Market Overview

The Singapore commercial aircraft evacuation system market current size stands at around USD ~ million, reflecting steady procurement and replacement demand driven by safety-critical cabin equipment across active fleets. The market is shaped by mandatory airworthiness compliance, recurring certification cycles, and periodic retrofit programs tied to cabin reconfigurations. Supply dynamics are influenced by long lead times for certified components, reliance on imported systems, and stringent conformity checks prior to linefit and aftermarket installation, sustaining stable demand for compliant evacuation assemblies.

Singapore anchors demand concentration due to its dense airline operations ecosystem, high aircraft utilization, and mature MRO infrastructure clustered around Changi. The city-state’s role as a regional aviation hub concentrates certification activities, installation capabilities, and spares provisioning. Strong regulatory oversight, robust safety governance, and integrated airline engineering functions reinforce consistent adoption. Regional route networks amplify replacement cycles, while advanced logistics and quality assurance capabilities enable rapid turnaround for evacuation system maintenance and recertification.

Market Segmentation

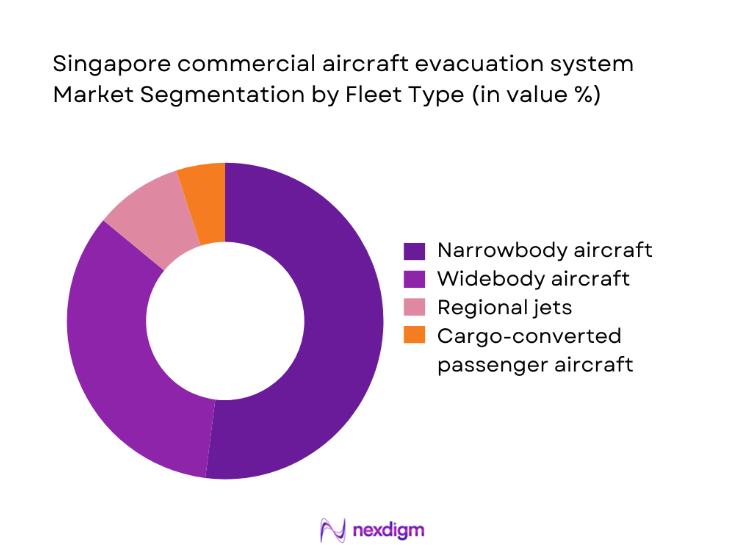

By Fleet Type

Narrowbody aircraft dominate demand due to dense short-haul utilization, high daily cycle counts, and standardized door configurations that drive frequent inspection and replacement of evacuation components. Widebody fleets contribute materially through slide-raft complexity for overwater routes, while regional jets maintain smaller but consistent demand through scheduled checks. Cargo-converted passenger aircraft introduce retrofit-driven requirements as door and cabin modifications necessitate certified evacuation interfaces. Fleet commonality strategies encourage standardized kits across types, supporting streamlined spares management and predictable maintenance planning across Singapore-based operators and lessor-managed fleets.

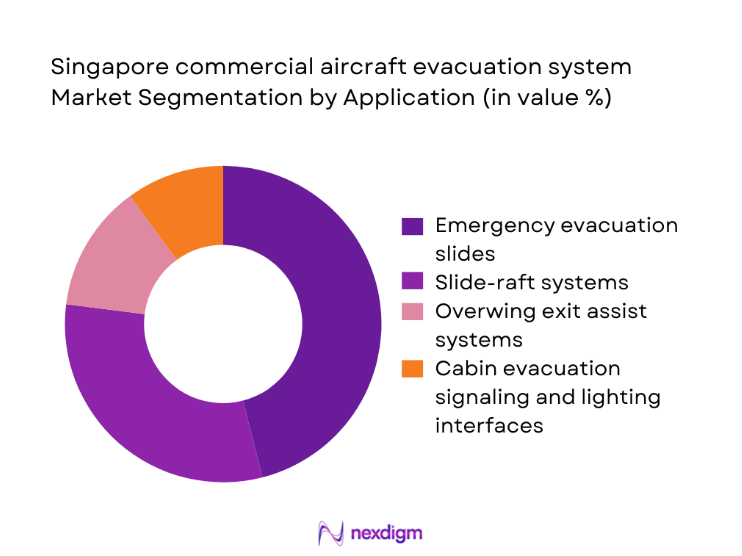

By Application

Emergency evacuation slides represent the core installed base across door positions, driven by routine recertification cycles and wear from operational handling. Slide-raft systems account for higher complexity on overwater routes, sustaining demand through stringent flotation and inflation compliance. Overwing exit assist systems remain niche but necessary for narrowbody configurations with specific cabin layouts. Cabin evacuation signaling and lighting interfaces complement physical systems, with growing emphasis on integration during cabin retrofits and connectivity-enabled maintenance workflows, supporting compliance documentation and faster airworthiness approvals.

