Market Overview

The Singapore commercial aircraft avionic systems market current size stands at around USD ~ million, reflecting sustained demand for certified flight decks, navigation suites, communication links, surveillance capabilities, and integrated avionics platforms across active commercial fleets and retrofit programs. Investment cycles prioritize compliance-driven upgrades, reliability enhancements, and software-enabled functionality. Procurement is shaped by airworthiness mandates, fleet commonality objectives, and lifecycle serviceability requirements. Spending patterns emphasize long-term maintainability, cybersecurity hardening, and interoperability with air traffic management modernization initiatives.

Singapore’s dominance is anchored in its role as a regional aviation hub with dense airline operations, deep maintenance ecosystems, and mature certification frameworks. Concentrated airline engineering capabilities, advanced MRO infrastructure, and proximity to regional flight corridors create sustained avionics demand. The policy environment favors safety, CNS modernization, and digitalization of air traffic systems, accelerating adoption of connected cockpit solutions. Strong logistics connectivity established supplier networks, and regulatory harmonization with international standards reinforce ecosystem maturity and technology deployment velocity.

Market Segmentation

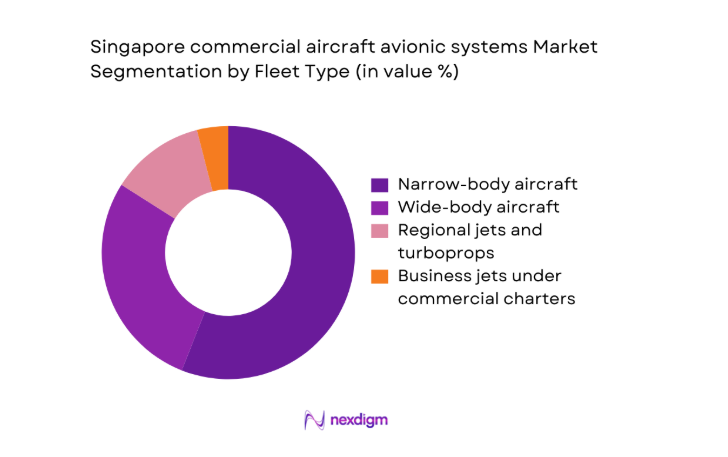

By Fleet Type

Narrow-body aircraft dominate avionics demand due to higher utilization intensity, shorter maintenance cycles, and frequent cabin and cockpit refresh programs supporting dense regional routes. Fleet commonality strategies encourage standardized avionics architectures to simplify training and spares management. Retrofit cycles are more frequent in narrow-body fleets because operational tempo accelerates component wear and software obsolescence. Leasing-driven fleet rotations also increase line-fit alignment and post-delivery avionics reconfiguration. Wide-body programs contribute fewer unit volumes but higher system complexity, while regional aircraft sustain steady demand for compliant navigation and surveillance suites aligned with evolving airspace mandates.

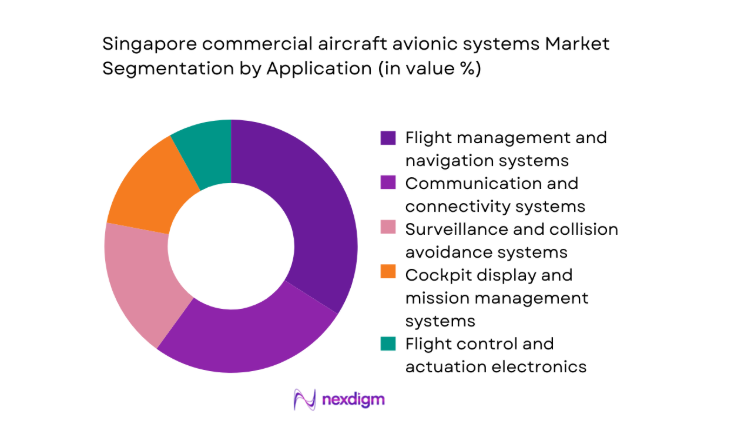

By Application

Flight management and navigation systems account for the largest value share due to mandatory performance-based navigation upgrades, software refresh cycles, and integration with surveillance and communication modules. Communication and connectivity follow closely, driven by operational efficiency requirements and cockpit data flows. Surveillance and collision avoidance upgrades are prioritized by compliance timelines and airspace modernization. Cockpit displays and mission management gain traction through digitization initiatives that improve situational awareness. Flight control electronics remain stable, supported by reliability mandates and periodic retrofits aligned with certification updates and service bulletins.

