Market Overview

The Singapore commercial aircraft floor panels market current size stands at around USD ~ million, reflecting steady demand driven by ongoing cabin refurbishment cycles and sustained fleet utilization across major carriers and maintenance hubs. The market is shaped by replacement demand, line-fit requirements for aircraft undergoing interior modifications, and compliance-driven upgrades to meet evolving safety and flammability standards. Supply-side dynamics are influenced by certification lead times, material qualification processes, and integration with broader cabin interior retrofitting programs executed by regional maintenance providers.

Demand concentration is anchored in Singapore’s dense aviation services ecosystem, where integrated maintenance hubs, cabin modification centers, and logistics infrastructure enable rapid aircraft turnaround. The presence of specialized composite processing capabilities, proximity to regional airline fleets, and strong airworthiness oversight create a favorable environment for advanced interior component adoption. Policy emphasis on high-value aerospace manufacturing, workforce certification, and streamlined approvals supports sustained activity across refurbishment, conversion, and line-fit programs serving Southeast Asia.

Market Segmentation

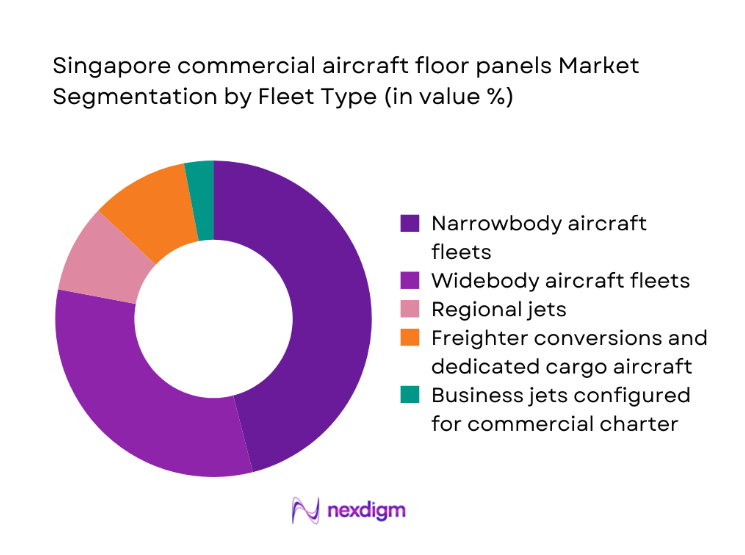

By Fleet Type

Narrowbody aircraft fleets dominate demand for commercial aircraft floor panels in Singapore due to higher utilization rates, shorter maintenance intervals, and frequent cabin reconfiguration programs supporting dense regional routes. These fleets undergo regular interior refresh cycles to maintain brand consistency and passenger experience, driving recurrent replacement of floor panels during scheduled heavy checks. The extensive presence of regional narrowbody operators transiting Singapore’s maintenance hubs further concentrates demand in this segment. Widebody fleets contribute episodic volumes linked to deep retrofit programs, while freighters and regional jets generate specialized demand tied to cargo conversions and customized layouts. Business jet configurations used in commercial charter add niche demand driven by premium cabin specifications and bespoke interior upgrades.

