Market Overview

The commercial aircraft market in Singapore is projected to experience significant growth based on recent data, with a market size reaching USD ~ billion. This growth is primarily driven by the expanding demand for air travel, coupled with the government’s push to improve aviation infrastructure. The rapid development of the airline industry, particularly in Southeast Asia, plays a pivotal role in boosting the market. The country’s strategic location as a regional aviation hub further amplifies its significance in the global aircraft industry.

Cities such as Singapore serve as key players in this market due to their advanced infrastructure, governmental support, and high demand for both passenger and cargo air services. Singapore’s aviation ecosystem, bolstered by Changi Airport’s status as one of the busiest in the world, contributes heavily to this growth. In addition to strong local aviation demand, Singapore’s connectivity to global markets positions it as an attractive hub for both international carriers and regional fleet expansions.

Market Segmentation

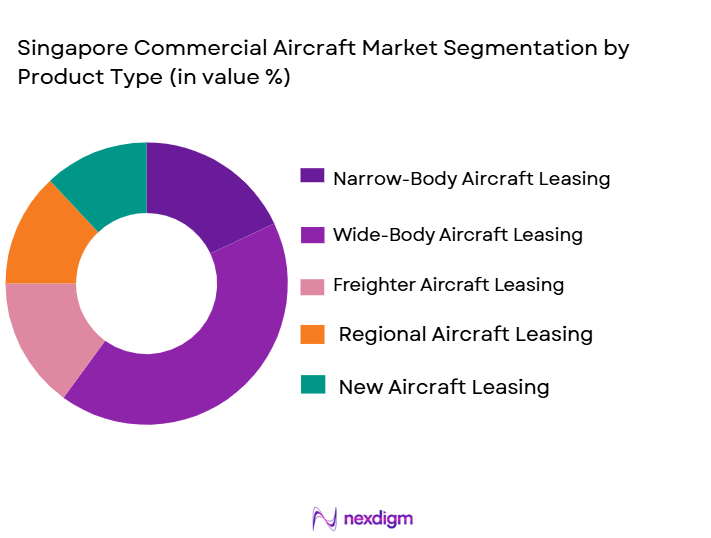

By Product Type:

The commercial aircraft market is segmented by system type into narrow-body aircraft, wide-body aircraft, regional aircraft, freighter aircraft, and business jets. Recently, narrow-body aircraft have a dominant market share due to their cost efficiency, versatility in regional and international operations, and suitability for increasing passenger traffic in Southeast Asia. As air travel demand grows across the region, airlines opt for these models due to their lower operating costs and ability to serve high-frequency routes. Additionally, the rise of low-cost carriers further fuels the popularity of narrow-body aircraft.

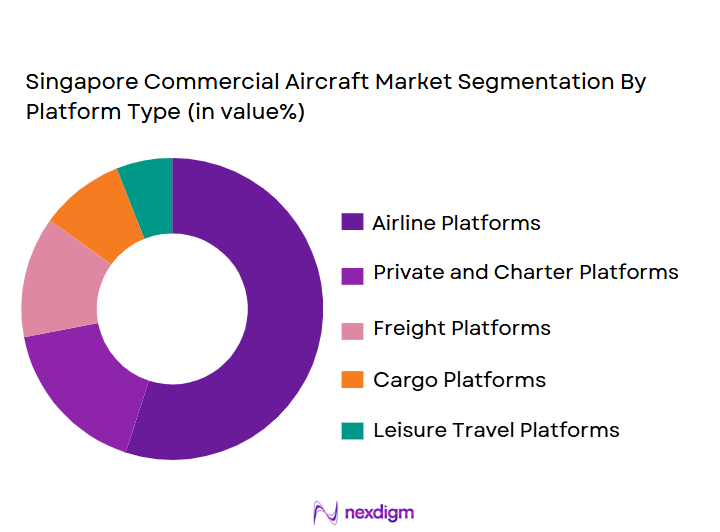

By Platform Type:

The market is segmented into fixed-wing aircraft, rotary-wing aircraft, hybrid aircraft, electric aircraft, and autonomous aircraft. The dominant sub-segment is fixed-wing aircraft, particularly for commercial use, due to their proven reliability, range, and fuel efficiency. The increasing number of airlines opting for both narrow-body and wide-body fixed-wing aircraft to serve international and regional routes contributes to this dominance. Moreover, the economic viability and availability of after-sales services continue to drive the demand for fixed-wing aircraft.