Competitive Landscape

The competitive environment is shaped by certification depth, installed base continuity, retrofit execution capability, and lifecycle service coverage. Differentiation centers on modular architectures, software upgrade cadence, regional MRO support, and alignment with regulatory compliance cycles. Long-term partnerships with operators and service providers reinforce switching costs, while open architecture strategies influence future competitive intensity.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Avionics | 2000 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Electronics & Defense | 2015 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin Aviation | 1989 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore commercial aircraft avionic systems Market Analysis

Growth Drivers

Fleet modernization by Singapore-based carriers and lessors

Fleet renewal programs accelerated between 2022 and 2025 as operators inducted 74 new narrow-body aircraft and retired 38 older units, increasing demand for certified flight decks and integrated navigation suites. National aviation authorities updated performance-based navigation mandates in 2023, expanding required avionics functions across terminal and en-route phases. Air traffic movements through Singapore airspace reached 1910000 in 2024, raising utilization cycles and maintenance intervals. Training pipelines expanded with 620 additional licensed engineers certified in avionics disciplines during 2024, improving retrofit throughput. Airline maintenance slots increased from 14 to 19 docks by 2025, enabling parallel avionics upgrades. These institutional and operational indicators reinforce sustained system replacement cycles.

Mandated upgrades for CNS/ATM and ADS-B compliance

Airspace modernization programs between 2022 and 2025 expanded CNS capabilities, requiring ADS-B Out equipage across controlled airspace corridors supporting 128 daily international routes. Regulatory audits in 2024 recorded 97 compliance checkpoints per operator for surveillance, navigation accuracy, and communication redundancy. The air navigation service provider upgraded 23 ground stations to support enhanced data link protocols, increasing cockpit-system interoperability requirements. Certification authorities processed 146 supplemental type certificates related to avionics updates in 2023 and 2024, accelerating retrofit pipelines. Operator safety management systems reported 412 reportable navigation deviations in 2022, prompting accelerated avionics software revisions. These institutional signals intensify compliance-driven avionics demand cycles.

Challenges

High certification and regulatory approval timelines for avionics upgrades

Certification pathways remain lengthy, with 9 approval stages per major avionics modification between 2022 and 2025, extending aircraft downtime windows. Engineering organizations processed 284 conformity inspections in 2024, creating bottlenecks for simultaneous fleet upgrades. Type certification review cycles averaged 11 months across software-intensive avionics changes during 2023 and 2024, delaying operational deployment. Airworthiness authorities issued 67 special conditions for cybersecurity and data integrity in 2025, increasing documentation burdens. MRO capacity constraints surfaced as 41 aircraft awaited certification signoff in 2024. These institutional approval dynamics slow retrofit velocity, increase scheduling risk, and compress maintenance planning windows for operators managing mixed fleets.

Supply chain constraints for semiconductors and certified components

Avionics lead times fluctuated between 24 and 38 weeks across 2022 to 2025 due to constrained semiconductor fabrication capacity and certification lot releases. Logistics disruptions affected 17 certified component categories in 2024, requiring revalidation of alternate suppliers. Repair turnaround times increased from 12 to 19 days for line-replaceable units during peak demand periods in 2023. Regional bonded warehouse inventories covered 61 days of critical spares in 2025, below operational targets. Airworthiness traceability audits flagged 23 documentation gaps in 2024, extending release cycles. These operational frictions elevate downtime exposure and complicate synchronized fleet-wide avionics upgrades.

Opportunities

Retrofit demand for legacy fleets operating from Singapore

Legacy aircraft cohorts remained active through 2022 to 2025, with 112 aircraft exceeding 12 years of service life operating scheduled routes from Singapore. Navigation accuracy incidents declined from 84 in 2022 to 51 in 2024 following targeted avionics retrofits, indicating performance gains. Regulatory advisories issued 29 service bulletins during 2023 and 2024 encouraging upgrades for surveillance integrity and data link resilience. MRO hangar utilization increased from 71 to 86 percent by 2025, signaling retrofit capacity absorption. Pilot training syllabi incorporated 14 new avionics modules in 2024, supporting operational readiness. These indicators point to sustained retrofit pipelines anchored in compliance and reliability imperatives.

Adoption of open avionics architectures enabling modular upgrades

Open systems architectures gained regulatory recognition through 18 certification guidance notes issued between 2023 and 2025, enabling modular avionics substitutions. Software configuration audits documented 263 successful module swaps without full system recertification in 2024, reducing downtime. Engineering change requests for interface standardization increased to 97 submissions in 2025, reflecting operator demand for flexibility. Interoperability testing cycles shortened from 21 to 13 days during 2023 and 2024 through standardized data buses. Maintenance error reports related to interface mismatches declined from 46 in 2022 to 19 in 2024. These institutional and operational shifts support scalable upgrade pathways and faster lifecycle refreshes.

Future Outlook

From 2026 onward, avionics adoption in Singapore will be shaped by continued airspace modernization, cybersecurity mandates, and digital cockpit integration. Fleet renewal and retrofit cycles are expected to converge around modular architectures, while certification processes evolve to accommodate software-centric upgrades. Regional connectivity growth and MRO capacity expansion will reinforce sustained demand. Regulatory harmonization with international standards will further accelerate deployment of connected avionics platforms across mixed fleets.