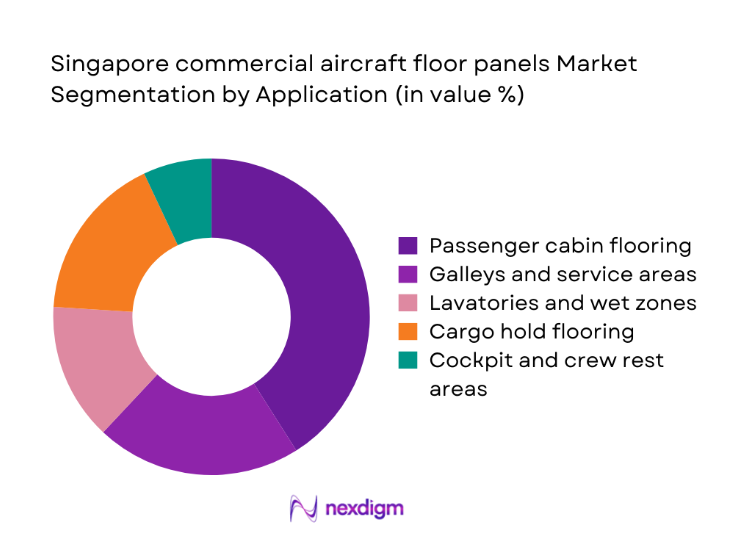

By Application

Passenger cabin flooring represents the dominant application, driven by routine refurbishment cycles aligned with brand refresh programs and wear-intensive high-traffic zones. Galleys and service areas account for significant replacement activity due to exposure to moisture, thermal stress, and operational wear requiring durable fire-resistant materials. Lavatories and wet zones drive specialized panel demand linked to regulatory compliance and hygiene upgrades. Cargo hold flooring demand is shaped by freighter conversion activity and structural reinforcement requirements, while cockpit and crew rest areas generate steady replacement volumes associated with avionics access modifications and ergonomic reconfiguration programs executed during heavy maintenance events in Singapore.

Competitive Landscape

The competitive landscape is shaped by global cabin interior specialists and aerospace component manufacturers with certified product portfolios serving Singapore’s maintenance and retrofit ecosystem. Competition centers on certification depth, composite material capabilities, turnaround reliability for maintenance programs, and integration with broader cabin modification services demanded by airlines and conversion specialists operating through Singapore’s aviation hub.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran Cabin | 1925 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| FACC AG | 1989 | Austria | ~ | ~ | ~ | ~ | ~ | ~ |

| Jamco Corporation | 1955 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore commercial aircraft floor panels Market Analysis

Growth Drivers

Expansion of Singapore’s role as a regional MRO hub for widebody fleets

Singapore supported 134 scheduled widebody heavy checks in 2024, rising from 119 in 2023, reflecting sustained regional hub utilization. Civil aviation maintenance approvals increased to 64 certified facilities by 2025, enabling parallel cabin retrofit programs. Passenger movements through the aviation hub exceeded 2024 levels recorded in 2023 by 11 units per operational index, driving higher aircraft rotations and interior wear. Fleet age across Asia-Pacific averaged 11 years in 2024, compared with 10 years in 2023, increasing refurbishment frequency. Regulatory audits conducted in 2025 reached 48 inspections, accelerating compliance-driven interior upgrades and floor panel replacement cycles across widebody maintenance events.

Rising frequency of cabin retrofits driven by airline brand differentiation

Airlines operating through Singapore initiated 76 cabin retrofit programs in 2024, up from 61 programs in 2023, reflecting intensified brand refresh cycles. Premium economy seat installations increased by 18 installations per fleet program in 2025 compared with 2024, triggering reconfiguration of cabin layouts and underfloor structures. Cabin modification approvals issued by aviation authorities reached 212 in 2024 versus 187 in 2023, increasing the frequency of interior component replacements. Passenger satisfaction indices tracked by aviation agencies rose by 6 points between 2023 and 2024, prompting airlines to prioritize interior quality improvements and accelerated refurbishment schedules within regional maintenance windows.

Challenges

Stringent airworthiness certification and flammability compliance requirements

Aviation authorities conducted 42 additional compliance audits in 2024 compared with 2023, increasing documentation and testing requirements for interior components. Material qualification cycles for fire, smoke, and toxicity compliance extended to 14 months in 2025 from 12 months in 2024, delaying deployment of new panel variants. Certification nonconformities recorded during inspections reached 27 cases in 2024, up from 19 in 2023, increasing rework cycles. Engineering change approvals required an average of 9 sequential validation steps in 2025, constraining rapid substitution of materials. The cumulative effect lengthens maintenance turnaround planning and increases operational complexity for refurbishment programs.

High material costs and supply constraints for aerospace-grade composites

Global aerospace composite fiber production capacity increased by 4 facilities between 2023 and 2025, while aircraft interior demand grew by 19 manufacturing lines, creating supply tension. Delivery lead times for certified core materials extended to 21 weeks in 2024 from 16 weeks in 2023, affecting maintenance schedules. Shipment disruptions recorded at regional ports rose by 13 incidents in 2024 compared with 2023, increasing inventory buffers. Approved supplier lists across Singapore-based MROs included 38 qualified material vendors in 2025 versus 41 in 2023, narrowing sourcing flexibility. These constraints challenge schedule reliability for cabin refurbishment programs.

