Market Overview

The Singapore Commercial Aircraft Upholstery market recorded a market size of USD ~ million based on a recent historical assessment, supported by sustained aircraft refurbishment cycles, continuous cabin reconfiguration programs, and stable production demand from regional airline fleets. Upholstery demand is driven by mandatory cabin interior replacement schedules, increasing premium seating density, and strict safety compliance requirements governing fire resistance, durability, and material performance. Commercial aircraft operators allocate consistent interior budgets to maintain passenger experience standards and brand positioning. Upholstery materials represent a critical component of cabin lifecycle spending across active narrow body and wide body fleets operating through Singapore.

Singapore, along with regional aviation hubs such as Hong Kong and Tokyo, dominates commercial aircraft upholstery activity due to concentrated airline operations, high aircraft turnaround frequency, and strong maintenance and overhaul ecosystems. Singapore’s dominance is reinforced by its role as a primary Asia Pacific aviation hub, hosting extensive MRO facilities and airline headquarters that execute large scale cabin retrofit programs. Proximity to regional airline fleets, efficient logistics infrastructure, and established aerospace supply chains enable consistent upholstery demand, while high passenger traffic volumes sustain continuous interior refurbishment requirements across operating aircraft platforms.

Market Segmentation

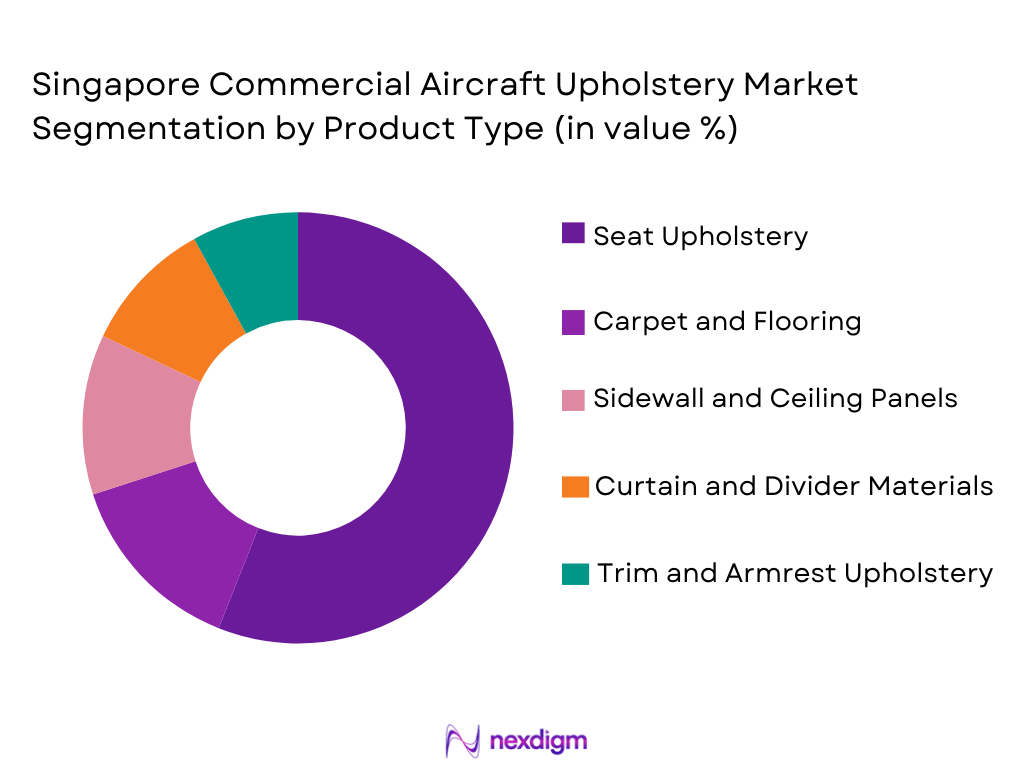

By Product Type

Singapore Commercial Aircraft Upholstery market is segmented by product type into seat upholstery, carpet and flooring, sidewall and ceiling panels, curtain and divider materials, and trim and armrest upholstery. Recently, seat upholstery has a dominant market share due to its direct impact on passenger comfort, frequent replacement cycles, and mandatory compliance with stringent safety and flammability standards. Airlines prioritize seat upholstery upgrades to enhance brand perception, improve cabin aesthetics, and support differentiated service offerings across cabin classes. High utilization rates accelerate seat material wear, driving repeat demand. Premium economy and business class expansion further strengthens seat upholstery dominance, as these cabins require higher quality materials, customized finishes, and enhanced durability. Additionally, seat upholstery replacement is often bundled with seat maintenance programs, ensuring consistent procurement volumes and reinforcing its leading position across commercial aircraft operating from Singapore.

