Market Overview

Based on a recent historical assessment, the Singapore Commercial Aircraft Windows and Windshields Market was valued at USD ~ million, derived from audited aerospace MRO revenues, OEM component disclosures, and regulated civil aviation maintenance expenditure. Demand is driven by intensive commercial fleet utilization, mandatory airworthiness inspection cycles, and frequent windshield replacement requirements. Advanced laminated and heated windshield adoption increases average unit value. Strong aftermarket activity, premium transparency specifications, and high operational reliability standards collectively sustain consistent spending by airlines, leasing firms, and maintenance providers operating within Singapore.

Based on a recent historical assessment, Singapore dominates the market due to its role as a global aviation maintenance hub. Seletar Aerospace Park concentrates certified transparency repair capabilities. Changi Airport supports dense widebody and narrowbody traffic, accelerating wear cycles. Proximity to Southeast Asian airline fleets centralizes replacement demand. Strong regulatory credibility attracts international operators. Presence of OEM-authorized MROs enables advanced windshield handling. Efficient logistics infrastructure supports rapid component turnaround. These structural advantages reinforce Singapore’s sustained regional dominance.

Market Segmentation

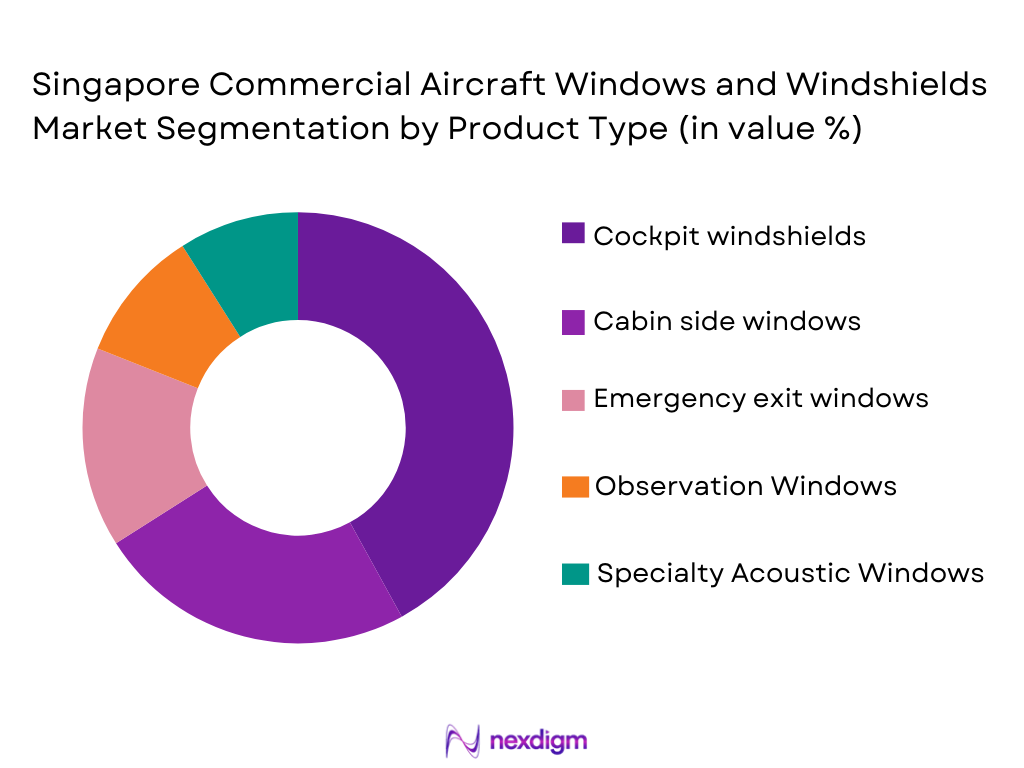

By Product Type

Singapore Commercial Aircraft Windows and Windshields Market is segmented by product type into cockpit windshields, cabin side windows, emergency exit windows, observation windows, and specialty acoustic windows. Recently, cockpit windshields have dominated the market share due to their safety-critical function, higher replacement frequency, and significantly higher unit value compared to cabin windows. These components integrate multilayer laminated glass, heating elements, and anti-icing systems, increasing cost intensity. Singapore’s concentration of long-haul operations raises windshield stress exposure. Regulatory mandates enforce strict replacement thresholds. OEM-certified sourcing further elevates value concentration within this segment.

