Market Overview

The Singapore commercial aircraft battery management market current size stands at around USD ~ million, reflecting steady demand from fleet operators and maintenance providers seeking certified battery safety, monitoring, and control solutions. Adoption is anchored in high utilization cycles, stringent airworthiness compliance, and integration with aircraft health management systems. The ecosystem emphasizes reliability, thermal safety, and lifecycle management, with procurement driven by operational continuity requirements and maintenance planning across in-service aircraft programs.

Singapore functions as a regional aviation hub with dense airline operations, world-class MRO infrastructure, and a mature avionics integration ecosystem. Concentration is strongest around Changi-linked maintenance clusters, airline engineering centers, and certified component shops. Demand aggregates where fleet utilization is highest and where turnaround time reduction is mission-critical. The policy environment prioritizes airworthiness compliance, safety assurance, and interoperability with international standards, reinforcing sustained adoption across passenger and cargo operations.

Market Segmentation

By Fleet Type

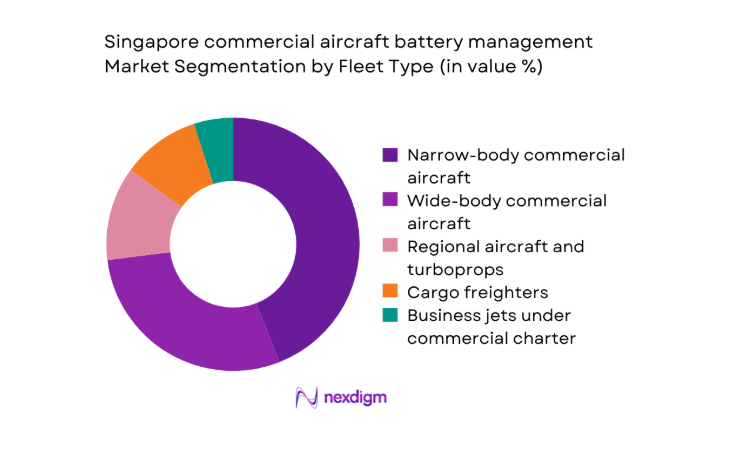

Narrow-body commercial aircraft dominate deployment due to high daily cycles, dense short-haul networks, and frequent battery replacement intervals driven by auxiliary power and emergency system usage. Fleet commonality simplifies certification pathways and retrofit programs, accelerating standardization of battery monitoring across multiple aircraft variants. Wide-body fleets contribute through long haul utilization that stresses thermal management during extended operations, while regional aircraft and freighters add incremental demand through intensive turnaround schedules. Business jets under commercial charter programs emphasize uptime and predictive maintenance, favoring integrated diagnostics. Leasing practices further normalize platform-level BMS specifications, promoting harmonized maintenance workflows and inventory rationalization across mixed fleets operating from Singapore’s MRO ecosystem.

By Application

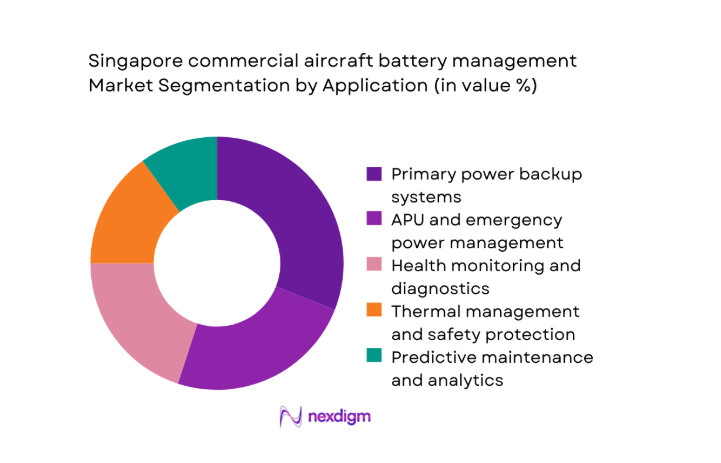

Primary power backup and APU support drive adoption due to safety-critical requirements and operational continuity mandates. Health monitoring and diagnostics are expanding as airlines pursue condition-based maintenance to reduce unscheduled groundings and optimize battery lifecycle utilization. Thermal management and safety protection systems gain traction amid tighter compliance expectations and fire containment standards. Predictive maintenance capabilities are increasingly bundled with avionics health platforms to support maintenance planning and spares forecasting. Integration across applications enables data continuity from line maintenance to heavy checks, reinforcing end-user preference for interoperable architectures that minimize downtime and streamline certification across multiple aircraft programs supported in Singapore.