Competitive Landscape

The competitive landscape of the Singapore commercial aircraft market is highly consolidated, with a few major players dominating the market. These companies have a significant influence on market dynamics due to their innovation, global reach, and extensive portfolio of products and services. As the demand for air travel increases, especially with the growth of low-cost carriers and regional airline services, the market sees continuous innovation in aircraft technologies and service models.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Billion) | Market-specific Parameter |

| Singapore Airlines | 1947 | Singapore | ~ | ~ | ~ | ~ | ~ |

| ST Aerospace | 2000 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Embraer | 1969 | Brazil | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

Singapore Commercial Aircraft Market Analysis

Growth Drivers

Increase in Air Passenger Traffic:

The growing air passenger traffic, driven by a surge in tourism, business, and regional connectivity, significantly propels the commercial aircraft market. As Singapore is a major global travel hub, airlines are expanding their fleets to accommodate the increasing number of passengers. The expansion of low-cost carriers in Southeast Asia, which frequently operate within Singapore’s airspace, further fuels the demand for new aircraft. Additionally, Singapore’s strategic location as a regional hub, combined with its advanced aviation infrastructure, attracts international airlines seeking to expand their operations. This shift in the aviation sector also necessitates newer and more efficient aircraft models to keep up with the increased demand for flights within the region and globally. With air travel expected to double in the coming decades, the growth driver of rising passenger demand will continue to impact the commercial aircraft market, particularly in Singapore, where both international and regional air travel continues to grow steadily.

Government Support for Aviation Industry:

Governmental support is another major driver for the market, particularly in Singapore, where strategic initiatives are actively promoting the aviation sector. The government has made substantial investments in aviation infrastructure, such as the expansion of Changi Airport, which supports the growth of air traffic and increases the demand for aircraft. Furthermore, Singapore’s stable political environment and robust regulatory framework provide a conducive environment for aircraft manufacturers and operators. In line with the nation’s goal to be a leading aviation hub, the government’s initiatives focus on the development of advanced technologies, such as electric and hybrid aircraft, making Singapore an attractive market for aircraft manufacturers. As the government continues to prioritize the growth of air travel, particularly in Southeast Asia, it will further fuel the demand for both commercial aircraft and related services, helping the market thrive.

Market Challenges

High Capital Investment Requirements:

One of the major challenges for the commercial aircraft market in Singapore is the high capital investment required for the acquisition of aircraft. Airlines and other stakeholders must commit substantial amounts to purchase or lease aircraft, which limits the ability of smaller or newer airlines to enter the market. This financial burden also affects the maintenance, repair, and operations (MRO) services, which require ongoing investment to ensure aircraft meet the required standards. With the economic uncertainty arising from global disruptions such as pandemics or fluctuating fuel prices, this high capital expenditure may deter some investors from expanding their fleet. The capital-intensive nature of the market also impacts the adoption of new technologies such as electric or autonomous aircraft, as these require extensive financial outlay. In the long term, these challenges could hinder the market’s ability to fully embrace newer, more sustainable solutions that would otherwise contribute to growth.

Regulatory Compliance and Certification Barriers:

Regulatory hurdles and certification barriers are significant challenges in the commercial aircraft market, especially in a country like Singapore, where stringent safety standards and regulations are enforced. Aircraft manufacturers and operators must comply with a complex set of international and national aviation standards, which adds time and cost to the production and operation of aircraft. The process for obtaining certifications for new aircraft technologies, particularly for electric and autonomous aircraft, is lengthy and involves extensive testing. This regulatory complexity can delay the market adoption of innovative technologies and increase operational costs for airlines. Additionally, regulatory bodies’ response to the environmental impact of aviation, including the introduction of carbon taxes and emissions regulations, adds further compliance requirements. These factors could limit the pace at which the market can innovate, even though global aviation sustainability efforts push for faster transitions to greener alternatives.

Opportunities

Development of Electric and Hybrid Aircraft:

The development and deployment of electric and hybrid aircraft represent a significant opportunity for the commercial aircraft market. As the aviation industry looks for ways to reduce its carbon footprint, Singapore is well-positioned to lead the adoption of sustainable aircraft technologies. Both electric and hybrid aircraft have the potential to lower operating costs and reduce emissions, providing a competitive edge for airlines operating in the region. Governments and regulatory bodies worldwide are introducing incentives for green technologies, making electric and hybrid aircraft a viable alternative. Singapore’s commitment to sustainability and its status as an aviation hub are key enablers in this market transformation. The global push for greener aviation solutions, combined with advancements in battery technology and energy efficiency, will allow electric and hybrid aircraft to play a major role in the future of commercial aviation. As a market leader in innovation, Singapore is likely to see increased investment and interest in electric aircraft development, making this a crucial opportunity for the industry.

