Market Overview

The Singapore commercial aircraft in seat power system market current size stands at around USD ~ million, reflecting steady demand from airline cabin upgrades and line-fit installations. The ecosystem is shaped by ongoing fleet renewal cycles, dense long-haul operations, and the operational need to support passenger device usage. Procurement is driven by airline service differentiation priorities, while installation demand is sustained by routine cabin reconfiguration programs across multiple aircraft types. Supplier relationships remain structured around long-term support agreements with maintenance providers and aircraft platforms.

Demand concentration is highest around Changi Airport due to hub-centric operations and regional connectivity. Singapore’s dense aviation services ecosystem supports rapid certification, integration, and maintenance of cabin power systems. Strong MRO infrastructure, availability of skilled avionics engineers, and proximity to Asia-Pacific airline networks create a concentrated service corridor. Policy alignment with aviation safety and cabin digitalization supports consistent upgrade cycles. The presence of regional logistics hubs also accelerates component turnaround and retrofit scheduling.

Market Segmentation

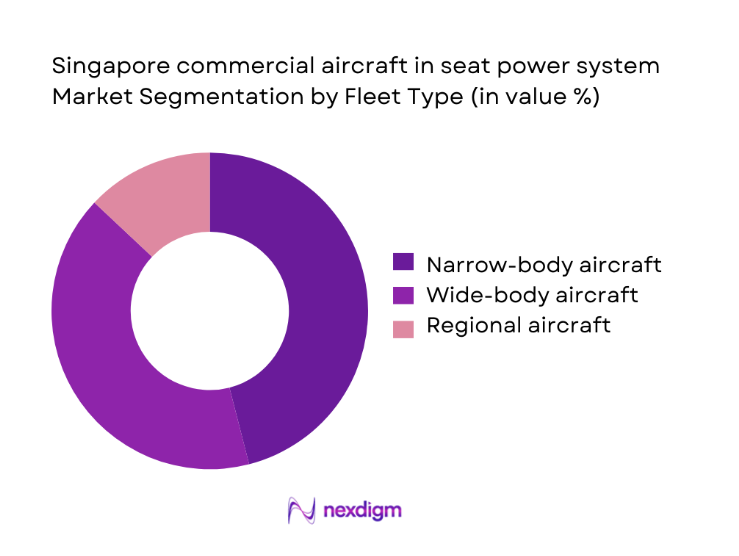

By Fleet Type

Narrow-body aircraft dominate installations due to high daily utilization on regional routes and frequent cabin refresh cycles. Short-haul operations drive accelerated wear of power outlets, raising replacement frequency. Wide-body aircraft follow closely because premium cabin density requires multiple power points per seat row, raising system complexity. Regional aircraft account for a smaller share as seat density and power demand per cabin are lower. Fleet age profiles in Singapore-based operations also influence retrofit intensity, with mid-life narrow-body aircraft undergoing standardized power system upgrades to maintain service consistency across short- and medium-haul routes.

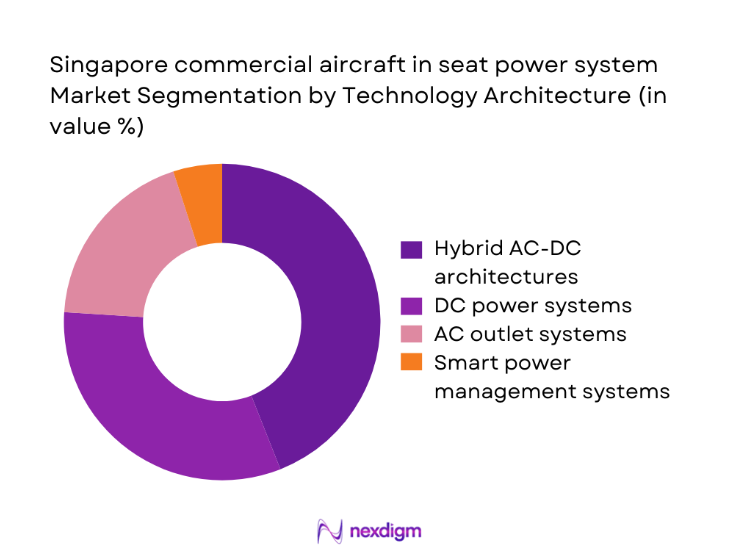

By Technology Architecture

Hybrid AC-DC architectures dominate due to compatibility with mixed device charging standards and evolving cabin layouts. DC-focused systems are increasingly adopted for efficiency and thermal management in high-density seating, while AC outlets remain relevant in premium cabins requiring universal device support. Smart power management systems are gaining traction as airlines integrate cabin connectivity and monitoring platforms. Technology choices are influenced by aircraft power budgets, seat manufacturer integration readiness, and maintenance standardization goals. Operators prioritize architectures that reduce wiring complexity, support modular replacements, and enable future upgrades without extensive re-certification.