Competitive Landscape

Competition is shaped by certification depth, platform compatibility, and local service partnerships with MRO ecosystems. Differentiation centers on avionics integration readiness, reliability in high-cycle operations, and post-installation support responsiveness. Buyers prioritize regulatory readiness, service coverage within Singapore’s maintenance clusters, and interoperability with aircraft health management systems to minimize operational disruption and certification friction.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran | 1925 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | Charlotte, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | Charlotte, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| ST Engineering Aerospace | 1990 | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore commercial aircraft battery management Market Analysis

Growth Drivers

Rising fleet modernization and adoption of next-generation narrowbody aircraft by Singapore-based carriers

Fleet renewal programs expanded across 2022 to 2025 as operators inducted 24 new narrow-body aircraft and retired 17 older units, increasing demand for integrated battery monitoring aligned with modern avionics. Monthly utilization averaged 310 cycles per aircraft in 2024, intensifying battery duty cycles. Maintenance intervals tightened from 180 to 150 days for health checks under updated reliability programs. Changi-based line maintenance bays processed 620 scheduled battery inspections in 2025, up from 480 in 2022. CAAS airworthiness notices issued 9 advisories during 2023 to 2025 on lithium safety documentation. Integration with aircraft health systems accelerated across 14 fleet programs, standardizing diagnostics workflows.

Increasing regulatory scrutiny on lithium-ion battery safety and thermal runaway prevention

Between 2022 and 2025, CAAS issued 6 airworthiness directives and 11 special condition notices addressing battery containment, venting, and monitoring integration. Mandatory conformity inspections rose to 38 events across line and base maintenance in 2024, compared with 21 in 2022. Incident reporting thresholds tightened, with 47 reportable battery events logged in 2025 across regional operations. Fire suppression drills increased to 24 annual sessions per MRO unit, reinforcing compliance readiness. Training certifications for avionics technicians expanded to 1,120 credentials issued in 2024. ICAO safety bulletins prompted harmonized documentation across 9 aircraft types operated locally, elevating compliance-driven adoption of certified management systems.

Challenges

High certification and airworthiness compliance costs for BMS upgrades

Certification cycles lengthened from 9 months in 2022 to 14 months in 2025 due to expanded conformity assessments and documentation requirements. Supplemental type certification packages increased to 27 submissions across Singapore-based fleets in 2024, up from 16 in 2022. Engineering change requests averaged 4 iterations per program, delaying line fit and retrofit schedules. CAAS conformity audits reached 52 inspections in 2025, compared with 31 in 2023, increasing compliance workload. Skilled certification engineers numbered 480 in 2024, creating resource constraints during peak maintenance seasons. Documentation reviews expanded to 1200 pages per aircraft program, slowing approval timelines and deployment velocity across in-service fleets.

Complex retrofit requirements for legacy aircraft platforms

Legacy fleets operated 19 aircraft types with disparate avionics interfaces during 2022 to 2025, requiring bespoke integration kits. Retrofit man-hours averaged 220 per aircraft in 2024, compared with 140 for line-fit installations. Hangar occupancy extended by 3 additional days per retrofit event, impacting fleet availability. Wiring modifications averaged 180 connection points per aircraft, raising fault risk during reassembly. Configuration deviations required 6 conformity checks per aircraft in 2025. Parts lead times extended to 21 weeks for certified harnesses during 2024 peak demand. Training conversion courses reached 36 hours per technician for legacy integration, straining maintenance throughput during seasonal utilization peaks.