Strategic Partnerships with Low-Cost Carriers:

One of the most promising opportunities in the commercial aircraft market is the growing partnership between aircraft manufacturers and low-cost carriers (LCCs). In Southeast Asia, LCCs are expanding rapidly, especially in Singapore, where airfares are competitive, and the demand for budget-friendly travel continues to rise. Aircraft manufacturers are focusing on producing more fuel-efficient, cost-effective aircraft to meet the specific needs of LCCs, which often operate in price-sensitive environments. This trend creates a significant opportunity for manufacturers to develop aircraft that cater specifically to the operational needs of LCCs, such as narrow-body planes with high passenger capacity and low operational costs. As these carriers expand their fleets and enter new markets, they will continue to drive demand for more affordable aircraft, creating a sustained opportunity for the commercial aircraft market to innovate and grow. Singapore, with its strategic location and the presence of major budget carriers, is likely to remain a key beneficiary of this trend.

Future Outlook

The commercial aircraft market in Singapore is set to experience sustained growth, supported by an increase in air travel, government initiatives, and advancements in aircraft technology. Over the next five years, the market is expected to benefit from the continuous development of greener aircraft, such as electric and hybrid models. Additionally, the demand for both domestic and international flights is expected to rise as economic recovery boosts tourism and business travel. With further investments in aviation infrastructure and regulatory support, the market’s growth trajectory remains positive, albeit tempered by the challenges posed by high capital costs and regulatory complexities.

Major Players

- Singapore Airlines

- ST Aerospace

- Embraer

- Airbus

- Boeing

- Rolls-Royce

- GE Aviation

- Pratt & Whitney

- Honeywell Aerospace

- Raytheon Technologies

- Safran

- Rockwell Collins

- United Technologies

- AirAsia

- Jetstar Airways

Key Target Audience

- Airlines operating in Southeast Asia

- Aircraft leasing companies

- Aviation regulators and policymakers

- Aircraft manufacturers

- Aviation service providers

- Airport operators

- Investors in the aerospace sector

- Aircraft maintenance and repair companies

Research Methodology

Step 1: Identification of Key Variables

Identify the main factors affecting the market, such as demand trends, technological advancements, and government policies.

Step 2: Market Analysis and Construction

Analyze the market size, growth patterns, and key segments to construct a detailed market report.

Step 3: Hypothesis Validation and Expert Consultation

Validate market hypotheses by consulting industry experts, conducting interviews, and analyzing third-party reports.

Step 4: Research Synthesis and Final Output

Synthesize the collected data, insights, and expert opinions to generate a comprehensive report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Air Passenger Traffic

Expansion of Aviation Infrastructure

Government Support for Aerospace Industry

Technological Advancements in Aircraft Design

Rise in Air Cargo Demand - Market Challenges

High Capital Investment Requirements

Regulatory Compliance and Certification Barriers

Environmental and Sustainability Concerns

Fuel Price Fluctuations

Supply Chain Disruptions - Market Opportunities

Development of Electric and Hybrid Aircraft

Strategic Partnerships with Asian Airlines

Growth of Low-Cost Carriers in the Region - Trends

Adoption of AI and Automation in Aircraft Systems

Shift Towards Sustainable Aviation Fuel

Integration of Advanced Navigation Systems

Increased Focus on Passenger Comfort

Demand for Next-Generation Aircraft Models - Government Regulations & Defense Policy

Aviation Safety and Certification Regulations

Environmental Regulations and Sustainability Targets

Government Investment in Aerospace R&D - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Aircraft

Freighter Aircraft

Business Jets - By Platform Type (In Value%)

Fixed-wing Aircraft

Rotary-wing Aircraft

Hybrid Aircraft

Electric Aircraft

Autonomous Aircraft - By Fitment Type (In Value%)

OEM Equipment

Aftermarket Equipment

Upgraded Systems

Replacement Parts

Refurbished Systems - By EndUser Segment (In Value%)

Commercial Airlines

Freight Operators

Private Aviation

Government & Military

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct Procurement

Aircraft Leasing

Government Tenders

Private Sector Procurement

Online Bidding Platforms - By Material / Technology (In Value%)

Aluminum Alloys

Composites

Titanium Alloys

Carbon Fiber Reinforced Polymers

Smart Materials

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Aircraft Type, System Complexity, Procurement Channel, Platform Type, EndUser Segment, Material Technology, Certification Process, Regulatory Compliance, Price Sensitivity, Supplier Reliability) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Singapore Airlines

ST Aerospace

Embraer

Airbus

Boeing

Rolls-Royce

GE Aviation

Pratt & Whitney

Honeywell Aerospace

Raytheon Technologies

Safran

Rockwell Collins

United Technologies

AirAsia

Jetstar Airways

- Increase in Demand from Low-Cost Carriers

- Growth in Regional Air Transport

- Shift in Aircraft Leasing Market Dynamics

- Government Regulations Affecting Commercial Aviation

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035