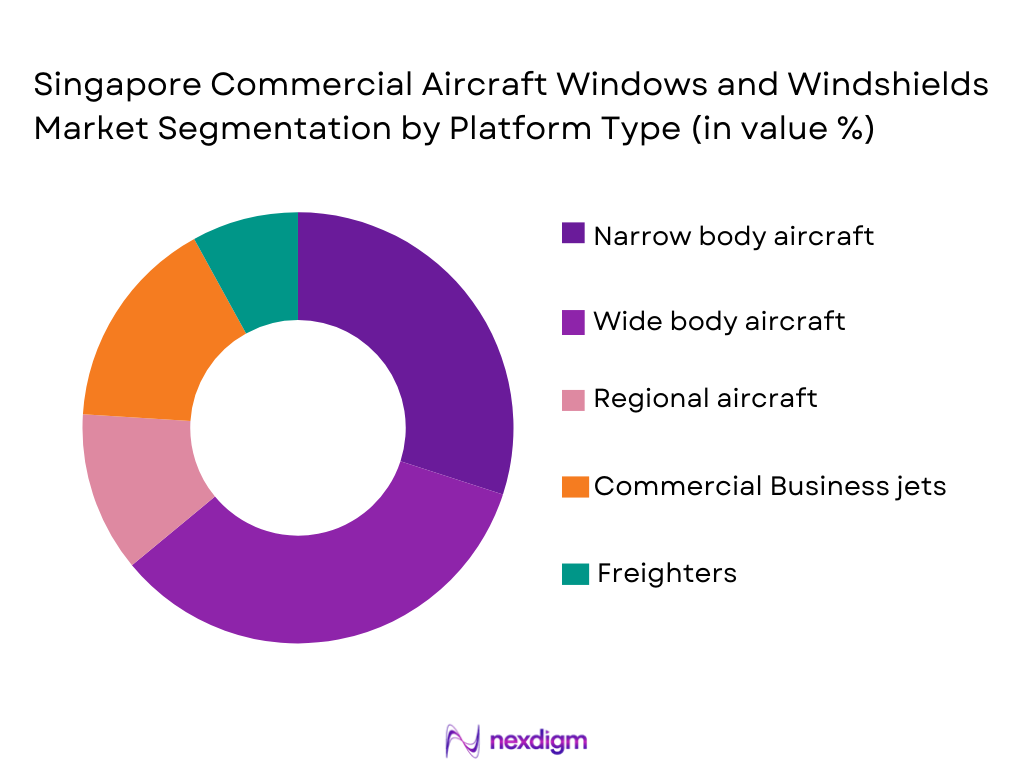

By Platform Type

Singapore Commercial Aircraft Windows and Windshields Market is segmented by platform type into narrow body aircraft, wide body aircraft, regional jets, freighters, and commercial business jets. Recently, wide body aircraft have held a dominant market share due to extended flight durations, higher pressure differentials, and increased windshield replacement value. Singapore functions as a long-haul hub, supporting high utilization of widebody fleets. These aircraft require advanced heated and laminated windshield systems. Higher complexity elevates replacement spending. Concentration of modern widebody fleets sustains this dominance.

