Market Overview

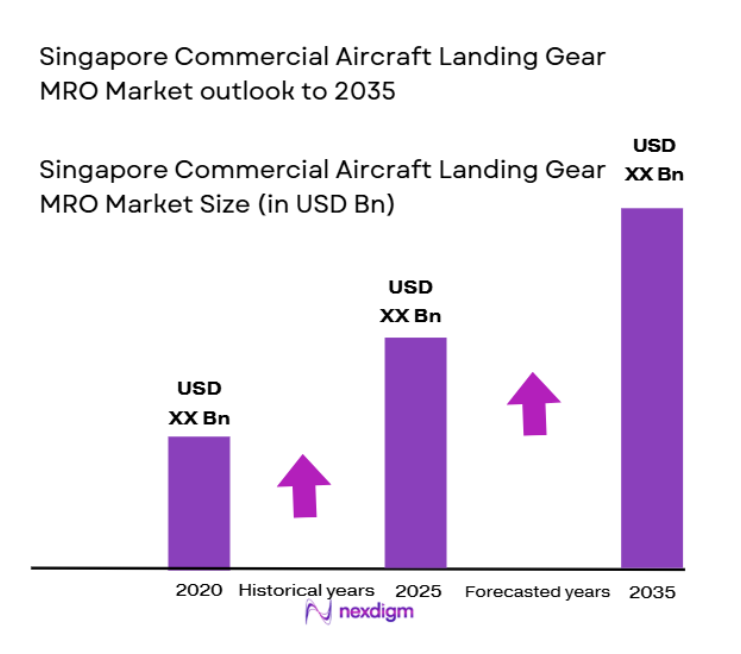

The commercial aircraft landing gear MRO market in Singapore is valued based on a recent historical assessment, with significant contributions from the rapidly expanding air travel sector. The market has been driven by an increasing number of aircraft in operation, with Singapore’s position as a major regional aviation hub further boosting demand. The market size is USD ~ billions, driven by the need for regular maintenance, repair, and overhaul services to ensure aircraft safety and compliance with stringent aviation standards.

Singapore, known for its highly developed aviation infrastructure, stands out as a dominant player in the commercial aircraft landing gear MRO market. The country’s strategic location in Southeast Asia has attracted key players in the aviation industry, providing access to numerous airlines and aviation services. Additionally, Singapore’s strong regulatory environment, investment in cutting-edge technology, and well-established MRO facilities contribute to its dominance. The nation’s ongoing investments in infrastructure and technology further solidify its position in the market.

Market Segmentation

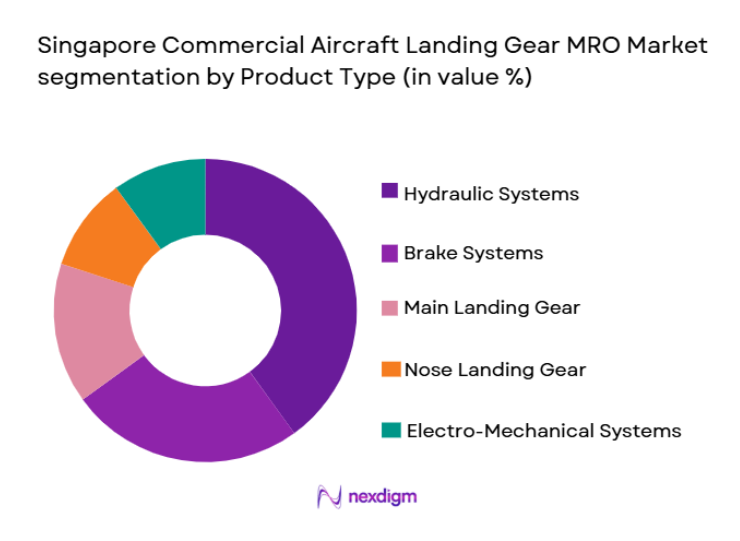

By Product Type

Singapore commercial aircraft landing gear MRO market is segmented by product type into hydraulic systems, brake systems, main landing gear, nose landing gear, and electro-mechanical systems. Recently, hydraulic systems have a dominant market share due to their widespread application in aircraft, offering high reliability and durability. The demand for hydraulic systems is increasing as airlines prioritize performance, safety, and efficiency, especially with a growing number of aircraft being added to regional fleets. This segment’s dominance is attributed to the continuous need for hydraulic components in the maintenance cycles of both narrowbody and widebody aircraft.