Competitive Landscape

The competitive landscape reflects certified solution providers aligned to airframe compatibility, aftermarket support depth, and regional service readiness. Differentiation centers on certification coverage across fleet types, integration with MRO workflows, and lifecycle support capabilities tailored to high-utilization operations in Singapore’s hub environment.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran | 1925 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Survitec | 1920 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 1896 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| ST Engineering Aerospace | 1990 | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore commercial aircraft evacuation system Market Analysis

Growth Drivers

Fleet renewal and expansion by Singapore-based carriers driving linefit demand

Fleet renewal programs increased active narrowbody and widebody counts across Singapore operators during 2024 and 2025, with delivery schedules aligned to network restoration. Annual aircraft movements at Changi exceeded 330000 in 2024, sustaining high utilization cycles that accelerate certification checks on evacuation assemblies. The Civil Aviation Authority of Singapore issued updated airworthiness directives affecting door equipment conformity across multiple types in 2023 and 2025. Average daily utilization exceeded 11 hours on regional routes, increasing handling events. Maintenance planning cycles aligned to 24-month checks drive predictable linefit installations across inducted aircraft.

Stringent CAAS airworthiness and safety compliance requirements

Regulatory oversight intensified through recurrent audits of operator continuing airworthiness management organizations during 2024 and 2025, with findings mandating documentation updates and component conformity verification. CAAS conducted over 140 organizational audits in 2024 across air operators and MROs, reinforcing compliance for evacuation equipment certification and traceability. Training mandates required recurrent competency checks for over 2600 licensed engineers in 2025, raising procedural rigor for installation and inspection. Incident reporting thresholds tightened in 2023, increasing reporting volumes and triggering preventive maintenance actions on door systems, inflation mechanisms, and restraint interfaces across active fleets.

Challenges

High certification and qualification costs for new evacuation system variants

Certification pathways require multi-stage conformity inspections, flammability testing, and deployment performance verification under simulated cabin conditions. In 2024, certification programs required over 18 discrete test sequences per configuration, extending program timelines across 9 to 14 months. CAAS conformity audits added up to 6 additional documentation gates for imported assemblies, increasing administrative burden for operators and MROs. Limited availability of accredited test facilities within the region led to overseas test scheduling constraints during 2023 and 2025, delaying induction planning. Engineering change approvals require cross-functional reviews across structures, cabin safety, and quality assurance teams.

Long OEM qualification timelines with airframe manufacturers

Airframe qualification for evacuation components involves configuration control across multiple door types and cabin layouts, requiring alignment with type certificate holders. During 2024, average approval lead times extended to 32 weeks due to concurrent modification programs across fleets. Change incorporation requires compliance with over 20 interface specifications per door position, adding engineering workload. Production ramp fluctuations in 2023 constrained supplier readiness windows, compressing qualification schedules. Documentation harmonization across operator manuals and maintenance planning documents required coordination across engineering teams numbering above 400 personnel, extending implementation timelines and complicating fleet-wide rollouts.

Opportunities

Retrofit demand from cabin reconfiguration and seat densification programs

Cabin densification initiatives expanded during 2024 and 2025 as operators sought higher seat counts on high-frequency routes, triggering door area reconfiguration and evacuation interface updates. Over 120 aircraft underwent cabin layout changes in 2024 within Singapore-managed fleets, necessitating re-certification of slide geometry and pack volume constraints. CAAS approval workflows required updated evacuation analysis substantiation packages, creating opportunities for retrofit kits and integration services. Average modification downtime targeted below 14 days to protect utilization, incentivizing pre-kitted evacuation assemblies and MRO-aligned installation programs that streamline compliance documentation and reduce aircraft on ground durations.

Adoption of lightweight materials to support airline fuel efficiency targets

Weight reduction programs prioritized cabin component mass optimization during 2023 to 2025, with operators targeting per-aircraft reductions exceeding 120 kilograms across interiors. Evacuation systems using advanced coated fabrics and compact inflation modules support these targets while maintaining deployment performance. Fuel efficiency initiatives tied to sustainability roadmaps mandated engineering reviews of interior mass across more than 300 aircraft in 2024. CAAS acceptance of material substitutions following flammability and durability validation opened pathways for next-generation textiles. Lifecycle benefits include reduced handling strain during maintenance, lowering injury incidents reported across 2 consecutive safety review cycles.

Future Outlook

The market outlook remains stable through 2035, supported by fleet renewal cycles, sustained utilization across regional and long-haul routes, and ongoing cabin modification programs. Regulatory rigor will continue to shape procurement standards and certification workflows. Integration with MRO planning systems and lifecycle service models is expected to deepen, improving turnaround efficiency and compliance management across Singapore-based operators.