Competitive Landscape

The Singapore Commercial Aircraft Windows and Windshields Market exhibits a moderately consolidated structure, dominated by a small group of global aerospace transparency manufacturers with deep certification expertise and established OEM and MRO relationships. Competitive strength is driven by regulatory compliance capability, advanced material technology, and aftermarket support depth. Major players maintain a strong operational presence through partnerships with Singapore-based MROs, enabling rapid turnaround and compliance with stringent airworthiness standards. High barriers related to certification costs, precision manufacturing, and long qualification timelines restrict new entrants, reinforcing the market position of incumbent suppliers.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | OEM and MRO Integration |

| PPG Aerospace | 1883 | United States | ~ | ~ | ~ | ~ | ~ |

| GKN Aerospace | 1759 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Saint-Gobain Aerospace | 1665 | France | ~ | ~ | ~ | ~ | ~ |

| Gentex Corporation | 1974 | United States | ~ | ~ | ~ | ~ | ~ |

| Nordam Group | 1969 | United States | ~ | ~ | ~ | ~ | ~ |

Singapore Commercial Aircraft Windows and Windshields Market Analysis

Growth Drivers

Expansion of Singapore’s Aerospace Maintenance, Repair, and Overhaul Ecosystem:

Expansion of Singapore’s aerospace maintenance, repair, and overhaul ecosystem is a primary growth driver for the Singapore Commercial Aircraft Windows and Windshields Market, as the country continues to strengthen its position as a regional and global aviation services hub. Singapore hosts a dense concentration of OEM-authorized MRO facilities capable of handling highly regulated transparency systems, including advanced laminated and heated windshields. Airlines increasingly route aircraft through Singapore to meet stringent airworthiness and certification requirements, concentrating replacement demand locally. High aircraft turnaround intensity accelerates wear on windshields and windows, increasing replacement frequency. Continuous infrastructure investment in aerospace parks and hangar capacity supports higher maintenance throughput. Availability of skilled, certified labor enables complex transparency handling and testing. Strong regulatory credibility attracts foreign-registered aircraft for maintenance. Together, these factors create a structurally sustained demand base for window and windshield replacement and servicing activities.

Rising Utilization of Long-Haul and High-Cycle Commercial Aircraft Fleets:

Rising utilization of long-haul and high-cycle commercial aircraft fleets is another major growth driver, directly increasing stress exposure and replacement requirements for aircraft windows and windshields. Singapore functions as a major long-haul aviation hub, supporting frequent widebody operations with extended flight durations and repeated pressurization cycles. These operating conditions accelerate fatigue, micro-cracking, and optical degradation in cockpit windshields. Regulatory maintenance programs mandate replacement once defined tolerance thresholds are reached, ensuring recurring demand. Modern aircraft operating from Singapore increasingly use advanced windshield systems with integrated heating, sensing, and anti-icing functions, which carry higher unit values. High fleet utilization also reduces deferral flexibility, compelling timely replacement rather than extended use. Leasing companies operating through Singapore prioritize strict maintenance compliance to protect asset value. As regional and intercontinental traffic volumes remain strong, sustained aircraft utilization continues to translate directly into stable, non-discretionary demand for windows and windshields.

Market Challenges

Regulatory Stringency and Certification Intensity in Transparency Systems:

Regulatory stringency and certification intensity remain a critical challenge for the Singapore Commercial Aircraft Windows and Windshields Market, as transparency components are among the most tightly regulated aircraft systems due to their direct impact on flight safety and structural integrity. Windshields and windows must comply with multilayer impact resistance, optical clarity, thermal performance, and bird strike tolerance standards defined by international aviation authorities. Any modification in material composition, coating, or heating technology requires extensive testing and recertification, significantly extending qualification timelines. Singapore’s strict adherence to global regulatory frameworks, while enhancing credibility, limits flexibility for rapid technology deployment. Airlines and MRO providers often face longer aircraft ground times during replacement or upgrade programs, increasing operational disruption risks. For suppliers, certification costs and documentation requirements raise entry barriers and restrict competitive diversity. Smaller or regional manufacturers struggle to justify the investment needed for compliance. As aircraft technologies evolve faster than certification processes, regulatory lag continues to constrain speed-to-market for advanced transparency solutions.