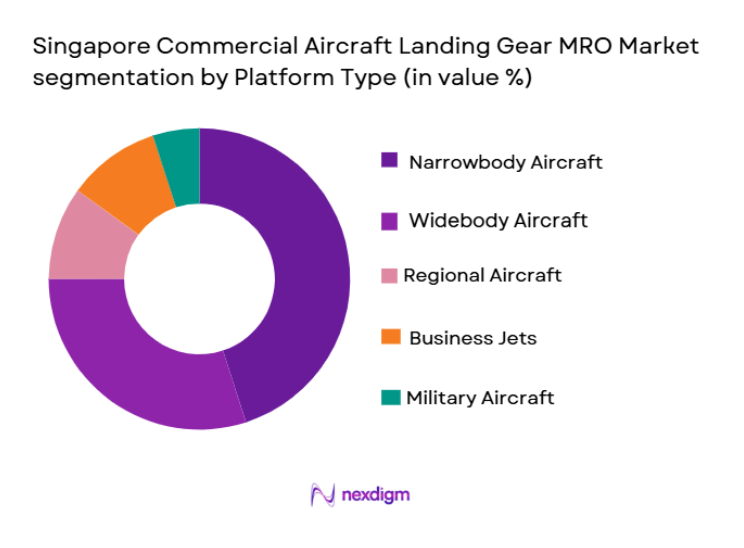

By Platform Type

Singapore commercial aircraft landing gear MRO market is segmented by platform type into narrowbody aircraft, widebody aircraft, regional aircraft, business jets, and military aircraft. Recently, narrowbody aircraft have a dominant market share due to the significant growth in budget airlines and regional travel in Asia-Pacific. The increasing demand for cost-effective air travel solutions and the expansion of regional routes have led to a higher concentration of narrowbody aircraft, driving the demand for their landing gear MRO services. This trend is expected to continue as low-cost carriers expand their fleets in the region.

Competitive Landscape

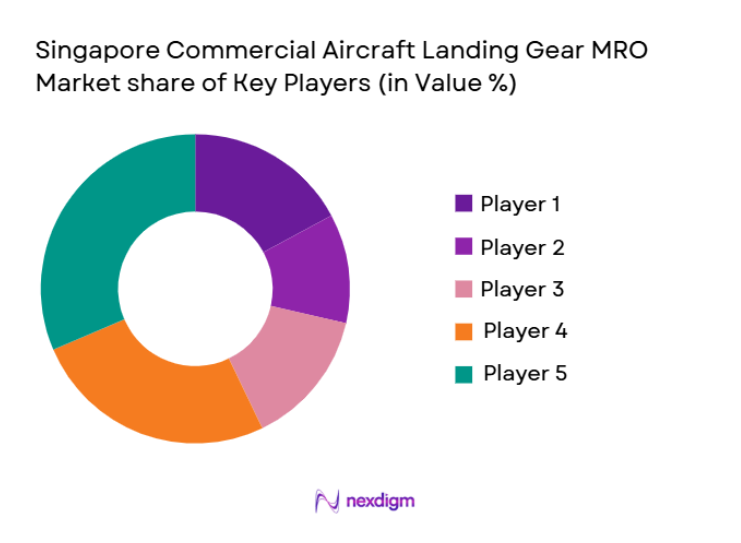

The competitive landscape of the Singapore commercial aircraft landing gear MRO market is characterized by consolidation and significant influence from major players with global reach. These companies drive the market forward through technological innovations, service expansions, and strategic partnerships. The strong presence of established MRO providers in Singapore, coupled with an increase in demand for advanced landing gear systems, has made the market highly competitive. Leading players continue to innovate and enhance their service offerings to maintain a competitive edge.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD billion) | Additional Parameter |

| ST Engineering Aerospace | 1997 | Singapore | ~ | ~ | ~ | ~ | ~ |

| SIA Engineering Company | 1982 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Safran Landing Systems | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1999 | USA | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2002 | USA | ~ | ~ | ~ | ~ | ~ |

Singapore Commercial Aircraft Landing Gear MRO Market Analysis

Growth Drivers

Expansion of Airline Fleets

The expansion of airline fleets in Singapore and the broader Asia-Pacific region has significantly driven demand for commercial aircraft landing gear MRO services. With the rise in the number of low-cost carriers and regional airlines, there is an increasing need for landing gear maintenance and overhauling services. Singapore’s strategic location as an aviation hub in Southeast Asia makes it a key player in the global MRO industry. This increase in fleet numbers, coupled with a surge in air travel, especially after pandemic recovery, has fueled the growth of the MRO market. The region’s growing emphasis on safety and regulatory compliance has led airlines to maintain their aircraft in top condition, driving continuous demand for landing gear services. Additionally, newer aircraft models with advanced landing gear systems are requiring more specialized MRO services, contributing further to the growth.