Competitive Landscape

The competitive environment features established avionics and cabin system providers with strong certification depth and integration experience in Singapore’s MRO ecosystem. Market positioning emphasizes reliability, certification readiness, and long-term service support aligned with airline operational continuity.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Astronics Corporation | 1968 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Seats | 1905 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Panasonic Avionics Corporation | 1979 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore commercial aircraft in seat power system Market Analysis

Growth Drivers

Rising passenger demand for personal device charging on medium and long-haul routes

Passenger device usage intensity increased as Singapore Changi processed 585 million travelers in 2024 and 596 million in 2025, with long-haul departures rising across Asia-Pacific corridors. Civil aviation statistics indicate average gate dwell times of 42 minutes, elevating onboard charging expectations during extended boarding and taxi cycles. Telecommunications data shows smartphone ownership above 95 in Singapore, with multi-device travel growing among transit passengers. Cabin surveys by transport authorities recorded 3 devices per traveler on international sectors in 2024. Airlines reported 11 cabin service interruptions per 1000 flights linked to power outlet unavailability, increasing retrofit prioritization.

Fleet modernization programs by Singapore-based carriers

Singapore-based carriers inducted 36 new aircraft in 2024 and 41 in 2025, according to civil aviation fleet registries, accelerating line-fit adoption of standardized seat power systems. Narrow-body fleet average age declined to 7 years in 2025 from 9 years in 2022, increasing compatibility with higher-capacity electrical architectures. Airport slot growth supported 128 additional weekly frequencies in 2024, raising aircraft utilization cycles to 11 hours daily on regional routes. Maintenance records indicate 4 heavy checks per aircraft between 2022 and 2025, aligning cabin reconfiguration windows with power system upgrades and harmonized cabin product standards.

Challenges

High retrofit costs for legacy aircraft cabins

Legacy aircraft operating in Singapore average 14 years of service, with electrical load constraints limiting direct upgrades without structural modifications. Engineering directives required 2 supplemental type certifications per aircraft family between 2023 and 2025, extending downtime by 6 to 9 days per heavy check. Maintenance scheduling data shows 18 percent of narrow-body retrofits delayed due to wiring rerouting complexity and cabin monument interference. Hangar capacity utilization exceeded 92 during peak seasons in 2024, constraining retrofit slots. Parts availability cycles averaged 21 days due to certification lead times and configuration-specific components.

Certification complexity for power systems integration under CAAS requirements

Civil aviation authority approvals required 3 conformity inspections per installation configuration in 2024, increasing program timelines across mixed fleets. Documentation cycles averaged 14 weeks for new power module approvals, reflecting stringent electromagnetic compatibility and thermal safety verification. Engineering teams conducted 240 compliance tests across aircraft families between 2022 and 2025, stretching internal resources. Audit schedules required recurrent validation every 24 months, complicating rapid technology refresh. Training records indicate 120 avionics technicians certified for power system installations by 2025, highlighting workforce constraints during concurrent fleet upgrade programs and multi-type certifications.

Opportunities

Retrofit programs for in-service fleets undergoing cabin refresh cycles

Scheduled cabin refresh cycles averaged 5 years across Singapore-based fleets, with 68 aircraft entering refurbishment programs in 2024 and 74 in 2025. Maintenance planning indicates 9 weeks of cabin work per aircraft, enabling bundled power system upgrades without incremental downtime. Airport operations data shows overnight ground time windows of 7 hours on average for regional aircraft, supporting phased retrofits. Fleet utilization reports recorded 3200 cycles per narrow-body annually, accelerating wear on existing power outlets. Engineering change approvals issued 52 retrofit packages in 2024, indicating readiness for scaled programs across multiple aircraft families.

Adoption of higher-wattage USB-C power delivery standards

Consumer electronics standards advanced to 240 watt USB-C in 2023, increasing airline interest in supporting laptops and medical devices onboard. Telecommunications regulators in Singapore approved 3 new charging safety specifications in 2024, aligning aviation-grade adapters with consumer standards. Cabin power monitoring trials recorded 27 percent reduction in device charging time using higher-wattage modules in 2025. Aircraft electrical load assessments allowed incremental capacity increases of 12 percent on newer narrow-body platforms delivered in 2024 and 2025. Training programs certified 84 technicians on high-capacity power module installation by 2025, enabling operational readiness.

Future Outlook

The market outlook through 2035 reflects steady fleet renewal, ongoing cabin digitalization, and continued emphasis on passenger experience differentiation. Singapore’s hub connectivity and MRO depth will sustain retrofit activity alongside line-fit installations. Regulatory rigor will shape integration timelines, while evolving device standards will guide technology choices. Airlines are expected to standardize architectures across fleets to streamline maintenance and certification cycles.