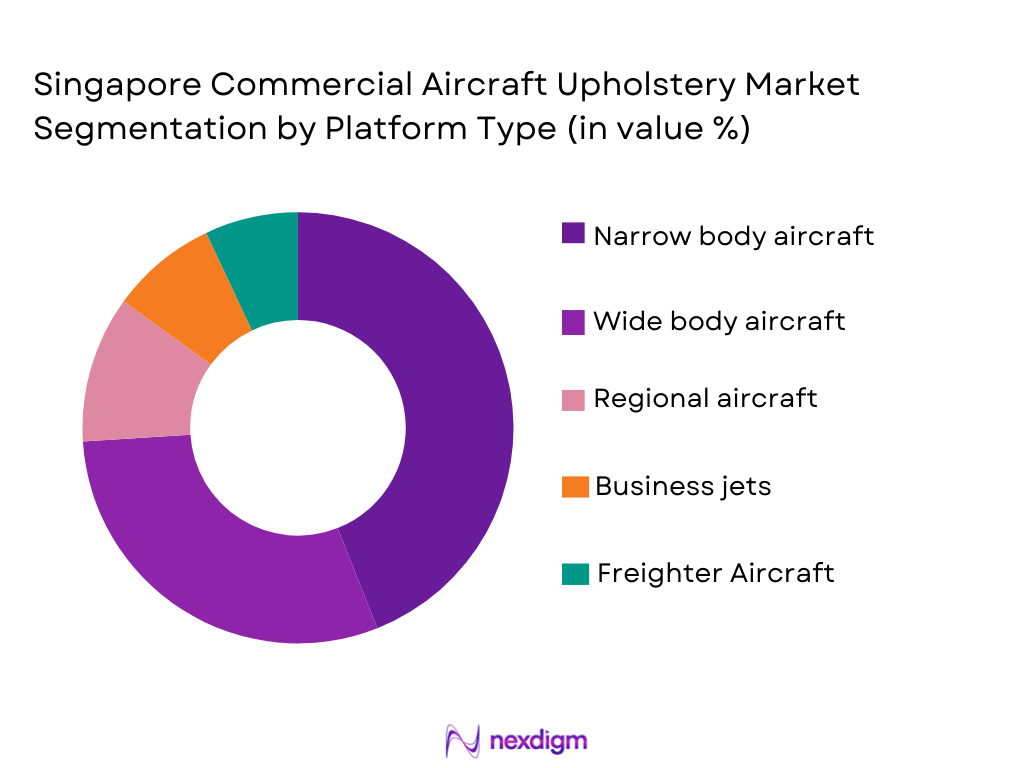

By Platform Type

Singapore Commercial Aircraft Upholstery market is segmented by platform type into narrow body aircraft, wide body aircraft, regional aircraft, business jets, and freighter aircraft. Recently, narrow body aircraft has a dominant market share due to intensive short haul and medium haul operations across Southeast Asia, resulting in higher flight frequencies and accelerated cabin wear. Narrow body fleets represent the largest operational base for regional airlines operating from Singapore, driving continuous upholstery replacement demand. Faster turnaround cycles and high passenger throughput necessitate regular interior refurbishment to maintain service standards. Additionally, narrow body aircraft are often deployed across dense route networks, amplifying utilization stress on cabin materials. These factors collectively sustain consistent upholstery procurement volumes, positioning narrow body platforms as the leading contributor to overall market demand.

