Market Overview

Based on a recent historical assessment, the Singapore Commercial Helicopters market was valued at USD ~ million, driven by offshore oil and gas crew transportation, emergency medical aviation demand, corporate mobility requirements, and aerial utility operations. Stable long-term offshore service contracts, high safety compliance standards, and continued fleet renewal programs supported capital expenditure. Strong maintenance, repair, and overhaul capabilities, combined with leasing penetration and charter utilization, reinforced recurring revenue streams. Regulatory clarity and advanced aviation infrastructure further enabled sustained operational reliability across commercial helicopter activities.

Based on a recent historical assessment, Singapore emerged as the dominant hub due to its strategic maritime location, advanced heliport infrastructure, and concentration of offshore energy logistics. Seletar remains the primary operational cluster supported by certified maintenance facilities and skilled aviation manpower. Regional connectivity with Southeast Asian offshore fields, strong emergency response frameworks, and dense corporate travel demand reinforced helicopter utilization. Stable governance, efficient air traffic management, and proximity to regional energy corridors strengthened the country’s leadership position.

Market Segmentation

By Product Type

Singapore Commercial Helicopters market is segmented by product type into light single engine helicopters, light twin engine helicopters, medium twin engine helicopters, heavy lift helicopters, and utility multi role helicopters. Recently, medium twin engine helicopters have dominated market share due to their optimal balance between payload capacity, safety redundancy, and operating range. These platforms align closely with offshore transport and emergency medical requirements, where twin engine reliability is mandatory. Their compatibility with existing heliport infrastructure, strong OEM support presence, and efficient lifecycle economics further reinforce adoption. Proven performance in humid maritime environments and fleet standardization benefits continue to position medium twin engine helicopters as the preferred choice across operators.

By Platform Type

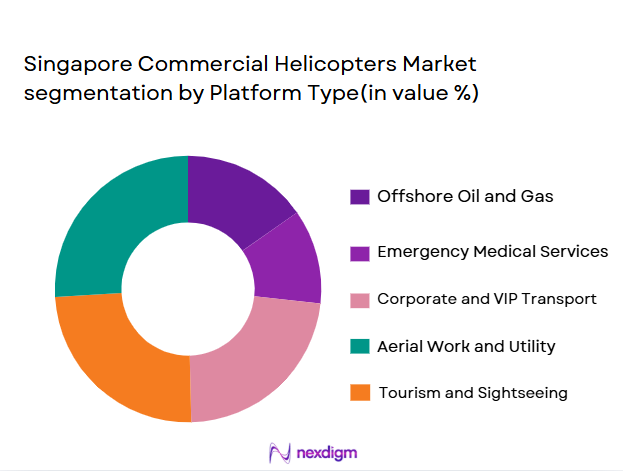

Singapore Commercial Helicopters market is segmented by platform type into offshore oil and gas transport, emergency medical services, corporate and VIP transport, aerial work and utility services, and tourism and charter operations. Recently, offshore oil and gas transport has held the dominant market share due to continuous crew rotation requirements, safety critical mission profiles, and long-term transport agreements. High utilization rates, predictable demand cycles, and regulatory preference for helicopter transport sustain this dominance. Singapore’s proximity to offshore assets and established operator networks further reinforce the leadership of offshore transport platforms within the market.

Competitive Landscape

The Singapore Commercial Helicopters market exhibits moderate consolidation, characterized by the presence of global OEMs, leasing firms, and specialized operators maintaining influence through fleet standardization, long-term service contracts, and integrated support offerings.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter: Fleet Size |

| Airbus Helicopters | 1992 | France | ~ | ~ | ~ | ~ | ~ |

| Leonardo Helicopters | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

| Bell Textron | 1935 | United States | ~ | ~ | ~ | ~ | ~ |

| Sikorsky Aircraft | 1925 | United States | ~ | ~ | ~ | ~ | ~ |

| Bristow Group | 1954 | United States | ~ | ~ | ~ | ~ | ~ |

Singapore Commercial Helicopters Market Analysis

Growth Drivers

Offshore Energy Logistics Expansion:

Offshore Energy Logistics Expansion is a critical growth driver for the Singapore Commercial Helicopters market because offshore platforms depend on helicopters for reliable, time-sensitive crew transportation across dispersed maritime assets. The geographic positioning of Singapore allows efficient access to multiple offshore fields, increasing daily flight cycles and utilization intensity for operators. Long-duration service contracts provide predictable revenue visibility and justify continued investments in modern twin engine fleets. Regulatory frameworks prioritize helicopter usage for safety compliance, reinforcing demand stability. Singapore’s integrated maintenance and overhaul ecosystem reduces aircraft downtime and improves operational continuity. Leasing adoption enables operators to scale capacity without heavy balance sheet exposure. Digital flight planning and predictive maintenance tools enhance scheduling efficiency. Collectively, offshore logistics requirements sustain consistent helicopter demand across commercial operators while supporting fleet modernization decisions.

