Market Overview

The commercial aircraft interior lighting market in Singapore is expected to reach USD ~ billion, with a robust demand for advanced lighting solutions. Market drivers include technological advancements in lighting systems, which provide improved energy efficiency, durability, and enhanced passenger comfort. The increase in air travel and the subsequent demand for better passenger experiences on both commercial and private flights also contribute to market growth. The industry is driven by both the expansion of aviation infrastructure and growing customer preferences for modernized, sustainable lighting solutions.

The dominance of Singapore in the commercial aircraft interior lighting market is due to its strategic position as a global aviation hub, with strong growth in regional and international flight connectivity. Singapore’s highly developed aerospace and aviation infrastructure, as well as its established regulatory framework, provide a conducive environment for both the manufacturing and adoption of advanced aircraft lighting systems. The government’s strong support for aviation technology further accelerates the market’s growth, making it a key player in the Asia-Pacific region.

Market Segmentation

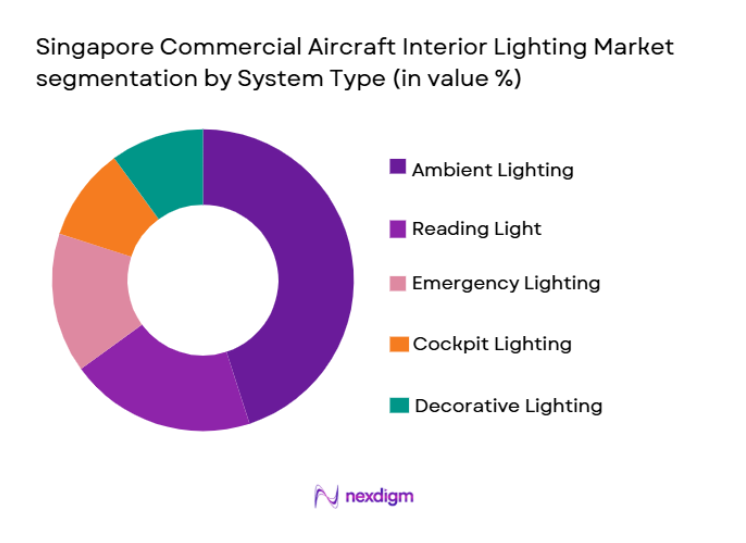

By System Type

The commercial aircraft interior lighting market is segmented by system type into ambient lighting, reading light, emergency lighting, cockpit lighting, and decorative lighting. Among these, ambient lighting has dominated the market share recently. This is due to the rising preference for enhanced passenger comfort and the growing demand for energy-efficient lighting solutions. Ambient lighting systems are favored for their ability to create a calming atmosphere, reduce fatigue, and improve overall cabin aesthetics. This system is also highly adaptable to various lighting requirements, making it popular in both economy and premium cabins. Furthermore, advancements in LED technology, which offer better durability and energy savings, have boosted the adoption of ambient lighting solutions.

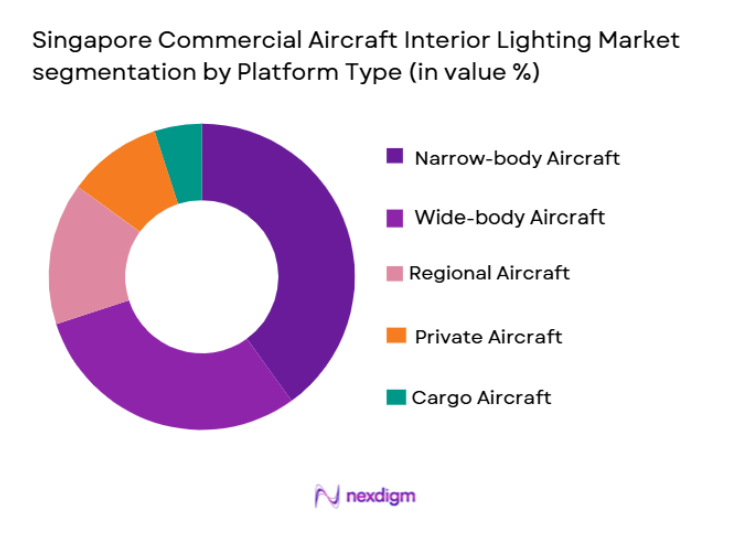

By Platform Type

The commercial aircraft interior lighting market is segmented by platform type into narrow-body aircraft, wide-body aircraft, regional aircraft, private jets, and cargo aircraft. Narrow-body aircraft have recently emerged as the dominant platform type in terms of market share. This dominance is largely driven by the increasing demand for cost-effective, energy-efficient lighting solutions for short and medium-haul flights, which often utilize narrow-body aircraft. Airlines operating narrow-body fleets are investing in lighting systems that optimize cabin space and enhance passenger experience while minimizing energy consumption. Additionally, the growing adoption of low-cost carriers has contributed to the rise in narrow-body aircraft usage, further fueling demand for interior lighting solutions tailored for such platforms.