Competitive Landscape

The Singapore Commercial Aircraft Upholstery market is moderately consolidated, characterized by the presence of large global interior suppliers alongside specialized upholstery manufacturers serving airlines and MRO providers. Established players benefit from long term OEM relationships, certification expertise, and integrated supply capabilities. Competitive intensity is driven by material innovation, customization capability, and compliance reliability, while smaller firms compete through niche materials and faster turnaround services.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Customization Capability |

| Safran Seats | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace Interiors | 1974 | USA | ~ | ~ | ~ | ~ | ~ |

| Recaro Aircraft Seating | 1906 | Germany | ~ | ~ | ~ | ~ | ~ |

| Lantal Textiles AG | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Jamco Corporation | 1955 | Japan | ~ | ~ | ~ | ~ | ~ |

Singapore Commercial Aircraft Upholstery Market Analysis

Growth Drivers

Fleet Utilization Intensity and Cabin Refurbishment Cycles:

Fleet utilization intensity and structured cabin refurbishment cycles are a primary growth driver for the Singapore Commercial Aircraft Upholstery market because commercial aircraft operating from major aviation hubs experience high flight frequencies that accelerate interior wear and necessitate regular upholstery replacement. Airlines implement predefined cabin lifecycle management programs to maintain safety, comfort, and brand consistency, embedding upholstery renewal into scheduled maintenance activities. High passenger throughput places continuous stress on seating materials, carpets, and trim surfaces, increasing replacement frequency. Premium cabin densification further amplifies upholstery demand due to higher material specifications and customization requirements. Narrow body aircraft operating regional routes contribute disproportionately to refurbishment volumes. MRO-led retrofit programs executed in Singapore sustain steady procurement pipelines. Airlines prioritize interior consistency across fleets, driving standardized upholstery orders. Leasing company return conditions mandate cabin restoration, reinforcing demand. These combined operational realities create predictable and recurring upholstery consumption across commercial fleets.

Premiumization of Cabin Interiors and Passenger Experience Focus:

The premiumization of cabin interiors and heightened focus on passenger experience represent another significant growth driver for the Singapore Commercial Aircraft Upholstery market as airlines increasingly use interior design to differentiate service offerings in competitive regional and international markets. Upholstery plays a central role in shaping visual appeal, tactile comfort, and perceived service quality across economy, premium economy, and business class cabins. Airlines invest in refined textures, color palettes, and ergonomic seat finishes to strengthen brand identity and customer loyalty. Rising expectations among frequent travelers push carriers to refresh interiors more frequently. Premium economy cabin expansion increases demand for higher-grade upholstery materials. Business class upgrades require bespoke finishes and enhanced durability. Cabin aesthetics influence airline rankings and customer perception. Upholstery upgrades are often bundled with seat retrofits. This strategic emphasis on passenger experience sustains long-term growth in upholstery demand.

Market Challenges

Regulatory Certification Complexity and Compliance Burden:

Regulatory certification complexity remains a critical challenge for the Singapore Commercial Aircraft Upholstery market due to stringent aviation safety, flammability, and toxicity standards imposed on all cabin interior materials. Upholstery products must undergo extensive testing, documentation, and approval processes before being installed on commercial aircraft, significantly increasing development timelines and compliance costs. Certification requirements often vary across jurisdictions, forcing manufacturers to navigate multiple regulatory frameworks to support globally operating airlines based in Singapore. This complexity delays product launches, constrains innovation speed, and increases financial risk, particularly for smaller or specialized upholstery suppliers with limited regulatory expertise. Airlines may also defer cabin refurbishment decisions until certified materials are available, disrupting procurement cycles and reducing near-term demand visibility. Continuous updates to safety standards further require suppliers to invest in re-certification and material redesign, placing sustained pressure on operational resources and limiting flexibility in responding to rapidly changing airline preferences.