Technological Advancements in MRO Services

Another key growth driver is the advancement of technologies in MRO services. Automation, predictive maintenance, and the integration of digital technologies in MRO processes are enhancing the efficiency and effectiveness of landing gear maintenance. The use of predictive analytics helps in identifying potential failures before they occur, reducing downtime and maintenance costs. Singapore’s MRO industry has been at the forefront of adopting such technologies, allowing it to provide world-class services to airlines globally. The demand for more sophisticated landing gear systems, including the integration of electric systems and lightweight materials, has prompted MRO providers to innovate continually. This technological advancement is driving the growth of the market by improving operational efficiency, extending the lifespan of aircraft, and reducing operational costs for airlines.

Market Challenges

High Maintenance Costs

One of the significant challenges facing the Singapore commercial aircraft landing gear MRO market is the high cost of maintenance services. Aircraft landing gear systems are highly complex and require specialized components and skilled technicians for their maintenance and repair. The cost of advanced materials, as well as the technology required for the overhaul, can be prohibitive for smaller airlines or those operating on thin margins. This is particularly a challenge for regional and budget airlines in Singapore, who may find it more challenging to afford regular maintenance or high-quality MRO services. Although there is growing demand for MRO services, the financial burden on airlines remains a challenge that could limit their ability to maintain their fleets to the highest standards. Moreover, rising labor costs and inflation in raw material prices add to the financial strain, further complicating the market landscape.

Regulatory and Compliance Barriers

The commercial aircraft landing gear MRO market in Singapore faces significant regulatory challenges. Strict aviation safety standards and certification requirements imposed by global regulatory bodies like the International Civil Aviation Organization (ICAO) and the Civil Aviation Authority of Singapore (CAAS) ensure high operational safety but also increase the complexity and cost of MRO services. MRO providers must adhere to these stringent regulations, which often require ongoing investments in training, certifications, and upgrades to MRO facilities to meet evolving compliance standards. This regulatory burden can act as a barrier to entry for new players and strain the operations of existing companies. Additionally, evolving regulations regarding sustainability and environmental concerns in the aviation industry are placing pressure on MRO providers to adopt eco-friendly practices, which may increase costs and limit operational flexibility.

Opportunities

Adoption of Predictive Maintenance Technologies

One of the most significant opportunities in the Singapore commercial aircraft landing gear MRO market is the adoption of predictive maintenance technologies. The integration of advanced data analytics, artificial intelligence, and the Internet of Things (IoT) into aircraft maintenance systems allows MRO providers to predict failures and schedule maintenance proactively, minimizing aircraft downtime and optimizing fleet management. Predictive maintenance reduces the likelihood of emergency repairs, extends the lifespan of components, and lowers overall maintenance costs. As the aviation industry increasingly focuses on improving operational efficiency, predictive maintenance will continue to be a key differentiator for MRO providers. Singapore, with its advanced technological infrastructure, is well-positioned to lead this transformation, making it an attractive market for investment in MRO technology. Furthermore, airlines are increasingly interested in reducing their operational costs, and predictive maintenance provides a solution to achieving that goal while ensuring high safety and reliability standards.

Expansion of MRO Services to Regional Aircraft and Business Jets

Another opportunity lies in the expansion of MRO services to regional aircraft and business jets, a growing segment in Singapore’s aviation market. As regional travel continues to increase across Southeast Asia and the wider Asia-Pacific region, the demand for maintenance services for smaller aircraft types, such as regional jets and business aircraft, is expected to rise. Singapore’s well-established MRO infrastructure, coupled with its strategic location, makes it an ideal hub for serving these aircraft. The growing trend of business jet ownership, especially among corporate executives and private individuals, is also contributing to the demand for specialized MRO services in this segment. Offering customized and efficient MRO services to regional aircraft and business jets presents a significant growth opportunity for MRO providers, with the potential for long-term contracts and partnerships with regional airlines and private aviation firms.