Emergency Medical Aviation Modernization:

Emergency Medical Aviation Modernization drives growth in the Singapore Commercial Helicopters market through increasing reliance on rapid aerial response capabilities for critical care and disaster management. High urban density and chronic surface traffic congestion necessitate helicopter-based patient transfer solutions to meet clinical response time requirements. Advanced medical interiors, night vision systems, and integrated avionics increase aircraft value and mission effectiveness. Government coordination with healthcare providers strengthens deployment readiness and utilization consistency. Dedicated emergency fleets require high availability, sustaining flight hours throughout the year. Continuous training and certification investments elevate service quality and compliance. Public health preparedness frameworks reinforce long-term demand continuity. Ongoing technological upgrades further stimulate capital expenditure in specialized medical helicopters.

Market Challenges

High Lifecycle Cost and Capital Intensity:

High lifecycle cost and capital intensity represent a core challenge for the Singapore Commercial Helicopters market because commercial helicopter operations require substantial upfront investment and sustained expenditure throughout the asset life. Acquisition costs for certified twin engine helicopters are high, and operators must also account for long delivery timelines and customization expenses driven by mission requirements. Maintenance, repair, and overhaul obligations add recurring cost pressure due to strict airworthiness standards and reliance on certified parts and skilled labor. Insurance premiums remain elevated because of operational risk exposure and offshore mission profiles. Currency fluctuations impact procurement budgets since aircraft and components are largely imported. Limited fleet sizes reduce economies of scale, constraining cost optimization. Leasing mitigates some capital burden but introduces long-term payment commitments. Together, these factors compress operating margins and restrict the ability of smaller operators to expand fleets or absorb demand volatility.

Airspace Constraints and Regulatory Operating Complexity:

Airspace constraints and regulatory operating complexity pose another major challenge for the Singapore Commercial Helicopters market due to dense urban development and highly controlled aviation environments. Singapore’s limited airspace requires close coordination with fixed-wing traffic, increasing scheduling complexity and operational planning requirements. Heliport availability is constrained by land scarcity, zoning controls, and environmental approvals, limiting expansion flexibility. Noise regulations impose operational curfews and routing restrictions, particularly near residential and commercial districts. Compliance with stringent civil aviation regulations increases documentation, audit frequency, and certification costs. Emergency priority missions can disrupt planned commercial operations, affecting utilization efficiency. Weather variability in maritime environments adds operational uncertainty. Collectively, these constraints increase administrative burden, limit scalability, and slow the pace of market expansion despite underlying demand drivers.

Opportunities

Sustainable Aviation and Fleet Modernization Opportunity:

Sustainable aviation and fleet modernization represent a significant opportunity for the Singapore Commercial Helicopters market as operators increasingly align procurement strategies with environmental compliance, operational efficiency, and long-term cost optimization. Regulatory authorities and corporate customers are placing greater emphasis on reduced emissions, lower noise footprints, and improved fuel efficiency, encouraging the adoption of newer helicopter platforms. Modern twin-engine helicopters equipped with advanced avionics, lightweight composite structures, and optimized engines enable operators to meet these expectations while improving safety margins. Compatibility with sustainable aviation fuel further strengthens the business case for fleet renewal. Leasing companies are actively supporting modernization by offering flexible financing structures that reduce upfront capital burden. OEM innovation pipelines focused on digital health monitoring, predictive maintenance, and fuel efficiency improve asset utilization and lifecycle economics. These factors collectively enable operators to differentiate services, secure long-term contracts, and enhance regulatory alignment, making sustainability-driven modernization a commercially attractive opportunity.

Regional Leasing, Charter, and Service Expansion Opportunity:

Regional leasing, charter, and service expansion present another strong opportunity for the Singapore Commercial Helicopters market as demand grows for flexible access to helicopter services across Southeast Asia. Leasing models allow operators and customers to avoid ownership risk while rapidly adjusting capacity to mission needs. Charter services support offshore logistics, emergency response, corporate travel, and tourism without long-term fleet commitments. Singapore’s position as a financial and aviation hub enables efficient cross-border operations, fleet pooling, and maintenance support for neighboring markets. Digital booking platforms and integrated service offerings improve customer accessibility and operational transparency. Regional infrastructure development and offshore activity sustain demand for short-to-medium range helicopter missions. Operators can leverage Singapore-based maintenance and training ecosystems to support regional fleets efficiently. This expansion pathway improves utilization rates, diversifies revenue streams, and strengthens Singapore’s role as a regional helicopter services center, creating scalable growth potential.