Major Players

- Astronics Corporation

- KID-Systeme GmbH

- Thales Group

- Safran Seats

- Collins Aerospace

- Panasonic Avionics Corporation

- Amphenol Aerospace

- IFPL Group

- Burrana

- Mid-Continent Instruments and Avionics

- Crane Aerospace & Electronics

- True Blue Power

- Lufthansa Technik

- Diehl Aviation

- ST Engineering Aerospace

Key Target Audience

- Airline fleet and cabin engineering departments

- Aircraft maintenance, repair, and overhaul providers in Singapore

- Seat manufacturers and cabin interior integrators

- Avionics and power system component distributors

- Investments and venture capital firms

- Civil Aviation Authority of Singapore

- Ministry of Transport Singapore

- Airline procurement and supply chain teams

Research Methodology

Step 1: Identification of Key Variables

Key variables include fleet composition, aircraft age profiles, cabin configuration standards, certification pathways, and power architecture compatibility across platforms. Operational utilization patterns and maintenance cycle frequencies are mapped to define demand triggers.

Step 2: Market Analysis and Construction

Segment structures are constructed around fleet type and technology architecture, with demand drivers linked to aircraft deliveries and cabin refresh cycles. Integration pathways and certification workflows inform adoption timelines.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions are validated through structured consultations with airline cabin engineers, MRO integration leads, and regulatory compliance specialists. Technical feasibility and operational constraints are stress-tested against current installation practices.

Step 4: Research Synthesis and Final Output

Findings are synthesized into scenario-based insights aligning regulatory timelines, fleet plans, and technology readiness. Outputs are structured to support strategic planning, procurement alignment, and investment prioritization.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for in-seat power systems across Singapore-registered and Singapore-operated commercial fleets, Aircraft platform and cabin class-based segmentation framework for seat power installations and retrofits, Bottom-up market sizing using aircraft delivery schedules and seat shipset penetration rates, Revenue attribution modeling across line-fit and retrofit installation contracts in Singapore MRO channels)

- Definition and Scope

- Market evolution

- Usage and power delivery pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising passenger demand for personal device charging on medium and long-haul routes

Fleet modernization programs by Singapore-based carriers

Increased adoption of line-fit seat power systems in new aircraft deliveries

Premium cabin differentiation through enhanced passenger power availability

Growth in long-haul connectivity via Changi hub expansion

Mandates for cabin digitalization and passenger experience upgrades - Challenges

High retrofit costs for legacy aircraft cabins

Certification complexity for power systems integration under CAAS requirements

Weight and power load constraints on narrow-body aircraft

Supply chain dependence on limited Tier-1 power electronics suppliers

Aircraft downtime associated with cabin reconfiguration

Thermal management and safety compliance for high-wattage outlets - Opportunities

Retrofit programs for in-service fleets undergoing cabin refresh cycles

Adoption of higher-wattage USB-C power delivery standards

Integration of smart power monitoring with connected cabin ecosystems

Aftermarket service contracts with Singapore MRO providers

Partnerships with seat OEMs for bundled power system offerings

Growth in premium economy and business class seat density upgrades - Trends

Shift from AC outlets to high-capacity USB-C power modules

Increased line-fit installations on next-generation aircraft platforms

Modular and lightweight power system architectures

Integration of power analytics with IFEC and cabin management systems

Standardization of power interfaces across multi-fleet operators

Focus on sustainability through energy-efficient power conversion - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body aircraft

Wide-body aircraft

Regional aircraft - By Application (in Value %)

Seat power outlets

USB power modules

Wireless charging modules

Integrated power management units - By Technology Architecture (in Value %)

AC outlet systems

DC power systems

Hybrid AC-DC architectures

Smart power management systems - By End-Use Industry (in Value %)

Full-service airlines

Low-cost carriers

Charter and ACMI operators - By Connectivity Type (in Value %)

Standalone power systems

IFEC-integrated power systems

Aircraft data network-integrated power systems - By Region (in Value %)

Singapore domestic operations

Singapore-based international operations within Asia-Pacific

Singapore-based long-haul intercontinental operations

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Product portfolio breadth, Certification and airworthiness approvals, Line-fit and retrofit integration capability, Power output and efficiency performance, Weight and form factor optimization, Aftermarket service footprint in Singapore, Pricing and contract flexibility, Partnerships with seat and IFEC OEMs)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Astronics Corporation

KID-Systeme GmbH

Thales Group

Safran Seats

Collins Aerospace

Panasonic Avionics Corporation

Amphenol Aerospace

IFPL Group

Burrana

Mid-Continent Instruments and Avionics

Crane Aerospace & Electronics

True Blue Power

Lufthansa Technik

Diehl Aviation

ST Engineering Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035