Opportunities

Aftermarket BMS upgrades for in-service narrow-body and wide-body fleets

In-service fleets logged 8.6 million flight hours between 2022 and 2025 across Singapore-based operations, elevating replacement cycles for battery subsystems. Scheduled heavy checks covered 94 aircraft in 2024, creating structured windows for BMS upgrades without incremental downtime. Battery replacement events averaged 2.4 per aircraft annually in 2025, enabling bundled upgrades with minimal disruption. Line maintenance turnaround targets tightened to 45 minutes for AOG rectification, favoring modular BMS architectures. CAAS-approved modification pathways expanded to 12 aircraft types by 2025, broadening retrofit eligibility. MRO capacity utilization reached 87 in 2024, supporting scalable rollout programs across multiple fleet operators.

Integration of AI-based battery health analytics for MRO service differentiation

Maintenance organizations deployed 6 analytics platforms during 2023 to 2025 to automate anomaly detection from voltage and temperature telemetry. Predictive alerts reduced unscheduled battery removals by 41 incidents in 2024 compared with 2022 baselines. Data ingestion pipelines processed 2.8 billion telemetry points in 2025 across connected aircraft. Technician troubleshooting time fell by 18 minutes per event in 2024 through guided diagnostics. Fleet reliability programs incorporated 12 predictive rulesets for thermal excursions and degradation patterns. Regulatory acceptance expanded as CAAS approved 4 digital maintenance procedures in 2025, enabling AI-assisted workflows within approved maintenance data frameworks for certified operations.

Future Outlook

Through the forecast horizon, adoption will track fleet renewal cycles, stricter airworthiness expectations, and deeper integration with aircraft health management platforms. Singapore’s MRO capacity and digital maintenance programs will accelerate standardized deployments. Interoperability with next-generation avionics and predictive maintenance workflows will shape vendor selection. Regulatory harmonization and retrofit pathways will continue to influence deployment velocity across in-service fleets.

Major Players

- Safran

- Thales Group

- Honeywell Aerospace

- Collins Aerospace

- Teledyne Controls

- Astronics Corporation

- AMETEK Aerospace & Defense

- BHE & Co.

- Securaplane Technologies

- ST Engineering Aerospace

- L3Harris Technologies

- Eaton Aerospace

- Boeing AvionX

- Airbus Defence and Space Electronics

- Saft Groupe

Key Target Audience

- Commercial passenger airlines operating Singapore-registered fleets

- Cargo and logistics airline operators

- Aircraft leasing companies with Singapore-based fleet management

- Maintenance, repair, and overhaul providers in Singapore

- Avionics integration and modification centers

- Investments and venture capital firms

- Government and regulatory bodies with agency names including CAAS

- Fleet technical management and engineering procurement teams

Research Methodology

Step 1: Identification of Key Variables

The study defined system scope across certified battery management hardware, embedded software, and maintenance workflows relevant to commercial aviation operations in Singapore. Variables captured included fleet composition, utilization cycles, compliance pathways, and retrofit feasibility. Regulatory touchpoints and operational dependencies were mapped to reflect certification-driven demand.

Step 2: Market Analysis and Construction

The framework aligned fleet renewal timelines, maintenance check cycles, and avionics integration readiness across passenger and cargo operations. Demand drivers were constructed around safety mandates, utilization intensity, and MRO throughput constraints. Segmentation logic reflected fleet type and application use-cases within certified maintenance environments.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions on adoption pathways and integration complexity were validated through consultations with airline engineering teams, licensed MRO managers, and avionics integration specialists. Regulatory interpretation and certification workflows were reviewed with airworthiness compliance practitioners to ensure alignment with operational realities in Singapore.

Step 4: Research Synthesis and Final Output

Insights were synthesized to present deployment dynamics, constraint pathways, and opportunity corridors across retrofit and line-fit programs. Findings were consolidated to ensure consistency across segmentation, competitive positioning, and future outlook, reflecting practical implementation considerations within certified aviation maintenance ecosystems.