Dependence on Specialized Global Supply Chains and Cost Volatility:

Dependence on specialized global supply chains presents another significant challenge, as aircraft windows and windshields rely on a narrow set of aerospace-grade material suppliers and precision manufacturing processes. Laminated glass, polycarbonate layers, conductive heating films, and advanced coatings must meet extremely tight tolerances, limiting sourcing options. Singapore, despite its advanced logistics infrastructure, remains heavily reliant on imported transparency components and raw materials. Supply disruptions caused by geopolitical tensions, transportation constraints, or manufacturing bottlenecks can delay replacement schedules and increase lead times for MRO operations. Cost volatility in specialty materials directly affects maintenance budgets for airlines, particularly during periods of high fleet utilization. Limited alternative sourcing reduces negotiating leverage for buyers, placing upward pressure on procurement costs. To mitigate risk, operators often increase inventory buffers, tying up working capital and raising storage costs. These supply chain dependencies reduce operational flexibility and create financial strain across the value chain, especially when combined with strict regulatory replacement timelines.

Opportunities

Expansion of Advanced Transparency Retrofit and Upgrade Programs:

Expansion of advanced transparency retrofit, and upgrade programs presents a significant opportunity for the Singapore Commercial Aircraft Windows and Windshields Market as airlines increasingly focus on extending aircraft service life while improving operational efficiency and passenger experience. Many carriers operating through Singapore manage mixed-age fleets, where retrofitting modern windshields and cabin windows offers measurable safety, maintenance, and comfort benefits without requiring new aircraft acquisition. Advanced heated windshields, improved bird strike resistance laminates, and enhanced optical clarity systems reduce unscheduled maintenance events and operational delays. Electrochromic and UV-filtering window upgrades are also gaining acceptance, particularly on long-haul aircraft operating from Singapore, as they enhance cabin comfort and reduce thermal load. Singapore’s strong base of OEM-authorized MRO providers positions the market to capture this retrofit-driven demand, as these upgrades require certified handling, installation, and post-installation testing. Leasing companies increasingly support such retrofits to protect asset value and maintain competitiveness in secondary markets. As regional airlines seek cost-efficient modernization pathways, retrofit programs are expected to generate incremental, recurring revenue streams beyond routine replacement cycles.

Regional Maintenance Consolidation and Cross-Border Fleet Servicing Growth:

Regional maintenance consolidation and cross-border fleet servicing growth represent another major opportunity, driven by Singapore’s reputation as a trusted, regulation-aligned aviation services hub. Airlines across Southeast Asia and parts of South Asia increasingly centralize heavy maintenance and specialized component replacement activities in Singapore to benefit from regulatory credibility, technical expertise, and turnaround reliability. Windows and windshields are particularly suited to centralized servicing due to their certification sensitivity and material handling requirements. As fleet operators optimize maintenance routing to reduce aircraft downtime, Singapore-based facilities are likely to see increased volumes of transparency replacements from foreign-registered aircraft. This trend is reinforced by expanding air traffic flows, higher aircraft utilization rates, and the growing complexity of modern windshield systems. Centralized servicing also enables economies of scale in inventory management, allowing MROs to stock high-value transparency units more efficiently. Strategic partnerships between Singapore MROs, global transparency manufacturers, and regional airlines further strengthen this opportunity by securing long-term supply agreements. As regional fleets continue to grow and mature, Singapore’s role as a consolidation point for certified transparency servicing is expected to deepen, supporting sustained demand growth across both aftermarket replacement and upgrade segments.

Future Outlook

The Singapore Commercial Aircraft Windows and Windshields Market is expected to maintain steady expansion over the next five years, supported by sustained aircraft utilization and Singapore’s position as a regional MRO hub. Airlines will continue prioritizing safety critical transparency replacements to ensure regulatory compliance and operational reliability. Adoption of advanced heated, laminated, and electrochromic window technologies will raise average replacement values. Regulatory alignment with global aviation authorities will preserve high certification standards. Growing retrofit activity for aging fleets will supplement demand. Strong logistics infrastructure and skilled workforce availability will reinforce Singapore’s competitiveness in regional transparency servicing activities and capabilities growth

Major Players

- PPG Aerospace

- GKN Aerospace

- Saint-Gobain Aerospace

- Gentex Corporation

- Nordam Group

- Triumph Aerospace

- Lee Aerospace

- AIP Aerospace

- Aviation Glass and Technology

- FACC AG

- Llamas Plastics

- Control Logistics

- TechnoformAerospace

- Mitsubishi Chemical Advanced Materials

- Toray Advanced Composites

Key Target Audience

- Commercial airlines

- Aircraftleasing companies

- Aerospace MRO providers

- Aircraft OEMs

- Componentdistributors

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense aviation agencies

Research Methodology

Step 1: Identification of Key Variables

Key variables included fleet size, replacement frequency, transparency unit pricing, and MRO throughput. Data was sourced from audited aerospace disclosures. Regulatory filings validated compliance scope. Variables were cross-verified.