Major Players

- Safran

- Collins Aerospace

- Survitec

- Zodiac Aerospace

- EAM Worldwide

- Trelleborg Sealing Solutions

- AmSafe Bridport

- AVIC Cabin Systems

- Diehl Aviation

- Latecoere

- ST Engineering Aerospace

- Jamco Corporation

- AAR Corp

- FACC AG

- GKN Aerospace

Key Target Audience

- Commercial airline operators in Singapore

- Aircraft lessors with Singapore-managed fleets

- MRO providers operating at Changi

- Cabin retrofit and modification centers

- Aircraft interior integrators and engineering design organizations

- Investments and venture capital firms

- Civil Aviation Authority of Singapore and related regulatory bodies

- Aviation safety and compliance procurement teams

Research Methodology

Step 1: Identification of Key Variables

Variables included fleet composition by aircraft type, door configuration standards, certification pathways, maintenance cycles, and retrofit triggers linked to cabin modifications. Regulatory audit frequencies and operator utilization patterns were mapped to define demand cadence and compliance touchpoints.

Step 2: Market Analysis and Construction

The market framework was constructed by aligning installed base logic with induction schedules at Singapore MROs, certification workflows, and component replacement intervals. Supply chain dependencies and qualification timelines were embedded to reflect operational constraints and lead-time sensitivities.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on retrofit intensity, certification bottlenecks, and lifecycle service adoption were validated through structured consultations with airline engineering teams, safety managers, and airworthiness specialists. Operational logs and compliance records informed refinement of adoption drivers and constraints.

Step 4: Research Synthesis and Final Output

Findings were synthesized into an integrated market narrative reflecting regulatory, operational, and technical dynamics. Cross-validation ensured internal consistency across segmentation, analysis themes, and outlook assumptions, producing a coherent, decision-oriented output.

- Executive Summary

- Research Methodology (Market Definitions and certification scope for commercial aircraft evacuation systems in Singapore, Fleet-based segmentation aligned to narrowbody widebody and regional aircraft operated by Singapore carriers, Bottom-up market sizing using installed base of slides rafts and escape systems across active aircraft in Singapore, Revenue attribution based on OEM linefit contracts and MRO retrofit replacement cycles in Singapore)

- Definition and Scope

- Market evolution

- Usage and certification pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Fleet renewal and expansion by Singapore-based carriers driving linefit demand

Stringent CAAS airworthiness and safety compliance requirements

Rising widebody utilization on long-haul routes increasing slide-raft replacement cycles

Growth in low-cost carrier narrowbody fleets requiring standardized evacuation equipment

Higher aircraft utilization rates accelerating wear and recertification cycles - Challenges

High certification and qualification costs for new evacuation system variants

Long OEM qualification timelines with airframe manufacturers

Dependency on aircraft delivery schedules and production rate volatility

Supply chain constraints for coated fabrics and inflation systems

Limited local manufacturing base increasing reliance on imports - Opportunities

Retrofit demand from cabin reconfiguration and seat densification programs

Adoption of lightweight materials to support airline fuel efficiency targets

Aftermarket service contracts with Singapore-based MROs

Integration of health monitoring features for predictive maintenance

Regional export opportunities via Singapore MRO hubs serving ASEAN fleets - Trends

Shift toward lighter and more compact slide-raft designs

Increasing standardization across fleet types to reduce spares inventory

Closer OEM-MRO partnerships for installation and certification support

Use of advanced textiles for durability in humid tropical conditions

Lifecycle service bundling with long-term support agreements - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrowbody aircraft

Widebody aircraft

Regional jets

Cargo-converted passenger aircraft - By Application (in Value %)

Emergency evacuation slides

Slide-raft systems

Overwing exit assist systems

Cabin evacuation signaling and lighting interfaces - By Technology Architecture (in Value %)

Single-lane slide systems

Dual-lane slide systems

Compact lightweight slide materials

Integrated inflation and deployment mechanisms - By End-Use Industry (in Value %)

Full-service passenger airlines

Low-cost carriers

Charter and ACMI operators

Aircraft lessors operating in Singapore - By Connectivity Type (in Value %)

Non-connected evacuation systems

Condition-monitoring enabled evacuation systems

Maintenance data bus-integrated systems - By Region (in Value %)

Singapore domestic operations

Intra-ASEAN operated fleets based in Singapore

Long-haul international fleets based in Singapore

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (certification coverage, fleet compatibility breadth, regional MRO support presence, lead times and delivery reliability, lifecycle service offerings, pricing competitiveness, product weight and pack volume, aftermarket response time)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Safran

Collins Aerospace

Survitec

Zodiac Aerospace

EAM Worldwide

Trelleborg Sealing Solutions

AmSafe Bridport

AVIC Cabin Systems

Diehl Aviation

Latecoere

ST Engineering Aerospace

Jamco Corporation

AAR Corp

FACC AG

GKN Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035