Competitive Landscape

The competitive landscape in the commercial aircraft interior lighting market is characterized by the presence of several established global players, leading to a high level of consolidation. Major companies are focusing on innovation, with particular emphasis on the development of energy-efficient lighting systems that align with both consumer demands and regulatory requirements. The market is also shaped by strategic partnerships between lighting manufacturers and aircraft OEMs to provide custom solutions for modern aircraft interiors.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Innovation Focus |

| Honeywell | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | Charlotte, USA | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 1909 | Nurnberg, Germany | ~ | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 1896 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Luminator Technology | 1972 | Plano, USA | ~ | ~ | ~ | ~ | ~ |

Singapore Commercial Aircraft Interior Lighting Market Analysis

Growth Drivers

Increased Demand for Energy-Efficient Solutions

The commercial aircraft interior lighting market has witnessed significant growth driven by the increasing demand for energy-efficient lighting systems. Airlines are continuously seeking ways to reduce operating costs, and energy-efficient lighting, particularly in the form of LED technology, offers substantial savings in terms of electricity consumption and maintenance costs. This shift is not only driven by the airlines’ need for cost-effective solutions but also by growing environmental concerns. With rising fuel prices and the aviation industry’s focus on sustainability, energy-efficient lighting systems have become an essential part of modern aircraft designs. Airlines are also keen on upgrading their fleets with lighting systems that align with their green initiatives and reduce their carbon footprint, making energy-efficient lighting a key driver in the market. The adoption of LED lighting, known for its long lifespan and lower energy consumption compared to traditional lighting, has become an industry standard, thus bolstering the growth of this segment. Additionally, advancements in smart lighting systems that can be controlled and adjusted to meet specific passenger needs have further strengthened the demand for energy-efficient lighting solutions.

Technological Advancements in Lighting Solutions

Another major driver of the market is the rapid technological advancements in aircraft interior lighting systems. The increasing integration of advanced technologies such as smart lighting, OLED (Organic Light Emitting Diodes), and human-centric lighting has transformed the way aircraft lighting systems are designed. The adoption of these innovative solutions not only improves the aesthetic appeal of aircraft interiors but also enhances passenger comfort, reduces fatigue, and promotes well-being during flights. Smart lighting systems that adjust automatically to the time of day and passenger needs have become increasingly popular in modern aircraft. Additionally, the trend towards OLED lighting, which offers flexible, lightweight, and energy-efficient solutions, is gaining momentum. These technological advancements not only improve the efficiency and effectiveness of lighting systems but also contribute to the overall passenger experience, making them a key driver for the market. With ongoing research and development in lighting technology, the market is expected to witness continuous innovations that cater to the evolving needs of airlines and passengers.

Market Challenges

High Initial Cost of Advanced Lighting Systems

One of the significant challenges faced by the commercial aircraft interior lighting market is the high initial cost associated with the installation of advanced lighting systems. While technologies such as LED and OLED offer long-term savings in terms of energy efficiency and reduced maintenance, their upfront costs remain a barrier, especially for smaller airlines or those with limited budgets. The high costs of these lighting systems, coupled with the complexity of retrofitting older aircraft with modern lighting solutions, present significant financial challenges. Airlines and operators are often reluctant to invest in these systems due to the high capital expenditure required for their installation and maintenance. This challenge is particularly pronounced in developing markets or among smaller carriers that operate older fleets and lack the financial resources to invest in new lighting technologies. Despite the long-term benefits, the high upfront investment remains a challenge to widespread adoption.

Regulatory and Safety Standards

Another challenge facing the commercial aircraft interior lighting market is the strict regulatory and safety standards that govern the design and installation of lighting systems. Aircraft lighting must comply with numerous safety regulations set by aviation authorities such as the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency). These regulations ensure that lighting systems are durable, reliable, and capable of operating under extreme conditions, but they also add complexity and cost to the development and implementation of lighting systems. Manufacturers must ensure that their lighting solutions meet all necessary safety requirements, which can increase development times and costs. Furthermore, any modifications to lighting systems in existing aircraft require approval from regulatory bodies, adding an additional layer of bureaucracy. This regulatory burden can slow down the adoption of new lighting technologies and increase costs, presenting a significant challenge for the market.

Opportunities

Expansion in Emerging Markets

The commercial aircraft interior lighting market has significant growth potential in emerging markets, particularly in Asia-Pacific and Latin America. These regions are experiencing rapid economic growth, resulting in increased air travel and a higher demand for modernized and efficient aircraft interiors. Airlines in these regions are upgrading their fleets to cater to the growing number of passengers and improve the overall passenger experience. As a result, there is a growing demand for advanced interior lighting systems, particularly those that provide better energy efficiency and enhanced comfort. This offers a substantial opportunity for lighting manufacturers to expand their operations and capitalize on the growing demand in these emerging markets. With airlines in these regions focused on cost optimization and sustainability, energy-efficient lighting solutions, such as LED and OLED technologies, are expected to see strong adoption. Additionally, the expansion of low-cost carriers in these regions further drives the demand for affordable and efficient lighting solutions.

