Market Overview

Based on a recent historical assessment, the Singapore connected aircraft market was valued at USD ~ billion, supported by steady investments in aviation digitalization, fleet modernization programs, and rising adoption of real-time data connectivity across commercial and defense aircraft. Market growth is driven by airline demand for enhanced operational efficiency, predictive maintenance capabilities, and passenger connectivity services. Strong government backing for smart aviation initiatives and Singapore’s role as a regional aviation hub further stimulate demand for advanced airborne connectivity platforms and integrated data systems.

Based on a recent historical assessment, Singapore remains the dominant national hub within the regional connected aircraft ecosystem due to its concentration of major airlines, aerospace MRO facilities, and technology integrators. Changi Airport’s advanced digital infrastructure supports large-scale deployment of connected aircraft solutions. The presence of global avionics suppliers, strong regulatory clarity from aviation authorities, and proximity to Southeast Asian air traffic corridors reinforce Singapore’s leadership. High aircraft utilization rates and regional fleet management activities further strengthen local market dominance.

Market Segmentation

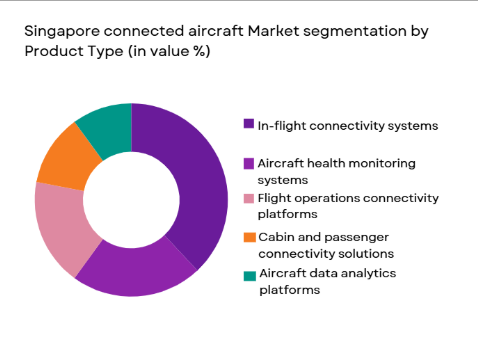

By Product Type

Singapore connected aircraft market is segmented by product type into in-flight connectivity systems, aircraft health monitoring systems, flight operations connectivity platforms, cabin and passenger connectivity solutions, and aircraft data analytics platforms. Recently, in-flight connectivity systems have a dominant market share due to strong airline focus on passenger experience enhancement, widespread broadband availability, and competitive differentiation among carriers. Airlines increasingly prioritize onboard internet, streaming, and real-time communications to improve customer satisfaction and brand loyalty. The segment benefits from established satellite networks, scalable hardware solutions, and recurring service revenues. Integration simplicity, regulatory approvals, and proven performance further reinforce dominance. Growing business travel and premium cabin demand also support higher adoption of in-flight connectivity systems across Singapore-based fleets.

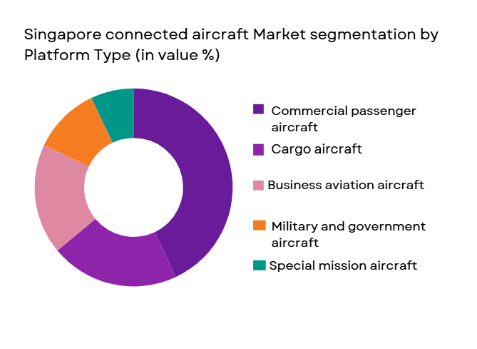

By Platform Type

Singapore connected aircraft market is segmented by platform type into commercial passenger aircraft, cargo aircraft, business aviation aircraft, military and government aircraft, and special mission aircraft. Recently, commercial passenger aircraft hold a dominant market share due to high fleet density, intensive flight operations, and strong emphasis on digital passenger services. Singapore-based airlines operate large widebody and narrowbody fleets requiring continuous connectivity for flight operations, maintenance, and customer engagement. High aircraft utilization and competitive service positioning accelerate connectivity upgrades. Integration of connectivity into new aircraft deliveries and retrofits further supports dominance, alongside regulatory alignment and strong OEM partnerships.

