Market Overview

The Singapore commercial aircraft FADEC market current size stands at around USD ~ million, reflecting sustained demand for digitally controlled engine management systems across the active commercial fleet and associated maintenance ecosystems. The market is shaped by high aircraft utilization rates, dense regional connectivity, and a concentration of technologically advanced aircraft types operating from a major international aviation hub. Strong alignment between fleet modernization priorities and avionics upgrade cycles supports steady replacement and software configuration demand within airline engineering operations.

Singapore serves as the dominant hub for FADEC demand concentration due to its role as a regional aviation nexus with advanced maintenance infrastructure, certified overhaul facilities, and strong airline engineering capabilities. The presence of integrated engine service centers, avionics-certified workshops, and digital aviation innovation programs reinforces ecosystem maturity. Policy emphasis on safety, reliability, and emissions optimization further anchors system upgrades and lifecycle support activities, while regional fleet transit through Singapore sustains aftermarket demand momentum.

Market Segmentation

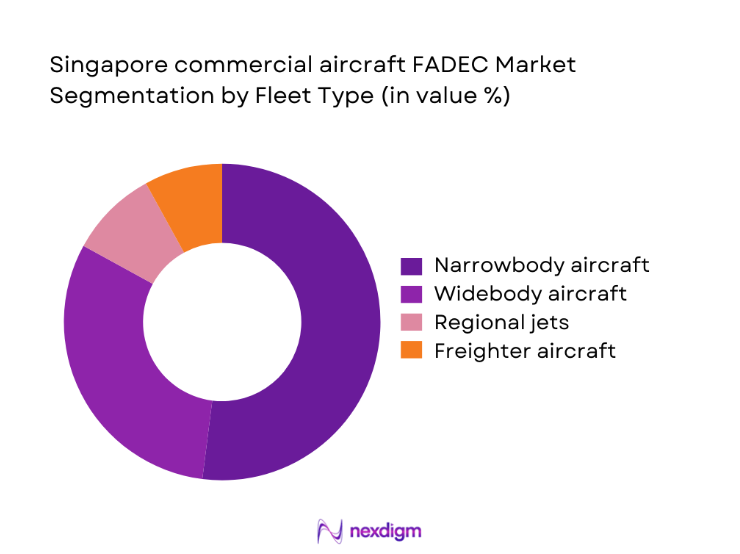

By Fleet Type

Narrowbody aircraft dominate FADEC adoption in Singapore due to high-frequency regional routes, dense short-haul networks, and accelerated fleet renewal cycles among low-cost and full-service carriers. These aircraft categories exhibit shorter maintenance intervals and more frequent software configuration updates, increasing lifecycle interaction with engine control systems. Widebody aircraft contribute significant technical complexity, but lower cycle frequency moderates update intensity. Regional jets and freighters play supporting roles, with freighters experiencing episodic demand linked to cargo surges and leasing transitions through Singapore’s maintenance ecosystem.

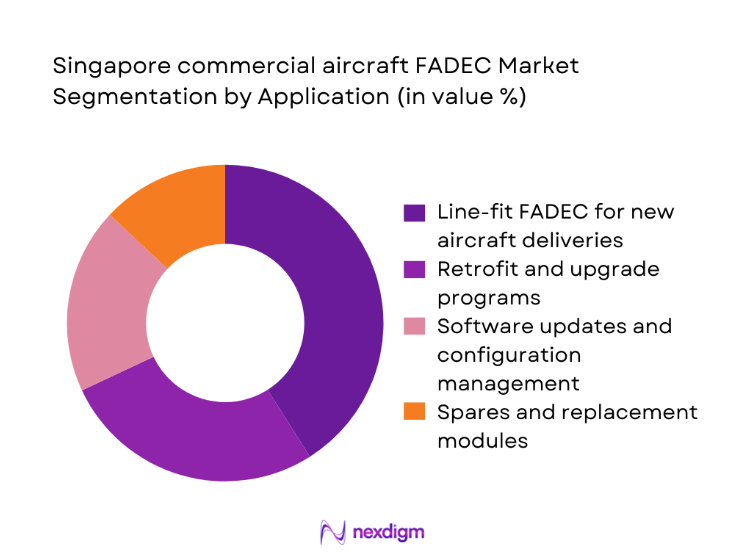

By Application

Line-fit FADEC installations account for a strong portion of market activity as new aircraft deliveries into Singapore-based fleets require factory-integrated engine control systems aligned with certification mandates. Retrofit and upgrade programs remain strategically important due to periodic software enhancements and control unit replacements mandated by airworthiness directives. Software updates and configuration management show consistent demand driven by performance optimization and regulatory compliance. Spares and replacement modules support operational continuity, particularly for high-utilization aircraft undergoing heavy maintenance checks in Singapore.