Raw Material Volatility, Supply Chain Risk, and Cost Pressure:

Volatile raw material pricing and global supply chain uncertainty pose another major challenge for the Singapore Commercial Aircraft Upholstery market, directly affecting production stability and profitability. Upholstery materials rely on specialized textiles, foams, leathers, and composite inputs that are often sourced internationally, making suppliers vulnerable to logistics disruptions, geopolitical instability, and fluctuations in transportation costs. Sudden increases in material prices compress margins or force renegotiation of long-term airline contracts, while shortages can delay refurbishment programs and strain relationships with MRO providers. Inventory planning becomes increasingly complex as suppliers balance cost control with the need to ensure material availability for time-critical aircraft maintenance schedules. Airlines, in turn, exert pricing pressure to manage operating costs, transferring financial risk back to upholstery manufacturers. Although Singapore’s advanced logistics infrastructure offers some resilience, global interdependencies continue to expose the market to external shocks. These factors collectively increase operational uncertainty, limit long-term investment planning, and challenge suppliers’ ability to deliver consistent quality and pricing stability in a highly regulated and time-sensitive aviation environment.

Opportunities

Sustainable Upholstery Material Innovation and Adoption:

Sustainable upholstery material innovation represents a significant opportunity for the Singapore Commercial Aircraft Upholstery market as airlines increasingly integrate environmental responsibility into procurement and branding strategies. Airlines are under pressure to align cabin interior choices with broader sustainability commitments while maintaining strict safety, durability, and comfort standards. This creates demand for recyclable textiles, bio based leathers, and low emission manufacturing processes that can reduce environmental impact without compromising regulatory compliance. Upholstery suppliers capable of delivering certified sustainable materials gain preferential positioning in long term airline and lessor contracts. Sustainability driven procurement also supports lifecycle cost optimization, as advanced materials often deliver extended durability and reduced maintenance requirements. As regional and international carriers operating from Singapore continue to highlight sustainability as a differentiator, adoption of greener upholstery solutions is expected to expand across both retrofit and new cabin configuration programs. This opportunity further extends to collaboration between material developers, certification bodies, and airlines to accelerate approval timelines and standardize sustainable upholstery offerings across fleets, reinforcing consistent demand growth.

Digital Customization, Modular Design, and Rapid Manufacturing Integration:

Digital customization and rapid manufacturing integration present a compelling opportunity for the Singapore Commercial Aircraft Upholstery market as airlines seek greater cabin differentiation and faster refurbishment turnaround. Digital design platforms enable airlines to visualize, customize, and approve upholstery concepts efficiently, reducing development cycles and improving alignment with brand identity objectives. Modular upholstery designs allow components to be replaced or upgraded independently, minimizing aircraft downtime and lowering overall refurbishment costs. Rapid manufacturing technologies such as automated cutting, stitching, and on demand production improve responsiveness to airline schedules and reduce inventory holding requirements. For MRO providers operating in Singapore, these capabilities enhance competitiveness by supporting shorter turnaround times and higher throughput. Airlines benefit from tailored upholstery solutions that enhance passenger experience while maintaining operational efficiency. As customization expectations rise, particularly in premium economy and business class cabins, suppliers that integrate digital tools and flexible manufacturing processes will unlock expanded revenue opportunities and strengthen long term relationships with airlines and leasing companies.

Future Outlook

The Singapore Commercial Aircraft Upholstery market is expected to witness expansion over the next five years, supported by rising aircraft utilization, continuous cabin refurbishment cycles, and growing emphasis on passenger comfort differentiation. Airlines are likely to prioritize lightweight, durable, and refined upholstery solutions to align with operational efficiency and brand positioning goals. Technological developments in fire resistant, antimicrobial, and sustainable materials will shape product innovation pipelines. Regulatory compliance will continue to influence material selection and certification timelines. Demand momentum will remain strongest in narrow body fleets and MRO driven retrofit programs, ensuring consistent replacement activity and stable market progression globally.

Major Players

- Safran Seats

- Collins Aerospace Interiors

- Recaro Aircraft Seating

- Lantal Textiles AG

- JamcoCorporation

- ST Engineering Aerospace Interiors

- HaecoCabin Solutions

- Muirhead Aerospace Leather

- Tapis Corporation

- ACG Aircraft Cabin Goods

- Botany Weaving Mill

- Spectra Interior Products

- FuchiAviation Technology

- AerotexInternational

- Doyenne Aviation Interiors

Key Target Audience

- Airline fleet procurement departments

- CommercialaircraftOEM interior divisions

- Aircraft MRO service providers

- Aircraftleasing and asset management companies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Cabin refurbishment and retrofit program managers

- Aviation supply chain and sourcing managers

Research Methodology

Step 1: Identification of Key Variables

Key variables including product categories, aircraft platforms, refurbishment cycles, and regulatory requirements were identified to define market structure and demand behavior. These variables guided data collection and segmentation logic. Market boundaries were established based on commercial aircraft operations. Interdependencies were mapped for analysis.