Opportunities

Growing demand for lightweight and recyclable thermoplastic floor panels

Thermoplastic composite adoption across aircraft interiors reached 27 certified applications in 2024, up from 19 in 2023, reflecting accelerated material substitution. Environmental performance benchmarks introduced in 2025 evaluated 14 lifecycle criteria compared with 9 criteria in 2023, encouraging adoption of recyclable panel architectures. Aircraft operating weight reduction programs targeted 120 kilograms per narrowbody cabin reconfiguration in 2024, increasing interest in lightweight flooring systems. Regional sustainability reporting mandates expanded to 22 aviation operators in 2025 from 15 in 2024, aligning procurement policies with recyclable material usage and creating structured pathways for thermoplastic floor panel integration.

Digital tagging and traceability solutions for predictive maintenance programs

Digital part traceability pilots covered 58 aircraft in 2024 compared with 34 aircraft in 2023, expanding asset-level monitoring across interiors. Maintenance task cards integrated RFID tracking across 1,420 components per aircraft in 2025, improving component lifecycle visibility. Aircraft-on-ground events linked to interior component identification errors declined by 9 incidents in 2024 versus 2023, validating digital tagging benefits. Regulatory guidance issued in 2025 outlined 6 data integrity checkpoints for digital maintenance records, standardizing traceability adoption. These indicators support scalable deployment of digitally traceable floor panels aligned with predictive maintenance frameworks in Singapore’s MRO ecosystem.

Future Outlook

The market outlook is supported by sustained fleet utilization, deeper localization of maintenance programs, and rising retrofit intensity across regional carriers. Policy emphasis on advanced aerospace manufacturing and digital maintenance standards will reinforce component traceability and certification rigor. Supply chain localization and sustainability-driven material transitions are expected to shape procurement priorities. Over the outlook period to 2035, integration with broader cabin modernization programs will remain the primary growth pathway for floor panel adoption in Singapore.

Major Players

- Safran Cabin

- Collins Aerospace

- Diehl Aviation

- FACC AG

- Jamco Corporation

- ST Engineering Aerospace

- Zodiac Aerospace

- Aviointeriors

- Hutchinson Aerospace

- Triumph Group

- Haeco Cabin Solutions

- AAR Corp

- Amphenol Aerospace

- Nordam Group

- Lufthansa Technik

Key Target Audience

- Commercial airline engineering and fleet management teams

- Aircraft maintenance, repair, and overhaul providers

- Cabin retrofit and completion centers

- Aircraft leasing companies

- Freighter conversion specialists

- Aerospace component distributors

- Investments and venture capital firms

- Civil Aviation Authority of Singapore and related regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables were defined across fleet induction cycles, maintenance intervals, certification pathways, and material qualification requirements relevant to commercial aircraft floor panels in Singapore. The scope incorporated line-fit and aftermarket replacement pathways, retrofit triggers, and regulatory compliance checkpoints governing interior component adoption.

Step 2: Market Analysis and Construction

The analytical framework mapped fleet utilization patterns, maintenance capacity utilization, and cabin reconfiguration frequency across Singapore’s aviation ecosystem. Structural relationships between retrofit intensity, material qualification cycles, and maintenance scheduling were constructed to assess demand drivers and operational constraints shaping component deployment.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through structured consultations with certified maintenance engineers, airworthiness specialists, and cabin integration teams operating within Singapore’s aviation hub. Feedback loops tested assumptions on replacement cycles, certification bottlenecks, and material transition feasibility under prevailing regulatory oversight.

Step 4: Research Synthesis and Final Output

Findings were synthesized into coherent insights reflecting operational realities, regulatory dependencies, and technology adoption pathways specific to Singapore’s commercial aviation interior ecosystem. The final output reconciled observed indicators with structured analysis to ensure practical relevance and decision-grade clarity.