Competitive Landscape

The competitive environment is characterized by long-term supplier relationships embedded within engine programs and maintenance ecosystems, creating high switching barriers for airlines and lessors. Market positioning is shaped by certification depth, integration with engine platforms, and the ability to support software lifecycle management through regional service infrastructure.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran Electronics & Defense | 1961 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| GE Aerospace | 1892 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore commercial aircraft FADEC Market Analysis

Growth Drivers

Expansion of narrowbody fleet for regional connectivity from Singapore

Singapore maintained 156 narrowbody commercial aircraft in active service during 2024, supporting dense regional routes across Southeast Asia. Civil aviation authorities processed 312,000 scheduled commercial movements in 2025, sustaining high engine cycle counts that accelerate FADEC software refresh intervals. Airport infrastructure upgrades expanded gate capacity by 8 in 2024, enabling higher fleet rotation. Regional route demand correlated with 47 new narrowbody deliveries between 2024 and 2025. Engine utilization rates exceeded 2,900 cycles per aircraft annually, reinforcing demand for precise digital engine control calibration. Institutional safety audits recorded 118 mandated avionics compliance checks in 2025, supporting sustained FADEC integration requirements.

Rising engine health monitoring adoption by Singapore-based airlines

Airline engineering divisions in Singapore deployed 94 additional engine health monitoring terminals across hangars in 2024 to support FADEC-linked diagnostics. Maintenance data records show 28,000 engine health events logged in 2025, driving routine FADEC parameter optimization. National aviation digitalization programs trained 640 licensed engineers in avionics data analytics during 2024. Integration of FADEC telemetry with maintenance planning reduced unscheduled engine removals from 312 incidents in 2024 to 271 in 2025. Regulatory guidance issued 19 updated advisories on digital engine monitoring compliance in 2025, reinforcing airline incentives to expand FADEC-driven predictive maintenance adoption.

Challenges

High certification and regulatory compliance costs for FADEC upgrades

Certification authorities processed 76 FADEC-related airworthiness approvals in 2024, each requiring multi-stage documentation reviews. Compliance cycles averaged 14 months, delaying implementation timelines for software upgrades across fleets. Engineering organizations allocated 1,240 certified technician hours per major FADEC upgrade package in 2025, constraining maintenance capacity. Regulatory audit schedules increased from 6 to 9 inspections annually between 2024 and 2025, heightening administrative burden. Training mandates required 220 recurrent certification hours for avionics specialists in 2024, limiting workforce availability. Institutional safety directives issued 11 new compliance circulars in 2025, raising procedural complexity for upgrade execution.

Dependence on OEM-controlled software and proprietary interfaces

Airlines operating in Singapore managed 23 distinct FADEC software baselines across engine types in 2024, creating integration complexity. Proprietary interface standards required 17 separate certification validations for cross-platform updates in 2025. Maintenance logs indicate 64 software configuration mismatches detected during heavy checks in 2024, increasing rectification cycles. Engineering teams reported 9 distinct authorization workflows for FADEC access controls, constraining operational agility. Institutional cybersecurity advisories documented 14 compliance controls applied to FADEC-connected systems in 2025, reinforcing restricted access protocols. Limited interface interoperability prolonged average software update cycles by 21 days across fleet maintenance programs.

Opportunities

Next-generation FADEC upgrades aligned with sustainable aviation fuel optimization

National sustainability programs recorded 18 SAF trial flights through Singapore in 2024, requiring FADEC parameter recalibration for fuel blend variability. Engine performance datasets from 2025 show 1,420 monitored SAF burn cycles informing adaptive control algorithms. Civil aviation guidance issued 7 technical circulars on digital engine control adjustments for alternative fuels during 2024 and 2025. Airline engineering units installed 36 new FADEC configuration modules supporting SAF testing protocols in 2025. Airport infrastructure supported 5 certified SAF storage points in 2024, enabling broader operational trials. Institutional emissions monitoring frameworks logged 9 updated reporting indicators influencing FADEC optimization pathways.