Partnerships with Aircraft OEMs

Another promising opportunity in the commercial aircraft interior lighting market lies in strategic partnerships with aircraft original equipment manufacturers (OEMs). As OEMs look to differentiate their products and offer enhanced passenger experiences, they are increasingly turning to lighting solutions providers to integrate advanced lighting systems into their aircraft designs. Collaborative efforts between lighting system manufacturers and aircraft OEMs present an opportunity to develop custom lighting solutions that meet the specific needs of modern aircraft. These partnerships enable lighting manufacturers to gain access to a larger customer base and establish long-term relationships with aircraft manufacturers. Additionally, as new aircraft models are introduced, there is a growing demand for innovative lighting solutions that improve both aesthetics and functionality. By collaborating with OEMs, lighting companies can play a key role in the design and development of next-generation aircraft interiors, ensuring their systems are an integral part of modern aviation.

Future Outlook

The future outlook for the commercial aircraft interior lighting market is positive, with continued growth expected over the next five years. Technological innovations, such as advancements in LED and OLED lighting, will continue to drive the adoption of energy-efficient and sustainable lighting solutions. As air travel continues to rise globally, airlines are focusing on improving the passenger experience, and interior lighting plays a crucial role in this endeavor. Additionally, growing regulatory support for sustainability and the increasing adoption of smart lighting systems will contribute to the market’s expansion.

Major Players

- Honeywell

- Collins Aerospace

- Diehl Aviation

- Zodiac Aerospace

- Luminator Technology

- Astronics Corporation

- STG Aerospace

- Safran

- Lufthansa Technik

- Rockwell Collins

- Panasonic Avionics

- B/E Aerospace

- JAMCO Corporation

- Thales Group

- Safran Cabin

Key Target Audience

- Airlines

- Aircraft Manufacturers

- MRO Companies

- Aircraft Interior Manufacturers

- Aviation Regulatory Authorities

- Aircraft Lighting Solution Providers

- Investors in Aviation Industry

- Aviation Supply Chain Partners

Research Methodology

Step 1: Identification of Key Variables

Understanding the market’s size, growth potential, and key drivers through secondary research and industry reports.

Step 2: Market Analysis and Construction

Assessing trends, segmentation, and growth factors based on primary and secondary data collection.

Step 3: Hypothesis Validation and Expert Consultation

Engaging industry experts to validate findings and refine market forecasts.

Step 4: Research Synthesis and Final Output

Compiling comprehensive data into actionable insights for the commercial aircraft interior lighting market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Energy-Efficient Lighting

Technological Advancements in LED Lighting

Focus on Passenger Comfort and Experience

Regulatory Push for Aircraft Interior Standardization

Growth of Low-Cost Airlines in Asia-Pacific - Market Challenges

High Initial Cost of LED Lighting Systems

Regulatory Challenges in Lighting Standards

Supply Chain Constraints in Aircraft Manufacturing

Competition Among Aircraft Lighting Providers

Complexity in Retrofitting Aircraft Lighting Systems - Market Opportunities

Rising Adoption of Smart Lighting Systems

Growth in the Asian Aviation Market

Increase in Aircraft Orders and Production - Trends

Shift Towards Sustainable Lighting Technologies

Increased Demand for Customizable Cabin Interiors

Growing Trend for IoT-Integrated Lighting Solutions

Integration of Smart Control Systems

Advancements in Human-Centric Lighting Design - Government Regulations & Defense Policy

Aircraft Interior Lighting Safety Standards

Environmental Regulations for Aircraft Lighting

Government Initiatives Promoting Aviation Technology - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ambient Lighting Systems

Reading Light Systems

Emergency Lighting Systems

Cockpit Lighting Systems

Cabin Decorative Lighting Systems - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Aircraft

Private Jets

Cargo Aircraft - By Fitment Type (In Value%)

Line-fit Solutions

Retrofit Solutions

OEM Solutions

Upgraded Systems

Modular Solutions - By EndUser Segment (In Value%)

Commercial Airlines

Private Aviation

Aircraft OEMs

Maintenance, Repair, and Overhaul (MRO)

Aircraft Interior Manufacturers - By Procurement Channel (In Value%)

Direct Procurement

OEM Partnerships

MRO Suppliers

Third-party Distributors

Online Marketplaces - By Material / Technology (In Value%)

LED Technology

OLED Technology

Fiber Optic Technology

Incandescent Lighting

Fluorescent Lighting

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Fitment Type, Procurement Channel, Material/Technology, EndUser Segment, Growth Drivers, Challenges, Trends, Opportunities)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Honeywell International

Diehl Aviation

Collins Aerospace

Safran

Zodiac Aerospace

LEDs Direct

Luminator Technology Group

AeroSpace Technologies

Eaton Corporation

Astronics Corporation

Valo Lighting

STG Aerospace

Luxcloud Ltd

Hera Lighting

Soderberg Aviation

- Airlines’ Focus on Passenger Experience and Comfort

- OEM’s Emphasis on Lightweight, Energy-Efficient Solutions

- MRO Industry’s Role in System Upgrades and Retrofitting

- Interior Manufacturers’ Integration of Advanced Lighting Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035