Competitive Landscape

The Singapore connected aircraft market is moderately consolidated, with a mix of global avionics leaders and strong regional aerospace integrators. Major players leverage long-term airline contracts, OEM partnerships, and integrated service portfolios to maintain competitive positions. Consolidation is driven by high certification requirements, capital intensity, and the need for global satellite coverage. Technology differentiation, cybersecurity capabilities, and lifecycle service offerings significantly influence competitive dynamics.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| SITAONAIR | 1949 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Avionics | 1968 | France | ~ | ~ | ~ | ~ | ~ |

| Panasonic Avionics | 1979 | United States | ~ | ~ | ~ | ~ | ~ |

Singapore Connected Aircraft Market Analysis

Growth Drivers

Aviation Digital Transformation and Data-Driven Operations:

Aviation Digital Transformation and Data-Driven Operations: The Singapore connected aircraft market is strongly driven by the aviation sector’s transition toward data-centric operations and digital transformation strategies. Airlines increasingly rely on real-time aircraft data to optimize fuel efficiency, route planning, and maintenance scheduling. Connected aircraft systems enable predictive maintenance, reducing unscheduled downtime and improving fleet availability. Singapore’s advanced digital infrastructure supports seamless data exchange between aircraft, ground systems, and cloud platforms. Strong regulatory support for smart aviation further accelerates adoption. Airlines seek operational resilience through enhanced situational awareness. Integration with airport systems improves turnaround efficiency. These factors collectively sustain long-term demand for connected aircraft solutions.

Passenger Experience Enhancement and Service Differentiation

Passenger Experience Enhancement and Service Differentiation: Airlines operating from Singapore prioritize premium passenger experiences to remain competitive in regional and long-haul markets. Connected aircraft enable high-speed internet, streaming entertainment, and personalized digital services onboard. Passenger expectations for continuous connectivity mirror ground-based digital lifestyles. Premium cabin offerings increasingly depend on reliable broadband connectivity. Airlines leverage connectivity data to tailor services and loyalty programs. Business travelers value uninterrupted communication during flights. These service-driven requirements significantly contribute to market expansion. Connectivity also supports ancillary revenue generation through digital platforms.

Market Challenges

High Implementation Costs and Integration Complexity

High Implementation Costs and Integration Complexity: Deploying connected aircraft systems involves substantial upfront investment in hardware, software, certification, and installation. Airlines face high lifecycle costs, including maintenance and service subscriptions. Integration with legacy avionics systems increases technical complexity. Certification processes extend deployment timelines. Smaller operators face financial constraints. Cost sensitivity remains a key barrier despite long-term operational benefits. Upgrades during maintenance cycles require careful scheduling. These challenges can delay adoption decisions and limit penetration among cost-focused operators.

Cybersecurity and Data Protection Risks

Cybersecurity and Data Protection Risks: Connected aircraft systems introduce exposure to cyber threats targeting aircraft networks and data links. Airlines must ensure secure transmission of operational and passenger data. Regulatory scrutiny around data privacy is increasing. Complex system architectures expand attack surfaces. Continuous software updates are required to address vulnerabilities. Cyber incidents can disrupt operations and damage brand reputation. High investment in encryption and monitoring is necessary. Managing cybersecurity across global networks remains a persistent challenge.

Opportunities

Next-Generation Satellite Connectivity Adoption

Next-Generation Satellite Connectivity Adoption: The emergence of low-earth-orbit satellite constellations presents significant opportunities for the Singapore connected aircraft market. These systems offer lower latency, higher bandwidth, and improved coverage. Airlines can deliver enhanced connectivity experiences across all flight phases. New satellite technologies support data-intensive applications. Competitive pricing models increase accessibility. Integration with existing systems enables phased upgrades. Singapore’s strategic location supports early adoption. This opportunity drives long-term technology refresh cycles.

AI-Enabled Predictive Maintenance Expansion

AI-Enabled Predictive Maintenance Expansion: Advanced analytics and artificial intelligence create opportunities for deeper utilization of connected aircraft data. Airlines can predict component failures with greater accuracy. Maintenance costs can be reduced through condition-based interventions. AI-driven insights improve fleet reliability. Singapore’s aerospace ecosystem supports data science innovation. Collaboration with MRO providers accelerates deployment. These capabilities enhance operational efficiency and safety outcomes. Demand for intelligent connectivity platforms continues to grow.