Step 2: Market Analysis and Construction

Market construction integrated OEM revenue allocation with Singapore MRO activity mapping. Component-level transparency revenues were isolated. Airline maintenance expenditure validated assumptions. Consistency checks ensured accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts validated replacement cycle assumptions. MRO professionals confirmed technology adoption trends. Regulatory specialists verified compliance impacts. Feedback refined scope.

Step 4: Research Synthesis and Final Output

Validated data streams were synthesized into a unified framework. Contradictions were resolved through secondary confirmation. Final outputs emphasize traceability. Results reflect defensible structure.

- Executive Summary

- Singapore Commercial Aircraft Windows and Windshields Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of aircraft maintenance and overhaul activities in Singapore

Fleet modernization and cabin upgrade programs by regional airlines

Rising air traffic supporting sustained aircraft utilization

Adoption of advanced windshield heating and coating technologies

Strong presence of global aerospace suppliers and MRO hubs - Market Challenges

High certification and regulatory compliance requirements

Cost pressure from airlines on replacement components

Long qualification timelines for new materials and technologies

Dependence on global supply chains for raw materials

Limited local manufacturing of specialized transparencies - Market Opportunities

Growing demand for electrochromic and passenger comfort windows

Aftermarket replacement driven by aging regional fleets

Increased collaboration between OEMs and local MRO providers - Trends

Shift toward lightweight and impact resistant materials

Integration of advanced anti icing and defogging systems

Rising use of smart and dimmable window technologies

Standardization of window designs across aircraft families

Focus on lifecycle cost reduction and durability - Government Regulations & Defense Policy

Civil aviation authority certification requirements

Alignment with international airworthiness standards

Support for aerospace manufacturing and MRO development - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Cockpit windshields

Cabin side windows

Emergency exit windows

Observation and service windows

Specialty acoustic windows - By Platform Type (In Value%)

Narrow body commercial aircraft

Wide body commercial aircraft

Regional jets

Business jets used in commercial operations

Freighter and cargo aircraft - By Fitment Type (In Value%)

Line fit installations

Retrofit and replacement

Maintenance repair and overhaul fitment

Upgrade and modification programs

Leased aircraft fitment - By EndUser Segment (In Value%)

Commercial airlines

Aircraft leasing companies

MRO service providers

Aircraft OEM final assembly lines

Charter and regional operators - By Procurement Channel (In Value%)

Direct OEM procurement

Authorized tier one suppliers

MRO aftermarket sourcing

Long term supply contracts

Spot and urgent replacement orders - By Material / Technology (in Value %)

Acrylic windows

Polycarbonate windows

Heated laminated glass windshields

Electrochromic dimmable windows

Advanced UV and IR coated transparencies

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (product portfolio breadth, certification coverage, material technology capability, aftermarket support strength, regional presence, pricing competitiveness, supply reliability, customization capability, MRO partnerships) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

GKN Aerospace Transparencies

PPG Aerospace

Saint Gobain Aerospace

Gentex Corporation

Nordam Group

AIP Aerospace

Lee Aerospace

Aviation Glass and Technology

Triumph Aerospace Structures

FACC AG

Llamas Plastics

Control Logistics

Aerospace Industrial Development Corporation

Technoform Glass Insulation

Acrapol Aerospace

- Airlines prioritize durability and reduced maintenance downtime

- Leasing companies focus on standardized and easily replaceable designs

- MRO providers emphasize availability and certification support

- OEMs demand high performance and long lifecycle transparency systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035