Market Overview

The Singapore commercial aircraft leasing market has witnessed significant growth, driven by the strategic importance of Singapore as a key aviation hub in Asia. Based on recent historical assessments, the market size is valued at USD ~billion, fueled by a consistent rise in air travel demand, particularly from the Asia-Pacific region. The growth of low-cost carriers, expansion of fleet size by airlines, and the increasing adoption of leasing models for fleet management have been key contributors to the market’s expansion. These factors, along with Singapore’s leading role in international air traffic and aviation finance, continue to drive growth in the aircraft leasing sector.

Singapore, with its world-class aviation infrastructure, has become a dominant player in the global commercial aircraft leasing market. The country’s strategic location, top-tier airport facilities, and highly developed financial systems make it a preferred destination for aviation financing and leasing activities. Moreover, Singapore’s strong regulations and efficient governance, along with its deep ties to international aviation organizations, have bolstered its dominance. This position is further strengthened by the involvement of global lessors and financiers based in Singapore, all of which contribute to the nation’s leadership in the aircraft leasing space.

Market Segmentation

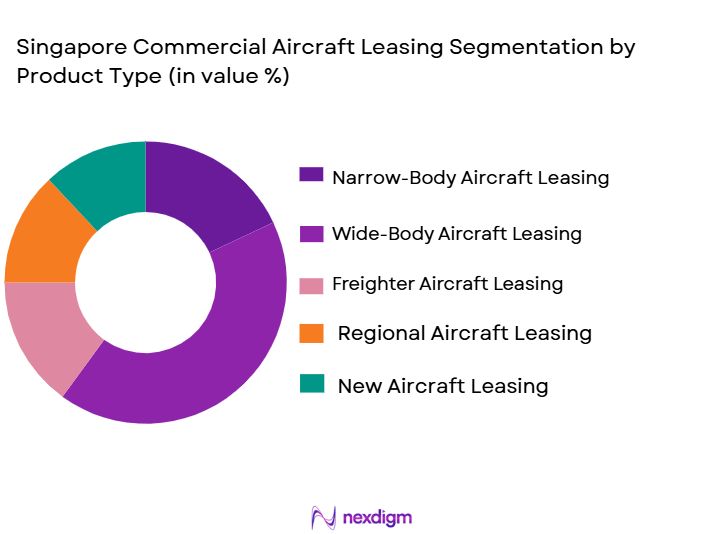

By Product Type:

The Singapore commercial aircraft leasing market is segmented by aircraft type into narrow-body, wide-body, regional, freighter, and private aircraft leasing. Recently, narrow-body aircraft leasing has dominated the market share due to the increasing demand for cost-effective, fuel-efficient aircraft by both low-cost and full-service carriers. Narrow-body aircraft are favored for short-haul flights, which comprise a significant portion of the air travel market in the Asia-Pacific region. Additionally, the widespread preference for these aircraft is fueled by their ability to provide flexibility, lower operating costs, and higher load factors, making them attractive for lease agreements.

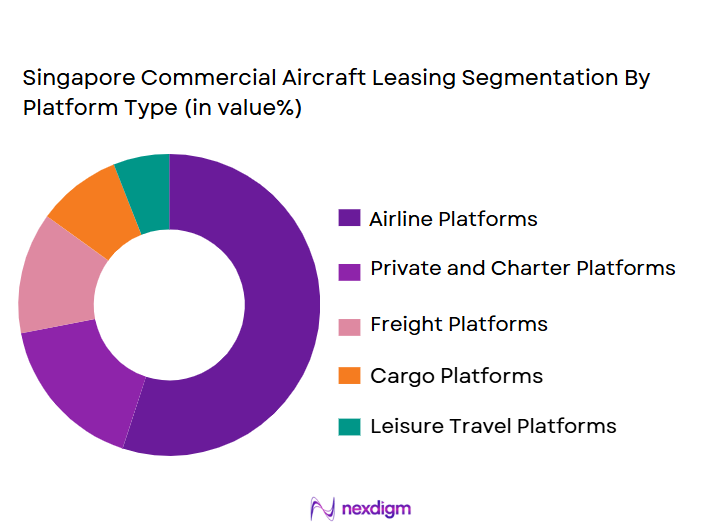

By Platform Type:

The Singapore commercial aircraft leasing market is segmented by procurement channel into direct leasing from lessors, through brokers and intermediaries, online leasing platforms, direct aircraft manufacturers, and leasing from aircraft financing entities. Recently, direct leasing from lessors has taken a dominant market share due to the growing trend of long-term and flexible leasing options offered by aircraft leasing companies based in Singapore. Lessors often offer attractive terms, including maintenance and support packages, which make them a more attractive option for airlines compared to other procurement channels.