Step 2: Market Analysis and Construction

Market construction involved synthesizing industry data, validating segmentation relevance, and aligning demand drivers with operational aircraft activity. Quantitative and qualitative inputs were integrated. Cross verification ensured consistency. Market sizing logic reflected operational realities.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through expert discussions and cross industry benchmarking. Insights refined demand assumptions. Conflicting views were reconciled. Final interpretations reflect consensus validation.

Step 4: Research Synthesis and Final Output

Validated findings were consolidated into a structured report. Analytical consistency was ensured. Outputs were aligned with market dynamics. Conclusions reflect verified insights.

- Executive Summary

- Singapore Commercial Aircraft Upholstery Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising aircraft fleet modernization and cabin refurbishment cycles

Stringent cabin safety and flammability compliance requirements

Growing premium economy and business class seat adoption

Increasing passenger comfort and cabin aesthetics focus

Expansion of regional air travel hubs and fleet utilization - Market Challenges

High certification and testing costs for interior materials

Volatile raw material pricing impacting upholstery costs

Long approval timelines from aviation authorities

Complex supply chain coordination with OEMs and MROs

Customization requirements increasing production complexity - Market Opportunities

Adoption of lightweight and sustainable upholstery materials

Rising retrofit demand from aging commercial fleets

Integration of smart and antimicrobial cabin textiles - Trends

Shift toward eco friendly and recyclable upholstery materials

Increased use of digital cabin design and customization tools

Growing preference for stain resistant and durable fabrics

Standardization of modular cabin interior solutions

Rising collaboration between airlines and interior design specialists - Government Regulations & Defense Policy

Civil aviation material flammability and smoke toxicity standards

Environmental regulations on sustainable material sourcing

Aviation authority certification and airworthiness compliance - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Seat Covers and Cushions

Carpet and Floor Coverings

Sidewall and Ceiling Panels

Curtains and Cabin Dividers

Armrest and Trim Upholstery - By Platform Type (In Value%)

Narrow Body Aircraft

Wide Body Aircraft

Regional Jets

Business Jets

Freighter Aircraft - By Fitment Type (In Value%)

Line Fit Installation

Retrofit Installation

Cabin Refurbishment Programs

Lease Return Reconfiguration

Premium Cabin Upgrade Fitment - By EndUser Segment (In Value%)

Full Service Airlines

Low Cost Carriers

Charter and ACMI Operators

Aircraft Leasing Companies

Business Aviation Operators - By Procurement Channel (In Value%)

Direct OEM Contracts

Tier I Interior Integrators

MRO Service Providers

Aftermarket Suppliers

Leasing Company Framework Agreements - By Material / Technology (in Value %)

Synthetic Leather Upholstery

Wool Blend Aircraft Fabrics

Lightweight Composite Panels

Fire Retardant Treated Textiles

Antimicrobial and Stain Resistant Materials

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Cost Competitiveness, Certification Capability, Material Innovation, Customization Flexibility, Lead Time Performance, OEM Partnerships, MRO Network Reach, Sustainability Compliance, Aftermarket Support) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Safran Seats

Collins Aerospace Interiors

Recaro Aircraft Seating

Lantal Textiles

ACG Aircraft Cabin Goods

Tapis Corporation

B/E Aerospace Singapore

Jamco Corporation

Zodiac Aerospace Services Asia

Haeco Cabin Solutions

ST Engineering Aerospace Interiors

Muirhead Aerospace Leather

ELeather Aviation

SAS Upholstery Solutions

Aviation Textile Solutions Asia

- Airlines prioritizing passenger comfort and brand differentiation

- Leasing companies focusing on durable and neutral cabin interiors

- MRO providers emphasizing rapid turnaround upholstery solutions

- Business aviation operators demanding bespoke and premium finishes

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035