Future Outlook

The Singapore Commercial Helicopters market is expected to experience stable growth over the next five years, supported by continued offshore activity, fleet modernization initiatives, and expanding leasing adoption. Technological advancements in avionics and maintenance analytics are likely to improve operational efficiency. Regulatory clarity and environmental compliance will shape procurement strategies. Demand from emergency services and corporate mobility is expected to remain resilient.

Major Players

- Airbus Helicopters

- Leonardo Helicopters

- Bell Textron

- Sikorsky Aircraft

- Kawasaki Aerospace

- NHIndustries

- Robinson Helicopter Company

- MD Helicopters

- Russian Helicopters

- Bristow Group

- CHC Helicopter

- Milestone Aviation

- Era Group

- Weststar Aviation

- ST Engineering Aerospace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Helicopter operators

- Aviation OEMs

- Aircraftleasing companies

- Offshore oil and gas companies

- Emergency medical service providers

- Corporate and VIP aviation users

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, regulatory, and technology variables were identified through structured industry mapping. Market boundaries were clearly defined to ensure relevance. Core assumptions were standardized across segments. Data validity and consistency were verified.

Step 2: Market Analysis and Construction

Primary interviews and secondary data sources were synthesized into a unified analytical framework. Market structures were constructed by segment and platform. Interdependencies were assessed for coherence. Internal consistency checks were applied.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through consultations with industry experts and operators. Assumptions were stress tested against operational realities. Divergent views were reconciled through triangulation. Consensus-driven conclusions were finalized.

Step 4: Research Synthesis and Final Output

Validated insights were consolidated into structured outputs. Analytical coherence and formatting accuracy were ensured. Findings were aligned with stated objectives. Final quality assurance checks were completed.

- Executive Summary

- Singapore Commercial Helicopters Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Offshore energy logistics demand in regional waters

Expansion of emergency medical aviation services

Rising corporate mobility and executive travel needs

Growth in aerial utility and inspection activities

Advancements in helicopter safety and avionics - Market Challenges

High acquisition and lifecycle maintenance costs

Stringent civil aviation regulatory compliance

Limited operational airspace and congestion

Skilled pilot and maintenance workforce shortages

Volatility in offshore energy sector demand - Market Opportunities

Adoption of sustainable aviation fuel compatible helicopters

Fleet modernization through advanced twin engine platforms

Growth in regional charter and tourism services - Trends

Increased deployment of digital health monitoring systems

Rising preference for twin engine safety configurations

Integration of advanced navigation and situational awareness tools

Growth of leasing over outright ownership models

Focus on noise reduction and environmental compliance - Government Regulations & Defense Policy

Civil aviation authority certification harmonization

Airspace management and operational safety mandates

Environmental and noise emission compliance frameworks - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Light Single Engine Helicopters

Light Twin Engine Helicopters

Medium Twin Engine Helicopters

Heavy Lift Helicopters

Utility and Multi Role Helicopters - By Platform Type (In Value%)

Offshore Oil and Gas Transport

Emergency Medical Services

Corporate and VIP Transport

Aerial Work and Utility Services

Tourism and Charter Operations - By Fitment Type (In Value%)

Factory New Helicopters

Retrofit and Upgraded Helicopters

Leased Helicopter Platforms

Charter Configured Helicopters

Mission Specific Configured Helicopters - By EndUser Segment (In Value%)

Oil and Gas Operators

Medical and Emergency Service Providers

Corporate Aviation Operators

Tourism and Charter Service Providers

Government Linked Commercial Operators - By Procurement Channel (In Value%)

Direct OEM Procurement

Authorized Dealer Procurement

Operating Lease Agreements

Wet Lease and Charter Contracts

Secondary Market Acquisitions - By Material / Technology (in Value %)

Composite Airframe Structures

Advanced Avionics and Flight Management Systems

Fly by Wire Control Systems

Fuel Efficient Turboshaft Engines

Condition Based Maintenance Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (Fleet Size, Engine Type, Mission Capability, Operating Range, Payload Capacity, Avionics Suite, Maintenance Support, Leasing Options, Regulatory Certifications) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Airbus Helicopters

Leonardo Helicopters

Bell Textron

Sikorsky Aircraft

Kawasaki Heavy Industries Aerospace

NHIndustries

Robinson Helicopter Company

MD Helicopters

Russian Helicopters

Bristow Group

CHC Helicopter

Milestone Aviation Group

Era Group

Weststar Aviation Services

Singapore Technologies Aerospace

- Operational reliability prioritized for offshore transport missions

- Rapid response capability driving EMS fleet specifications

- Cost efficiency influencing corporate helicopter utilization

- Charter flexibility supporting tourism and ad hoc mobility needs

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035