Competitive Landscape

The competitive landscape of the Singapore commercial aircraft leasing market is highly concentrated, with several global leasing giants dominating the space. Major players like AerCap, GECAS, and SMBC Aviation Capital hold significant influence, driving consolidation within the industry. These companies benefit from extensive global reach, vast fleets, and strong financial capabilities. The competitive dynamics are shaped by factors such as leasing terms, fleet diversification, regulatory compliance, and partnerships with airlines across the region. The market’s growth is further bolstered by the increasing number of aircraft lessors and financiers establishing a strong presence in Singapore due to favorable regulatory conditions and access to international aviation networks.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Billion) | Aircraft Fleet Size |

| AerCap | 1991 | Dublin, Ireland | ~ | ~ | ~ | ~ | ~ |

| GECAS | 1993 | Shannon, Ireland | ~ | ~ | ~ | ~ | ~ |

| SMBC Aviation Capital | 2008 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Air Lease Corporation | 2010 | Los Angeles, USA | ~ | ~ | ~ | ~ | ~ |

| Macquarie AirFinance | 2005 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ |

Singapore Commercial Aircraft Leasing Market Analysis

Growth Drivers

Increasing Demand for Air Travel in the Asia-Pacific Region:

The rapid expansion of air travel within the Asia-Pacific region, particularly in Southeast Asia, has been a significant growth driver for the Singapore commercial aircraft leasing market. Airlines operating in this region are expanding their fleets to meet the growing passenger demand, especially as the middle class in emerging markets continues to rise. This growth has prompted airlines to seek flexible leasing solutions, as they offer more manageable financial commitments compared to direct purchases. Additionally, leasing enables airlines to quickly adjust to fluctuations in demand by expanding or reducing fleet size, allowing them to capitalize on both domestic and international growth opportunities. Consequently, leasing companies in Singapore have been actively catering to this need, expanding their portfolios and strengthening their leasing terms to attract both established and new airlines.

Singapore’s Strategic Position as an Aviation Hub:

Singapore’s positioning as a key aviation hub in Asia has been a crucial growth driver for its commercial aircraft leasing market. The nation’s well-established financial infrastructure, coupled with its world-class airport and aviation-related services, attracts both international and regional players to establish leasing operations. Singapore’s open regulatory environment, efficient processes for aircraft registration and maintenance, and strong connectivity with key global markets contribute to its status as a preferred destination for aircraft leasing. Furthermore, the government’s continued investment in aviation infrastructure and technology has fostered the growth of the leasing sector, making it an ideal location for aircraft financiers and lessors looking to serve both regional and international airline customers. This growth is further supported by Singapore’s robust legal and financial frameworks, providing lessors with favorable conditions to operate and expand their businesses.

Market Challenges

Volatility in Fuel Prices and Economic Uncertainty:

A key challenge facing the Singapore commercial aircraft leasing market is the volatility in global fuel prices, which directly impacts the cost of operating leased aircraft. Airlines, particularly low-cost carriers, are highly sensitive to fluctuations in fuel prices as it affects their operating costs. In periods of high fuel prices, airlines may be forced to delay or cancel aircraft lease agreements or restructure existing contracts, which could lead to reduced demand for leased aircraft. Moreover, economic uncertainties such as recessions or geopolitical tensions can dampen consumer demand for air travel, reducing the need for fleet expansion and leading to lower lease agreements. This volatility poses a risk to leasing companies, which rely on steady demand to maintain their fleet utilization rates and financial performance.

Regulatory and Compliance Barriers in International Markets:

Regulatory and compliance challenges, particularly with regard to international leasing agreements, represent another significant hurdle for the Singapore commercial aircraft leasing market. Leasing companies operating in Singapore must navigate a complex web of regulations that govern aircraft registration, financing, and operations in multiple jurisdictions. Different countries have varying requirements for aircraft leasing contracts, including safety certifications, environmental standards, and tax regulations. These varying regulations can complicate cross-border leasing agreements and increase operational costs for lessors. Moreover, changes in government policies, trade agreements, or international regulations could further complicate leasing practices, leading to delays, legal disputes, or unexpected costs for lessors operating in diverse markets.

Opportunities

Growth of Low-Cost Carriers in Asia-Pacific:

The expansion of low-cost carriers (LCCs) in the Asia-Pacific region presents a significant opportunity for the Singapore commercial aircraft leasing market. As the region’s middle class grows, there is a rising demand for affordable air travel, which is driving the expansion of LCCs. These airlines typically prefer leasing over purchasing aircraft, as it allows them to maintain low operational costs and reduce financial risk. Leasing companies in Singapore are well-positioned to meet the demand from these carriers, offering them flexible leasing terms that are well-suited to the needs of low-cost operations. Furthermore, the rise of LCCs presents an opportunity for lessors to diversify their portfolios by including smaller, fuel-efficient aircraft types, which are increasingly in demand. As LCCs continue to expand in Asia-Pacific, leasing companies will be able to capitalize on this growth by offering tailored leasing solutions that support the business models of these cost-conscious carriers.