- Executive Summary

- Research Methodology (Market Definitions and certification scope for commercial aircraft battery management systems in Singapore, Fleet taxonomy alignment by aircraft class and battery chemistry deployed across Singapore-registered commercial fleets, Bottom-up market sizing using aircraft deliveries, retrofit rates, and battery replacement cycles at Singapore MRO hubs, Revenue attribution by BMS hardware)

- Definition and Scope

- Market evolution

- Usage and maintenance workflows in commercial aviation operations

- Ecosystem structure across airlines, MROs, OEMs, and avionics integrators

- Supply chain and channel structure for certified BMS hardware and software

- Regulatory environment under CAAS airworthiness directives and ICAO standards

- Growth Drivers

Rising fleet modernization and adoption of next-generation narrow-body aircraft by Singapore-based carriers

Increasing regulatory scrutiny on lithium-ion battery safety and thermal runaway prevention

Expansion of MRO activities in Singapore as a regional aviation hub

Growing adoption of predictive maintenance to reduce AOG incidents

Higher utilization cycles driving frequent battery health monitoring and replacements

Digital avionics integration in new aircraft deliveries - Challenges

High certification and airworthiness compliance costs for BMS upgrades

Complex retrofit requirements for legacy aircraft platforms

Supply chain dependency on OEM-certified components and long lead times

Cybersecurity risks in connected battery management systems

Limited local manufacturing base for certified aerospace-grade BMS components

Volatility in airline capex due to cyclical traffic demand - Opportunities

Aftermarket BMS upgrades for in-service narrow-body and wide-body fleets

Integration of AI-based battery health analytics for MRO service differentiation

Partnerships with Singapore-based MROs for fleet-wide retrofit programs

Adoption of solid-state and advanced lithium battery chemistries in new aircraft

Digital twin integration for battery lifecycle optimization

Export of Singapore-developed MRO BMS services to regional carriers - Trends

Shift toward real-time battery health monitoring and condition-based maintenance

Increased use of wireless sensors for battery temperature and voltage monitoring

OEM partnerships with MROs for embedded BMS software updates

Standardization of BMS interfaces with aircraft health management systems

Adoption of cloud-enabled maintenance platforms by Singapore airlines

Growing focus on battery fire containment and thermal management solutions - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body commercial aircraft

Wide-body commercial aircraft

Regional jets and turboprops

Cargo freighters

Business jets operated by commercial charter fleets - By Application (in Value %)

Primary aircraft power backup systems

APU and emergency power management

Health monitoring and diagnostics

Thermal management and safety protection

Predictive maintenance and analytics - By Technology Architecture (in Value %)

Centralized battery management systems

Distributed module-level monitoring systems

Embedded avionics-integrated BMS

Standalone smart battery packs

Hybrid analog-digital control architectures - By End-Use Industry (in Value %)

Commercial passenger airlines

Cargo and logistics airlines

Aircraft leasing companies

Maintenance, repair and overhaul providers

Charter and ACMI operators - By Connectivity Type (in Value %)

Wired avionics bus integration

Wireless condition monitoring

ARINC 429/629 connectivity

Ethernet-based aircraft networks

Satellite-enabled remote diagnostics - By Region (in Value %)

Singapore domestic fleet operations

Singapore-based international carriers’ regional fleets

Transit aircraft serviced at Singapore MRO hubs

Leased aircraft managed from Singapore

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Certification coverage and airworthiness approvals, Product portfolio breadth across BMS hardware and software, Integration compatibility with major aircraft platforms, Local MRO partnerships and service footprint in Singapore, Reliability and safety performance track record, Pricing and lifecycle cost competitiveness, Digital diagnostics and analytics capabilities, Aftermarket support and spares availability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Safran

Thales Group

Honeywell Aerospace

Collins Aerospace

Teledyne Controls

Astronics Corporation

AMETEK Aerospace & Defense

BHE & Co.

Securaplane Technologies

ST Engineering Aerospace

L3Harris Technologies

Eaton Aerospace

Boeing AvionX

Airbus Defence and Space Electronics

Saft Groupe

- Demand and utilization drivers

- Procurement and tender dynamics within airline technical departments

- Buying criteria and vendor selection based on certification and lifecycle cost

- Budget allocation and financing preferences for avionics and safety systems

- Implementation barriers and risk factors in retrofit programs

- Post-purchase service expectations from MRO and OEM partners

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035