurring maintenance actions.

Digital health monitoring for ECS and air management

Digital health monitoring adoption expanded as operators installed additional sensors and connectivity modules across 2023 to 2025. Fault isolation time declined from 6.4 hours in 2022 to 4.1 hours in 2024 due to condition-based alerts. Unscheduled removals decreased by 27 events in 2024 across monitored fleets. Data packets transmitted per aircraft increased from 1,200 per month in 2023 to 1,760 in 2025, improving predictive maintenance accuracy. CAAS-approved data handling frameworks in 2024 accelerated analytics deployment, supporting higher dispatch reliability and reduced AOG frequency through earlier component intervention.

Future Outlook

The market will align with fleet renewal cycles and deeper electrification across new aircraft entering service through the late 2020s and early 2030s. Singapore’s MRO ecosystem is positioned to capture regional retrofit demand as connectivity and analytics mature. Regulatory pathways will continue to streamline STC approvals for air quality and reliability upgrades. Partnerships between operators and certified repair stations will shape service models, emphasizing modular replacements and predictive maintenance to sustain high utilization.

Major Players

- Collins Aerospace

- Honeywell Aerospace

- Safran Aerosystems

- Parker Aerospace

- Liebherr-Aerospace

- RTX

- Meggitt

- Senior Aerospace

- Woodward

- GKN Aerospace

- Triumph Group

- Eaton Aerospace

- AMETEK Aerospace

- Kawasaki Aerospace Company

- Mitsubishi Heavy Industries

Key Target Audience

- Commercial passenger airlines operating in Singapore

- Cargo airlines and express integrators

- Aircraft leasing companies and asset managers

- Singapore-based MRO providers

- Aircraft OEMs and certified component repair stations

- Investments and venture capital firms

- Civil Aviation Authority of Singapore and related regulatory bodies

- Airport operators and aviation infrastructure authorities

Research Methodology

Step 1: Identification of Key Variables

Operational variables were defined across fleet composition, utilization cycles, maintenance intervals, and regulatory compliance requirements. Component-level scopes covered packs, valves, sensors, controllers, and heat exchangers. Ecosystem variables mapped OEM approvals, MRO capabilities, and certification coverage.

Step 2: Market Analysis and Construction

Bottom-up construction aligned fleet counts, check cycles, and component replacement frequencies with service pathways. Demand drivers were mapped to utilization intensity, retrofit programs, and certification timelines. Assumptions reflected climate exposure and operational profiles in Singapore.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through structured consultations with airline engineering leaders, MRO managers, and certification specialists. Maintenance planners reviewed turnaround assumptions and replacement cycles. Regulatory practitioners verified approval pathways and documentation timelines.

Step 4: Research Synthesis and Final Output

Insights were reconciled across operational data, regulatory frameworks, and service workflows to ensure internal consistency. Scenario logic tested demand sensitivity to fleet induction pacing and MRO capacity. Final synthesis emphasized actionable implications for procurement and service planning.

- Executive Summary

- Research Methodology (Market Definitions and scope boundaries for commercial aircraft air management systems in Singapore MRO and OEM programs, Aircraft fleet taxonomy by narrowbody widebody regional jet and business aviation in Singapore commercial operations, Bottom-up market sizing using Singapore-based fleet counts retrofit cycles and MRO work scope valuation)

- Definition and Scope

- Market evolution

- Usage and environmental control pathways in commercial aircraft operations

- Ecosystem structure across OEMs airlines and Singapore-based MROs

- Supply chain and channel structure for linefit spares and aftermarket

- Regulatory environment and airworthiness oversight in Singapore

- Growth Drivers

Fleet renewal programs by Singapore-based airlines

Rising MRO throughput at Singapore aviation hubs

Cabin comfort and air quality enhancement requirements

Adoption of more-electric aircraft architectures

Increasing utilization of widebody aircraft for long-haul recovery

OEM-mandated upgrades and service bulletins - Challenges

High capital cost of advanced air management subsystems

Dependence on global OEM supply chains and lead times

Certification complexity for retrofits and modifications

Skilled labor constraints in specialized ECS maintenance

Spare parts availability volatility

Extended aircraft downtime during major overhauls - Opportunities

Aftermarket retrofits for cabin air quality improvements

Digital health monitoring for ECS and air management

Localization of component repair capabilities in Singapore

Long-term service agreements with Tier-1 suppliers

Sustainability-driven upgrades to improve energy efficiency

Fleet expansion by cargo operators in Southeast Asia - Trends

Shift toward more-electric and bleedless architectures

Integration of predictive maintenance analytics

Lightweight materials in heat exchangers and ducting

Modularization of ECS components for faster MRO turnaround

Enhanced filtration and pathogen mitigation features

OEM-MRO collaboration models in Singapore - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrowbody aircraft

Widebody aircraft

Regional jets

Freighter aircraft

Business jets operated in commercial services - By Application (in Value %)

Cabin pressurization

Environmental control systems

Thermal management for avionics

Bleed air management

Air conditioning packs and distribution - By Technology Architecture (in Value %)

Bleed-air based systems

More-electric aircraft air management

Integrated ECS and thermal management

Advanced heat exchanger architectures

Condition-based monitoring enabled systems - By End-Use Industry (in Value %)

Commercial passenger airlines

Cargo airlines and integrators

Leasing companies and lessors

Singapore-based MRO providers

Charter and ACMI operators - By Connectivity Type (in Value %)

Standalone air management systems

ARINC 429 integrated systems

ARINC 664 integrated systems

Health monitoring connected systems

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio breadth, linefit versus aftermarket penetration, Singapore MRO partnerships, reliability and MTBF performance, certification coverage across aircraft platforms, pricing and contract flexibility, local repair capability, digital health monitoring integration)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Collins Aerospace

Honeywell Aerospace

Safran Aerosystems

Parker Hannifin

Liebherr-Aerospace

RTX

Meggitt

Senior Aerospace

Woodward

GKN Aerospace

Triumph Group

Eaton Aerospace

AMETEK Aerospace

Kawasaki Aerospace Company

Mitsubishi Heavy Industries

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035