Rising Demand for Sustainable and Eco-friendly Aircraft Leasing:

With increasing environmental concerns and the push for sustainability in aviation, there is a growing demand for eco-friendly aircraft, such as those that are fuel-efficient or equipped with green technologies. The Singapore commercial aircraft leasing market stands to benefit from this trend as airlines seek to reduce their carbon footprint and adhere to stricter environmental regulations. Leasing companies can capitalize on this demand by offering aircraft with advanced fuel-efficient technologies or alternative propulsion systems. This trend is especially significant in the context of international aviation regulations that are becoming increasingly stringent regarding emissions and sustainability. Leasing companies that provide eco-friendly aircraft or those equipped with technologies to reduce fuel consumption are likely to attract more airline customers looking to enhance their sustainability credentials.

Future Outlook

The future outlook for the Singapore commercial aircraft leasing market looks promising, with continued growth expected over the next five years. As air travel demand in the Asia-Pacific region continues to rise, leasing companies will experience sustained demand for both narrow-body and wide-body aircraft. Technological advancements, particularly in fuel efficiency and sustainable aviation technologies, will drive the market further, with airlines increasingly seeking eco-friendly options. Additionally, regulatory support for aviation infrastructure and leasing operations in Singapore will further bolster the market’s growth prospects. Leasing companies are expected to focus on enhancing their portfolios with newer, more efficient aircraft and expanding their services to meet the demands of emerging low-cost carriers and environmentally-conscious airlines.

Major Players

- AerCap

- GECAS

- SMBC Aviation Capital

- Air Lease Corporation

- Macquarie AirFinance

- Avolon

- Aviation Capital Group

- BOC Aviation

- Nordic Aviation Capital

- ICBC Leasing

- Goshawk Aviation

- Minmetals Development Company

- Oaktree Capital Management

- China Aviation Leasing Company

- ILFC (International Lease Finance Corporation)

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines and aircraft operators

- Aircraft maintenance and support services

- Aviation insurance companies

- Aircraft manufacturers

- Aviation infrastructure developers

- Aircraft financing firms

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying and defining the key variables that influence the commercial aircraft leasing market, including market size, growth drivers, challenges, and competitive landscape.

Step 2: Market Analysis and Construction

In this step, data from primary and secondary sources is collected and analyzed to understand market trends, segmentation, and dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations and industry interviews are conducted to validate hypotheses and refine market assumptions based on the insights provided by professionals in the aircraft leasing and aviation sectors.

Step 4: Research Synthesis and Final Output

The final step synthesizes all research findings and prepares the final report, ensuring that it is accurate, comprehensive, and ready for presentation to stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for air travel in Asia-Pacific

Singapore’s strategic positioning as an aviation hub

Increased demand for fleet expansion by airlines

Adoption of flexible leasing models

Technological advancements in aircraft leasing - Market Challenges

Volatility in global fuel prices

Regulatory compliance complexities

Competition among leasing companies

Economic fluctuations affecting leasing agreements

Aircraft availability and supply chain disruptions - Market Opportunities

Expansion of low-cost carriers in Asia

Growth of air cargo operations

Increased demand for environmental-friendly aircraft leasing solutions - Trends

Growth in hybrid and electric aircraft

Rise of digital platforms for aircraft leasing

Emphasis on reducing the carbon footprint of aircraft fleets

Technological advancements in aircraft maintenance

Emerging markets in Southeast Asia boosting demand - Government Regulations & Defense Policy

Stringent safety and maintenance regulations

International aviation treaties impacting leasing

Government policies supporting aviation sector growth - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Narrow-body Aircraft Leasing

Wide-body Aircraft Leasing

Regional Aircraft Leasing

Freighter Aircraft Leasing

Private Aircraft Leasing - By Platform Type (In Value%)

Aircraft Fleet Operators

Airline Leasing Companies

Aircraft Maintenance and Support Companies

Aircraft Manufacturers

Government & Defense Leasing Programs - By Fitment Type (In Value%)

Short-term Leasing

Long-term Leasing

Operating Lease

Finance Lease

Sale & Leaseback - By EndUser Segment (In Value%)

Airlines

Charter Operators

Freight Operators

Private Operators

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct Leasing from Lessors

Through Brokers and Intermediaries

Online Leasing Platforms

Direct Aircraft Manufacturers

Leasing from Aircraft Financing Entities - By Material / Technology (In Value%)

Aviation Technology Systems

Aircraft Components Leasing

Aircraft Maintenance & Repair Technology

Fuel Efficiency Technologies

Avionics Systems Leasing

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Aircraft Type, Lease Duration, Geographic Reach, Fleet Size, Pricing, Customer Support, Regulatory Compliance, Technological Adoption, Financial Flexibility, Market Penetration) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Singapore Aircraft Leasing Enterprise

Avolon

AerCap

SMBC Aviation Capital

GECAS

Boeing Capital Corporation

Air Lease Corporation

Macquarie AirFinance

ICBC Leasing

Citi Aviation

China Aviation Leasing Company

Fuyo Aviation Leasing

AviaAM Leasing

International Lease Finance Corporation

Japan Aircraft Leasing Co. Ltd

- Airlines adopting more leasing options for fleet expansion

- Private companies leasing aircraft for exclusive use

- Government regulations impacting the leasing terms

- Increased competition among airline operators leading to cost optimization

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035