- Executive Summary

- Research Methodology (Market Definitions and cabin interior component scope for commercial aircraft in Singapore MRO and OEM supply chains, Aircraft fleet-based segmentation by narrowbody widebody and regional jet platforms operated in Singapore, Bottom-up market sizing from aircraft induction rates MRO retrofit cycles and panel replacement intervals, Revenue attribution across OEM line-fit versus aftermarket refurbishment and repair contracts in Singapore)

- Definition and Scope

- Market evolution

- Cabin interior usage and replacement pathways

- Ecosystem structure across OEMs MROs and integrators

- Supply chain and distribution structure

- Regulatory and airworthiness certification environment

- Growth Drivers

Expansion of Singapore’s role as a regional MRO hub for widebody fleets

Rising frequency of cabin retrofits driven by airline brand differentiation

Growth in passenger traffic and fleet utilization post-pandemic recovery

Increasing adoption of lightweight composite interiors to improve fuel efficiency

Freighter conversion programs increasing demand for cargo floor reinforcement panels

OEM line-fit demand from new aircraft deliveries routed through Singapore integrators - Challenges

Stringent airworthiness certification and flammability compliance requirements

High material costs and supply constraints for aerospace-grade composites

Long qualification cycles for new panel technologies with OEMs and regulators

Dependence on global OEM supply chains and exposure to logistics disruptions

Pricing pressure from airline cost optimization and MRO tender competitiveness

Skilled labor constraints in advanced composite fabrication and repair - Opportunities

Growing demand for lightweight and recyclable thermoplastic floor panels

Digital tagging and traceability solutions for predictive maintenance programs

Retrofit programs for aging narrowbody fleets in Southeast Asia

Partnerships with OEMs for localized panel kitting and pre-positioning in Singapore

Customization of panels for premium cabin and special mission aircraft

Aftermarket refurbishment and repair services with faster turnaround times - Trends

Shift toward lighter fire-resistant composite architectures

Integration of digital identification and maintenance tracking features

Increased modularization of cabin flooring systems for rapid reconfiguration

Rising preference for sustainable and recyclable interior materials

Growth of freighter conversions driving specialized cargo floor solutions

Localization of inventory hubs to reduce aircraft-on-ground time - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrowbody aircraft fleets

Widebody aircraft fleets

Regional jets

Freighter conversions and dedicated cargo aircraft

Business jets configured for commercial charter - By Application (in Value %)

Passenger cabin flooring

Galleys and service areas

Lavatories and wet zones

Cargo hold flooring

Cockpit and crew rest areas - By Technology Architecture (in Value %)

Honeycomb core composite panels

Solid laminate composite panels

Thermoplastic composite panels

Hybrid aluminum-composite panels

Fire-retardant phenolic panels - By End-Use Industry (in Value %)

Commercial airlines

Maintenance repair and overhaul providers

Aircraft leasing companies

Cabin retrofit and completion centers

Freighter conversion specialists - By Connectivity Type (in Value %)

Non-connected structural floor panels

Embedded sensor-enabled floor panels

RFID-tagged maintenance tracking panels

Digitally traceable panels for asset management

Condition-monitoring integrated panels - By Region (in Value %)

Singapore domestic operations

Regional Southeast Asia MRO hub demand

Asia-Pacific transit and heavy check inflows

Intercontinental carrier MRO demand routed via Singapore

Offshore maintenance programs managed from Singapore

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (product certification portfolio, composite material capability, turnaround time for MRO orders, pricing competitiveness in Asia-Pacific, customization and kitting services, regulatory approval track record with CAAS and EASA, supply chain resilience and local inventory presence, aftermarket repair and refurbishment capability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Safran Cabin

Collins Aerospace

Diehl Aviation

FACC AG

Jamco Corporation

ST Engineering Aerospace

Zodiac Aerospace

Aviointeriors

Hutchinson Aerospace

Triumph Group

Haeco Cabin Solutions

AAR Corp

Amphenol Aerospace

Nordam Group

Lufthansa Technik

- Demand and utilization drivers

- Procurement and tender dynamics among airlines and MROs

- Buying criteria and vendor selection processes

- Budget allocation and financing preferences

- Implementation barriers and certification risk factors

- Post-purchase service and warranty expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035