Future Outlook

The future outlook for the Singapore commercial aircraft landing gear MRO market is optimistic, with continued growth anticipated in the coming years. Advancements in technology, such as the adoption of artificial intelligence and predictive maintenance, will drive operational efficiencies and cost savings for MRO providers and airlines. The increasing demand for air travel across Southeast Asia will continue to fuel the need for MRO services, especially for narrowbody and regional aircraft. Regulatory support and infrastructure investments in Singapore will further bolster the market, making it a key player in the global MRO industry.

Major Players

- ST Engineering Aerospace

- SIA Engineering Company

- Safran Landing Systems

- Honeywell Aerospace

- Collins Aerospace

- AAR Corporation

- Magellan Aerospace

- Meggitt PLC

- GE Aviation

- Pratt & Whitney

- Rolls-Royce

- Turkish Technic

- Delta TechOps

- Lufthansa Technik

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines and aviation companies

- Aircraft manufacturers

- MRO service providers

- Component suppliers

- Private sector and technology firms

- Aerospace engineering firms

Research Methodology

Step 1: Identification of Key Variables

Identifying and defining the key variables and factors that influence the commercial aircraft landing gear MRO market, such as technological advancements, regulatory frameworks, and market trends.

Step 2: Market Analysis and Construction

Building a comprehensive analysis of the market by examining historical trends, market dynamics, and emerging opportunities to construct a clear market overview.

Step 3: Hypothesis Validation and Expert Consultation

Validating hypotheses and gathering insights through consultations with industry experts, key stakeholders, and market participants to ensure the accuracy and reliability of the data.

Step 4: Research Synthesis and Final Output

Synthesizing the collected data into a structured report, presenting actionable insights and forecasts, and finalizing the research to provide a comprehensive market outlook.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Air Travel Demand

Rising Aircraft Fleet in Asia Pacific

Technological Advancements in Landing Gear Design

Government Support for Aviation Infrastructure

Expansion of MRO Facilities in Singapore - Market Challenges

High Maintenance Costs

Limited Skilled Workforce

Complex Regulatory Requirements

Supply Chain Disruptions

Technological Integration Issues - Market Opportunities

Adoption of Predictive Maintenance Technologies

Strategic Partnerships with Aircraft Manufacturers

Emerging Demand for Electric Aircraft Landing Gear - Trends

Shift Toward Eco-friendly and Lightweight Materials

Automation in Landing Gear Maintenance

Increased Investment in Asia-Pacific Aviation Market

Rising Demand for Advanced Maintenance Techniques

Expansion of Asia-Pacific MRO Network - Government Regulations & Defense Policy

Safety and Certification Regulations

Environmental Standards for Aircraft Components

Support for Aviation Industry Growth Initiatives - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Hydraulic Systems

Brake Systems

Main Landing Gear

Nose Landing Gear

Electro-Mechanical Systems - By Platform Type (In Value%)

Narrowbody Aircraft

Widebody Aircraft

Regional Aircraft

Business Jets

Military Aircraft - By Fitment Type (In Value%)

OEM Landing Gear

Replacement Landing Gear

Overhaul Services

Component Repair Services

Landing Gear Inspection Services - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

MRO Service Providers

Component Suppliers

Government and Defense - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Third-Party Distributors

Online Platforms

Private Sector Procurement - By Material / Technology (in Value%)

Titanium Alloys

Steel Components

Composite Materials

Aluminum Alloys

Advanced Coatings

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material Type, Technology, Service Scope, Fleet Size, Geographical Presence)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

ST Engineering Aerospace

SIA Engineering Company

Airbus

Safran Landing Systems

Lufthansa Technik

Collins Aerospace

Honeywell Aerospace

AAR Corporation

Magellan Aerospace

Meggitt PLC

GE Aviation

Pratt & Whitney

Rolls-Royce

Turkish Technic

Delta TechOps

- Airlines Focusing on Cost-Effective MRO Solutions

- MRO Service Providers Expanding Service Offerings

- Aircraft Manufacturers Partnering for Maintenance Solutions

- Government and Defense Agencies Enhancing Aircraft Fleet Maintenance

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035