Major Players

- Honeywell Aerospace

- Collins Aerospace

- Thales Avionics

- Safran Electronics & Defense

- Garmin Aviation

- L3Harris Technologies

- BAE Systems

- Leonardo DRS

- Universal Avionics

- Astronics Corporation

- Avidyne Corporation

- Cobham Aerospace Communications

- Curtiss-Wright Defense Solutions

- Elbit Systems

- GE Aerospace

Key Target Audience

- Commercial airline operators

- Aircraft leasing companies

- Maintenance, repair, and overhaul providers

- Avionics system integrators

- Investments and venture capital firms

- Government and regulatory bodies with agency names: Civil Aviation Authority of Singapore

- Air navigation service providers

- Fleet asset management companies

Research Methodology

Step 1: Identification of Key Variables

Operational avionics categories, certification pathways, and retrofit cycles were defined. Fleet composition, utilization patterns, and regulatory mandates were mapped to avionics demand drivers. Interdependencies between navigation, surveillance, communication, and cockpit systems were structured to define scope. Assumptions on lifecycle refresh intervals were documented.

Step 2: Market Analysis and Construction

Fleet-level installed base audits and maintenance schedules were synthesized with certification timelines. Retrofit intensity, software update cadence, and MRO throughput were modeled to construct demand pathways. Supply chain constraints and approval cycles were incorporated into deployment feasibility. Scenario ranges were built around regulatory implementation pacing.

Step 3: Hypothesis Validation and Expert Consultation

Operator engineering leads, certification specialists, and MRO program managers validated assumptions on downtime, integration complexity, and modular upgrade readiness. Regulatory interpretations of CNS modernization were cross-checked against implementation practices. Feedback loops refined interface standardization and cybersecurity adoption pathways.

Step 4: Research Synthesis and Final Output

Validated inputs were reconciled across fleet operations, regulatory cycles, and service capacity constraints. Findings were structured into drivers, challenges, and opportunities with operational indicators. The synthesis emphasized implementation feasibility, institutional readiness, and lifecycle considerations for future adoption.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for commercial aircraft avionics in Singapore, Avionics system taxonomy across flight control, navigation, surveillance, and communication suites, Bottom-up fleet-level system sizing using airline and MRO installed base audits, Revenue attribution by OEM line-fit)

- Definition and Scope

- Market evolution

- Usage and upgrade pathways across line-fit and retrofit cycles

- Ecosystem structure across OEMs, airlines, MROs, and regulators

- Supply chain and distribution structure

- Regulatory environment under CAAS and international certification regimes

- Growth Drivers

Fleet modernization by Singapore-based carriers and lessors

Mandated upgrades for CNS/ATM and ADS-B compliance

Rising adoption of connected cockpit and real-time health monitoring

Expansion of Singapore’s MRO hub for avionics retrofits

Increased aircraft utilization driving avionics reliability investments

Digital transformation of airline operations and flight efficiency programs - Challenges

High certification and regulatory approval timelines for avionics upgrades

Supply chain constraints for semiconductors and certified components

Long aircraft downtime associated with complex avionics retrofits

Interoperability challenges across mixed fleet avionics architectures

High capex requirements for next-generation avionics suites

Dependency on global OEM delivery schedules and pricing power - Opportunities

Retrofit demand for legacy fleets operating from Singapore

Adoption of open avionics architectures enabling modular upgrades

Growth of predictive maintenance and avionics analytics services

Integration of cybersecurity solutions for connected avionics

Partnerships between OEMs and Singapore MROs for regional support hubs

Localization of avionics repair and testing capabilities in Singapore - Trends

Shift toward integrated modular avionics across new deliveries

Rising penetration of cockpit digitization and large-format displays

Increased deployment of SATCOM for real-time flight operations

Software-centric upgrades and over-the-air configuration management

Growing emphasis on avionics cybersecurity and data integrity

Standardization of avionics interfaces across mixed fleets - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body aircraft

Wide-body aircraft

Regional jets and turboprops

Business jets operated under commercial charters - By Application (in Value %)

Flight management and navigation systems

Communication and connectivity systems

Surveillance and collision avoidance systems

Flight control and actuation electronics

Cockpit display and mission management systems - By Technology Architecture (in Value %)

Integrated modular avionics

Federated avionics

Open systems architecture avionics

Software-defined avionics platforms - By End-Use Industry (in Value %)

Commercial airlines

Aircraft leasing companies

Maintenance, repair, and overhaul providers

Charter and ACMI operators - By Connectivity Type (in Value %)

Satellite-based connectivity

Air-to-ground connectivity

Hybrid SATCOM and ATG connectivity

Onboard data bus and aircraft network connectivity - By Region (in Value %)

Singapore domestic aviation market

ASEAN hub operations routed via Singapore

Intercontinental long-haul operations based in Singapore

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio breadth, Certification coverage, installed base in Singapore fleets, Retrofit and MRO support capabilities, Pricing and lifecycle cost competitiveness, Software upgrade cadence, Aftermarket service network depth, Partnerships with airlines and MROs)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Honeywell Aerospace

Collins Aerospace

Thales Avionics

Safran Electronics & Defense

Garmin Aviation

L3Harris Technologies

BAE Systems

GE Aerospace

Cobham Aerospace Communications

Leonardo DRS

Elbit Systems

Universal Avionics

Astronics Corporation

Avidyne Corporation

Curtiss-Wright Defense Solutions

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035