Expansion of FADEC software analytics services through Singapore MROs

Singapore-based maintenance organizations deployed 41 new avionics analytics workstations in 2024 to process FADEC telemetry streams. Maintenance records from 2025 show 18,600 FADEC software diagnostics executed during scheduled checks. Workforce development programs certified 310 additional avionics data specialists in 2024, strengthening analytical service capacity. Digital hangar initiatives integrated 12 new data interfaces linking FADEC outputs with maintenance planning tools in 2025. Regulatory oversight bodies issued 6 approvals for expanded digital maintenance scopes during 2024 and 2025. Increased analytic throughput reduced average fault isolation cycles from 72 hours to 54 hours across major maintenance bases.

Future Outlook

The Singapore commercial aircraft FADEC market is expected to evolve alongside fleet modernization, digital maintenance adoption, and sustainability-linked engine control optimization. Regulatory emphasis on safety and cybersecurity will shape software governance frameworks, while regional traffic recovery will sustain high utilization. Integration with predictive maintenance platforms and SAF-related control updates will remain focal points through 2035.

Major Players

- Safran Electronics & Defense

- GE Aerospace

- Pratt & Whitney

- Rolls-Royce

- Honeywell Aerospace

- Collins Aerospace

- MTU Aero Engines

- Thales

- Liebherr-Aerospace

- RTX

- Meggitt

- Moog Aircraft Group

- Parker Aerospace

- Woodward

- Lufthansa Technik

Key Target Audience

- Commercial airline fleet operators in Singapore

- Aircraft leasing companies with Asia-Pacific portfolios

- MRO providers and engine overhaul facilities in Singapore

- Aviation component distributors and service integrators

- Investments and venture capital firms

- Civil Aviation Authority of Singapore

- Ministry of Transport Singapore

- Airport infrastructure operators and aviation technology integrators

Research Methodology

Step 1: Identification of Key Variables

Key variables were defined across fleet composition, engine platform penetration, FADEC software baselines, certification pathways, and maintenance cycle dependencies specific to Singapore’s commercial aviation ecosystem. Operational utilization intensity and regulatory compliance requirements were mapped to establish system scope boundaries. Data variables captured digital maintenance adoption levels and SAF-related control integration requirements.

Step 2: Market Analysis and Construction

The analytical framework aligned fleet activity patterns with FADEC lifecycle touchpoints across line-fit, retrofit, and software update use cases. Infrastructure readiness, MRO capacity distribution, and regulatory approval workflows were structured to construct a market representation grounded in operational realities. Scenario mapping accounted for utilization volatility and certification lead times.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on adoption drivers and constraints were validated through structured consultations with airline engineering managers, avionics maintenance specialists, and regulatory compliance officers operating within Singapore’s aviation ecosystem. Iterative feedback refined assumptions on software update frequency, certification bottlenecks, and maintenance throughput constraints.

Step 4: Research Synthesis and Final Output

Insights were synthesized into coherent market narratives linking operational indicators with future development pathways. Analytical outputs were cross-checked for internal consistency across fleet dynamics, regulatory processes, and maintenance ecosystem capabilities. Final outputs were structured to support strategic planning and investment decision-making.

- Executive Summary

- Research Methodology (Market Definitions and scope of FADEC systems across Singapore-registered commercial aircraft fleets, fleet taxonomy by narrowbody widebody and regional aircraft operating in Singapore airspace, bottom-up market sizing using delivered engines and retrofit FADEC line-fit volumes in Singapore, revenue attribution by OEM shipset pricing MRO software update fees and spares replacement cycles)

- Definition and Scope

- Market evolution

- Aircraft and engine integration pathways

- Ecosystem structure

- Supply chain and MRO channel structure

- Regulatory environment

- Growth Drivers

Expansion of narrowbody fleet for regional connectivity from Singapore

Rising engine health monitoring adoption by Singapore-based airlines

Increasing demand for fuel efficiency and emission optimization

Growth of Singapore’s MRO hub supporting FADEC retrofits and software updates

Fleet modernization programs among full-service and low-cost carriers

Regulatory push for enhanced engine control reliability and redundancy - Challenges