Future Outlook

Over the next five years, the Singapore connected aircraft market is expected to experience steady expansion driven by digital aviation initiatives, advanced satellite connectivity, and rising data analytics adoption. Regulatory support for smart aviation and cybersecurity frameworks will reinforce confidence. Airlines will continue investing in passenger-centric services and operational optimization. Technological advancements in connectivity and artificial intelligence will further strengthen market fundamentals.

Major Players

- SITAONAIR

- Honeywell Aerospace

- Collins Aerospace

- Thales Avionics

- Panasonic Avionics

- Viasat

- Inmarsat

- Iridium Communications

- Safran Electronics & Defense

- ST Engineering Aerospace

- L3Harris Technologies

- Airbus Skywise

- Boeing AvionX

- Gogo Business Aviation

- Embraer Defense & Security

Key Target Audience

- Commercial airlines

- Cargo airline operators

- Aircraft leasing companies

- Aerospace OEMs

- MRO service providers

- Defense aviation agencies

- Government aviation authorities

- Investment and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market variables were identified through analysis of connectivity technologies, aircraft platforms, regulatory frameworks, and airline operational requirements across Singapore’s aviation ecosystem.

Step 2: Market Analysis and Construction

Data from industry reports, aviation authorities, and company disclosures were synthesized to construct market structure, segmentation, and competitive positioning.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultation with aviation technology experts, airline executives, and MRO specialists to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

Validated insights were consolidated into a structured report, integrating qualitative and quantitative analysis to present a comprehensive market outlook.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for real-time aircraft data and analytics

Expansion of premium passenger connectivity services

Fleet modernization and digital aviation initiatives

Growth of data-driven maintenance and operations

Strong regional aviation hub positioning - Market Challenges

High installation and lifecycle costs

Cybersecurity and data protection concerns

Integration with legacy aircraft systems

Bandwidth and network reliability limitations

Regulatory compliance and certification complexity - Market Opportunities

Adoption of next-generation satellite connectivity

Expansion of predictive maintenance applications

Integration of AI-driven flight operations platforms - Trends

Shift toward cloud-native aircraft data platforms

Increased adoption of Ka-band and LEO satellites

Enhanced cybersecurity architectures for aircraft networks

Personalized passenger connectivity services

Growing role of connected aircraft in sustainability initiatives - Government Regulations & Defense Policy

Civil aviation digitalization policies

Cybersecurity and data sovereignty regulations

Defense aviation connectivity modernization programs - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

In-flight connectivity systems

Aircraft health monitoring systems

Flight operations connectivity platforms

Cabin and passenger connectivity solutions

Data analytics and aircraft IoT systems - By Platform Type (In Value%)

Commercial passenger aircraft

Business and general aviation aircraft

Cargo and freighter aircraft

Military and government aircraft

Special mission aircraft - By Fitment Type (In Value%)

Line-fit installation

Retrofit and aftermarket installation

Software-enabled upgrades

Hybrid hardware-software fitment

Service-based connectivity integration - By EndUser Segment (In Value%)

Commercial airlines

Cargo operators

Business jet operators

Defense and government operators

Aircraft leasing companies - By Procurement Channel (In Value%)

OEM-led procurement

Airline direct procurement

MRO-based installation contracts

System integrator procurement

Leasing company driven procurement - By Material / Technology (in Value %)

Satellite communication systems

Air-to-ground connectivity technology

Aircraft sensors and embedded IoT

Cloud-based data platforms

Cybersecurity and encryption technologies

- Market share snapshot of major players

- Cross Comparison Parameters (connectivity bandwidth, network reliability, cybersecurity compliance, integration flexibility, lifecycle cost, global coverage, scalability, data analytics capability, OEM compatibility)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

SITAONAIR

Honeywell Aerospace

Collins Aerospace

Thales Avionics

Panasonic Avionics

Viasat

Inmarsat

Gogo Business Aviation

Iridium Communications

Safran Electronics & Defense

Airbus Skywise

Boeing AvionX

ST Engineering Aerospace

L3Harris Technologies

Embraer Defense & Security

- Airlines leveraging connectivity for operational efficiency

- Cargo operators adopting real-time fleet monitoring

- Business aviation prioritizing premium connectivity

- Defense operators integrating secure airborne networks

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035