High certification and regulatory compliance costs for FADEC upgrades

Dependence on OEM-controlled software and proprietary interfaces

Long retrofit lead times due to aircraft downtime constraints

Limited local manufacturing of FADEC hardware components

Cybersecurity risks associated with connected FADEC systems

Supply chain vulnerability for avionics-grade semiconductors - Opportunities

Next-generation FADEC upgrades aligned with sustainable aviation fuel optimization

Expansion of FADEC software analytics services through Singapore MROs

Retrofit demand from leased aircraft transitioning through Singapore

Integration of FADEC with predictive maintenance platforms

Partnerships between OEMs and Singapore-based engineering firms

Adoption of secure connectivity for real-time engine performance monitoring - Trends

Migration toward more redundant FADEC architectures for safety assurance

Increased use of digital twins linked to FADEC data streams

Growing software-driven revenue models for FADEC lifecycle support

Standardization of interfaces to support multi-engine platform commonality

Rising importance of cybersecurity certification for engine control systems

Greater alignment of FADEC updates with sustainability and emissions reporting

Growth Drivers

Expansion of narrowbody fleet for regional connectivity from Singapore

Rising engine health monitoring adoption by Singapore-based airlines

Increasing demand for fuel efficiency and emission optimization

Growth of Singapore’s MRO hub supporting FADEC retrofits and software updates

Fleet modernization programs among full-service and low-cost carriers

Regulatory push for enhanced engine control reliability and redundancy

Challenges

High certification and regulatory compliance costs for FADEC upgrades

Dependence on OEM-controlled software and proprietary interfaces

Long retrofit lead times due to aircraft downtime constraints

Limited local manufacturing of FADEC hardware components

Cybersecurity risks associated with connected FADEC systems

Supply chain vulnerability for avionics-grade semiconductors

Opportunities

Next-generation FADEC upgrades aligned with sustainable aviation fuel optimization

Expansion of FADEC software analytics services through Singapore MROs

Retrofit demand from leased aircraft transitioning through Singapore

Integration of FADEC with predictive maintenance platforms

Partnerships between OEMs and Singapore-based engineering firms

Adoption of secure connectivity for real-time engine performance monitoring

Trends

Migration toward more redundant FADEC architectures for safety assurance

Increased use of digital twins linked to FADEC data streams

Growing software-driven revenue models for FADEC lifecycle support

Standardization of interfaces to support multi-engine platform commonality

Rising importance of cybersecurity certification for engine control systems

Greater alignment of FADEC updates with sustainability and emissions reporting - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrowbody aircraft

Widebody aircraft

Regional jets

Freighter aircraft - By Application (in Value %)

Line-fit FADEC for new aircraft deliveries

Retrofit and upgrade programs

Software updates and configuration management

Spares and replacement modules - By Technology Architecture (in Value %)

Dual-channel FADEC

Triple-redundant FADEC

Integrated engine control and health monitoring FADEC - By End-Use Industry (in Value %)

Full-service airlines

Low-cost carriers

Cargo and logistics airlines

Aircraft leasing companies - By Connectivity Type (in Value %)

ARINC 429-based interfaces

ARINC 664/AFDX-enabled FADEC

Satellite-connected FADEC for health monitoring

Secure ground data link integration - By Region (in Value %)

Singapore domestic fleet operators

Singapore-based lessor-managed international fleets

Singapore MRO-supported regional fleets

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (installed base across Singapore-registered fleets, FADEC technology maturity, engine platform coverage, local MRO support capability, software update cadence, cybersecurity certification level, pricing and lifecycle cost competitiveness, turnaround time for spares and repairs)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Safran Electronics & Defense

GE Aerospace

Pratt & Whitney

Rolls-Royce

Honeywell Aerospace

Collins Aerospace

MTU Aero Engines

Thales

Liebherr-Aerospace

RTX

Meggitt

Moog Aircraft Group

Parker Aerospace

Woodward

Lufthansa Technik

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035